Did you know that even seasoned traders can make mistakes that are as common as forgetting to wear socks with sandals? In the fast-paced world of day trading arbitrage, avoiding pitfalls is crucial to success. This article delves into the most common mistakes day traders make, highlighting the impact of emotional trading, the importance of timing, and the risks of ignoring market volatility. We'll discuss how a lack of research, poor risk management, and reliance on technology can lead to losses, as well as the significance of having a clear trading plan. Additionally, we'll explore the dangers of over-leveraging, the costs of chasing losses, and the often-overlooked tax implications. With insights from DayTradingBusiness, you'll learn how to navigate these challenges effectively and improve your arbitrage strategy.

What common mistakes do day traders make in arbitrage?

Day traders often make several common mistakes in arbitrage:

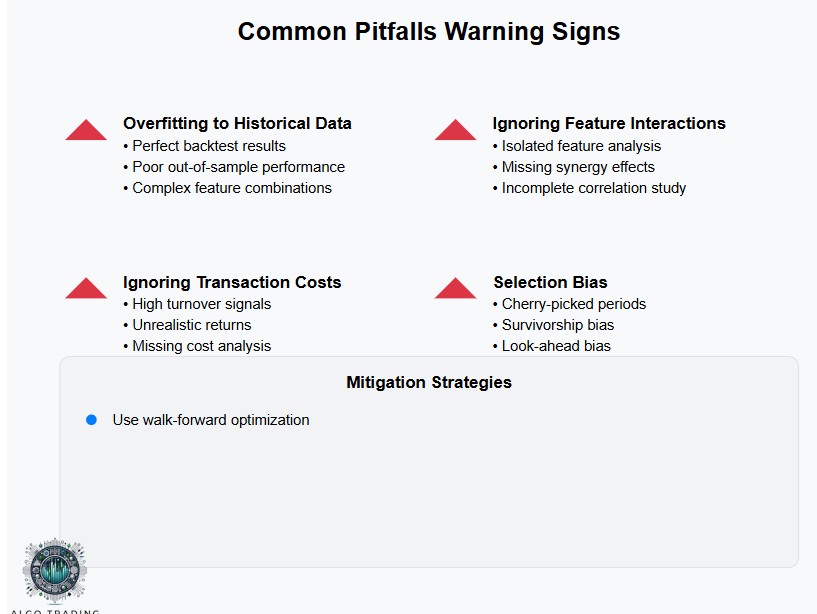

1. Ignoring Transaction Costs: Failing to account for fees can wipe out profits.

2. Overleveraging: Using too much leverage increases risk and can lead to significant losses.

3. Neglecting Market Conditions: Not considering volatility or liquidity can result in poor execution.

4. Rushing Trades: Making impulsive decisions without thorough analysis often leads to mistakes.

5. Lack of Diversification: Focusing too narrowly on a few assets increases risk exposure.

6. Inadequate Research: Skipping detailed research on price discrepancies can lead to missed opportunities or losses.

7. Emotional Trading: Letting emotions dictate decisions can derail strategy and lead to errors.

Avoiding these pitfalls can improve your chances of success in day trading arbitrage.

How can emotional trading impact my arbitrage strategy?

Emotional trading can undermine your arbitrage strategy by leading to poor decision-making. If you react impulsively to market fluctuations, you may miss profitable opportunities or hold onto losing positions too long. Stress can cause you to overlook critical data, skewing your analysis. Stick to your predefined strategy and avoid letting fear or greed dictate your trades to maintain effectiveness in arbitrage.

What are the risks of ignoring market volatility in arbitrage?

Ignoring market volatility in arbitrage can lead to significant losses. Price discrepancies can vanish quickly, leaving traders with unprofitable positions. Sudden price swings may trigger margin calls if you're using leverage. Additionally, liquidity can dry up in volatile markets, making it hard to execute trades at desired prices. Lastly, emotional decision-making during volatile periods can lead to mistakes, amplifying risks. Always monitor volatility to protect your arbitrage strategies.

Why is timing crucial in day trading arbitrage?

Timing is crucial in day trading arbitrage because price discrepancies are often fleeting. If you act too slowly, the opportunity can vanish, resulting in potential losses. Quick execution maximizes profit margins and minimizes risks associated with market fluctuations. Additionally, precise timing helps capture spreads before they close, ensuring that you benefit from the arbitrage situation. Delays can lead to missed trades or unfavorable prices, undermining your strategy.

How can lack of research lead to losses in arbitrage trading?

Lack of research in arbitrage trading can lead to significant losses by causing traders to miss price discrepancies, overlook transaction fees, or fail to account for market volatility. Without thorough analysis, traders might execute trades based on outdated information, resulting in unprofitable positions. Additionally, neglecting to understand the underlying assets can lead to poor decision-making, increasing the risk of losses. Always conduct comprehensive research to identify opportunities and mitigate risks effectively.

What role does technology play in day trading arbitrage mistakes?

Technology can lead to day trading arbitrage mistakes through latency issues, software glitches, and misconfigured algorithms. Slow execution times can result in missed opportunities or unfavorable prices. Automated trading systems can malfunction, executing trades that don't align with your strategy. Additionally, relying on inaccurate data feeds can mislead decision-making. Regularly updating and monitoring your technology is crucial to minimize these risks.

How does over-leveraging affect my arbitrage trades?

Over-leveraging in arbitrage trades increases your risk significantly. If a trade doesn't go as planned, losses can quickly exceed your initial investment. This could force you to close positions prematurely, missing out on potential gains. High leverage can also lead to margin calls, where you must deposit more funds to maintain your positions. Always use leverage cautiously to protect your capital and ensure sustainable trading practices.

Why should I avoid chasing losses in day trading arbitrage?

Chasing losses in day trading arbitrage can lead to significant financial damage. It often results in impulsive decisions, increasing your risk exposure. Instead of recovering losses, you may end up compounding them, leading to a cycle of emotional trading. Stick to your strategy, set clear limits, and accept losses as part of the game to maintain discipline and long-term profitability.

What are the pitfalls of ignoring transaction costs in arbitrage?

Ignoring transaction costs in arbitrage can lead to several pitfalls. First, it can erode your profit margins, turning a seemingly profitable trade into a loss. Second, it may cause you to miscalculate the risk-reward ratio, leading to poor decision-making. Third, frequent trading can amplify fees, especially with high-frequency strategies. Lastly, neglecting these costs can result in missed opportunities, as you might overlook more cost-effective trades. Always factor in transaction costs to ensure your arbitrage strategies remain viable and profitable.

How can poor risk management ruin my arbitrage strategy?

Poor risk management can devastate your arbitrage strategy by exposing you to significant losses. If you fail to set strict stop-loss orders, a sudden market shift can wipe out your profits. Ignoring position sizing can lead you to over-leverage, risking more than you can afford to lose. Additionally, inadequate monitoring of market conditions can result in missed opportunities or unexpected costs, like slippage. Without a clear exit strategy, you may hold onto losing trades too long. Each of these mistakes can erode your capital and undermine your overall trading success.

Learn about How can poor risk management ruin a day trading account?

What mistakes arise from not having a clear trading plan?

Not having a clear trading plan in day trading arbitrage can lead to several mistakes:

1. Emotional Trading: Without a plan, traders often make impulsive decisions based on fear or greed.

2. Inconsistent Strategy: Lack of a defined strategy results in erratic trading patterns and missed opportunities.

3. Poor Risk Management: Traders may over-leverage positions, risking more capital than intended.

4. Failure to Set Goals: Without clear objectives, it’s hard to measure success or adjust tactics.

5. Neglecting Research: A plan typically includes analysis; without it, traders may overlook critical market signals.

6. Chasing Losses: Traders might increase their trades to recover losses, leading to further financial strain.

Establishing a clear trading plan helps avoid these pitfalls and supports disciplined decision-making.

How does failing to stay updated on market news impact arbitrage?

Failing to stay updated on market news can significantly impact arbitrage by leading to missed opportunities and increased risks. Without current information, you might overlook price discrepancies between markets or assets, resulting in lost profits. Additionally, unexpected market shifts can create sudden losses if you're unaware of events like earnings reports or economic announcements. Staying informed is crucial for timely decision-making in arbitrage trading.

Learn about How to Stay Updated on Crypto Market News for Day Trading

Why is it important to diversify when engaging in arbitrage?

Diversifying in arbitrage is crucial because it spreads risk across different assets and markets. If one position fails, others may still profit, minimizing overall losses. It also increases opportunities for arbitrage, as different markets may have varying inefficiencies. Finally, diversification helps avoid overexposure to a single market event, which can lead to significant losses.

What are the dangers of relying solely on automated trading systems?

Relying solely on automated trading systems can lead to significant dangers. First, these systems can malfunction or face technical issues, resulting in unexpected losses. Second, they often lack the ability to adapt to changing market conditions, which can lead to poor decision-making during volatile periods. Third, over-reliance may cause traders to neglect essential market analysis skills, leading to a lack of understanding when manual intervention is necessary. Lastly, automated systems can be exploited by market manipulators, putting your investments at risk. Diversifying strategies and maintaining manual trading skills are crucial.

How can neglecting tax implications affect my day trading arbitrage?

Neglecting tax implications in day trading arbitrage can lead to unexpected financial burdens. If you don’t track your gains and losses accurately, you might overstate profits, resulting in higher tax liabilities. Not understanding short-term capital gains tax can eat into your profits since these are typically taxed at a higher rate. Additionally, failure to report all trades can trigger audits or penalties. Proper tax planning can help maximize your earnings and avoid nasty surprises during tax season.

Learn about How Does Insider Trading Affect Day Traders?

What common misconceptions should I avoid in arbitrage trading?

1. Assuming Arbitrage is Risk-Free: Many think arbitrage guarantees profits, but market fluctuations can lead to losses.

2. Ignoring Transaction Costs: Overlooking fees can erode potential profits. Always factor in costs when calculating returns.

3. Believing Speed Isn’t Crucial: Delays in execution can turn a profitable trade into a loss. Quick decision-making is essential.

4. Underestimating Market Efficiency: Markets are often more efficient than traders expect, reducing arbitrage opportunities.

5. Neglecting Exit Strategies: Failing to plan an exit can lead to missed opportunities or larger losses. Always have a clear exit strategy.

6. Relying Solely on Automation: While algorithms can help, they aren't foolproof. Always monitor trades and conditions.

7. Overtrading: Chasing every small opportunity can lead to burnout and poor decision-making. Focus on high-potential trades instead.

8. Misjudging Market Correlations: Incorrectly assuming assets will always move together can result in unexpected losses. Analyze correlations carefully.

Conclusion about Mistakes to Avoid in Day Trading Arbitrage

In day trading arbitrage, avoiding common pitfalls is essential for success. Recognizing the impact of emotional trading, market volatility, and the importance of timing can significantly enhance your strategy. Thorough research, sound risk management, and a well-defined trading plan are crucial to minimize losses and avoid the dangers of over-leveraging and transaction costs. Staying informed and diversifying your approach will further safeguard your investments. Ultimately, understanding these nuances will empower traders to make more informed decisions and improve their overall performance. For further insights and guidance, look to DayTradingBusiness to refine your arbitrage strategy.

Learn about Common Mistakes in Day Trading Analysis to Avoid