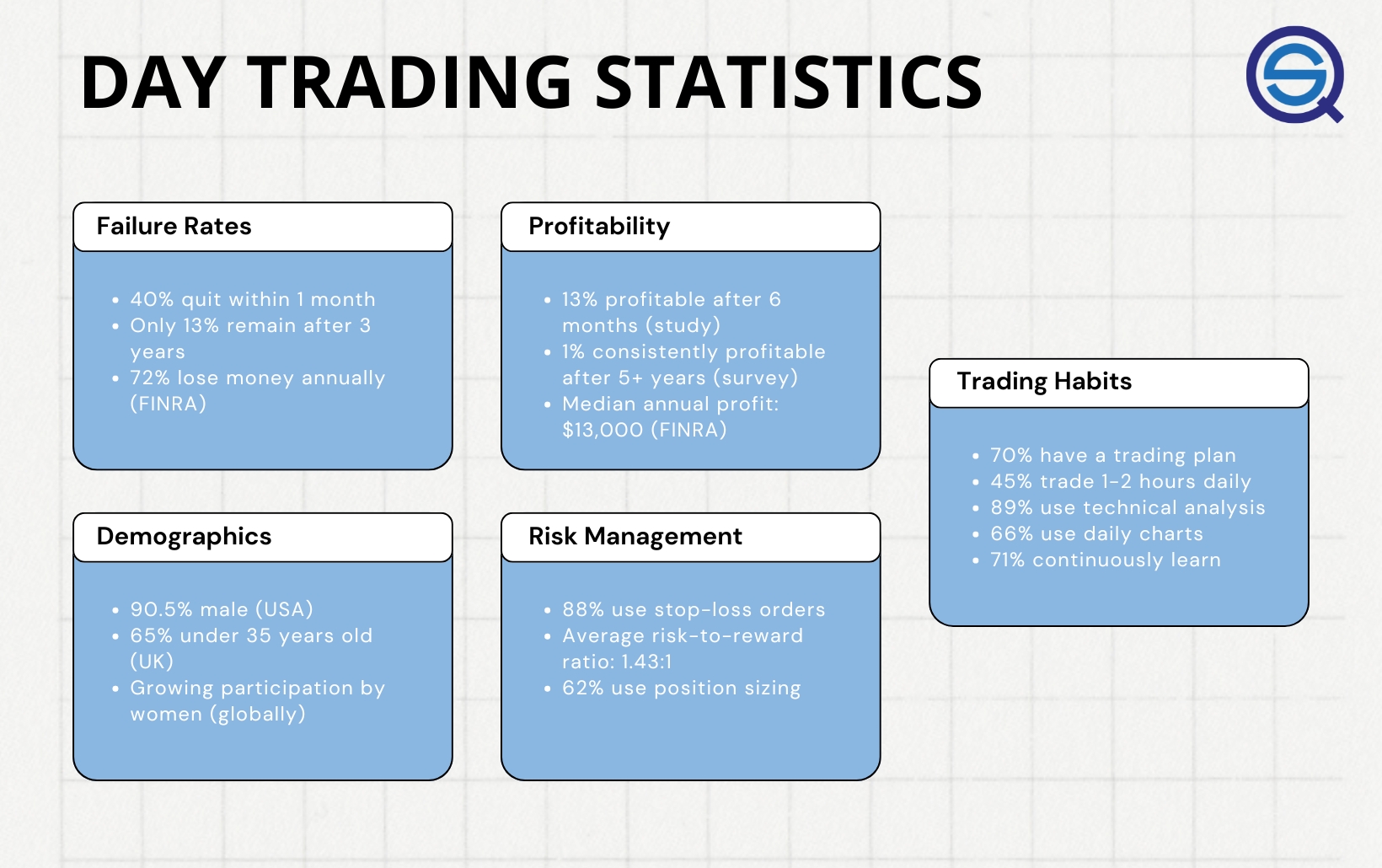

Did you know that over 80% of trading volume in the stock market is driven by algorithms? In this article, we dive into the captivating success stories of day traders harnessing the power of algorithmic trading. Discover how these strategies contribute to trading success, the types of algorithms that top traders utilize, and the impact on profit margins. We’ll explore the key factors behind successful algorithmic day trading, the importance of backtesting, and how beginners can learn from the pros. Additionally, we’ll highlight common mistakes, risk management techniques, and the preferred platforms of successful traders. Get ready to uncover the psychological benefits and market influences on algorithmic trading, along with valuable lessons from both triumphs and failures. Let DayTradingBusiness guide you through these insights to enhance your trading journey.

What are the success stories of day traders using algorithms?

One notable success story is that of James Simons, founder of Renaissance Technologies. His firm uses sophisticated algorithms and quantitative models to analyze market data, reportedly generating annual returns exceeding 66% over a 30-year span. Another example is the hedge fund Virtu Financial, which employs high-frequency trading algorithms to capitalize on market inefficiencies, providing consistent profits. Day traders like "The Trading Coach" have also shared their success using algorithmic strategies, leveraging automated systems to execute trades based on specific criteria, achieving substantial returns while managing risk effectively. These stories highlight how algorithmic trading can lead to significant financial gains in the day trading landscape.

How do algorithmic trading strategies contribute to day trading success?

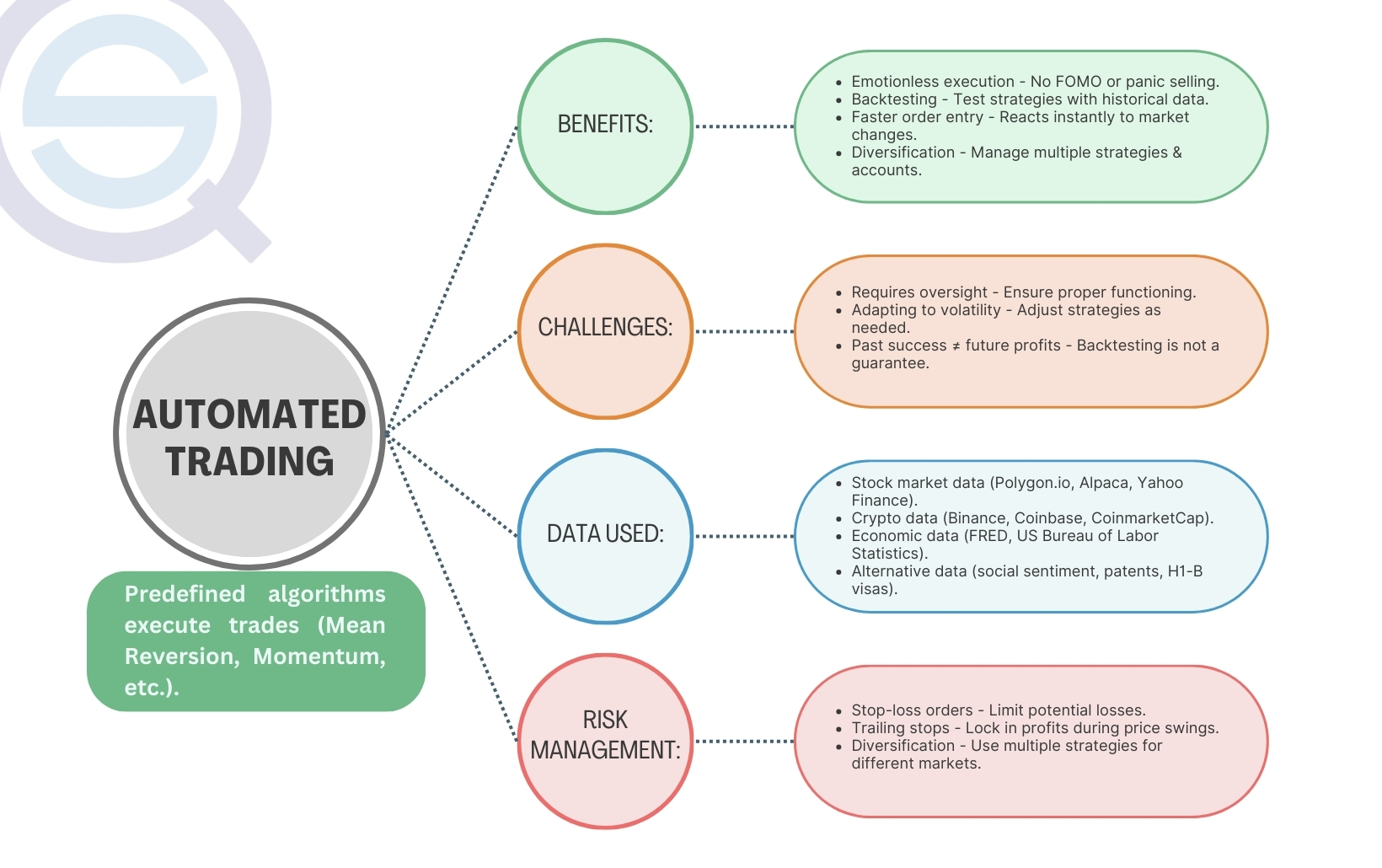

Algorithmic trading strategies enhance day trading success by enabling faster execution of trades, minimizing human error, and leveraging complex mathematical models to identify profitable opportunities. Traders like David Shaw and his firm D.E. Shaw Group have demonstrated how algorithms can analyze vast market data in real-time, allowing for informed decision-making and effective risk management. These strategies also facilitate backtesting, enabling traders to refine their approaches based on historical performance. Overall, algorithmic trading empowers day traders to capitalize on market fluctuations more efficiently.

What types of algorithms do successful day traders use?

Successful day traders often use algorithms like trend-following, mean reversion, arbitrage, and statistical arbitrage. Trend-following algorithms identify and capitalize on upward or downward market movements. Mean reversion algorithms exploit price fluctuations by betting that prices will return to their average. Arbitrage algorithms take advantage of price differences across markets, while statistical arbitrage uses quantitative models to predict price movements. These algorithms enable traders to make quick, data-driven decisions, enhancing their chances of success.

Can algorithmic trading increase a day trader's profit margins?

Yes, algorithmic trading can significantly increase a day trader's profit margins. By automating trades based on pre-set criteria, traders can execute orders faster and capitalize on market opportunities that human traders might miss. For example, a day trader using algorithms can analyze multiple stocks simultaneously and react instantly to price changes, leading to more profitable trades. Successful traders often share stories of improved consistency and reduced emotional decision-making, thanks to their algorithmic strategies.

What are the key factors behind successful algorithmic day trading?

The key factors behind successful algorithmic day trading include:

1. Robust Strategy: A well-defined trading strategy based on technical indicators, price patterns, or statistical arbitrage.

2. Backtesting: Thorough testing of the algorithm against historical data to ensure its effectiveness and to refine parameters.

3. Risk Management: Implementing strict risk controls, such as stop-loss orders and position sizing, to protect capital.

4. Market Conditions: Understanding how different market conditions affect trading strategies and adapting accordingly.

5. Technology: Utilizing high-speed trading systems and reliable data feeds to execute trades quickly and efficiently.

6. Continuous Improvement: Regularly updating and optimizing algorithms based on performance and changing market dynamics.

7. Discipline: Sticking to the algorithm without letting emotions interfere with decision-making.

Successful day traders often leverage these factors to maximize their profits while minimizing risks.

How do successful day traders develop their algorithms?

Successful day traders develop their algorithms by identifying market patterns and using historical data to test their strategies. They focus on key indicators, like moving averages and volume, to create rules for buying and selling. Many traders utilize backtesting to refine their algorithms, ensuring they perform well under different market conditions. They also continuously analyze performance and tweak their algorithms based on real-time results. Networking with other traders and staying updated on market trends can provide insights that enhance their trading strategies.

What role does backtesting play in algorithmic trading success?

Backtesting is crucial in algorithmic trading success as it allows traders to evaluate their strategies against historical data. By simulating trades based on past market conditions, traders can identify the effectiveness and potential profitability of their algorithms. Successful day traders often refine their strategies through backtesting, gaining insights into risk management and optimizing trade execution. For instance, a trader who backtested a momentum strategy might discover specific entry and exit points that maximize returns, leading to consistent gains in live trading. This analytical approach helps minimize risks and enhances confidence in algorithmic decisions.

How can beginners learn from successful algorithmic day traders?

Beginners can learn from successful algorithmic day traders by studying their strategies, analyzing their trading systems, and understanding their risk management techniques. Following successful traders on social media or in trading forums can provide insights into their thought processes and decision-making.

Additionally, beginners should examine case studies or success stories to identify common patterns and mistakes. Practical experience through paper trading or simulations can help them apply these strategies without financial risk. Using educational resources like online courses or books on algorithmic trading will also deepen their understanding.

What are the common mistakes day traders make with algorithms?

Common mistakes day traders make with algorithms include over-optimization, where they tweak settings too much based on past data, leading to poor real-world performance. Many fail to account for market conditions, using strategies that work in one environment but not another. Relying solely on algorithms without understanding the market can also be detrimental. Additionally, traders often neglect risk management, allowing losses to escalate. Finally, emotional trading—deviating from the algorithm due to fear or greed—can undermine success.

How do successful day traders manage risk with algorithms?

Successful day traders manage risk with algorithms by implementing automated stop-loss orders to limit potential losses. They use algorithms to analyze market data in real-time, enabling precise entry and exit points. Diversification is key; algorithms can spread investments across multiple assets to mitigate risks. Many traders develop custom algorithms that adapt to market conditions, ensuring they react quickly to volatility. Additionally, they often backtest their strategies to evaluate performance and adjust risk parameters accordingly. These practices help maintain consistent profitability while protecting their capital.

Learn about How Do Institutional Traders Manage Risk During Day Trading?

What platforms do successful algorithmic day traders prefer?

Successful algorithmic day traders often prefer platforms like MetaTrader 4/5, NinjaTrader, Thinkorswim, and TradeStation for their robust tools and customization options. Many also use Interactive Brokers for low commissions and access to various markets. These platforms support backtesting, real-time data analysis, and automated trading, essential for executing strategies efficiently.

How do successful day traders optimize their algorithms over time?

Successful day traders optimize their algorithms through continuous backtesting, which involves analyzing historical data to refine strategies. They monitor live performance closely, making adjustments based on real-time results. Incorporating machine learning allows them to adapt to market changes swiftly. They also focus on risk management, tweaking parameters to minimize losses while maximizing gains. Regularly reviewing trades helps identify patterns and improve decision-making. Collaboration with other traders and sharing insights can also enhance algorithm effectiveness.

What are the psychological benefits of algorithmic trading for day traders?

Algorithmic trading can enhance a day trader's psychological well-being by reducing emotional stress and anxiety associated with decision-making. By relying on algorithms, traders benefit from consistent strategies that remove the pressure of real-time judgments. This can lead to increased confidence, as traders trust the system to execute trades based on data rather than emotions. Additionally, algorithmic trading fosters discipline, helping traders stick to their plans and avoid impulsive actions. Success stories often highlight how traders experienced less burnout and improved focus, allowing them to enjoy the trading process more and achieve better results over time.

How do market conditions affect the success of trading algorithms?

Market conditions play a crucial role in the success of trading algorithms. In volatile markets, algorithms can capitalize on rapid price movements, leading to higher profits. Conversely, in stable or trending markets, their effectiveness may diminish as opportunities become limited.

For example, day traders using algorithms during a market surge can quickly execute trades, maximizing gains from price swings. Conversely, in sideways markets, algorithms might generate false signals, resulting in losses. Adapting algorithms to current market conditions is vital for maintaining success.

Learn about How Does Market Microstructure Affect Day Trading Strategies?

What lessons can be learned from failed algorithmic trading attempts?

Failed algorithmic trading attempts reveal several key lessons:

1. Risk Management is Crucial: Many failures stem from inadequate risk controls. Successful traders prioritize limits on loss and exposure.

2. Backtesting is Essential: Algorithms must perform well in historical simulations. Those who neglect this step often face unexpected losses.

3. Market Dynamics Change: Strategies that worked in the past may fail in new conditions. Successful traders adapt algorithms to evolving market environments.

4. Data Quality Matters: Poor data leads to flawed algorithms. Traders using high-quality, clean data tend to achieve better results.

5. Emotional Discipline: Many failures arise from emotional trading decisions. Successful algorithmic traders stick to their strategies, avoiding impulsive reactions.

6. Continuous Learning: The market is always changing. Traders who learn from both successes and failures refine their algorithms effectively.

7. Simplicity Over Complexity: Overly complex strategies can lead to unforeseen issues. Successful algorithms often rely on straightforward, robust models.

By analyzing these failures, traders can develop more effective algorithmic strategies that lead to success.

How can data analysis improve the chances of success in day trading?

Data analysis enhances day trading success by identifying patterns and trends in stock movements. Successful day traders use algorithms to process vast amounts of market data quickly, enabling them to make informed decisions in real-time.

For example, traders utilizing machine learning algorithms can predict price movements based on historical data, increasing their winning trades. One trader reported a 30% increase in profitability after implementing a data-driven strategy that analyzed volatility and trading volumes.

By leveraging data analysis, day traders can optimize entry and exit points, manage risk effectively, and adapt to market changes swiftly, leading to greater overall success.

Learn about How to Use Market Microstructure Data to Improve Day Trading Outcomes

Conclusion about Success Stories of Day Traders Using Algorithms

In conclusion, the journey of successful day traders utilizing algorithms reveals a wealth of strategies and insights that can enhance trading performance. From the types of algorithms employed to the importance of backtesting and risk management, these elements are crucial for maximizing profit margins. By learning from both successes and failures, traders can refine their approaches and adapt to ever-changing market conditions. DayTradingBusiness remains committed to providing the resources and knowledge necessary for traders to navigate the complexities of algorithmic trading and achieve their financial goals.

Sources:

- A profitable trading algorithm for cryptocurrencies using a Neural ...

- Do Individual Day Traders Make Money? Evidence from Taiwan

- Stock price prediction with optimized deep LSTM network with ...

- A parallel multi-module deep reinforcement learning algorithm for ...

- Understanding the High Failure Rate in Trading: Why 99% of ...

- A comparative study of ensemble learning algorithms for high ...