Did you know that even the most seasoned traders can be fooled by a sneaky false breakout? In the fast-paced world of day trading, distinguishing between true and false breakouts is crucial for success. This article dives deep into understanding false breakouts, covering their definition, identification tactics, and common causes. We’ll explore how they can impact trading strategies and the role of market sentiment. Learn to minimize losses, leverage volume analysis, and navigate the psychological factors at play. With insights from DayTradingBusiness, traders can sharpen their skills, enhance risk management, and develop strategies to turn potential pitfalls into opportunities.

What is a false breakout in day trading?

A false breakout in day trading occurs when the price of a stock or asset moves above a resistance level or below a support level but quickly reverses direction, failing to maintain that movement. Traders often enter positions expecting a continuation, but the price retreats, leading to losses. Recognizing false breakouts involves analyzing volume and other indicators to avoid getting trapped in these misleading price movements.

How can I identify a false breakout?

To identify a false breakout in day trading, look for these key indicators:

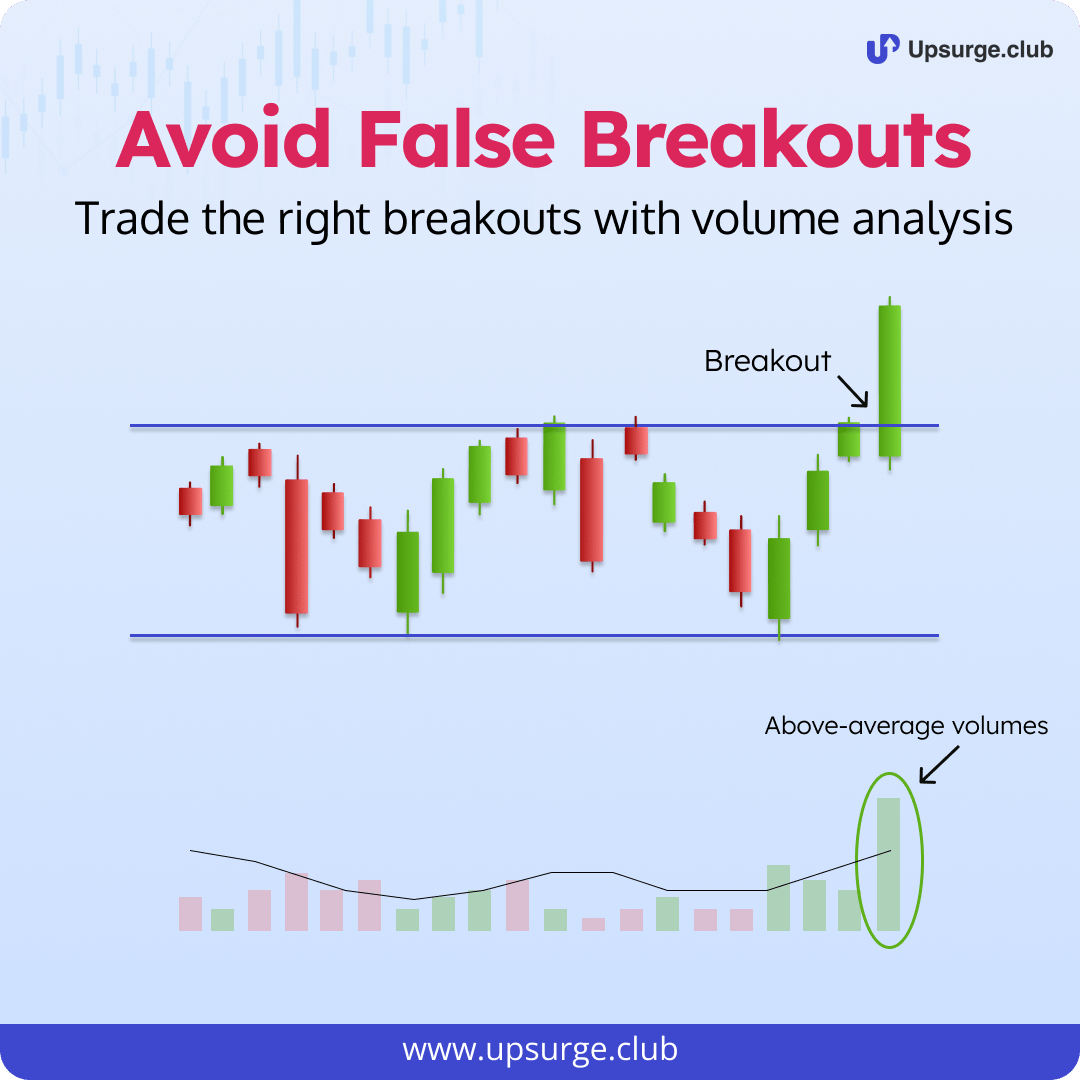

1. Volume Analysis: A breakout accompanied by low volume is often a false signal. Genuine breakouts usually see increased trading volume.

2. Price Action: Watch for quick reversals immediately after the breakout. If the price fails to hold above resistance or below support, it may be a false breakout.

3. Candlestick Patterns: Look for specific patterns like doji or engulfing candles that indicate uncertainty or reversal after a breakout.

4. Support and Resistance Levels: If the price quickly returns to the previous range after breaking a key level, it’s likely a false breakout.

5. Market Sentiment: Monitor news and overall market conditions. A breakout that contradicts the broader market trend may not be sustainable.

Use these signs to better assess potential false breakouts and make more informed trading decisions.

What are the common causes of false breakouts?

Common causes of false breakouts in day trading include low trading volume, lack of market news, and unclear support or resistance levels. Additionally, sudden market reversals, algorithmic trading activity, and trader sentiment shifts can trigger false signals. Misinterpretation of chart patterns and market manipulation by larger players also contribute to these misleading breakouts.

How do false breakouts affect trading strategies?

False breakouts can significantly disrupt trading strategies. They often lead traders to enter positions based on a perceived trend reversal or continuation, only for the price to quickly reverse and hit stop-losses. This can result in unexpected losses and increased volatility in a trading plan.

To mitigate the impact of false breakouts, traders can incorporate additional confirmation signals, like volume analysis or support and resistance levels, before executing trades. Adjusting stop-loss placements and using tighter risk management can also help protect against these scenarios. Ultimately, recognizing and adapting to false breakouts is essential for maintaining a robust day trading strategy.

What indicators can help detect false breakouts?

Indicators that can help detect false breakouts include:

1. Volume Analysis: Low volume during a breakout suggests lack of conviction. A strong breakout should have high volume confirming the move.

2. Price Action: Look for quick reversals or failure to sustain momentum after the breakout. This can indicate weakness.

3. Support and Resistance Levels: If the price quickly returns to a key level after breaking it, it may signal a false breakout.

4. Candlestick Patterns: Reversal patterns like shooting stars or bearish engulfing after a breakout can hint at a false move.

5. Momentum Indicators: Tools like RSI or MACD showing divergence from price movement can signal a potential false breakout.

6. Market Context: Consider overall market trends and news; a breakout against the prevailing trend is more likely to be false.

How can I differentiate between a true breakout and a false one?

To differentiate between a true breakout and a false one in day trading, look for these key indicators:

1. Volume Confirmation: A true breakout typically shows increased trading volume. If the volume is low or declines, it may indicate a false breakout.

2. Price Action: Monitor how the price behaves after breaking a key level. A sustained move above resistance or below support suggests authenticity. If the price quickly reverses, it’s likely a false breakout.

3. Timeframe: Analyze breakouts on multiple timeframes. A breakout that holds across longer timeframes is more reliable than one that only appears on a short timeframe.

4. Candlestick Patterns: Look for confirmation candlesticks, like bullish engulfing or strong close above resistance. Lack of supportive patterns can signal a false breakout.

5. Market Conditions: Consider overall market trends and news. Breakouts during volatile periods or against the trend can indicate potential false signals.

Use these strategies to improve your ability to spot true breakouts versus false ones in day trading.

What role does market sentiment play in false breakouts?

Market sentiment significantly influences false breakouts by driving trader emotions and decisions. When sentiment is overly bullish or bearish, traders might impulsively enter positions, leading to price spikes that fail to hold. This creates a false breakout, where the price briefly surpasses support or resistance before reversing. Understanding sentiment helps traders identify when a breakout is likely to fail, as excessive optimism or pessimism often precedes these events. Monitoring news, social media, and market indicators can provide insights into prevailing sentiment, helping traders anticipate false breakouts.

How Can Day Traders Identify and Avoid False Breakouts in Breakout Strategies?

Day trading breakout strategies involve identifying price points where an asset breaks through established support or resistance levels, signaling potential rapid price movements. Understanding false breakouts is crucial; they occur when the price temporarily breaches these levels but quickly reverses, leading to losses. To mitigate risks, traders often use volume analysis, stop-loss orders, and confirmation indicators to differentiate between genuine breakouts and false ones.

Learn more about: What Are Day Trading Breakout Strategies?

How can I minimize losses from false breakouts?

To minimize losses from false breakouts in day trading, use a few key strategies:

1. Set Stop Losses: Place tight stop losses just below support levels or above resistance to limit potential losses.

2. Volume Confirmation: Wait for a breakout to occur with strong volume. Low volume often indicates a false breakout.

3. Use Multiple Time Frames: Check higher time frames for trends. A breakout on a lower time frame may not hold if higher time frames show resistance.

4. Trend Indicators: Incorporate trend indicators like moving averages to confirm the direction before entering a trade.

5. Price Action Analysis: Look for candlestick patterns or other price action signals that can confirm the breakout’s validity.

6. Trade Smaller Positions: Reduce position sizes to minimize risk while still participating in potential breakouts.

Implementing these strategies can significantly reduce the impact of false breakouts on your trading account.

What are the psychological factors behind false breakouts?

False breakouts occur when a price movement appears to break through a support or resistance level but quickly reverses. Key psychological factors include:

1. FOMO (Fear of Missing Out): Traders rush in when they see a breakout, driving prices up, only to trigger a reversal as early buyers take profits.

2. Confirmation Bias: Traders may ignore contrary signals, believing the breakout will continue, leading to an influx of buying or selling.

3. Herd Mentality: Many traders follow the crowd, creating momentum that can lead to a false breakout as they react to the same signals.

4. Stop-Loss Triggers: Breakouts can trigger stop-loss orders placed by others, creating sudden price movements that lead to reversals.

5. Market Manipulation: Some traders or institutions may intentionally create false breakouts to trigger panic selling or buying, profiting from the ensuing volatility.

Understanding these factors can help traders avoid falling victim to false breakouts.

How do false breakouts vary across different markets?

False breakouts occur when the price moves beyond a key support or resistance level but quickly reverses, leading traders to lose potential profits. In stock markets, false breakouts often happen due to earnings reports or news events that create volatility. Forex markets may experience false breakouts due to sudden changes in economic indicators or geopolitical events. Cryptocurrency markets, known for their high volatility, frequently see false breakouts influenced by market sentiment or large trades. Each market's liquidity, participant behavior, and news sensitivity can affect the frequency and severity of false breakouts.

Learn about Does leverage risk vary across different markets?

Can false breakouts be predicted?

Yes, false breakouts can be predicted by analyzing key indicators such as volume, momentum, and price patterns. Look for low volume during a breakout, which often signals weakness. Divergence between price and momentum indicators can also suggest a potential false breakout. Additionally, observe support and resistance levels; if the price quickly reverses after breaking these, it may indicate a false breakout. Using these tools can improve your chances of identifying false breakouts in day trading.

What are the benefits of understanding false breakouts?

Understanding false breakouts in day trading helps you avoid unnecessary losses, refine entry and exit strategies, and improve overall market timing. Recognizing a false breakout allows you to identify when a price movement is likely to reverse, enabling you to stay out of bad trades. It also enhances your ability to spot genuine breakouts, increasing your chances of capitalizing on profitable opportunities. By mastering this concept, you can make more informed decisions, manage risk effectively, and boost your trading confidence.

How do false breakouts influence risk management?

False breakouts can significantly impact risk management in day trading. They often lead traders to enter positions based on misleading price movements, resulting in unexpected losses. To manage this risk, traders should set stricter stop-loss orders and avoid impulsive trades during high-volatility periods. Additionally, using confirmation signals, like volume spikes or trend indicators, can help distinguish genuine breakouts from false ones. This approach minimizes exposure and protects capital, ensuring more disciplined trading strategies.

What strategies can I use to trade around false breakouts?

To trade around false breakouts, consider these strategies:

1. Wait for Confirmation: Don't enter immediately after a breakout. Look for a close above resistance or below support, confirming the move.

2. Use Volume Analysis: Check if the breakout is accompanied by strong volume. Low volume may indicate a false breakout.

3. Set Tight Stop-Losses: Place stop-loss orders just beyond the breakout point to limit losses if the breakout fails.

4. Identify Key Levels: Focus on significant support and resistance levels. False breakouts often occur near these points.

5. Watch for Reversal Patterns: Look for candlestick patterns like pin bars or engulfing patterns that signal a reversal after a breakout.

6. Practice Risk Management: Only risk a small percentage of your capital on each trade to withstand multiple false breakouts.

7. Use Indicators: Employ indicators like RSI or MACD to spot overbought or oversold conditions, which can signal a potential false breakout.

8. Trade the Pullback: If a breakout fails, wait for a pullback to the breakout level before considering a trade in the opposite direction.

By applying these strategies, you can effectively navigate false breakouts in day trading.

How can I use volume analysis to spot false breakouts?

To spot false breakouts using volume analysis, look for low trading volume during the breakout. If the price breaks through a resistance level but volume is below average, it may indicate a lack of conviction in the move. Conversely, a genuine breakout typically shows increased volume. Additionally, monitor for a quick reversal back below the breakout level, especially if accompanied by declining volume. This suggests that the breakout lacked support and is likely a false signal. Always confirm with other indicators for stronger validation.

Learn about How to Spot Fakeouts with Volume Analysis

What lessons can traders learn from false breakouts?

Traders can learn several key lessons from false breakouts:

1. Confirmation is Crucial: Wait for additional indicators or volume before entering a trade after a breakout.

2. Set Tight Stop Losses: Protect against losses by placing stop losses just outside the breakout level.

3. Market Context Matters: Analyze the overall market trend and sentiment; false breakouts often occur in choppy markets.

4. Watch for Reversal Patterns: Recognize signs of reversal after a false breakout to avoid further losses.

5. Be Aware of Psychological Traps: Understand that emotions can lead to impulsive decisions; stick to your strategy.

6. Learn to Identify Key Levels: Familiarize yourself with support and resistance levels to better predict potential false breakouts.

7. Review Past Trades: Analyze past false breakouts to refine your strategy and improve future decision-making.

Conclusion about Understanding False Breakouts in Day Trading

In summary, recognizing and understanding false breakouts is crucial for successful day trading. By identifying key indicators, analyzing market sentiment, and utilizing effective strategies, traders can minimize losses and enhance their trading performance. Embracing these insights not only helps in distinguishing between true and false breakouts but also aids in developing robust risk management practices. For further guidance on navigating these complexities, DayTradingBusiness offers valuable resources and support to elevate your trading expertise.