Did you know that over 80% of traders believe they can predict the market's next move simply by reading the news? While that might sound ambitious, understanding how news events impact breakout trading is crucial for success. This article dives into the influence of news on breakout strategies, detailing the types of news that trigger market movements, how to prepare for news-driven breakouts, and the key indicators to watch. We’ll also cover the effects of economic reports and market sentiment on trading decisions, as well as the risks involved during major news events. With insights from DayTradingBusiness, you'll learn how to effectively monitor news for breakout signals and avoid common pitfalls. Get ready to enhance your trading strategy with the power of informed decision-making!

How Do News Events Influence Breakout Trading?

News events can significantly influence breakout trading by triggering sudden price movements. Positive news, like strong earnings reports, can lead to upward breakouts as traders buy in anticipation of further gains. Conversely, negative news can cause downward breakouts as traders sell to limit losses. The volatility generated by these events often creates clear entry and exit points for breakout traders, making it crucial to monitor news releases closely for potential trading opportunities.

What Types of News Events Affect Breakout Trading?

News events that affect breakout trading include earnings reports, economic data releases (like GDP or unemployment rates), central bank announcements, geopolitical developments, and major corporate news (such as mergers or scandals). These events can create volatility and lead to significant price movements, triggering breakouts above resistance or below support levels. Traders should monitor these events closely, as they can provide opportunities for profitable trades.

How Can Traders Prepare for News-Driven Breakouts?

Traders can prepare for news-driven breakouts by following these steps:

1. Stay Informed: Regularly check economic calendars for upcoming news events that could impact markets, such as earnings reports or economic data releases.

2. Analyze Historical Impact: Review how similar news events affected price movements in the past to anticipate potential breakout patterns.

3. Set Alerts: Use trading platforms to set alerts for key price levels around news events to catch breakouts as they happen.

4. Manage Risk: Establish clear stop-loss orders to protect against adverse movements following news releases.

5. Watch Market Sentiment: Monitor social media and financial news for trader sentiment, as this can influence breakout strength.

6. Practice Patience: Avoid entering trades too early; wait for confirmation of a breakout before committing.

7. Adjust Position Sizes: Consider smaller position sizes to limit exposure to volatility during news events.

By implementing these strategies, traders can effectively navigate news-driven breakouts.

What Are the Key Indicators of a News-Driven Breakout?

Key indicators of a news-driven breakout include:

1. Volume Spike: A significant increase in trading volume often precedes or accompanies a breakout, signaling strong interest.

2. Price Action: A sudden price movement beyond a resistance or support level indicates a potential breakout.

3. News Catalyst: Relevant news events, such as earnings reports, economic data releases, or geopolitical developments, can trigger breakouts.

4. Market Sentiment: A shift in sentiment, reflected in analyst upgrades or downgrades, can drive price movement.

5. Technical Patterns: Look for chart patterns like flags, triangles, or consolidation areas that suggest a breakout is imminent.

6. Timing: Breakouts often occur shortly after news releases, making timing critical.

Monitoring these indicators can help traders identify potential news-driven breakouts effectively.

How Do Economic Reports Impact Breakout Trading Strategies?

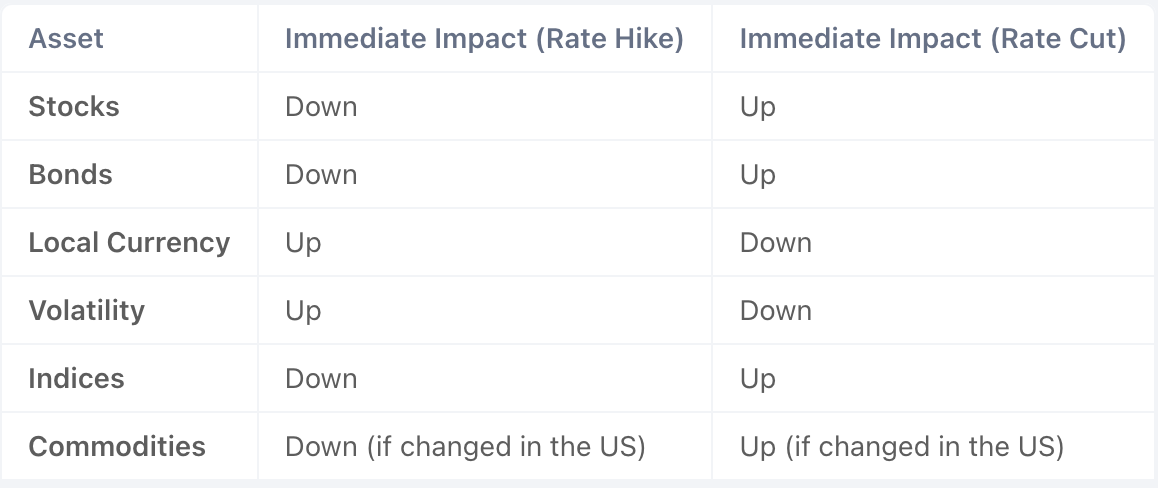

Economic reports significantly impact breakout trading strategies by influencing market volatility and trader sentiment. Positive reports, like strong employment data, can trigger upward breakouts as traders anticipate price increases. Conversely, negative reports may lead to downward breakouts as sellers react. Traders often watch key indicators, such as GDP or inflation rates, to identify potential breakout opportunities. Quick reactions to these reports can create sharp price movements, making it crucial for breakout traders to stay informed and adjust their strategies accordingly.

What Role Does Market Sentiment Play in Breakout Trades?

Market sentiment significantly influences breakout trades by driving price movements based on traders' perceptions and reactions to news events. Positive news can create bullish sentiment, leading to increased buying pressure and potential breakouts above resistance levels. Conversely, negative news may trigger bearish sentiment, causing sell-offs and breakdowns below support levels. Traders often use sentiment indicators and news analysis to gauge market mood, which helps them anticipate breakout opportunities. In essence, understanding market sentiment is crucial for timing and executing successful breakout trades.

How Can Traders Identify News Catalysts for Breakouts?

Traders can identify news catalysts for breakouts by monitoring economic calendars for scheduled announcements, following financial news outlets for unexpected events, and using social media for real-time updates. Key indicators include earnings reports, central bank meetings, and geopolitical events. Analyzing historical data on how similar news impacted price movements can also help predict potential breakouts. Additionally, setting alerts for significant news can keep traders informed and ready to act.

How Do News Events Influence Day Trading Breakout Strategies?

Day trading breakout strategies involve identifying price levels where an asset breaks through resistance or support, signaling potential for significant price movement. News events can significantly impact breakout trading by causing volatility and triggering breakouts as traders react to new information. Positive news may lead to bullish breakouts, while negative news can result in bearish breakouts. It's crucial for day traders to monitor news events to capitalize on these opportunities and manage risk effectively.

Learn more about: What Are Day Trading Breakout Strategies?

What Are the Risks of Trading Breakouts During Major News Events?

Trading breakouts during major news events carries several risks. First, price volatility can spike, leading to unexpected reversals. Slippage may occur, causing trades to execute at unfavorable prices. Additionally, spreads can widen, increasing costs. There's also the risk of false breakouts, where prices initially move through a level but quickly reverse. Lastly, market reactions to news can be unpredictable, making it difficult to rely on technical analysis alone.

How Do Earnings Reports Impact Breakout Opportunities?

Earnings reports can significantly impact breakout opportunities by causing sudden price movements. When a company reports earnings that exceed or fall short of expectations, it can lead to increased volatility. Positive earnings often drive the stock price above key resistance levels, creating breakout opportunities. Conversely, disappointing results can push prices below support levels, triggering sell-offs. Traders often look for these movements to capitalize on potential profit. In summary, earnings reports can either fuel breakouts or halt trends, making them critical to trading strategies.

What Timing Strategies Should Traders Use Around News Events?

Traders should use the following timing strategies around news events for breakout trading:

1. Pre-News Positioning: Enter trades before the news release if you anticipate a strong market reaction based on analysis.

2. Wait for Clarity: Avoid entering trades immediately after the news. Wait for a clear breakout direction, ideally after the initial volatility settles.

3. Use Stop Orders: Place buy or sell stop orders slightly above or below key support/resistance levels to catch breakouts triggered by the news.

4. Monitor Volume: Look for increased trading volume accompanying the breakout, confirming the move's strength.

5. Set Time Limits: Be aware of how long to hold trades post-news. Shorter time frames might be necessary due to rapid reversals after initial reactions.

6. Review Economic Calendars: Stay informed about upcoming news events and adjust your strategy accordingly, considering potential market impact.

Using these strategies can enhance your chances of success in breakout trading around news events.

How Can Technical Analysis Complement News-Driven Breakout Trading?

Technical analysis can enhance news-driven breakout trading by providing a framework to identify key levels of support and resistance. When news events occur, they can create volatility, making it crucial to recognize price patterns and trends. Traders can use technical indicators, like moving averages and volume analysis, to confirm breakout signals generated by news. For instance, if a stock breaks above resistance following positive earnings news, technical analysis can help validate the strength of that move. By combining technical signals with news events, traders can make more informed decisions and improve their chances of successful entries and exits.

What Are Common Mistakes in Trading Breakouts After News?

Common mistakes in trading breakouts after news include:

1. Reacting Too Quickly: Traders often jump in immediately after news breaks, leading to impulsive decisions without proper analysis.

2. Ignoring Market Context: Failing to consider overall market conditions can result in misjudging the breakout's strength.

3. Overtrading: Some traders take too many positions during volatile news events, increasing risk without adequate justification.

4. Setting Tight Stops: Placing stop-loss orders too close can trigger them unnecessarily due to volatility, leading to losses.

5. Neglecting Volume: A breakout without sufficient volume may indicate a false signal; traders often overlook this critical factor.

6. Chasing Price: Entering a trade after a breakout has already occurred can lead to getting in at unfavorable prices.

7. Lack of a Clear Exit Strategy: Failing to plan how to exit can result in missed profits or deeper losses if the trade reverses.

Avoiding these mistakes can improve breakout trading strategies around news events.

How Do Different Asset Classes React to News Events in Breakout Trading?

Different asset classes react uniquely to news events in breakout trading.

1. Stocks: Often show sharp movements; positive earnings or economic data can lead to significant price jumps, while negative news may trigger quick sell-offs.

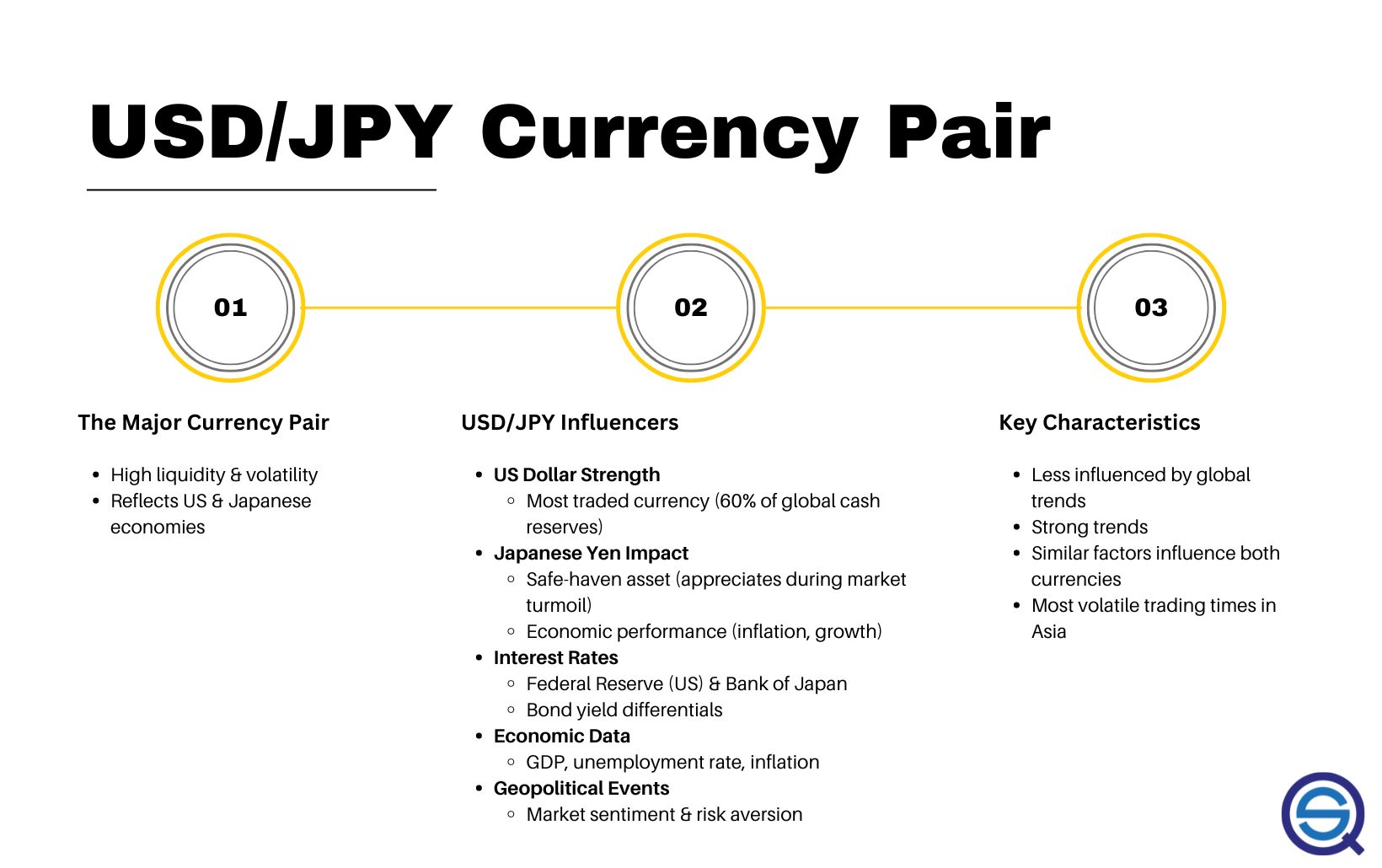

2. Forex: Highly sensitive to geopolitical events and economic indicators; major currency pairs can experience volatility, leading to breakout opportunities.

3. Commodities: Prices can spike or drop based on supply-demand reports, geopolitical tensions, or weather events; for example, oil prices often react strongly to OPEC announcements.

4. Cryptocurrencies: Highly reactive to regulatory news or technological developments; significant news can lead to rapid price movements and breakouts.

In breakout trading, understanding these reactions can help traders capitalize on volatility created by news events.

What Tools Can Help Traders Analyze News Impact on Breakouts?

Traders can use several tools to analyze news impact on breakouts:

1. Economic Calendars: Track key economic events and announcements that may affect market volatility, like job reports or central bank meetings.

2. News Aggregators: Platforms like Feedly or Bloomberg provide real-time news updates relevant to specific markets or assets.

3. Sentiment Analysis Tools: Tools like MarketPsych or Sentifi analyze market sentiment based on news and social media, helping traders gauge potential breakout movements.

4. Technical Analysis Software: Programs like TradingView allow traders to overlay news events with price charts, helping identify breakout patterns linked to news.

5. Backtesting Software: Tools like MetaTrader or NinjaTrader enable traders to test strategies based on historical news events to see their impact on breakouts.

Using these tools can enhance a trader's ability to understand how news influences breakout opportunities.

How Do Global Events Influence Breakout Trading in Different Markets?

Global events significantly influence breakout trading by creating volatility and shifts in market sentiment. Economic reports, geopolitical tensions, and natural disasters can lead to sudden price movements, triggering breakouts. For instance, a positive jobs report might cause stock prices to surge, prompting traders to enter long positions. Conversely, negative news, like trade disputes, can lead to sharp declines, encouraging short positions.

Traders often monitor news feeds and economic calendars to anticipate potential breakouts. High-impact events, such as central bank announcements or earnings reports, can lead to increased trading volume and sudden price changes, making them ideal for breakout strategies. Overall, staying informed about global events is crucial for identifying and capitalizing on breakout opportunities in various markets.

What Is the Best Way to Monitor News for Breakout Trading Signals?

The best way to monitor news for breakout trading signals is to use a combination of real-time news feeds, economic calendars, and social media platforms. Set up alerts for key economic indicators, earnings reports, and geopolitical events that can trigger market volatility. Utilize platforms like Bloomberg, Reuters, or specialized trading apps for instant updates.

Follow influential traders and analysts on Twitter or financial forums to gauge market sentiment. Always check historical data to see how similar news events impacted price movements in the past. This approach helps you identify potential breakouts effectively.

Conclusion about How News Events Impact Breakout Trading

Incorporating news events into breakout trading strategies is crucial for maximizing potential gains and minimizing risks. Understanding the types of news that drive market movements, along with their impact on sentiment and economic indicators, allows traders to prepare effectively. By leveraging technical analysis and monitoring global events, traders can better identify catalysts for breakouts. Remember to stay vigilant about the timing of your trades and avoid common pitfalls to enhance your trading success. For deeper insights and strategies, explore the resources available at DayTradingBusiness.

Learn about How News Events Impact Day Trading Decisions