Did you know that some traders can calculate arbitrage profits faster than a cheetah on roller skates? In this article, we dive into the world of arbitrage in day trading, exploring how to identify lucrative opportunities and leverage tools to calculate profits effectively. Learn the key steps for determining price differences, the impact of transaction fees, and the role of automated trading systems. We’ll also cover strategies for execution, the influence of market fluctuations, and common pitfalls to avoid. Plus, discover how to measure risk, improve your skills, and understand the tax implications. With insights from DayTradingBusiness, you’ll be well-equipped to maximize your arbitrage trading potential.

What is Arbitrage in Day Trading?

Arbitrage in day trading involves exploiting price discrepancies for the same asset across different markets or exchanges. To calculate arbitrage profits, follow these steps:

1. Identify the asset price on two different exchanges.

2. Subtract the lower price from the higher price to find the profit potential.

3. Factor in transaction fees and commissions.

4. Multiply the profit by the number of units you can trade.

For example, if stock A is $100 on Exchange 1 and $102 on Exchange 2, the potential profit per share is $2. If fees are $0.50 per trade, your net profit per share is $1.50.

How do I identify arbitrage opportunities in day trading?

To identify arbitrage opportunities in day trading, monitor price discrepancies between different markets or assets. Use real-time data feeds and trading platforms to spot variations in stock, currency, or cryptocurrency prices.

Calculate potential profits by subtracting the purchase price from the selling price after accounting for transaction fees. Ensure you act quickly, as these opportunities can vanish rapidly. Utilize tools like arbitrage calculators or trading bots to automate detection and execution. Always consider market volatility and liquidity to minimize risks.

What tools can help me calculate arbitrage profits?

To calculate arbitrage profits in day trading, use these tools:

1. Arbitrage Calculators: Online calculators specifically designed for arbitrage can quickly compute potential profits based on your inputs.

2. Spreadsheet Software: Tools like Microsoft Excel or Google Sheets allow you to create custom formulas to track prices and calculate profits.

3. Trading Platforms: Many trading platforms offer built-in tools and features for real-time profit calculations on arbitrage opportunities.

4. Market Data APIs: APIs like Alpha Vantage or CoinGecko provide real-time data feeds, enabling you to automate calculations based on the latest market prices.

5. Charting Software: Tools like TradingView can help visualize price discrepancies across markets, assisting in identifying arbitrage opportunities.

Choose one or a combination to streamline your arbitrage profit calculations.

How do I determine the price differences for arbitrage?

To determine price differences for arbitrage in day trading, follow these steps:

1. Identify Markets: Find two or more markets where the same asset is traded. This could be different exchanges or platforms.

2. Gather Price Data: Monitor the current prices of the asset across these markets in real-time. Use trading tools or APIs for accuracy.

3. Calculate Price Differences: Subtract the lowest price from the highest price to find the potential arbitrage opportunity.

4. Account for Fees: Factor in transaction fees, withdrawal fees, and any other costs that might affect your profit margin.

5. Monitor Volume and Liquidity: Ensure there’s enough volume and liquidity in both markets to execute your trades without significant slippage.

6. Execute Quickly: When you spot a price difference, act fast, as arbitrage opportunities can vanish quickly.

By following these steps, you can effectively calculate and capitalize on arbitrage profits in day trading.

What are the key steps to calculate arbitrage profits?

1. Identify price discrepancies: Look for differences in asset prices across different markets or platforms.

2. Calculate potential profit: Subtract the lower price from the higher price, then account for fees or commissions.

3. Confirm execution speed: Ensure you can buy and sell quickly to lock in profits before prices change.

4. Execute trades: Buy the asset at the lower price and sell at the higher price simultaneously.

5. Monitor your trades: Keep track of the transaction to confirm that profits are realized after all costs.

How do transaction fees impact arbitrage calculations?

Transaction fees reduce potential arbitrage profits by increasing the costs associated with buying and selling assets. When calculating arbitrage opportunities, subtract these fees from the price differences. If the fees exceed the price disparity, the arbitrage becomes unprofitable. Always factor in fees to ensure the trade remains viable and profitable.

Can I use automated trading systems for arbitrage?

Yes, you can use automated trading systems for arbitrage. To calculate arbitrage profits in day trading, identify price differences across markets or assets. Use your automated system to execute trades quickly when these discrepancies arise. Calculate profits by subtracting the total costs (like fees) from the gains made on the trades. The key is to ensure your system can operate fast enough to capitalize on fleeting opportunities.

What is the best strategy for executing arbitrage trades?

To execute arbitrage trades effectively, follow these steps:

1. Identify Price Discrepancies: Monitor multiple markets or exchanges for the same asset to spot price differences.

2. Use Real-Time Data: Implement tools or platforms that provide real-time pricing to quickly identify opportunities.

3. Calculate Costs: Factor in transaction fees, withdrawal fees, and any other costs that could impact your profit margin.

4. Execute Quickly: Once you spot an opportunity, act fast. Use automated trading bots if necessary to capitalize on fleeting price differences.

5. Risk Management: Set stop-loss orders to protect against sudden market shifts that could erode profits.

6. Regularly Review Strategies: Analyze past trades to refine your approach and improve your efficiency in identifying profitable arbitrage opportunities.

By focusing on these steps, you can calculate and maximize arbitrage profits in day trading.

How do market fluctuations affect arbitrage profits?

Market fluctuations can significantly impact arbitrage profits by altering price discrepancies between assets. When prices are stable, arbitrage opportunities are clearer and potentially more profitable. However, rapid fluctuations can reduce these opportunities or increase transaction costs, squeezing profits. To calculate arbitrage profits in day trading, monitor price spreads closely. Use real-time data to identify and act on discrepancies quickly, factoring in fees and slippage to ensure accurate profit calculations. Ultimately, the more volatile the market, the more challenging it can be to secure consistent arbitrage profits.

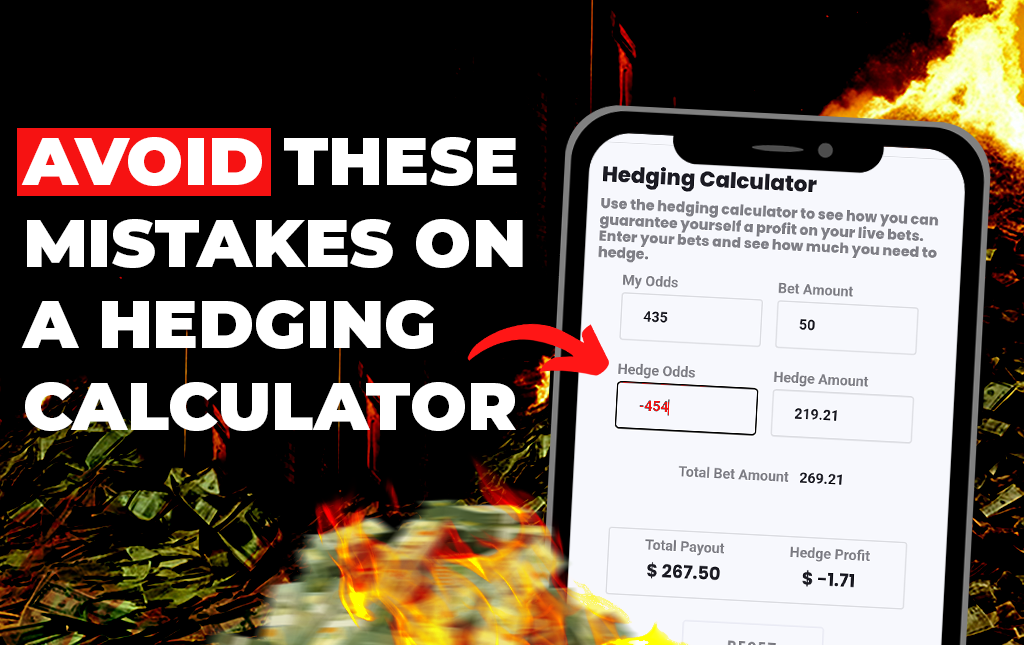

What are common mistakes in calculating arbitrage profits?

Common mistakes in calculating arbitrage profits include:

1. Ignoring Transaction Costs: Failing to account for trading fees can skew profit calculations.

2. Neglecting Price Slippage: Prices can change quickly; not considering slippage can lead to overestimating profits.

3. Using Inaccurate Data Sources: Relying on outdated or incorrect prices from exchanges affects profit accuracy.

4. Overlooking Tax Implications: Not factoring in taxes can misrepresent the actual profit.

5. Miscalculating Currency Conversion: Errors in currency exchange rates can distort profit calculations in international trades.

How do I measure risk in arbitrage trading?

To measure risk in arbitrage trading, assess the following factors:

1. Price Discrepancy: Calculate the difference between the purchase and selling price across platforms. Larger discrepancies can indicate higher potential profits but may also signal increased risk.

2. Transaction Costs: Include fees from exchanges and potential slippage. These costs can erode profits and must be factored in.

3. Market Volatility: Monitor how quickly prices change. High volatility can lead to sudden losses.

4. Liquidity: Ensure there’s enough volume to execute trades without significantly impacting the price. Low liquidity increases execution risk.

5. Time Sensitivity: Assess how long it takes to execute trades. Delays can reduce or eliminate profit opportunities.

6. Regulatory Risks: Be aware of legal implications that can affect trading practices and profits.

By analyzing these factors, you can effectively gauge the risk associated with your arbitrage trading strategy.

What role does timing play in arbitrage opportunities?

Timing is crucial in arbitrage opportunities because price discrepancies between markets can vanish quickly. To calculate arbitrage profits in day trading, you need to act fast when you identify a price difference. Monitor market trends and execute trades immediately to capitalize on fleeting opportunities. Delays can lead to reduced profits or losses, as prices often converge rapidly. Use real-time data and alerts to stay ahead and maximize your arbitrage gains.

How can I improve my arbitrage trading skills?

To improve your arbitrage trading skills, focus on these key steps:

1. Understand Pricing Discrepancies: Regularly analyze price differences across exchanges or markets. Use tools or platforms that track these variations in real-time.

2. Master Calculation: Learn the formula for calculating arbitrage profits: Profit = (Selling Price – Buying Price – Transaction Costs) x Quantity. This helps in assessing potential gains quickly.

3. Practice with Simulations: Use demo accounts or trading simulators to practice identifying arbitrage opportunities without financial risk.

4. Stay Informed: Follow market news and trends that can affect asset prices. Being aware of economic indicators can help predict price movements.

5. Develop a Trading Strategy: Create a clear plan that includes entry and exit points, risk management, and position sizing tailored for arbitrage trading.

6. Use Automation: Consider using trading bots or algorithms to automate the identification and execution of arbitrage trades, increasing efficiency and speed.

7. Review and Adjust: Regularly analyze your trades to understand what works and what doesn't. Adjust your strategy based on performance data.

By focusing on these areas, you'll enhance your ability to calculate and capitalize on arbitrage profits in day trading.

What are the tax implications of arbitrage profits?

Arbitrage profits are generally treated as short-term capital gains for tax purposes. This means they are taxed at your ordinary income tax rate. If you hold the assets for less than a year before selling, the gains are taxed as regular income. Keep detailed records of trades to report accurately. Additionally, be aware of any transaction fees that could affect your profit calculation. Consult a tax professional for personalized advice based on your situation.

How do I track my arbitrage trading performance?

To track your arbitrage trading performance, start by recording each trade's entry and exit prices, along with the assets involved. Calculate profits by subtracting the total costs (including fees and commissions) from the final amount received. Use spreadsheets or trading software to log this data and analyze your profit margins over time. Regularly review your performance metrics, like return on investment (ROI) and win rate, to identify patterns and optimize your strategies.

What are the advantages and disadvantages of arbitrage trading?

Advantages of arbitrage trading include risk reduction due to simultaneous buying and selling of assets, potential for quick profits, and capitalizing on price discrepancies across markets. It can provide consistent returns with low market exposure.

Disadvantages include high transaction costs that can erode profits, reliance on speed and technology, limited opportunities in efficient markets, and potential for losses if market conditions change unexpectedly. Additionally, regulatory risks may arise in certain jurisdictions.

Conclusion about How to Calculate Arbitrage Profits in Day Trading

In conclusion, calculating arbitrage profits in day trading requires a clear understanding of market dynamics, effective tools, and strategic execution. By identifying price discrepancies and accounting for transaction fees, traders can maximize their gains while minimizing risks. Continuous learning and performance tracking are essential for success in this fast-paced environment. Leveraging insights and resources from DayTradingBusiness can further enhance your arbitrage trading skills and profitability.

Learn about How to Calculate Taxable Income from Day Trading