Did you know that the first recorded stock market crash happened in 1637, when tulip bulb prices soared and then plummeted? Fast forward to today, mastering momentum trading can be your ticket to navigating the highs and lows of the market. In this article, we delve into developing a robust momentum trading plan, exploring key components like identifying momentum stocks, setting effective entry and exit points, and managing risk. We’ll also discuss the best indicators, psychological factors, and the importance of adapting your strategy to market changes. Plus, learn how to backtest your plan, track performance, and combine momentum trading with other strategies. With insights from DayTradingBusiness, you’ll be well-equipped to make informed trading decisions and avoid common pitfalls.

What is a momentum trading plan?

A momentum trading plan is a strategy that focuses on buying stocks or assets that are trending upward and selling those that are trending downward. To develop one, follow these steps:

1. Define Your Goals: Set clear profit targets and risk tolerance levels.

2. Select Indicators: Use technical indicators like moving averages, RSI, or MACD to identify momentum.

3. Choose Timeframes: Decide if you’ll trade intraday, daily, or weekly based on your availability and risk appetite.

4. Entry and Exit Rules: Establish criteria for entering and exiting trades, such as price levels or indicator signals.

5. Risk Management: Set stop-loss orders to protect against significant losses.

6. Review and Adjust: Regularly analyze your trades to refine your strategy based on performance.

Implementing these elements will help you create an effective momentum trading plan.

How do I identify momentum stocks?

To identify momentum stocks, look for those with consistent price increases and high trading volume. Use technical indicators like the Relative Strength Index (RSI) to spot overbought conditions and moving averages to confirm upward trends. Screen for stocks that have outperformed the market over a specific period, like the last 3 to 12 months. Monitor news and earnings reports for catalysts that could sustain momentum. Finally, create a watchlist and set entry and exit points based on your analysis.

What are the key components of a momentum trading strategy?

The key components of a momentum trading strategy include:

1. Trend Identification: Use technical indicators like moving averages or the Relative Strength Index (RSI) to spot upward or downward trends.

2. Entry Signals: Look for specific triggers, such as breakouts above resistance levels or bullish candlestick patterns.

3. Position Sizing: Determine how much capital to allocate based on risk tolerance and volatility.

4. Stop Losses: Set stop-loss orders to limit potential losses and protect your capital.

5. Profit Targets: Establish clear exit points to secure gains, often using trailing stops or fixed targets based on risk-reward ratios.

6. Market Conditions: Be aware of broader market trends and news that can impact momentum.

7. Performance Review: Regularly evaluate trades to refine the strategy based on what works and what doesn’t.

Incorporating these components will help you develop a robust momentum trading plan.

How can I set entry and exit points in momentum trading?

To set entry and exit points in momentum trading, follow these steps:

1. Identify Trends: Use indicators like Moving Averages or Relative Strength Index (RSI) to confirm strong upward or downward trends.

2. Entry Points: Look for breakouts above resistance levels or pullbacks to support levels. Consider entering when the price crosses above the moving average or when momentum indicators signal upward strength.

3. Exit Points: Set targets based on resistance levels or predetermined profit margins. Use trailing stops to lock in gains as the price moves in your favor. Exit when momentum indicators show signs of weakening or when the price drops below key support.

4. Risk Management: Determine stop-loss levels before entering trades to limit losses. This should be based on volatility and your risk tolerance.

5. Review and Adjust: Regularly assess your strategy’s effectiveness and adjust your entry and exit criteria based on market conditions and past performance.

By following these guidelines, you can create a structured momentum trading plan that effectively sets your entry and exit points.

What indicators are best for momentum trading?

The best indicators for momentum trading include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Average True Range (ATR). RSI helps identify overbought or oversold conditions. MACD shows the relationship between two moving averages and signals potential trend reversals. ATR measures volatility, aiding in setting stop-loss levels. Using these indicators together can enhance your momentum trading strategy.

How do I manage risk in a momentum trading plan?

To manage risk in a momentum trading plan, set a clear stop-loss for each trade, typically 1-2% of your capital. Use position sizing to limit exposure, ensuring no single trade significantly impacts your portfolio. Diversify across different assets to avoid over-concentration in one area. Monitor volatility and adjust your strategy accordingly; avoid trading in highly volatile conditions without proper safeguards. Regularly review and adapt your plan based on performance and changing market conditions. Lastly, keep emotions in check and stick to your predefined rules.

What timeframes are ideal for momentum trading?

Ideal timeframes for momentum trading typically range from 1 minute to 4 hours. Many traders prefer 5-minute and 15-minute charts for intraday trades. Swing traders may look at daily or weekly charts to capture more extended moves. Ultimately, choose a timeframe that matches your trading style and risk tolerance.

What Are Effective Day Trading Momentum Strategies and How Can I Create a Plan?

Day trading momentum strategies involve identifying stocks that are moving significantly in one direction on high volume. Traders buy when the price breaks out upward and sell when it shows signs of reversing. To develop a momentum trading plan, focus on setting clear entry and exit points, using technical indicators like moving averages or RSI to confirm trends, and implementing strict risk management to protect against losses.

Learn more about: What Are Day Trading Momentum Strategies?

How do I backtest my momentum trading strategy?

To backtest your momentum trading strategy, follow these steps:

1. Define Your Strategy: Clearly the entry and exit criteria based on momentum indicators like moving averages or RSI.

2. Select a Backtesting Platform: Use software like MetaTrader, TradingView, or specialized backtesting tools.

3. Gather Historical Data: Obtain reliable historical price data for the assets you plan to trade.

4. Implement Your Strategy: Code your trading rules into the backtesting platform, ensuring it accurately reflects your criteria.

5. Run the Backtest: Execute the backtest over a defined period to simulate trades based on your strategy.

6. Analyze Results: Review performance metrics such as win rate, maximum drawdown, and profit factor to assess effectiveness.

7. Iterate and Optimize: Adjust your strategy based on insights gained and retest to see if performance improves.

8. Forward Test: Validate your strategy in a live market with a demo account before full deployment.

This process helps ensure your momentum trading strategy is robust and profitable.

What psychological factors should I consider in momentum trading?

Consider the following psychological factors in momentum trading:

1. Fear and Greed: These emotions can drive impulsive decisions. Fear may cause you to exit a trade too early, while greed might lead to holding on too long.

2. Confirmation Bias: Traders often seek information that supports their existing beliefs. Stay aware of this bias to avoid ignoring contrary signals.

3. Loss Aversion: Fear of losing can lead to hesitation in executing trades. Acknowledge this to make more objective decisions.

4. Overconfidence: Believing too strongly in your ability to predict market movements can lead to risky trades. Keep a balanced perspective.

5. Anchoring: Relying too heavily on past prices or data can skew your judgment. Stay flexible and adjust your strategy based on current market conditions.

6. Social Influence: Be cautious of following the crowd. Groupthink can cloud your judgment, so stick to your strategy.

Address these factors in your momentum trading plan to enhance decision-making and improve outcomes.

How can I adapt my momentum trading plan to changing markets?

To adapt your momentum trading plan to changing markets, follow these steps:

1. Analyze Market Conditions: Regularly assess whether the market is trending or ranging. Use indicators like moving averages or the Average True Range (ATR) to gauge volatility.

2. Adjust Entry Criteria: Modify your entry criteria based on market signals. In strong trends, consider tighter entry points; in choppy markets, wait for clearer signals.

3. Reevaluate Exit Strategies: Set flexible exit strategies. In bullish markets, you might hold longer; in bearish phases, consider quicker exits.

4. Risk Management: Adjust your stop-loss levels based on market volatility. Use wider stops in volatile conditions and tighter stops when markets are stable.

5. Diversify: Expand your watchlist to include various assets. This helps capture momentum across different sectors or markets.

6. Stay Informed: Keep up with news and economic indicators that influence market sentiment. This helps you anticipate changes in momentum.

7. Review and Optimize: Regularly backtest your strategies against current market data to refine your approach and stay effective.

By continuously monitoring and adjusting these elements, your momentum trading plan can stay relevant and effective in changing market conditions.

What mistakes should I avoid in momentum trading?

Avoid these mistakes in momentum trading:

1. Ignoring Risk Management: Always set stop-loss orders to protect your capital.

2. Chasing Price: Don’t buy after a significant price jump; wait for a pullback.

3. Overtrading: Stick to your plan and avoid making impulsive trades based on emotions.

4. Neglecting Research: Analyze trends and news that could impact your assets before trading.

5. Focusing Solely on Indicators: Use a combination of indicators and market sentiment for better decisions.

6. Failure to Adapt: Be ready to adjust your strategy as market conditions change.

7. Ignoring Volume: Ensure that price movements are supported by strong trading volume.

Stay disciplined and stick to your trading plan.

How do I track performance in my momentum trading plan?

To track performance in your momentum trading plan, start by maintaining a detailed trading journal. Record each trade, including entry and exit points, position size, and the rationale behind each trade. Calculate key metrics like win rate, average gain, and average loss to evaluate overall effectiveness. Use performance charts to visualize your trades over time, identifying patterns and trends. Regularly review and adjust your strategy based on this data to enhance your trading approach.

What role does news play in momentum trading?

News plays a critical role in momentum trading by influencing market sentiment and driving price movements. Traders rely on news events—like earnings reports, economic data, and geopolitical developments—to identify potential momentum shifts. Positive news can trigger buying, creating upward momentum, while negative news can lead to selling pressure and downward trends. Incorporating news analysis helps traders anticipate market reactions, refine entry and exit points, and manage risk effectively in their momentum trading plans.

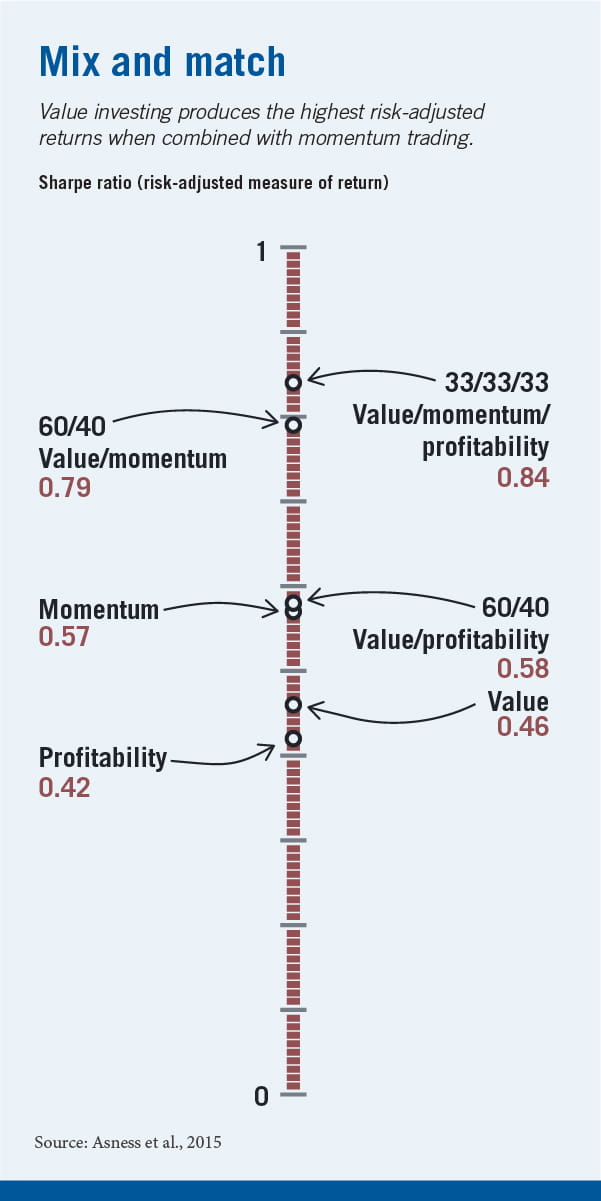

How can I combine momentum trading with other strategies?

To combine momentum trading with other strategies, consider these approaches:

1. Trend Following: Use momentum indicators to identify strong trends and confirm them with moving averages. Enter trades aligned with the trend.

2. Swing Trading: Incorporate momentum analysis to time entries and exits in swing trades. Look for price pullbacks in a momentum uptrend.

3. Fundamental Analysis: Pair momentum trading with fundamental indicators. Trade stocks with strong earnings reports that also show momentum.

4. Risk Management: Integrate momentum trading with a solid risk management strategy. Set stop-loss orders based on volatility to protect gains.

5. Diversification: Combine momentum trades across different asset classes to spread risk. For example, trade momentum stocks alongside currency pairs.

6. Market Timing: Use momentum signals to enter during optimal market conditions, avoiding times of high volatility or uncertainty.

By blending these strategies, you can enhance your momentum trading plan, improving your chances of success.

What resources are available for learning momentum trading?

To learn momentum trading, consider these resources:

1. Books: "Momentum Masters" by Mark Minervini and "The Little Book of Stock Market Cycles" by Jeffrey A. Hirsch offer valuable insights.

2. Online Courses: Platforms like Udemy or Coursera have courses specifically on momentum trading strategies.

3. Webinars: Look for free webinars from trading platforms like TD Ameritrade or Interactive Brokers.

4. Trading Communities: Join forums like Trade2Win or Reddit's r/stocks for discussions and ideas from experienced traders.

5. YouTube Channels: Channels focused on trading education, such as Warrior Trading, provide practical tips and strategies.

6. Stock Screeners: Tools like Finviz or Trade Ideas help identify momentum stocks based on technical indicators.

7. Newsletters: Subscribe to trading newsletters that focus on momentum strategies for regular insights and tips.

Utilize these resources to build a solid momentum trading plan.

How often should I review my momentum trading plan?

You should review your momentum trading plan at least once a month. This allows you to assess performance, adjust strategies based on market conditions, and refine your entry and exit criteria. Additionally, consider a quick review after significant trades or major market shifts. Regular reviews keep your plan aligned with your trading goals and market dynamics.

Conclusion about How to Develop a Momentum Trading Plan

In conclusion, developing a robust momentum trading plan involves understanding key components such as stock identification, entry and exit points, and effective risk management. By utilizing appropriate indicators and adapting to market changes, traders can enhance their strategies. Regular performance tracking and incorporating psychological insights further refine your approach. For comprehensive insights and ongoing support in your trading journey, consider leveraging the expertise offered by DayTradingBusiness.

Learn about How to Develop a Risk Management Plan for Day Trading