Did you know that the term "arbitrage" comes from the French word for "to take advantage of"? In the fast-paced world of day trading, arbitrage presents a unique opportunity for traders to capitalize on price discrepancies across different markets. This article dives into the essentials of arbitrage in day trading, exploring its definition, how it works, and the key benefits it offers, such as risk minimization and profit potential. We’ll also cover common strategies, tools for identifying opportunities, and the impact of market volatility. As you navigate the complexities of trading, DayTradingBusiness is here to guide you through the intricacies and help you avoid common pitfalls along the way.

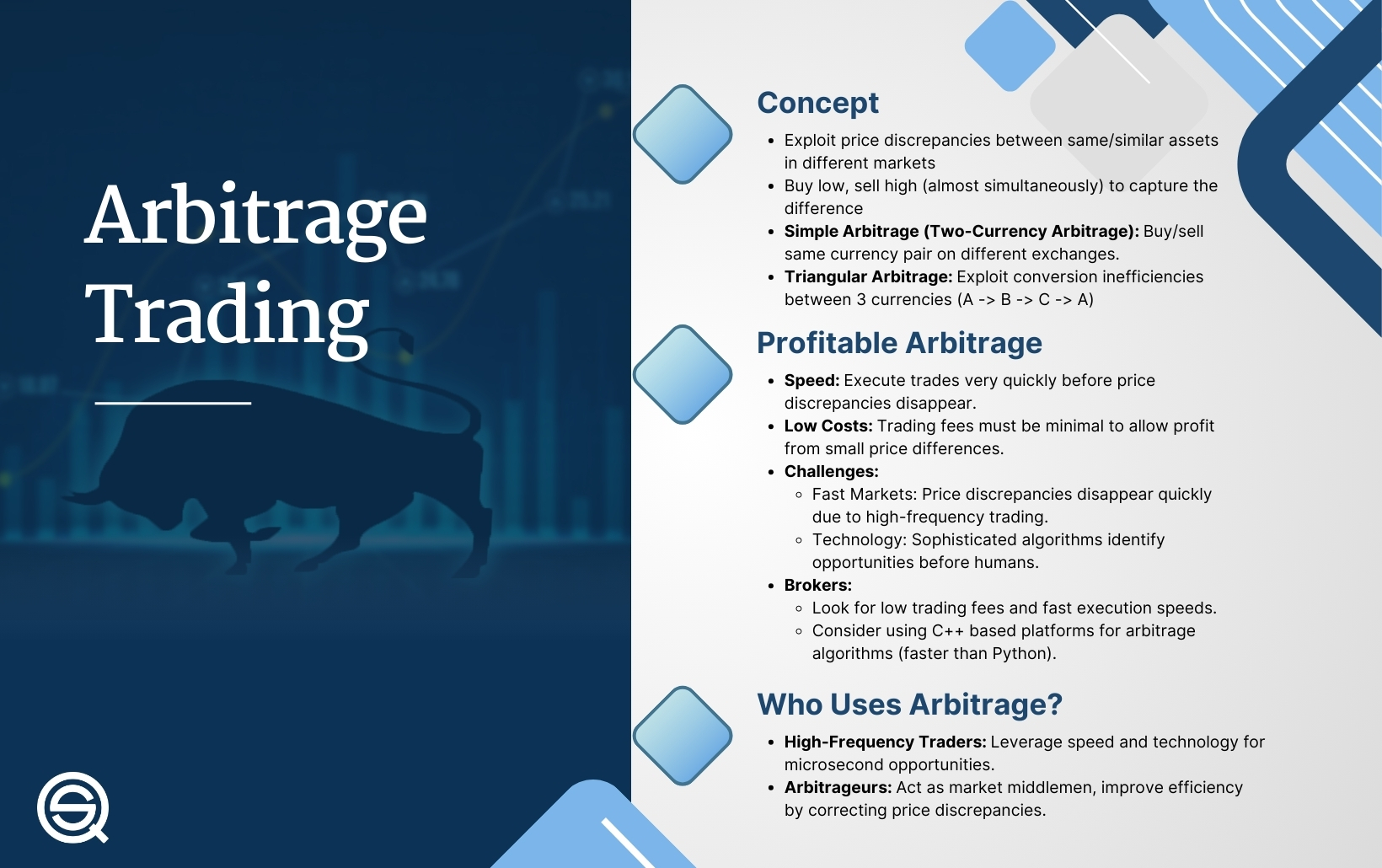

What is Arbitrage in Day Trading?

Arbitrage in day trading involves exploiting price differences of the same asset across different markets to make a profit. Key benefits include:

1. Low Risk: Since arbitrage relies on simultaneous buying and selling, it minimizes exposure to market volatility.

2. Quick Profits: Traders can capitalize on rapid price changes, often within minutes.

3. Market Efficiency: Arbitrage helps correct pricing inefficiencies in the market, benefiting all traders.

4. Consistent Returns: With a strategic approach, day traders can generate steady income through frequent, small profits.

5. Diversification: Engaging in arbitrage allows traders to access multiple markets and assets, reducing overall portfolio risk.

How Does Arbitrage Work in Financial Markets?

Arbitrage in financial markets involves taking advantage of price discrepancies for the same asset across different exchanges or markets. Day traders benefit from arbitrage by quickly buying low in one market and selling high in another, securing profit with minimal risk.

Key benefits include:

1. Risk Reduction: Since arbitrage relies on simultaneous trades, it minimizes exposure to market volatility.

2. Profit Opportunities: Small price differences can lead to substantial gains when executed efficiently.

3. Market Efficiency: Arbitrage helps equalize prices across markets, contributing to overall market stability.

4. Leverage: Traders can use borrowed funds to amplify returns on small price differences.

By capitalizing on these advantages, day traders can enhance their profitability while managing risks effectively.

What Are the Key Benefits of Arbitrage in Day Trading?

The key benefits of arbitrage in day trading include:

1. Risk Mitigation: Arbitrage allows traders to capitalize on price differences without significant market risk, since positions are often hedged.

2. Profit Opportunities: It identifies quick, low-risk profit opportunities by exploiting inefficiencies between markets or assets.

3. Market Efficiency: Arbitrage contributes to market efficiency by aligning prices across different platforms or instruments.

4. Leverage: Traders can use leverage to amplify returns on small price discrepancies, enhancing profit potential.

5. Diversification: Engaging in various arbitrage strategies can diversify a trader's portfolio, reducing overall risk.

6. Speed: Day traders can execute arbitrage quickly, taking advantage of fleeting opportunities throughout the trading day.

These benefits make arbitrage a popular strategy among day traders looking to optimize their profits.

Can Arbitrage Help Minimize Risk in Day Trading?

Yes, arbitrage can help minimize risk in day trading. It involves exploiting price discrepancies across different markets or assets to secure profits without significant exposure to market movements. By simultaneously buying and selling the same asset at different prices, traders can lock in gains while reducing the impact of volatility. This strategy enables quick trades, which can mitigate losses and enhance overall portfolio stability. Additionally, arbitrage opportunities often arise during market inefficiencies, allowing traders to benefit in a controlled manner.

How Does Arbitrage Increase Profit Potential?

Arbitrage increases profit potential by exploiting price discrepancies across different markets or assets. Traders buy low in one market and sell high in another, capturing the difference as profit. This strategy minimizes risk since transactions occur simultaneously, locking in profits before market prices align. Additionally, arbitrage can leverage high volume, allowing traders to amplify gains. Overall, it creates opportunities for consistent earnings with limited exposure to market volatility.

What Types of Arbitrage Strategies Are Common in Day Trading?

Common arbitrage strategies in day trading include:

1. Statistical Arbitrage: Using mathematical models to identify price discrepancies between correlated assets.

2. Merger Arbitrage: Buying shares of a target company after a merger announcement and shorting the acquirer’s stock to profit from the spread.

3. Spatial Arbitrage: Taking advantage of price differences for the same asset across different exchanges or markets.

4. Triangular Arbitrage: Exploiting discrepancies between currency pairs in the forex market by executing a series of trades that loop back to the original currency.

5. Risk Arbitrage: Capitalizing on mispriced options or other derivatives based on market events.

These strategies allow traders to profit from inefficiencies while minimizing risk.

How Can Day Traders Identify Arbitrage Opportunities?

Day traders can identify arbitrage opportunities by monitoring price discrepancies across different markets or exchanges. Use real-time data feeds to track asset prices. Look for correlated assets; if one is mispriced compared to another, it may signal an arbitrage chance. Leverage trading software that scans for price differences instantly. Also, keep an eye on news events that may cause temporary volatility. Speed is crucial; act quickly to capitalize on fleeting opportunities.

What Tools Are Essential for Successful Arbitrage Trading?

Essential tools for successful arbitrage trading include:

1. Trading Platforms: Reliable platforms like Binance or Coinbase Pro for executing trades quickly.

2. Price Comparison Software: Tools like CoinMarketCap or CoinGecko to track real-time prices across exchanges.

3. API Access: For automated trading and faster execution; many exchanges offer API services.

4. Market Data Feeds: Services providing real-time data to identify price discrepancies.

5. Risk Management Tools: Stop-loss and take-profit orders to minimize potential losses.

6. Calculators: Arbitrage calculators to quickly assess profit margins and transaction fees.

7. News Aggregators: Tools to stay updated on market news that can impact prices.

These tools help traders capitalize on price differences efficiently and effectively.

How Does Market Volatility Affect Arbitrage Opportunities?

Market volatility creates more price discrepancies between related assets, enhancing arbitrage opportunities. When prices fluctuate rapidly, traders can buy low in one market and sell high in another, capitalizing on these differences. Increased volatility can lead to faster trades and potentially higher profits, as the gaps between asset prices widen. However, it also introduces risks, as price movements can change quickly, requiring traders to act swiftly to secure gains. Overall, while volatility can amplify arbitrage chances, it demands careful risk management.

What Are the Common Mistakes in Arbitrage Trading?

Common mistakes in arbitrage trading include failing to account for transaction costs, which can erode profits; not executing trades quickly enough, leading to missed opportunities; and ignoring market inefficiencies that can change rapidly. Traders often miscalculate the risk associated with price discrepancies and may overlook the importance of liquidity. Additionally, relying too heavily on automated systems without proper oversight can lead to significant losses. Lastly, insufficient diversification can expose traders to higher risks.

How Can Day Traders Manage Costs in Arbitrage?

Day traders can manage costs in arbitrage by focusing on the following strategies:

1. Low-Cost Brokerage: Choose brokers with low commissions and fees to minimize transaction costs.

2. High-Speed Execution: Use platforms that offer fast trade execution to capitalize on price discrepancies quickly, reducing slippage.

3. Leverage Technology: Implement automated trading systems to identify and execute arbitrage opportunities efficiently, cutting down on manual errors and time.

4. Monitor Spreads: Pay attention to bid-ask spreads; narrow spreads can lower costs significantly.

5. Limit Orders: Use limit orders to control entry and exit prices, preventing unnecessary losses from market fluctuations.

6. Diversify Strategies: Combine different arbitrage strategies to spread risk and optimize overall cost management.

By applying these methods, day traders can effectively reduce costs associated with arbitrage trading.

Learn about How Do Institutional Traders Manage Risk During Day Trading?

What Role Do Transaction Fees Play in Arbitrage?

Transaction fees in arbitrage can significantly impact profitability. They reduce the overall gains from price discrepancies between markets. For successful arbitrage, traders must ensure that potential profits exceed these fees. Lower transaction fees enable more frequent trades and greater profit margins, making them crucial in day trading strategies. If fees are too high, they can negate the benefits of quick trades, leading to losses instead of gains. Thus, managing transaction costs is essential for effective arbitrage in day trading.

How Can Arbitrage Improve Portfolio Diversification?

Arbitrage improves portfolio diversification by capitalizing on price discrepancies across different markets or assets. This strategy reduces risk since it often involves low-volatility trades, which can offset losses in other parts of the portfolio. By including arbitrage opportunities, traders can achieve more consistent returns, enhancing overall performance. Additionally, it allows for exposure to multiple asset classes, further spreading risk and improving resilience against market fluctuations.

What Are the Limitations of Arbitrage in Day Trading?

The limitations of arbitrage in day trading include:

1. Market Efficiency: Prices adjust quickly, reducing the window for arbitrage opportunities.

2. Transaction Costs: High fees can erode profits, making small price differences unviable.

3. Execution Risk: Delays in trade execution can lead to losses if prices shift unexpectedly.

4. Capital Requirements: Significant capital is often needed to make meaningful profits from small price discrepancies.

5. Liquidity Issues: Low liquidity can hinder the ability to enter or exit trades at desired prices.

6. Regulatory Constraints: Compliance with regulations can limit certain arbitrage strategies.

These factors can significantly impact the effectiveness of arbitrage in day trading scenarios.

How Do Market Conditions Impact Arbitrage Effectiveness?

Market conditions significantly impact arbitrage effectiveness by influencing price discrepancies. In volatile markets, rapid fluctuations can create more opportunities for arbitrage as prices diverge across platforms. Conversely, in stable markets, price differences may be minimal, reducing potential gains. High liquidity typically enhances arbitrage opportunities, while low liquidity can lead to slippage, eroding profits. Additionally, market efficiency plays a role: in highly efficient markets, arbitrage opportunities disappear quickly, whereas less efficient markets allow more time to capitalize on price differences.

What Are Real-World Examples of Successful Arbitrage Trades?

Successful arbitrage trades often include:

1. Currency Arbitrage: Traders exploit price differences in currency pairs across different exchanges. For example, buying euros on one platform where it's undervalued and selling on another where it's priced higher.

2. Stock Arbitrage: Purchasing shares of a stock on one exchange at a lower price and simultaneously selling them on another exchange at a higher price. A notable case is when a company announces a merger, leading to price discrepancies between the acquiring and target companies.

3. Cryptocurrency Arbitrage: Traders buy Bitcoin on a platform where the price is lower and sell it on another where it is higher, capitalizing on exchange rate variations.

4. Sports Betting Arbitrage: Betting on all possible outcomes of an event across different bookmakers to guarantee a profit regardless of the outcome, due to differing odds.

These examples illustrate how arbitrage can effectively harness market inefficiencies for profit.

Conclusion about Key Benefits of Arbitrage in Day Trading

Incorporating arbitrage into day trading offers significant advantages, including risk reduction, profit enhancement, and improved portfolio diversification. By utilizing effective strategies and essential tools, traders can identify and capitalize on arbitrage opportunities, even amid market volatility. However, awareness of potential pitfalls, such as transaction fees and market conditions, is crucial for success. For those looking to deepen their understanding of arbitrage and enhance their trading strategies, DayTradingBusiness provides valuable insights and resources.

Learn about Key Benefits of Day Trading Options