Did you know that some traders believe their algorithms can predict the weather better than a meteorologist? While that might be a stretch, selecting the right algorithmic trading platform is no joke. In this article, we’ll break down essential features to consider, including cost evaluation, top platforms for beginners, and the importance of customer support. We’ll also guide you on comparing platforms, assessing security measures, and understanding the risks involved. Plus, discover how programming languages, backtesting capabilities, and user reviews can influence your decision. With insights from DayTradingBusiness, you'll be well-equipped to navigate the world of algorithmic trading effectively.

What features should I look for in an algorithmic trading platform?

Look for these key features in an algorithmic trading platform:

1. Speed: Low latency execution is crucial for high-frequency trading.

2. Customizability: Ability to create and modify trading algorithms based on your strategy.

3. Backtesting Tools: Robust backtesting capabilities to evaluate performance against historical data.

4. Data Access: Comprehensive market data, including real-time and historical feeds.

5. Risk Management: Features like stop-loss orders and position sizing to manage risk effectively.

6. User Interface: Intuitive design that makes navigation and execution easy.

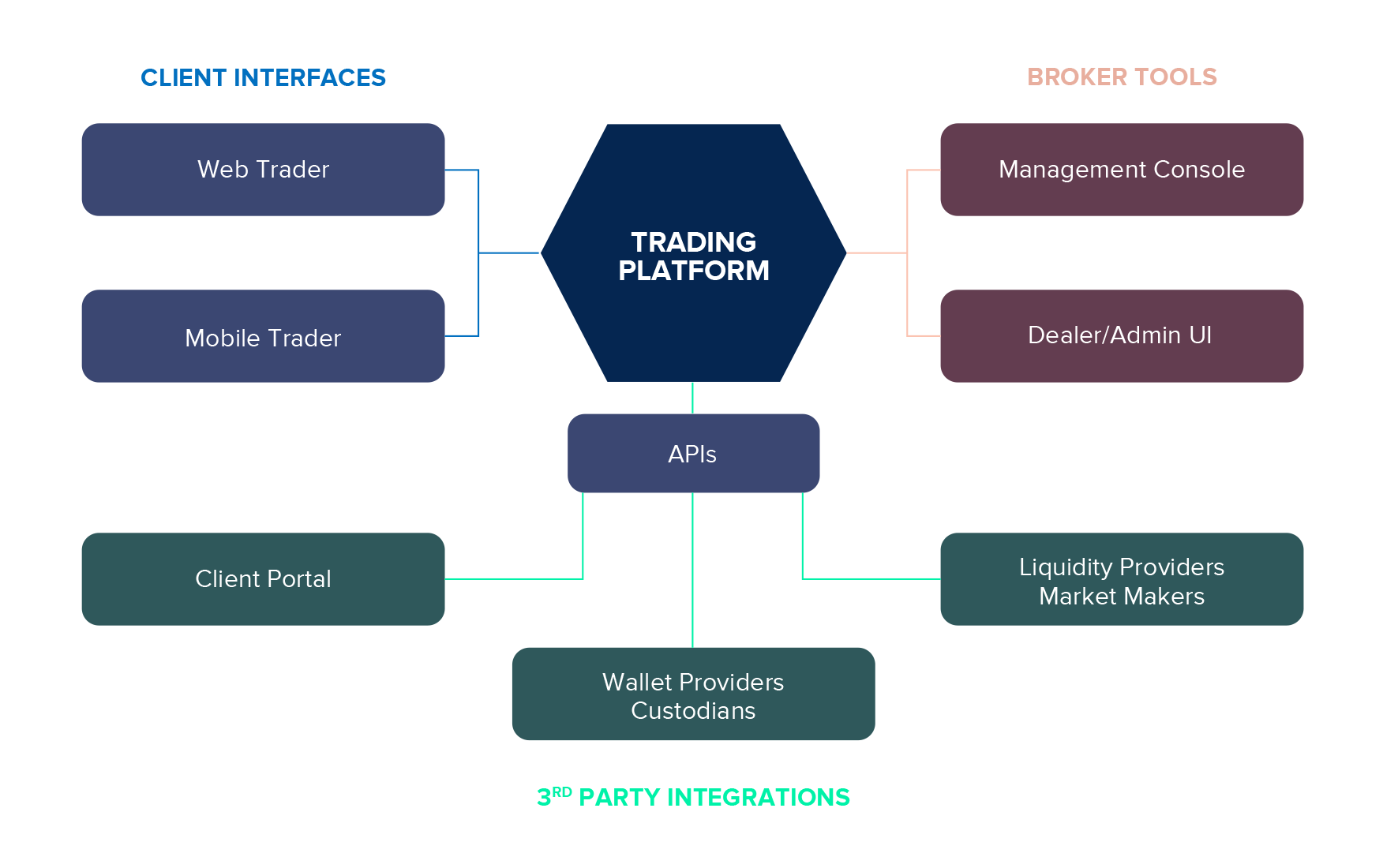

7. Integration: Compatibility with third-party tools or APIs for enhanced functionality.

8. Security: Strong encryption and regulatory compliance to protect your data and funds.

9. Support and Community: Access to customer support and an active user community for troubleshooting and sharing strategies.

How do I evaluate the cost of algorithmic trading platforms?

To evaluate the cost of algorithmic trading platforms, consider these factors:

1. Subscription Fees: Check for monthly or annual fees to access the platform.

2. Commission Rates: Look at trading commissions per transaction; lower rates can save money over time.

3. Data Fees: Assess the costs for market data access, including real-time and historical data.

4. Execution Costs: Investigate any fees related to trade execution, including slippage and spreads.

5. Withdrawal Fees: Review any charges for transferring funds out of the platform.

6. Additional Tools: Consider costs for advanced features, plugins, or API access that may enhance your trading.

7. Free Trials: Take advantage of free trials to gauge value before committing financially.

By analyzing these aspects, you can make an informed decision about the total cost of using an algorithmic trading platform.

What are the top algorithmic trading platforms for beginners?

The top algorithmic trading platforms for beginners include:

1. MetaTrader 4/5 – User-friendly interface with automated trading capabilities.

2. TradeStation – Offers powerful tools and educational resources for new traders.

3. QuantConnect – A cloud-based platform with a focus on algorithm development and backtesting.

4. AlgoTrader – Provides a comprehensive framework for algorithmic trading with a user-friendly setup.

5. NinjaTrader – Features advanced charting and market analysis tools, suitable for beginners.

Choose a platform based on ease of use, available educational resources, and the ability to test algorithms.

How can I compare algorithmic trading platforms effectively?

To compare algorithmic trading platforms effectively, focus on these key factors:

1. Features: Assess the tools available for backtesting, strategy development, and optimization. Look for advanced charting and analytics.

2. Fees: Compare trading commissions, platform fees, and any hidden costs. Lower fees can significantly impact profitability.

3. Execution Speed: Evaluate the platform’s order execution speed and reliability. Fast execution is crucial for algorithmic trading.

4. Data Access: Check the quality and breadth of market data provided. Real-time data is essential for successful algorithmic strategies.

5. User Experience: Consider the platform’s interface and ease of use. A user-friendly experience can enhance your trading efficiency.

6. Integration: Look for compatibility with your existing tools and APIs for custom development.

7. Support and Community: Assess the availability of customer support and the strength of the user community for troubleshooting and strategy sharing.

8. Regulation and Security: Ensure the platform is regulated and offers strong security measures to protect your funds and data.

By focusing on these aspects, you can effectively compare and choose the right algorithmic trading platform that meets your trading needs.

What programming languages do algorithmic trading platforms support?

Algorithmic trading platforms typically support programming languages like Python, R, C++, Java, and MATLAB. Python is popular for its simplicity and extensive libraries, while R excels in statistical analysis. C++ offers speed for high-frequency trading, and Java is favored for its portability. Choose a platform based on the language you're most comfortable with and the specific tools you need for your trading strategy.

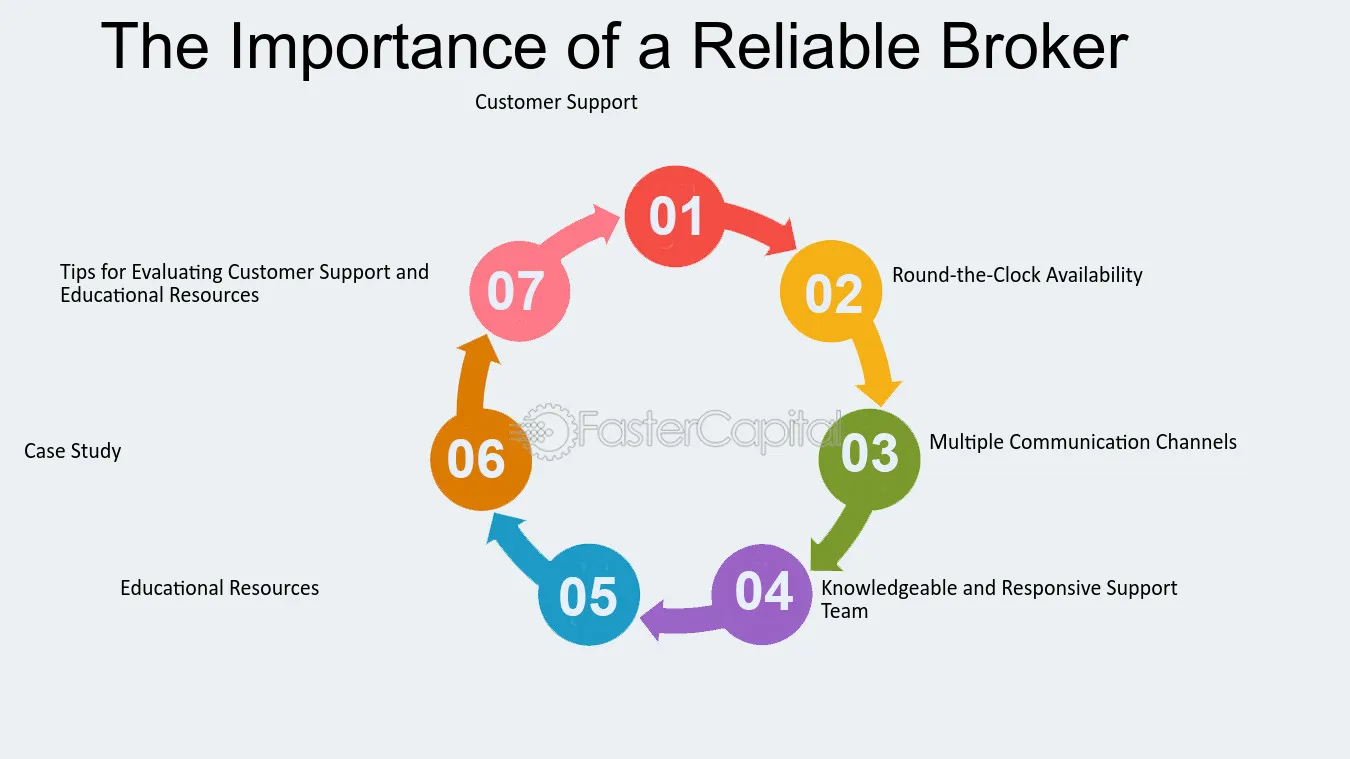

How important is customer support for trading platforms?

Customer support is crucial for trading platforms. It ensures prompt assistance during technical issues, helps resolve trading disputes, and provides guidance on platform features. Reliable customer support enhances user confidence and can prevent significant financial losses. Look for platforms that offer 24/7 support, multiple contact methods, and knowledgeable representatives to ensure a smooth trading experience.

What security measures should I consider in a trading platform?

Consider these security measures for a trading platform:

1. Two-Factor Authentication (2FA): Ensure the platform offers 2FA for an extra layer of protection.

2. Encryption: Look for end-to-end encryption to safeguard your data and transactions.

3. Regulatory Compliance: Verify that the platform complies with relevant regulations and has licenses from recognized authorities.

4. Cold Storage: Choose a platform that stores the majority of its assets in cold storage to minimize online vulnerabilities.

5. Withdrawal Whitelists: Check if the platform allows you to set withdrawal addresses, adding an extra security layer.

6. Regular Security Audits: Ensure the platform undergoes regular security audits and vulnerability assessments.

7. User Education: Look for platforms that provide resources on safe trading practices and phishing awareness.

Prioritize these features to enhance your trading security.

How do I assess the performance of an algorithmic trading platform?

To assess the performance of an algorithmic trading platform, evaluate the following key factors:

1. Backtesting Capabilities: Check how comprehensive the backtesting tools are. Ensure they allow for extensive historical data analysis.

2. Execution Speed: Test the latency and execution speed. Faster execution leads to better trade outcomes.

3. Algorithm Flexibility: Look for platforms that support multiple programming languages and custom strategies. This allows for tailored trading solutions.

4. Risk Management Features: Assess the available risk management tools, like stop-loss orders and position sizing.

5. Performance Metrics: Review key metrics such as Sharpe ratio, maximum drawdown, and win/loss ratio. These indicate the strategy's effectiveness.

6. User Experience: Evaluate the platform's interface for ease of use. A user-friendly design aids in effective strategy implementation.

7. Costs and Fees: Analyze the fee structure, including commissions, subscription fees, and any hidden charges.

8. Support and Community: Consider the quality of customer support and community resources, which can be crucial for troubleshooting and learning.

9. Integration: Check how well the platform integrates with data feeds, brokerage accounts, and other tools you use.

10. Regulatory Compliance: Ensure the platform adheres to relevant regulations for safety and security.

By focusing on these aspects, you can make a well-informed assessment of an algorithmic trading platform's performance.

What is the best trading platform for high-frequency trading?

The best trading platform for high-frequency trading often includes features like low latency, advanced charting tools, and extensive API access. Popular options are Interactive Brokers, TradeStation, and CQG. Look for platforms offering direct market access and robust data feeds. Additionally, consider transaction costs, order execution speed, and the availability of algorithmic trading capabilities.

How can I test trading strategies on a platform?

To test trading strategies on a platform, first, choose a platform that offers backtesting features. Look for one with historical data access, real-time simulation, and user-friendly interfaces. Import your trading strategy into the platform, then run simulations using past market data to evaluate performance. Analyze results to refine your strategy based on metrics like win rate and drawdown. Finally, consider using a demo or paper trading account to test in real-time conditions without risking actual capital.

What are the risks of using algorithmic trading platforms?

The risks of using algorithmic trading platforms include system failures, which can lead to significant financial losses; lack of transparency in algorithms, making it hard to understand decision-making processes; market volatility, where algorithms might react unpredictably; data security concerns, risking sensitive information; and over-reliance on technology, which can lead to neglecting market fundamentals. Always assess these risks before choosing a platform.

How do user reviews impact the choice of a trading platform?

User reviews significantly influence the choice of a trading platform by providing real insights into user experiences. Positive reviews can highlight reliability, ease of use, and effective customer support, while negative reviews often reveal issues like hidden fees or poor execution speeds. Traders rely on these firsthand accounts to gauge the platform’s performance and trustworthiness, which can ultimately affect their decision. A platform with consistently high ratings and satisfied users is more likely to be chosen for algorithmic trading.

What integration options should I look for in trading software?

Look for integration options like API access for connecting to exchanges, support for third-party trading tools, and compatibility with data feeds. Ensure it can integrate with your existing brokerage accounts and has features for backtesting and risk management. Check if it supports popular programming languages for custom algorithms and if it allows for real-time data integration.

How can I find a platform with robust backtesting capabilities?

To find a platform with robust backtesting capabilities, start by researching popular algorithmic trading platforms like MetaTrader, TradingView, and NinjaTrader. Look for features like historical data access, customizable strategies, and detailed performance metrics. Read user reviews and compare the backtesting tools offered. Test a few platforms using free trials to evaluate their ease of use and functionality. Prioritize platforms that allow you to run multiple simulations and refine your strategies effectively.

What role does liquidity play in choosing a trading platform?

Liquidity is crucial when choosing a trading platform because it determines how easily and quickly you can buy or sell assets. High liquidity means tighter spreads and better prices, which can enhance your trading efficiency. A platform with ample liquidity allows for larger trades without significantly impacting market prices, reducing slippage. Ensure the platform supports high-volume trading and offers access to liquid markets for optimal performance.

How do I ensure a trading platform complies with regulations?

To ensure a trading platform complies with regulations, check if it is registered with relevant authorities like the SEC or FCA. Look for transparency in their operations and clear terms of service. Verify if they implement robust security measures and provide regular reports on their activities. Research their compliance history and read user reviews regarding their regulatory adherence. Additionally, inquire about their process for handling customer funds and data protection.

Conclusion about How to Choose the Right Algorithmic Trading Platform

Selecting the right algorithmic trading platform requires careful consideration of features, costs, and user support. Evaluate platforms based on programming language compatibility, security measures, and performance metrics. Testing strategies and assessing user reviews can further guide your decision. For beginners, identifying platforms with strong backtesting capabilities and regulatory compliance is essential. By taking these factors into account, you can make informed choices that enhance your trading experience. Trust DayTradingBusiness to provide you with the insights needed to navigate this complex landscape effectively.

Learn about How to Choose the Right Day Trading Platform