Did you know that the first computer programmer was a woman named Ada Lovelace, who wrote algorithms in the 1800s? Fast forward to today, and programming languages play a crucial role in developing effective day trading algorithms. In this article, we explore the most popular programming languages for day trading, examining why Python is the go-to choice, how R compares, the significance of C++ in high-frequency trading, and whether Java and JavaScript are viable options. We’ll also discuss the advantages of MATLAB, the essentials of backtesting, and how to choose the right language based on your trading style. Plus, we’ll touch on using SQL for data manipulation, the benefits of Go, and integrating machine learning into your trading strategies. Beginners will find valuable insights on getting started, while seasoned traders can discover top resources for honing their programming skills. Join us at DayTradingBusiness as we navigate the technical landscape of algorithmic trading!

What are the best programming languages for day trading algorithms?

The best programming languages for day trading algorithms are Python, R, C++, and Java.

Python is favored for its simplicity and robust libraries like Pandas and NumPy. R excels in statistical analysis and data visualization. C++ offers high performance for low-latency trading systems. Java is popular for its portability and scalability in enterprise applications.

Choose based on your specific needs: Python for ease of use, R for analytics, C++ for speed, and Java for large systems.

Why is Python favored for day trading algorithm development?

Python is favored for day trading algorithm development because of its simplicity and readability, which makes it easy to write and maintain code quickly. It has extensive libraries like Pandas for data manipulation, NumPy for numerical analysis, and Matplotlib for visualization, allowing traders to analyze data efficiently. The active community and wealth of resources help developers troubleshoot and innovate. Additionally, Python's integration with APIs and trading platforms streamlines the implementation of trading strategies.

How does R compare to Python for trading algorithm creation?

R excels in statistical analysis and data visualization, making it ideal for developing sophisticated trading algorithms with extensive data manipulation capabilities. Python, on the other hand, is more versatile and user-friendly, with a broader range of libraries like Pandas and NumPy for data handling and machine learning, which can enhance algorithm performance. For quick prototyping and integration with web applications, Python often has the edge. However, if your focus is purely on statistical models and financial analysis, R might be the better choice.

What role does C++ play in high-frequency trading algorithms?

C++ is crucial in high-frequency trading algorithms due to its speed and efficiency. It allows for low-latency execution of trades, enabling firms to react to market changes in microseconds. The language’s performance optimizations and control over system resources make it ideal for handling complex calculations and large data sets in real time. Additionally, C++ supports multithreading, which helps manage multiple tasks simultaneously, enhancing trading strategy execution. Overall, its capabilities give traders a competitive edge in the fast-paced world of high-frequency trading.

Is Java a good choice for building trading applications?

Yes, Java is a good choice for building trading applications. It offers strong performance, portability, and a robust ecosystem of libraries. Java's multithreading capabilities allow for efficient handling of real-time data, which is crucial in trading. Additionally, its strong typing helps prevent bugs, making your application more reliable. Many financial institutions use Java due to its security features and scalability, making it a solid option for developing day trading algorithms.

How can JavaScript be used in day trading algorithms?

JavaScript can be used in day trading algorithms primarily for building web-based trading applications. It allows real-time data visualization through libraries like D3.js or Chart.js, enabling traders to analyze market trends. With Node.js, developers can create server-side applications for processing trades and integrating with APIs from trading platforms. JavaScript also supports asynchronous operations, making it suitable for handling multiple data streams and executing trades promptly. Additionally, frameworks like React can enhance user interfaces, providing traders with a responsive experience for monitoring their strategies.

What are the advantages of using MATLAB for trading strategies?

MATLAB offers several advantages for trading strategies:

1. Advanced Algorithms: It supports complex mathematical modeling and simulations, helping traders develop sophisticated algorithms.

2. Data Analysis: MATLAB excels in handling large datasets, allowing for efficient analysis of historical price data and market trends.

3. Visualization: Its powerful visualization tools enable traders to create detailed charts and graphs, enhancing strategy evaluation.

4. Toolboxes: Specialized toolboxes for financial analysis streamline the process of backtesting and optimizing trading strategies.

5. Integration: MATLAB easily integrates with other languages and platforms, facilitating real-time data feeds and execution.

6. Community Support: A robust community provides resources, tutorials, and forums, making it easier to troubleshoot and learn.

These features make MATLAB a strong choice for developing and testing trading algorithms.

Which programming languages are best for backtesting trading algorithms?

The best programming languages for backtesting trading algorithms are Python, R, C++, and Java.

Python is popular for its simplicity and extensive libraries like Pandas and NumPy. R excels in statistical analysis and visualization. C++ offers speed and performance, ideal for high-frequency trading. Java provides cross-platform capabilities and robustness.

Choose based on your specific needs: ease of use, speed, or statistical power.

How do you choose the right programming language for your trading style?

Choose the right programming language for your trading style by considering these factors:

1. Speed: If you need high-frequency trading, go for C++ or Java for their performance.

2. Ease of Use: For quick prototyping, Python is ideal due to its simplicity and vast libraries.

3. Community Support: Languages like R and Python have strong communities, offering resources and libraries for trading algorithms.

4. Integration: Ensure the language can easily integrate with trading platforms. Java and C# are good for platforms like Interactive Brokers.

5. Data Handling: If your strategy relies on heavy data analysis, Python or R excel in data manipulation and visualization.

Match the language to your trading style and technical comfort for the best results.

What are some popular libraries for algorithmic trading in Python?

Some popular libraries for algorithmic trading in Python include:

1. Pandas – For data manipulation and analysis.

2. NumPy – For numerical computations.

3. Matplotlib – For data visualization.

4. TA-Lib – For technical analysis indicators.

5. Backtrader – For backtesting trading strategies.

6. Zipline – For event-driven algorithmic trading.

7. ccxt – For connecting to cryptocurrency exchanges.

8. PyAlgoTrade – For backtesting and strategy development.

How does the speed of execution differ among programming languages for trading?

The speed of execution in trading algorithms varies significantly across programming languages. C++ is the fastest due to its low-level memory management and compilation efficiency, making it ideal for high-frequency trading. Java offers good performance with better portability and is often used in financial institutions for larger systems. Python, while slower, is popular for rapid prototyping and ease of use, but it may not be suitable for latency-sensitive applications. R is excellent for statistical analysis but lacks execution speed compared to C++ or Java. Ultimately, the choice of language impacts execution speed, with lower-level languages providing the best performance for trading algorithms.

Can you use SQL for data manipulation in trading algorithms?

Yes, you can use SQL for data manipulation in trading algorithms. SQL is effective for querying and managing large datasets, which is essential in trading for analyzing historical prices, volumes, and other market data. It can help in retrieving and aggregating data needed for making trading decisions, though it's often used in conjunction with other programming languages like Python or R for implementing complex algorithms and real-time trading strategies.

What are the benefits of using Go for trading system development?

Using Go for trading system development offers several benefits:

1. Performance: Go compiles to machine code, ensuring fast execution which is crucial for high-frequency trading.

2. Concurrency: Its built-in goroutines allow easy handling of multiple tasks simultaneously, ideal for processing market data and executing trades.

3. Simplicity: Go has a clean syntax, making it easier to read and maintain code, which is essential for complex trading systems.

4. Strong Typing: The strong type system helps catch errors early, reducing bugs in trading algorithms.

5. Rich Standard Library: Go provides a robust standard library, including networking and data handling tools, streamlining development.

6. Cross-Platform: Go applications can run on various operating systems without modification, enhancing flexibility in deployment.

7. Community and Support: A growing community means access to libraries and frameworks tailored for trading systems.

These features make Go a compelling choice for developing reliable and efficient trading algorithms.

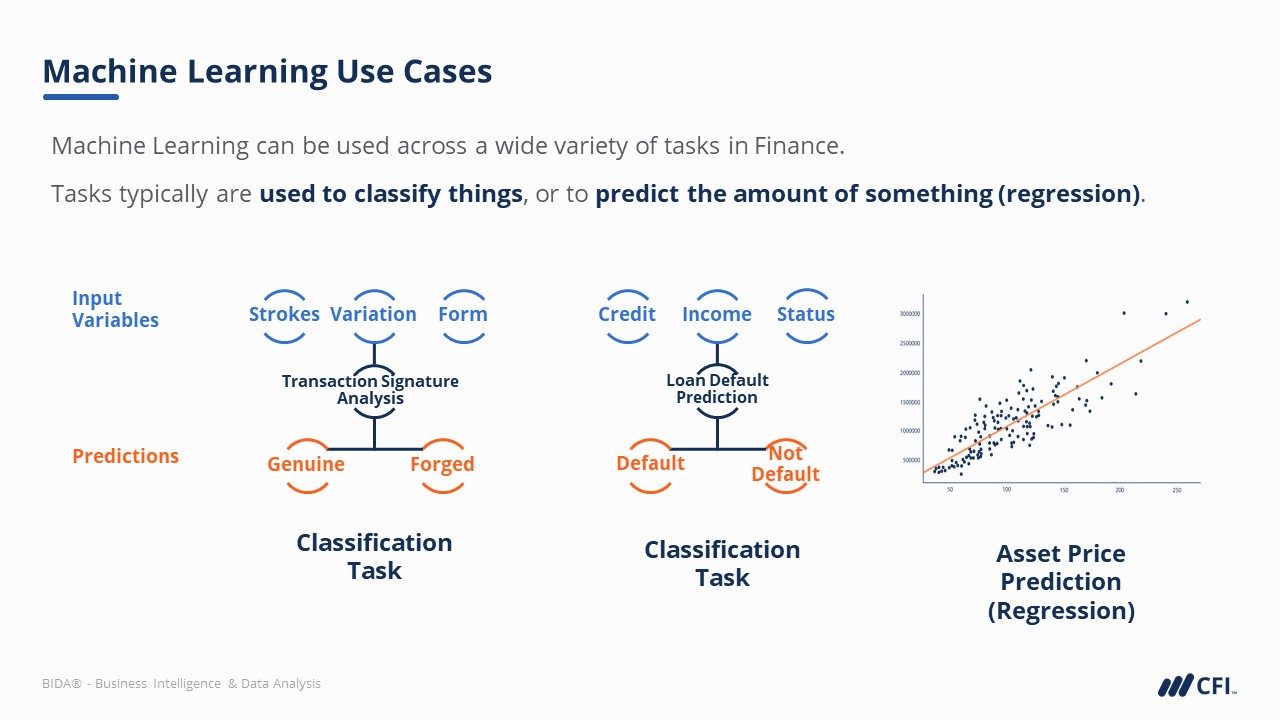

How can you integrate machine learning with programming languages for trading?

To integrate machine learning with programming languages for trading, consider the following popular languages:

1. Python: Use libraries like TensorFlow, scikit-learn, and Pandas for data analysis and model building. Python’s simplicity makes it ideal for quickly developing trading algorithms.

2. R: Leverage R’s statistical analysis capabilities and packages like caret and quantmod for building predictive models. It’s excellent for data visualization and backtesting.

3. C++: Utilize C++ for high-frequency trading algorithms. Its performance and speed make it suitable for real-time data processing and execution.

4. Java: Implement trading systems with Java for its portability and robustness. Libraries like Weka can help with machine learning tasks.

5. MATLAB: Use MATLAB for its extensive mathematical functions and toolboxes for financial modeling and machine learning.

Choose a language based on your specific trading strategy, required speed, and data processing needs. Each language offers unique strengths for developing effective trading algorithms.

Learn about How Does Machine Learning Enhance Day Trading?

What should beginners know about coding trading algorithms?

Beginners should know that popular programming languages for coding trading algorithms include Python, R, and Java. Python is favored for its simplicity and extensive libraries like Pandas and NumPy, making data analysis easier. R is great for statistical analysis and visualizations, while Java offers performance benefits for high-frequency trading. Understanding these languages can help beginners develop effective trading strategies and backtest them efficiently. Focus on learning Python first, as it has a strong community and plenty of resources for traders.

What are the top resources for learning programming languages for trading?

1. Codecademy: Offers interactive courses on Python and R, both popular for trading algorithms.

2. Coursera: Features specialized courses on data analysis and finance programming.

3. Udemy: Has practical courses focused on specific programming languages like Python for finance and algorithmic trading.

4. Kaggle: Provides datasets and notebooks for hands-on practice in Python, tailored for trading.

5. QuantInsti: Offers courses on algorithmic trading using Python, with a focus on real-world applications.

6. YouTube: Channels like "Sentdex" and "The Trading Channel" provide tutorials on Python for trading.

7. Books: "Python for Finance" by Yves Hilpisch and "Algorithmic Trading" by Ernie Chan are excellent resources.

8. Reddit: Subreddits like r/algotrading and r/learnprogramming can provide community support and resources.

9. Stack Overflow: Great for troubleshooting and specific programming questions related to trading.

10. GitHub: Explore repositories for existing trading algorithms to learn from real code.

Conclusion about Popular Programming Languages for Day Trading Algorithms

In summary, selecting the right programming language for day trading algorithms hinges on your specific needs and trading style. Python stands out for its simplicity and extensive libraries, while R is robust for statistical analysis. C++ excels in high-frequency trading due to its speed, and Java offers versatility for application development. Meanwhile, JavaScript can enhance user interfaces, and MATLAB is excellent for developing complex trading strategies. For backtesting, languages like Python and R are preferred for their rich ecosystems. Ultimately, understanding the strengths of each language will empower you to create effective trading algorithms. For more comprehensive insights and guidance, DayTradingBusiness is here to support your trading journey.

Learn about What Programming Languages Are Used for Day Trading Bots?