Did you know that even the most seasoned traders can get as flustered as a cat in a room full of rocking chairs? In the world of day trading, mastering breakout strategies can be the difference between purring profits and a tumultuous tumble. This article dives into the essentials of breakout trading, covering everything from defining a breakout strategy and identifying key indicators to developing a solid trading plan. You'll learn how to select the best timeframes, avoid common pitfalls, and leverage volume and volatility for success. Plus, discover the best stocks, tools, and psychological factors that influence your trading journey. With insights from DayTradingBusiness, you'll be well-equipped to navigate the fast-paced trading landscape with confidence and precision.

What is a breakout strategy in day trading?

A breakout strategy in day trading involves entering a position when the price moves beyond a defined support or resistance level, signaling potential strong momentum. Successful day traders often look for patterns like triangles or flags, waiting for confirmation before entering. They frequently use indicators like volume spikes to validate breakouts. This strategy aims for quick profits by capitalizing on rapid price movements following the breakout.

How do successful day traders identify breakouts?

Successful day traders identify breakouts by monitoring key support and resistance levels on charts. They look for stocks with high volume approaching these levels, signaling potential movement. Technical indicators like moving averages or the Relative Strength Index (RSI) can also help confirm breakouts. Traders often set entry points just above resistance or below support, using stop-loss orders to manage risk. Additionally, they watch for news or events that could drive volatility, making breakouts more likely.

What are the key indicators for breakout trading?

Key indicators for breakout trading include:

1. Volume: Increased trading volume confirms the strength of a breakout.

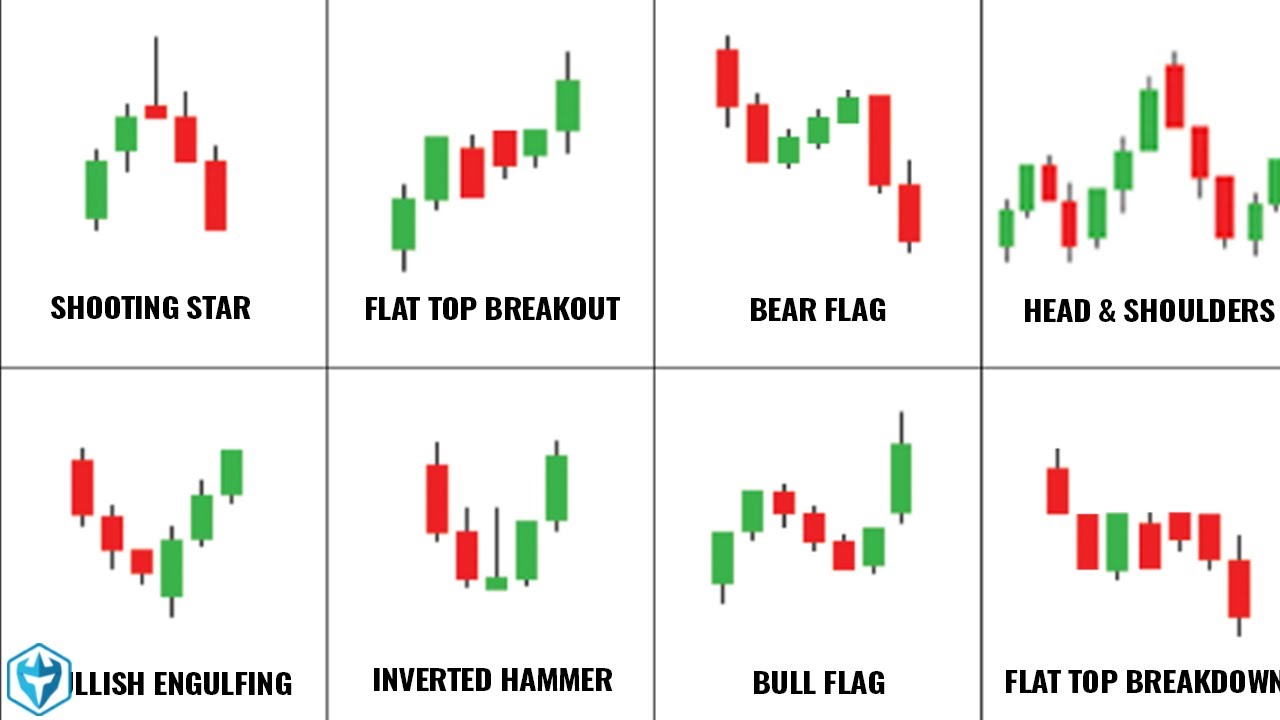

2. Price Patterns: Look for patterns like triangles, flags, or rectangles that indicate potential breakouts.

3. Moving Averages: Crossovers above key moving averages can signal bullish breakouts.

4. Support and Resistance Levels: Breakouts above resistance or below support are critical signals.

5. Relative Strength Index (RSI): An RSI above 70 may indicate overbought conditions, while below 30 suggests oversold, helping identify potential reversals.

6. Bollinger Bands: A price move outside the bands can indicate a breakout.

7. News and Events: Significant news can trigger breakouts; monitor economic reports or company announcements.

Using these indicators helps day traders identify profitable breakout opportunities.

How can I develop a breakout trading plan?

To develop a breakout trading plan, follow these steps:

1. Identify Key Levels: Look for resistance and support levels on your charts. These are crucial for spotting potential breakouts.

2. Set Entry Points: Decide on your entry point just above resistance for bullish breakouts or below support for bearish breakouts.

3. Define Risk Management: Establish stop-loss orders to limit losses. Typically, place them just below the breakout level for long trades and above for shorts.

4. Determine Position Size: Calculate how much of your capital you’ll risk on each trade. A common guideline is to risk no more than 1-2% of your total account.

5. Use Volume Confirmation: Ensure there's increased trading volume during the breakout. This confirms the strength of the move.

6. Establish Profit Targets: Set realistic profit targets based on risk-reward ratios. Aim for at least a 2:1 ratio.

7. Monitor Market Conditions: Stay updated on news and events that could impact your trades.

8. Review and Adjust: After each trade, analyze your results and refine your strategy as needed.

By following these steps, you can create a structured and effective breakout trading plan.

What timeframes are best for breakout strategies?

The best timeframes for breakout strategies in day trading are typically 5-minute, 15-minute, and 30-minute charts. These shorter timeframes allow traders to capture quick price movements after breakouts. For more significant breakouts, such as those from key support or resistance levels, 1-hour charts can also be effective. Always consider the volatility and volume during these periods to enhance the probability of successful trades.

What mistakes do new traders make with breakout strategies?

New traders often make several mistakes with breakout strategies. They frequently enter trades too early, before a clear breakout occurs, leading to false signals. Many overlook proper risk management, risking too much capital on a single trade. Traders might also ignore volume, which is crucial for confirming breakouts. Additionally, some fail to set appropriate stop-loss orders, resulting in larger losses than necessary. Emotional trading can lead to hesitation or impulsive decisions during high volatility. Lastly, new traders may neglect to have a clear plan for taking profits, missing out on gains when the market reverses.

How do volume and volatility affect breakout success?

Volume and volatility are crucial for breakout success in day trading. High volume confirms the strength of a breakout, indicating strong market interest and reducing the likelihood of false breakouts. Increased volatility can enhance price movement, allowing traders to capture larger gains. When both volume and volatility are high, breakouts are more likely to sustain their momentum, leading to successful trades. Conversely, low volume or low volatility can result in weak breakouts that quickly reverse, risking losses.

What are the best stocks for breakout day trading?

The best stocks for breakout day trading typically include those with high volatility, significant volume, and strong news catalysts. Look for stocks like Tesla (TSLA), AMD, and Shopify (SHOP), which often exhibit sharp price movements. Additionally, stocks with recent earnings reports or major announcements can provide excellent breakout opportunities. Always check technical indicators like moving averages and resistance levels to identify potential breakouts.

How Do Successful Day Traders Implement Breakout Strategies?

Day trading breakout strategies involve entering a position when the price breaks above resistance or below support, often accompanied by increased volume. Successful day traders using these strategies identify key price levels, utilize technical indicators, and manage risk through stop-loss orders.

Learn more about: What Are Day Trading Breakout Strategies?

How can I manage risk with breakout trades?

To manage risk with breakout trades, set a stop-loss order just below the breakout point to limit potential losses. Use position sizing to ensure that no single trade risks more than 1-2% of your trading capital. Monitor volume; a significant increase on the breakout confirms strength. Consider using trailing stops to lock in profits as the trade moves in your favor. Additionally, avoid trading in low-volume markets to reduce slippage. Always have an exit plan for both winning and losing trades.

What tools and platforms support breakout trading?

Tools and platforms that support breakout trading include:

1. TradingView: Offers real-time charting and customizable indicators for spotting breakouts.

2. ThinkorSwim: Provides advanced charting tools and alerts for breakout patterns.

3. MetaTrader 4/5: Popular for forex trading, includes automated trading options and technical analysis tools.

4. Interactive Brokers: Features a robust trading platform with comprehensive market data and analysis capabilities.

5. StockCharts: Ideal for technical analysis with interactive charts to identify breakout opportunities.

6. NinjaTrader: Offers advanced charting and backtesting features specifically for futures and forex traders.

Using these platforms, traders can effectively identify and capitalize on breakout opportunities in various markets.

How do news events influence breakout trading opportunities?

News events create volatility and can lead to significant price movements, making them prime opportunities for breakout trading. When a major news story is released, it can cause a stock to break through resistance or support levels. Successful day traders monitor news closely, looking for events like earnings reports, economic data, or geopolitical developments. These catalysts can trigger rapid buying or selling, allowing traders to enter positions as the price breaks out. For example, if a company reports better-than-expected earnings, the stock might surge past a resistance level, providing a clear breakout opportunity.

Learn about How News Events Impact Breakout Trading

What are common breakout patterns to watch for?

Common breakout patterns to watch for include:

1. Cup and Handle: A rounded bottom followed by a consolidation phase, indicating potential upward movement.

2. Ascending Triangle: Higher lows with a flat resistance level, suggesting a bullish breakout.

3. Descending Triangle: Lower highs with a flat support level, often leading to a bearish breakout.

4. Flags and Pennants: Short-term consolidation after a strong price movement, signaling continuation of the trend.

5. Head and Shoulders: A reversal pattern that indicates a change in trend direction after the formation completes.

Monitoring these patterns can help day traders identify entry points for successful breakout strategies.

How do successful traders track their breakout trades?

Successful traders track their breakout trades by using a combination of technical analysis, chart patterns, and volume indicators. They often look for key levels of support and resistance, identifying potential breakout points. Traders use tools like moving averages, Bollinger Bands, or the Relative Strength Index (RSI) to confirm breakouts.

They also monitor trading volume closely; a surge in volume often indicates a strong breakout. Many successful traders set alerts for specific price levels and utilize trading journals to analyze past trades. Additionally, they may use real-time data and trading platforms that offer advanced charting features to stay informed and react quickly to market movements.

What psychological factors impact breakout trading success?

Breakout trading success is influenced by several psychological factors:

1. Discipline: Successful traders stick to their strategies and avoid emotional decision-making during volatility.

2. Risk Tolerance: A higher risk tolerance can lead to taking advantage of breakout opportunities, but it must be balanced with proper risk management.

3. Patience: Waiting for the right breakout signals without chasing moves is crucial for success.

4. Confidence: Believing in one’s analysis and strategy helps traders execute their trades effectively.

5. Adaptability: The ability to adjust strategies based on market conditions can enhance breakout trading outcomes.

6. Stress Management: Handling the pressure of rapid market changes prevents panic selling or overtrading.

Focusing on these psychological factors can significantly boost breakout trading performance.

How can backtesting improve breakout strategy effectiveness?

Backtesting improves breakout strategy effectiveness by allowing traders to analyze historical price movements and identify successful entry and exit points. It helps refine the strategy by assessing performance metrics like win rates and risk-reward ratios. By testing against past market conditions, traders can adjust parameters to enhance profitability and reduce risks. This data-driven approach builds confidence and informs decision-making, leading to more disciplined trading during actual market conditions.

What are the differences between breakout and reversal strategies?

Breakout strategies focus on entering a trade when a stock price moves above a specific resistance level or below a support level, indicating potential continued momentum. In contrast, reversal strategies aim to identify points where a trend is likely to change direction, entering trades at overbought or oversold conditions.

Successful day traders using breakout strategies look for high volume and volatility to confirm the breakout, while those using reversal strategies rely on signals like candlestick patterns or technical indicators to spot trend shifts. Essentially, breakout strategies capitalize on momentum, whereas reversal strategies anticipate a change in that momentum.

Conclusion about Successful Day Traders Using Breakout Strategies

In summary, mastering breakout strategies is essential for successful day trading, as they can significantly enhance profit potential. By understanding key indicators, developing a robust trading plan, and managing risk effectively, traders can capitalize on market movements. Additionally, tools and platforms that support breakout trading, along with awareness of news events and psychological factors, further empower traders to make informed decisions. For those looking to deepen their understanding and refine their approach, DayTradingBusiness offers invaluable resources and support to navigate the complexities of breakout trading.

Learn about Challenges Faced by Day Traders Using HFT Strategies