Did you know that even robots can have a better poker face than most traders? In the fast-paced world of day trading arbitrage, automation is revolutionizing how traders capitalize on price discrepancies. This article explores how automation enhances trading efficiency, the benefits of automated systems, and the best tools available for arbitrage trading. We’ll dive into the role of algorithms, the significance of APIs, and the importance of backtesting to refine strategies. Additionally, we'll address the potential risks, compliance challenges, and market volatility's impact on automated systems. For those looking to navigate this innovative trading landscape, DayTradingBusiness provides essential insights to help you make informed decisions and optimize your automated trading approach.

How does automation enhance day trading arbitrage?

Automation enhances day trading arbitrage by executing trades at high speeds, identifying price discrepancies across markets instantly, and minimizing human error. Automated trading systems can analyze vast amounts of data and execute orders based on predefined algorithms, ensuring that opportunities are capitalized on before they vanish. This allows traders to maintain a competitive edge, as they can react to market changes faster than manual trading. Additionally, automation enables continuous monitoring of multiple assets, optimizing trade execution and maximizing profit potential.

What are the benefits of using automated systems in arbitrage trading?

Automated systems in arbitrage trading offer several key benefits:

1. Speed: They execute trades within milliseconds, capitalizing on price discrepancies before they close.

2. Precision: Automation reduces human error, ensuring trades are executed exactly as programmed.

3. 24/7 Operation: Automated systems can operate continuously, monitoring multiple markets simultaneously without fatigue.

4. Backtesting: Traders can test strategies against historical data to refine their approaches before real-time implementation.

5. Emotionless Trading: Automation removes emotional bias, allowing for disciplined trading based purely on data and algorithms.

6. Scalability: Automated systems can handle larger volumes of trades efficiently, making it easier to scale strategies.

These advantages make automation a powerful tool for maximizing profits in arbitrage trading.

What types of automation tools are best for day trading arbitrage?

The best automation tools for day trading arbitrage include algorithmic trading software, quantitative analysis platforms, and real-time data feeds. Tools like MetaTrader, TradeStation, and NinjaTrader allow for custom scripts and strategies. Additionally, APIs from exchanges can facilitate automated trading strategies. For monitoring price discrepancies, consider tools like Coinigy or TradingView. Always ensure these tools can handle high-frequency trading and execute trades quickly to capitalize on arbitrage opportunities.

How can algorithms improve trading efficiency in arbitrage?

Algorithms improve trading efficiency in arbitrage by quickly analyzing price discrepancies across markets, executing trades at high speeds, and minimizing human error. They can process vast amounts of data in real time, identify arbitrage opportunities faster than manual trading, and execute orders instantly to capitalize on those opportunities before they vanish. Automation also allows for backtesting strategies, optimizing trading parameters, and managing risks effectively, leading to more consistent profits in day trading arbitrage.

What are the risks associated with automated arbitrage trading?

Automated arbitrage trading carries several risks:

1. Market Volatility: Rapid price changes can lead to unexpected losses if the algorithm cannot adapt quickly enough.

2. Execution Errors: Technical glitches or latency issues can result in trades not executing as intended, causing financial loss.

3. Liquidity Risk: In thinly traded markets, finding counterparties for trades may be difficult, leading to slippage.

4. Over-Optimization: Relying on backtested strategies can lead to poor performance in live markets if conditions change.

5. Regulatory Risks: Compliance with trading regulations can be complex and failing to adhere can result in penalties.

6. Systemic Risks: Large-scale automated trading can contribute to market instability, affecting all traders.

7. Data Dependency: Flawed data inputs can lead to incorrect trading decisions, impacting profitability.

Mitigating these risks requires constant monitoring, strategy adjustments, and robust risk management practices.

How do traders set up automated systems for arbitrage?

Traders set up automated systems for arbitrage by following these steps:

1. Choose a Trading Platform: Select a platform that supports algorithmic trading and has access to multiple exchanges.

2. Define Arbitrage Opportunities: Identify the assets and markets to target, such as cryptocurrencies or stocks, where price discrepancies exist.

3. Develop an Algorithm: Write a trading algorithm using programming languages like Python or JavaScript. This algorithm should monitor price differences and execute trades automatically.

4. Backtesting: Test the algorithm against historical data to ensure it performs well under various market conditions.

5. Set Risk Parameters: Implement risk management rules to limit losses, such as stop-loss orders.

6. Deploy the Bot: Launch the automated system on a live account, ensuring it’s connected to the market for real-time trading.

7. Monitor Performance: Continuously track the system's performance and make adjustments as needed to optimize results.

Using these steps, traders can effectively leverage automation in day trading arbitrage.

What role do APIs play in automated day trading?

APIs enable automated day trading by allowing trading platforms to communicate with market data sources and execute trades. They provide real-time access to price feeds, making it possible to identify arbitrage opportunities quickly. Through APIs, traders can automate strategies, manage trades, and access multiple exchanges simultaneously, optimizing execution speed and reducing latency. This automation enhances decision-making, allowing traders to capitalize on fleeting market inefficiencies effectively.

How can backtesting improve automated arbitrage strategies?

Backtesting improves automated arbitrage strategies by allowing traders to simulate their strategies against historical data. This process helps identify the effectiveness and profitability of the strategy before real capital is at risk. By analyzing past price movements and market conditions, traders can fine-tune their algorithms to enhance performance. It also reveals potential pitfalls, such as slippage or market impact, enabling adjustments to minimize risks. Ultimately, backtesting provides valuable insights that lead to more robust and reliable automated trading systems.

What metrics should be monitored in automated arbitrage trading?

Monitor these key metrics in automated arbitrage trading:

1. Profit Margin: Measure the difference between buying and selling prices to gauge profitability.

2. Execution Speed: Track how quickly trades are executed to capitalize on price discrepancies.

3. Slippage: Analyze the difference between expected and actual trade prices to assess the impact on profits.

4. Transaction Costs: Include fees and commissions to understand their effect on overall returns.

5. Win Rate: Calculate the percentage of profitable trades to evaluate strategy effectiveness.

6. Drawdown: Monitor the peak-to-trough decline in capital to assess risk and volatility.

7. Liquidity: Check market depth to ensure sufficient volume for executing trades without significant price changes.

8. Market Correlation: Analyze how different assets move in relation to each other to identify potential arbitrage opportunities.

These metrics help refine strategies and enhance performance in automated arbitrage trading.

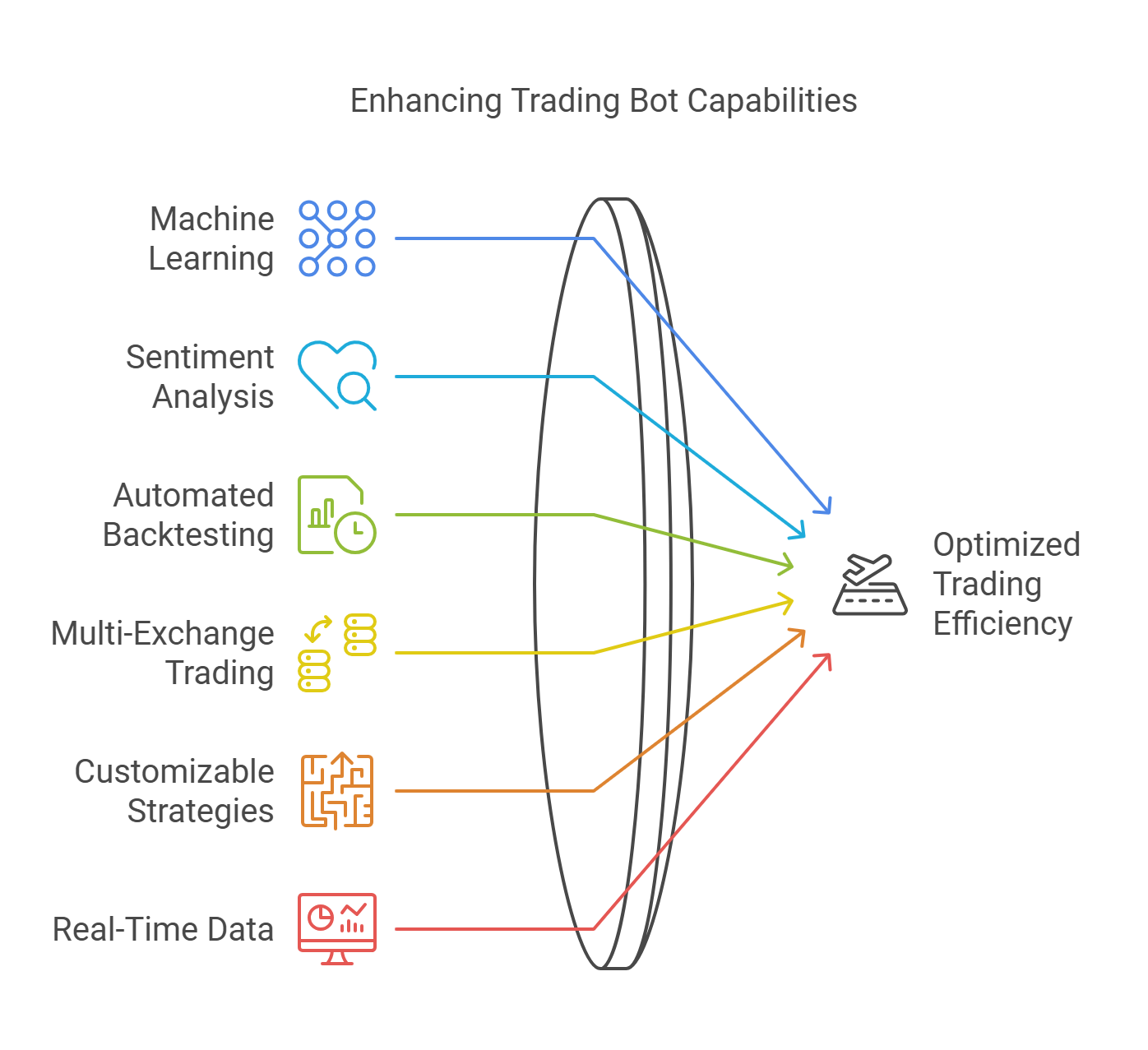

How does machine learning impact day trading arbitrage?

Machine learning enhances day trading arbitrage by analyzing vast amounts of data quickly to identify price discrepancies across markets. Algorithms can adapt to changing market conditions in real-time, executing trades faster than a human trader could. This automation improves efficiency, reduces human error, and increases profit potential by capitalizing on fleeting arbitrage opportunities. Moreover, machine learning models can predict market movements, allowing traders to make more informed decisions. Overall, it transforms day trading arbitrage into a more precise and strategic endeavor.

Learn about How Do Prop Firms Impact Day Trading Profitability?

What are common pitfalls in automated arbitrage trading?

Common pitfalls in automated arbitrage trading include:

1. Latency Issues: Delays in execution can lead to missed opportunities or losses.

2. Market Changes: Rapid shifts in market conditions can render strategies ineffective.

3. Overfitting: Strategies optimized on historical data may fail in live markets.

4. Liquidity Problems: Low liquidity can prevent trades from executing at expected prices.

5. Technical Failures: Software bugs or connectivity issues can disrupt trading.

6. Over-leverage: Excessive use of leverage can amplify losses.

7. Ignoring Fees: Trading costs can erode profits if not properly accounted for.

8. Regulatory Changes: New regulations can impact trading strategies unexpectedly.

Addressing these pitfalls is crucial for successful automated arbitrage trading.

How does real-time data affect automated trading outcomes?

Real-time data significantly enhances automated trading outcomes by providing up-to-the-second information on market conditions, price movements, and trading volumes. This immediacy allows algorithms to execute trades more accurately and swiftly, capitalizing on arbitrage opportunities before they vanish. With real-time data, automated systems can adjust strategies dynamically, improving decision-making and minimizing risks associated with lagging information. Overall, access to real-time data is crucial for maximizing profits and ensuring efficiency in day trading arbitrage.

Learn about How Does Confidence Fluctuate and Affect Trading Outcomes?

What is the cost of implementing automation in day trading?

The cost of implementing automation in day trading varies significantly based on several factors. Basic trading software can range from $100 to $1,000, while advanced algorithms and platforms may cost several thousand dollars. Additionally, you may incur ongoing costs for data feeds, brokerage commissions, and infrastructure like servers or cloud services. If you're hiring developers to create custom algorithms, expect to budget anywhere from $5,000 to $50,000 or more. Overall, initial investments could start around $1,000 and can escalate to tens of thousands, depending on your strategy and requirements.

How can traders ensure compliance while using automated systems?

Traders can ensure compliance while using automated systems by implementing the following measures:

1. Understand Regulations: Stay updated on trading regulations in your jurisdiction. Know the rules for automated trading and arbitrage strategies.

2. System Auditing: Regularly audit your automated systems to ensure they operate within legal limits and follow trading guidelines.

3. Risk Management: Incorporate risk management protocols in your algorithms to prevent excessive losses, which can trigger regulatory scrutiny.

4. Record Keeping: Maintain detailed logs of trades executed by your automated systems. This documentation is crucial for compliance checks.

5. Testing and Monitoring: Test your systems in a simulated environment before live trading. Continuously monitor performance to catch any non-compliance issues early.

6. Consult Legal Experts: Work with compliance officers or legal experts specializing in trading regulations to review your automated strategies.

7. Use Reputable Software: Choose reliable trading platforms that adhere to compliance standards and have built-in safeguards.

By following these steps, traders can effectively navigate the complexities of compliance in automated day trading arbitrage.

What are the best practices for maintaining automated trading systems?

1. Regularly monitor system performance to identify anomalies and ensure it operates as intended.

2. Implement robust risk management strategies to limit losses, including stop-loss orders.

3. Update algorithms based on market changes and backtest them with historical data.

4. Maintain a detailed log of trades and system decisions for analysis.

5. Ensure reliable data feeds and low-latency execution to enhance trade accuracy.

6. Conduct periodic maintenance to check hardware and software integrity.

7. Diversify trading strategies to mitigate risks associated with a single approach.

8. Stay informed about market news and economic indicators that may impact trading.

Learn about What Are the Best Practices for Maintaining Day Trading Broker Compliance?

How does market volatility impact automated arbitrage strategies?

Market volatility can significantly impact automated arbitrage strategies by affecting price discrepancies. High volatility may lead to rapid changes in asset prices, creating more opportunities for arbitrage. However, it can also increase the risk of slippage and execution delays, potentially reducing profits. Automated systems must adapt quickly to these fluctuations to capitalize on short-lived opportunities while managing associated risks effectively.

Conclusion about The Role of Automation in Day Trading Arbitrage

Automation plays a crucial role in enhancing the efficiency and effectiveness of day trading arbitrage. By leveraging advanced algorithms and real-time data, traders can capitalize on price discrepancies faster than ever before. However, it's essential to remain aware of the associated risks and to set up systems thoughtfully to ensure compliance and optimal performance. Regular monitoring and backtesting are vital for refining strategies and adapting to market volatility. For traders looking to maximize their potential, utilizing automation in day trading arbitrage can lead to significant advantages. Exploring resources from DayTradingBusiness can provide further insights and support for implementing these advanced trading strategies successfully.