Did you know that even the most seasoned day traders can make mistakes that would make a rookie cringe? In the world of day trading, combining strategies can significantly enhance your results. This article delves into the best day trading strategies to combine, offering insights on how to improve your outcomes through strategic pairings. Discover the benefits of using multiple approaches, how to analyze their effectiveness, and the crucial role of technical analysis. You'll learn about risk management techniques, key indicators to use, and how market conditions can influence your strategy combinations. Additionally, we’ll explore the integration of fundamental analysis, common pitfalls to avoid, and tips for creating a balanced trading portfolio. Whether you're a beginner or a pro, this guide from DayTradingBusiness will equip you with the knowledge to combine strategies effectively while maintaining discipline and analyzing psychological factors at play.

What Are the Best Day Trading Strategies to Combine?

The best day trading strategies to combine include scalping and momentum trading. Scalping allows for quick trades, capitalizing on small price movements, while momentum trading focuses on stocks that are moving significantly in one direction.

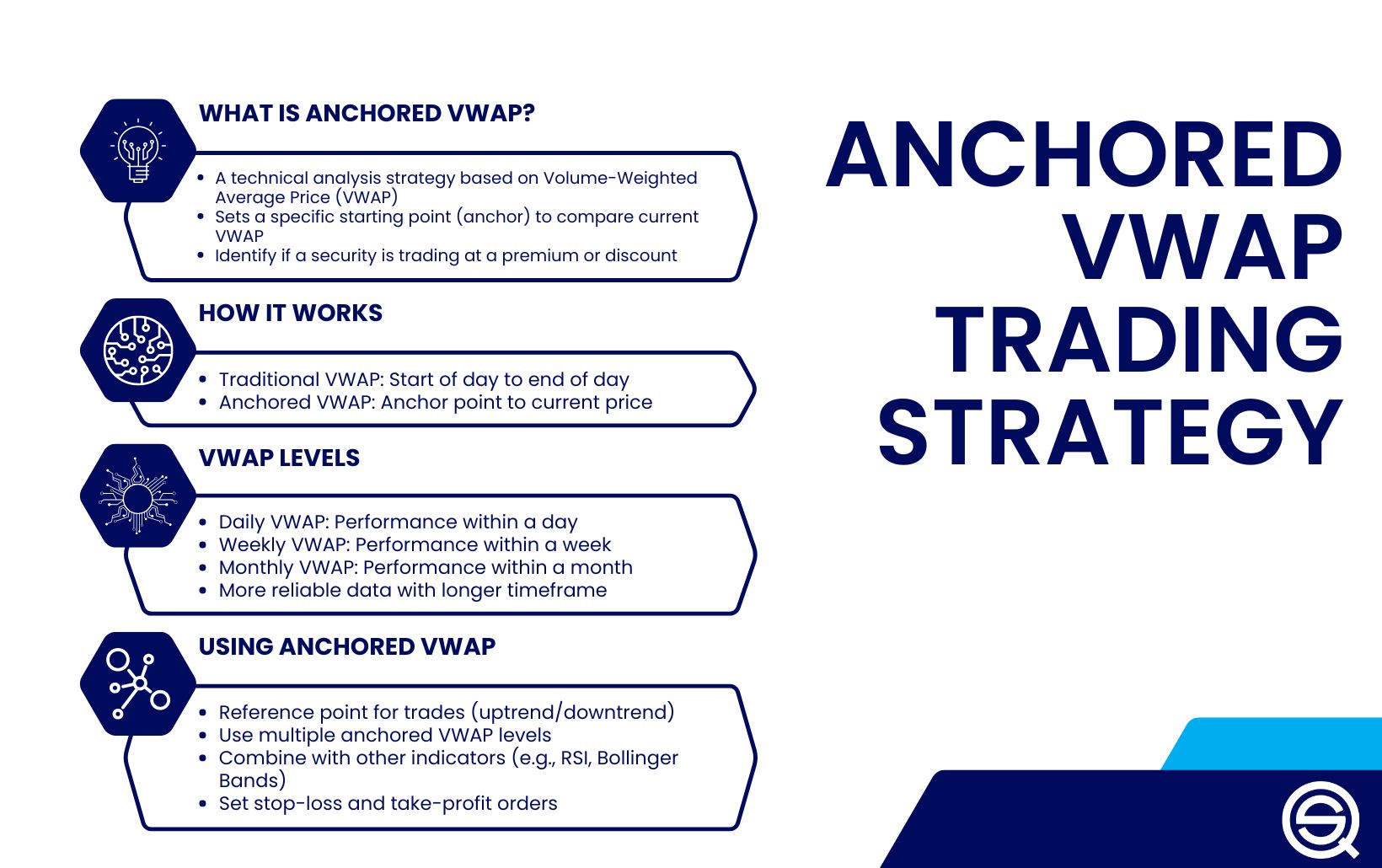

Additionally, pairing technical analysis with news trading can enhance results. Use technical indicators like moving averages and RSI to identify entry and exit points, and stay updated on market news to catch volatility.

Combining these approaches helps diversify your tactics and adapt to varying market conditions, increasing your chances of success.

How Can I Improve My Day Trading Results with Strategy Combinations?

To improve your day trading results with strategy combinations, start by identifying complementary strategies. For instance, use a trend-following strategy alongside a mean-reversion approach. This allows you to capitalize on both strong price movements and corrective phases.

Next, analyze market conditions to determine which strategy to prioritize. In trending markets, focus on momentum strategies; in sideways markets, lean on range-bound strategies.

Backtest your combined strategies to assess their effectiveness. Adjust parameters based on past performance, and continuously monitor results to refine your approach.

Finally, maintain discipline by setting clear entry and exit rules for each strategy combination, ensuring you stick to your plan even in volatile conditions. This structured approach will enhance your day trading performance.

What Are the Benefits of Using Multiple Day Trading Strategies?

Using multiple day trading strategies can enhance your trading performance by diversifying your approach, reducing risk, and improving adaptability. Different strategies can capitalize on various market conditions, allowing you to exploit opportunities more effectively. This combination can lead to more consistent profits and lower the impact of individual strategy failures. Additionally, it helps you stay engaged and responsive to market changes, ultimately improving your decision-making skills.

Which Day Trading Strategies Work Well Together?

Combining day trading strategies can enhance results. Here are three effective pairings:

1. Momentum and Scalping: Use momentum strategies to identify stocks with strong price movement, then scalp small profits as the price fluctuates within that trend.

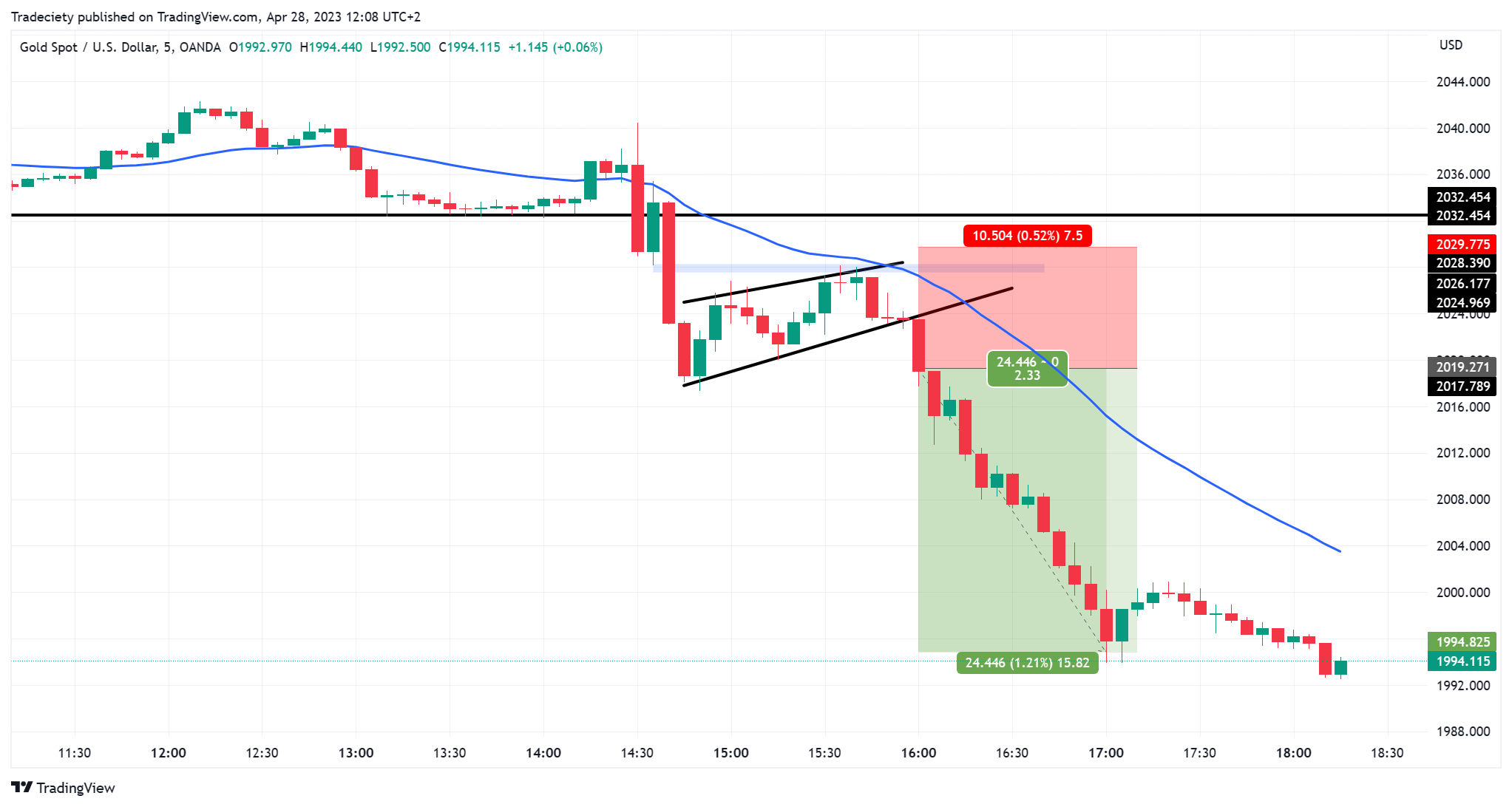

2. Technical Analysis and News Trading: Utilize technical indicators to pinpoint entry and exit points, while also reacting to news events that can cause volatility, allowing for quick trades based on market reactions.

3. Range Trading and Breakout Strategies: Identify price ranges and trade within them, but also watch for breakouts. When a stock breaks out of its range, switch to a breakout strategy to capitalize on the new trend.

Combining these approaches can provide multiple avenues for profit in day trading.

How Do I Analyze the Effectiveness of My Combined Strategies?

To analyze the effectiveness of your combined day trading strategies, follow these steps:

1. Track Performance Metrics: Record key metrics such as win rate, average profit/loss per trade, and overall return on investment (ROI).

2. Use a Trading Journal: Document each trade, including entry and exit points, reasoning, and outcomes. This helps identify patterns and areas for improvement.

3. Backtest Strategies: Simulate your combined strategies using historical data to see how they perform under different market conditions.

4. Analyze Correlation: Check how the strategies interact. Are they enhancing each other’s performance, or are they redundant?

5. Adjust and Iterate: Based on your analysis, tweak your strategies. Focus on what works and discard or modify what doesn’t.

6. Review Regularly: Set a schedule to review your performance and make adjustments as necessary to continuously improve your trading results.

What Is the Role of Technical Analysis in Strategy Combinations?

Technical analysis plays a crucial role in combining day trading strategies by providing insights into price movements, trends, and market sentiment. It helps traders identify entry and exit points through indicators like moving averages, RSI, and candlestick patterns. By analyzing historical price data, traders can refine their strategies, assess risk, and enhance decision-making. This data-driven approach allows for better alignment of different strategies, increasing the chances of profitable trades.

How Can Risk Management Enhance Combined Day Trading Strategies?

Risk management enhances combined day trading strategies by protecting capital, optimizing position sizing, and minimizing losses. By setting stop-loss orders, traders can limit their exposure to adverse market movements. Diversifying strategies helps balance risk across different assets or techniques, reducing the impact of a single poor-performing strategy. Additionally, using risk-reward ratios allows traders to assess potential gains against losses, ensuring that winning trades outweigh losing ones. Overall, effective risk management creates a more stable trading environment, enabling traders to combine strategies with confidence and improve overall performance.

What Indicators Should I Use for Combined Day Trading Strategies?

Use indicators like the Moving Average Convergence Divergence (MACD) for momentum, Relative Strength Index (RSI) for overbought or oversold conditions, and Bollinger Bands for volatility. Combine these with volume indicators to confirm trends and price action for entry and exit points. Utilizing multiple indicators helps filter false signals and enhances your day trading strategies.

How Do Market Conditions Affect Strategy Combinations in Day Trading?

Market conditions greatly influence which day trading strategies work best. In a trending market, momentum strategies can be effective, capitalizing on strong price movements. Conversely, in a choppy or sideways market, range trading strategies often yield better results, as prices oscillate between support and resistance levels.

High volatility can benefit scalping strategies, where traders seek quick profits from small price changes. However, in low volatility conditions, it may be wiser to adopt swing trading strategies, allowing for longer holds and more significant price swings.

Overall, successful day trading requires adapting strategies to fit current market dynamics, ensuring traders leverage the right approach for the prevailing conditions.

Can I Use Fundamental Analysis with My Day Trading Strategies?

Yes, you can use fundamental analysis with your day trading strategies. It helps you understand a stock’s intrinsic value and market trends that can influence short-term price movements. For example, staying updated on earnings reports or economic news can give you insights that enhance your trading decisions. Combine this with technical analysis for better timing on entry and exit points.

Learn about How to Use Sentiment Analysis in Day Trading

What Are Common Mistakes When Combining Day Trading Strategies?

Common mistakes when combining day trading strategies include:

1. Lack of Focus: Trying to merge too many strategies can dilute effectiveness. Stick to a few that complement each other.

2. Overcomplicating: Adding unnecessary indicators or rules can lead to confusion and missed opportunities.

3. Ignoring Risk Management: Failing to maintain consistent risk management across strategies can increase potential losses.

4. Inconsistent Timeframes: Using strategies based on different timeframes can create conflicting signals and hamper decision-making.

5. Emotional Trading: Relying on multiple strategies without a clear plan can lead to impulsive decisions based on fear or greed.

6. Neglecting Backtesting: Not thoroughly backtesting combined strategies can result in unforeseen pitfalls and poor performance.

7. Inflexibility: Sticking rigidly to a combination that isn’t working can lead to significant losses; be willing to adapt.

Avoid these mistakes to enhance the effectiveness of your day trading strategies.

Learn about Common Mistakes When Day Trading Stocks

How Do I Create a Balanced Day Trading Strategy Portfolio?

To create a balanced day trading strategy portfolio, start by diversifying your strategies. Combine momentum trading, range trading, and news-based strategies to capture different market conditions. Allocate a specific percentage of your capital to each strategy based on your risk tolerance and market understanding.

Next, regularly assess the performance of each strategy, adjusting your allocations as needed. Use risk management techniques like stop-loss orders and position sizing to protect your capital. Finally, keep learning and adapting your strategies based on market changes and your trading results. This approach ensures a well-rounded portfolio that can enhance your day trading success.

Learn about How to Plan Your Day Trading Strategy Around the PDT Rule?

What Timeframes Work Best for Combining Day Trading Techniques?

The best timeframes for combining day trading techniques typically range from 1-minute to 15-minute charts for active trades, while 30-minute and hourly charts can help identify broader trends. Use shorter timeframes for entry and exit signals, and longer ones to confirm overall market direction. This multi-timeframe approach enhances precision and improves decision-making, allowing you to capitalize on both quick moves and larger trends.

Learn about Best Timeframes for Momentum Day Trading

How Can Beginners Combine Day Trading Strategies for Improved Results?

Combining day trading strategies for better results involves using multiple techniques such as momentum trading, scalping, and technical analysis. Integrate risk management practices, diversify your trades, and adjust your strategies based on market conditions. This approach can enhance profitability and minimize losses.

Learn more about: Day Trading Strategies for Beginners

Learn about How to Combine Charting with Day Trading Strategies

How Can Backtesting Help Me Combine Day Trading Strategies?

Backtesting allows you to evaluate how different day trading strategies would have performed in the past using historical data. By simulating trades based on various strategies, you can see which combinations yield the best results, minimize risks, and maximize profits. It helps identify strengths and weaknesses in your approaches, enabling you to refine your strategies based on solid evidence rather than guesswork. This process increases your confidence in your trading decisions and can lead to more informed, effective trading.

Learn about How Do Prop Firms Affect Day Trading Strategies?

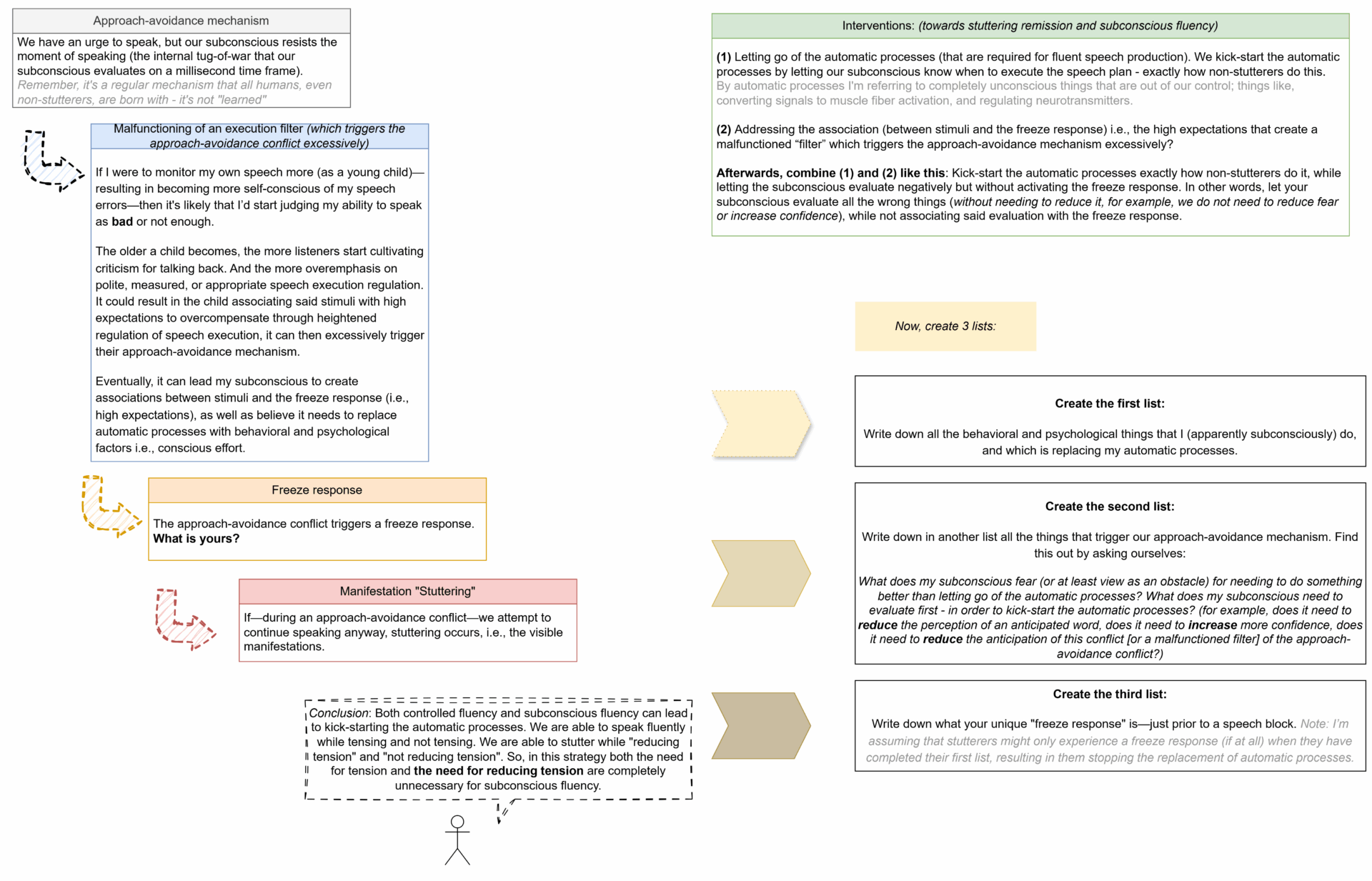

What Psychological Factors Should I Consider When Combining Strategies?

Consider these psychological factors when combining day trading strategies:

1. Risk Tolerance: Assess your comfort level with potential losses. A higher risk tolerance can influence your strategy choices.

2. Emotional Discipline: Maintain control over emotions like fear and greed. Mixed strategies can trigger conflicting feelings; stay focused on your plan.

3. Cognitive Biases: Be aware of biases like overconfidence or confirmation bias. They can lead to poor decision-making when integrating different strategies.

4. Stress Management: Day trading can be stressful. Ensure your combined strategies don’t overwhelm you, leading to hasty or irrational choices.

5. Consistency in Execution: Stick to your strategy combination. Inconsistency can arise from second-guessing or changing approaches based on short-term results.

6. Adaptability: Stay open to adjusting your strategies based on performance. Flexibility can improve outcomes but avoid impulsive changes without analysis.

7. Patience: Combining strategies takes time to yield results. Resist the urge for immediate gratification; focus on long-term success.

Integrating these psychological factors can enhance your day trading strategy effectiveness.

How Do I Stay Disciplined While Using Multiple Day Trading Strategies?

To stay disciplined while using multiple day trading strategies, follow these steps:

1. Define Clear Goals: Set specific, measurable targets for each strategy.

2. Create a Trading Plan: entry and exit points, risk management rules, and conditions for each strategy.

3. Use a Journal: Track your trades and reflect on outcomes to identify what works.

4. Limit Strategy Overlap: Avoid using strategies that conflict with each other to reduce confusion.

5. Schedule Regular Reviews: Analyze your performance weekly to adjust strategies as needed.

6. Stay Emotionally Detached: Stick to your plan and avoid impulsive decisions based on market swings.

7. Practice Patience: Focus on long-term gains instead of short-term noise.

By adhering to these practices, you’ll maintain discipline and enhance your trading success.

Learn about How to Stay Disciplined While Day Trading Scalping

Conclusion about Combining Day Trading Strategies for Better Results

Incorporating multiple day trading strategies can significantly enhance your trading performance by providing a more comprehensive approach to market fluctuations. By analyzing the effectiveness of these strategies, leveraging technical and fundamental analysis, and employing robust risk management, traders can optimize their results. Additionally, understanding market conditions and maintaining discipline are crucial to successfully executing combined strategies. For those seeking to refine their trading methods, DayTradingBusiness offers valuable insights and resources to help you navigate these complexities effectively.

Learn about Combining Indicators for Day Trading Strategies

Sources:

- Can Day Trading Really Be Profitable?

- A novel strongly-typed Genetic Programming algorithm for ...

- Multivariate probabilistic forecasting of electricity prices with trading ...

- A review of hybrid renewable energy systems: Solar and wind ...

- Composite forecasting approach, application for next-day electricity ...