Did you know that the average day trader spends about 5 hours a day glued to their screens, which is roughly the same time it takes to binge-watch an entire season of a new series? In the fast-paced world of momentum day trading, creating a watchlist is essential for success. This article dives into the fundamentals of momentum day trading, revealing how to identify potential stocks, the criteria for selection, and effective tracking methods. You'll learn about the best tools for building your watchlist, the importance of technical analysis, and risk management strategies. Plus, discover common pitfalls to avoid and how to refine your trading approach over time. With insights from DayTradingBusiness, you'll be well-equipped to enhance your trading results and navigate the exciting world of momentum stocks.

What is momentum day trading?

Momentum day trading involves buying stocks that are moving significantly in one direction, typically due to news, earnings, or market trends. To build a watchlist for momentum day trading, focus on stocks with high volume, recent price spikes, and positive news catalysts. Use screeners to filter for stocks with strong relative strength and volatility. Regularly update your list based on market movements, technical indicators, and sector performance to capitalize on emerging trends.

How do I identify momentum stocks for my watchlist?

To identify momentum stocks for your watchlist, focus on stocks with strong price movements, high trading volumes, and positive news catalysts. Use technical indicators like moving averages and Relative Strength Index (RSI) to spot upward trends. Monitor social media and financial news for buzz around specific stocks. Look for earnings reports or product launches that could drive interest. Finally, consider stocks that have recently broken out of key resistance levels.

What criteria should I use to select stocks for day trading?

To select stocks for day trading, focus on these criteria:

1. Volume: Look for stocks with high trading volume to ensure liquidity.

2. Volatility: Choose stocks that exhibit significant price movement within the day for potential profit.

3. Market News: Monitor stocks with recent news or events that could impact price.

4. Technical Indicators: Use indicators like moving averages or RSI to identify entry and exit points.

5. Sector Performance: Consider stocks in strong sectors that are trending positively.

6. Pre-market Activity: Check pre-market performance for early trading signals.

7. Price Range: Select stocks within a price range that allows for scalable profits without excessive risk.

These criteria will help build a focused watchlist for momentum day trading.

How can I track stock price movements effectively?

To track stock price movements effectively for momentum day trading, create a watchlist of stocks that show high volatility and trading volume. Use real-time market data platforms like TradingView or Thinkorswim to monitor price changes. Set alerts for specific price points or percentage changes to stay informed. Analyze charts for patterns and trends, focusing on indicators like moving averages and RSI. Regularly review and adjust your watchlist based on market conditions and stock performance.

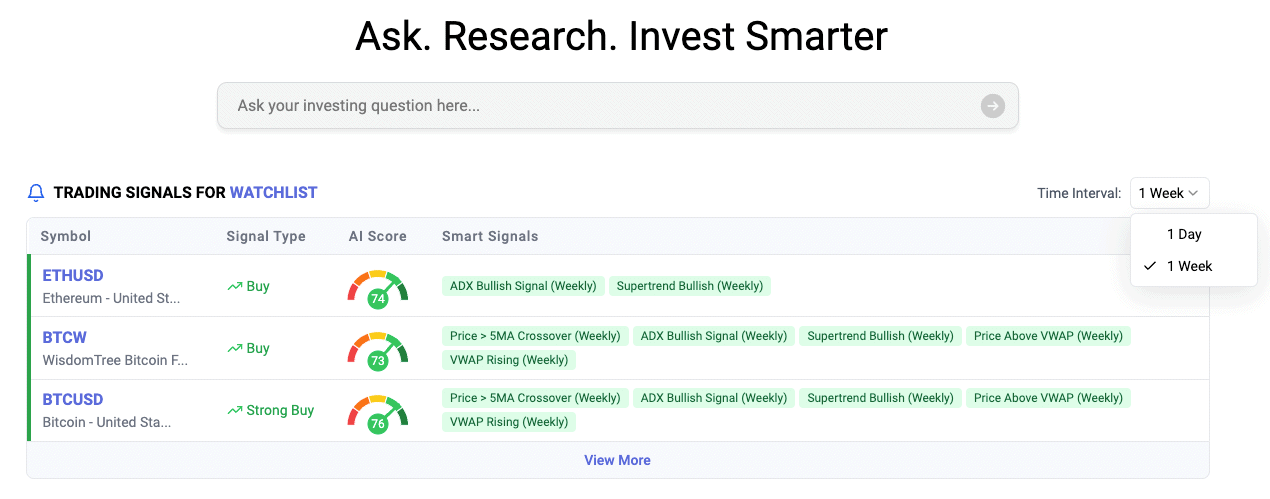

What tools are best for building a momentum trading watchlist?

The best tools for building a momentum trading watchlist include:

1. Stock Screener: Use tools like Finviz or TradeIdeas to filter stocks based on volume, price changes, and performance metrics.

2. News Aggregators: Services like Benzinga or Seeking Alpha provide real-time news to spot catalysts driving momentum.

3. Charting Platforms: TradingView and ThinkorSwim offer advanced charting tools to track price movements and identify patterns.

4. Social Media and Forums: Platforms like Twitter and StockTwits can reveal trending stocks and investor sentiment.

5. Brokerage Tools: Many brokerages, such as TD Ameritrade or E*TRADE, have built-in watchlist features that integrate alerts and research.

Use these tools to identify stocks with strong upward momentum and stay updated on market trends.

How often should I update my trading watchlist?

Update your trading watchlist daily. Check for stocks with strong momentum, recent news, earnings reports, and significant volume changes. Remove stocks that no longer meet your criteria and add new opportunities that show potential for movement. Adjusting your watchlist regularly helps you stay aligned with market trends and enhances your day trading strategy.

What are the key indicators for momentum trading?

Key indicators for momentum trading include:

1. Relative Strength Index (RSI): Measures the speed and change of price movements. An RSI above 70 indicates overbought conditions, while below 30 indicates oversold.

2. Moving Averages: The 50-day and 200-day moving averages help identify trends. A crossover (50-day crossing above the 200-day) signals bullish momentum.

3. Volume: Increased trading volume often confirms momentum. Look for volume spikes during price increases.

4. Price Action: Analyze recent highs and lows. Strong upward price movement indicates bullish momentum.

5. MACD (Moving Average Convergence Divergence): This indicator shows the relationship between two moving averages. A MACD line crossing above the signal line is a bullish signal.

6. Bollinger Bands: Price approaching the upper band can indicate strong upward momentum, while the lower band signals potential reversals.

Incorporate these indicators into your watchlist to identify potential momentum stocks effectively.

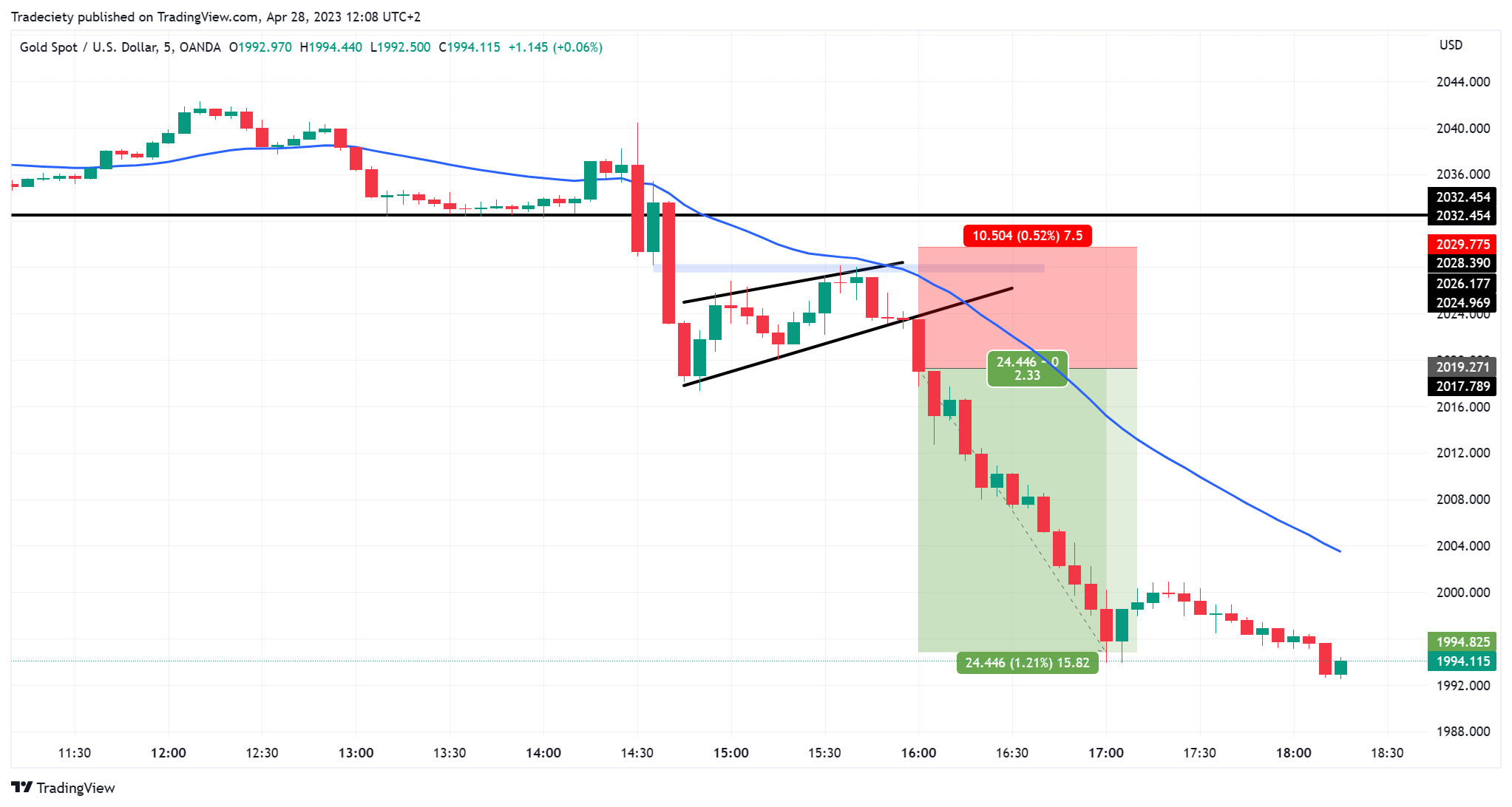

How do I use technical analysis in momentum day trading?

To use technical analysis in momentum day trading, start by building a watchlist of stocks with strong price movements and high trading volumes. Look for stocks that are breaking out of key resistance levels or showing significant trends on daily and intraday charts. Use indicators like the Relative Strength Index (RSI) to identify overbought or oversold conditions and Moving Averages to spot trends. Set entry and exit points based on support and resistance levels, and consider using volume spikes to confirm momentum. Regularly update your watchlist to focus on stocks that are currently trending.

What is the role of market news in momentum trading?

Market news plays a crucial role in momentum trading by influencing stock price movements. Traders use news to identify trends and potential breakout stocks. Positive news can drive up demand, creating upward momentum, while negative news can lead to rapid declines. Keeping an eye on earnings reports, economic indicators, and industry developments helps traders build a watchlist of stocks likely to experience significant price shifts. Timely news updates allow traders to act quickly, maximizing profit opportunities in a fast-paced market.

How can I manage risk while day trading momentum stocks?

To manage risk while day trading momentum stocks, start by creating a focused watchlist of stocks showing strong price movement and high volume. Set clear entry and exit points based on technical analysis. Use stop-loss orders to limit potential losses and protect your capital. Diversify your trades to avoid overexposure to any single stock. Keep position sizes small to mitigate risk and ensure you can withstand market fluctuations. Regularly review and adjust your watchlist based on market conditions and stock performance. Stay disciplined and stick to your trading plan.

Learn about How to Use Charts to Manage Day Trading Risk

What timeframes are best for momentum day trading?

For momentum day trading, the best timeframes are typically 1-minute, 5-minute, and 15-minute charts. The 1-minute chart is great for quick entries and exits, while the 5-minute chart provides a clearer view of trends and patterns. The 15-minute chart helps identify stronger momentum and supports overall strategy. Use these timeframes to build a watchlist focused on stocks with high volatility and volume, allowing for timely trades.

Learn about Best Timeframes for Momentum Day Trading

How do I know when to enter and exit trades?

To know when to enter and exit trades in momentum day trading, focus on these key indicators:

1. Entry Signals: Look for strong volume spikes, breakouts above resistance levels, or when a stock moves significantly above its moving average. Use technical indicators like the RSI to identify overbought or oversold conditions.

2. Exit Signals: Set specific profit targets based on your risk-reward ratio. Monitor for signs of weakening momentum, such as falling volume or price action reversing near resistance. Consider using trailing stops to lock in profits while allowing for potential further gains.

3. Watchlist Criteria: Create a watchlist of stocks with recent price momentum, high volume, and news catalysts. Update your list regularly to stay aligned with market trends.

4. Risk Management: Always define your stop-loss level before entering a trade to minimize losses and protect your capital.

By combining these strategies, you’ll enhance your timing for entering and exiting trades effectively.

What are common mistakes to avoid in momentum day trading?

Common mistakes to avoid when building a watchlist for momentum day trading include:

1. Ignoring volume: Ensure stocks have high trading volume to confirm momentum.

2. Overlooking news: Failing to account for news catalysts can lead to missed opportunities.

3. Lack of diversification: Focusing on too few stocks increases risk; spread your watchlist across sectors.

4. Not updating regularly: Stale watchlists can miss emerging trends; refresh your list daily.

5. Relying solely on technical indicators: Combine indicators with fundamental analysis for better insights.

6. Neglecting stop-loss levels: Always set stop-loss orders to manage risk effectively.

7. Focusing on past performance: Don’t assume past momentum will continue; consider current market conditions.

Avoid these pitfalls to create a more effective watchlist for momentum day trading.

Learn about What Are Common Mistakes in Institutional Day Trading?

How Can I Build a Watchlist for Effective Day Trading Momentum Strategies?

Day trading momentum strategies focus on identifying stocks that are moving significantly in one direction, typically based on news, earnings reports, or market trends. To build a watchlist for momentum day trading, select stocks with high volatility, strong volume, and recent price movements. Use scanners to filter stocks that have gained at least 5% in the last trading session or have high relative strength index (RSI) values. Regularly update your watchlist to reflect current market conditions and news events that may impact price momentum.

Learn more about: What Are Day Trading Momentum Strategies?

Learn about How Do Prop Firms Affect Day Trading Strategies?

How can I learn from my day trading watchlist performance?

To learn from your day trading watchlist performance, review which stocks consistently meet your entry criteria. Track their price movements, volume, and news catalysts throughout the day. Analyze your trades: note which setups led to profits and which didn't. Keep a trading journal to document your decisions and emotions. Over time, identify patterns in both successful and unsuccessful trades to refine your strategy. Regularly update your watchlist based on this analysis, focusing on stocks that show strong momentum and align with your criteria.

Learn about How to Learn from Day Trading Mistakes

What strategies can enhance my momentum trading results?

To enhance your momentum trading results, focus on these strategies for building a watchlist:

1. Identify High-Volume Stocks: Look for stocks with significant trading volume, as they often indicate strong momentum.

2. Use Technical Indicators: Incorporate indicators like moving averages, RSI, and MACD to spot potential trends and entry points.

3. Monitor News and Events: Stay updated on earnings reports, news releases, and industry developments that can drive a stock's momentum.

4. Set Price Alerts: Use alerts to track key price levels, ensuring you don’t miss breakout opportunities.

5. Diverse Sectors: Include stocks from various sectors to capture different momentum trends and mitigate risk.

6. Review Historical Performance: Analyze past performance of stocks during similar market conditions to predict future movement.

7. Limit Your List: Keep your watchlist concise—focus on 5 to 10 stocks to maintain clarity and avoid overwhelm.

8. Daily Review: Regularly update your watchlist based on market conditions and performance metrics.

By implementing these strategies, you can create a focused watchlist that enhances your momentum trading effectiveness.

How does volume affect momentum trading decisions?

Volume is crucial in momentum trading because it confirms price movements. High volume indicates strong interest, suggesting that the price trend is likely to continue. Traders often look for stocks with significant volume spikes, as these can signal potential breakouts or reversals. Conversely, low volume can lead to false signals, making it harder to trust the momentum. In building a watchlist, focus on stocks displaying both price momentum and increasing volume to identify the best trading opportunities.

Conclusion about Building a Watchlist for Momentum Day Trading

In summary, building a watchlist for momentum day trading is crucial for identifying and capitalizing on lucrative opportunities. By focusing on key criteria, utilizing effective tools, and staying updated on market news, traders can enhance their strategies and manage risks effectively. Regularly refining your watchlist based on performance and employing technical analysis can further improve your trading outcomes. For comprehensive insights and support in your trading journey, consider leveraging the expertise available at DayTradingBusiness.