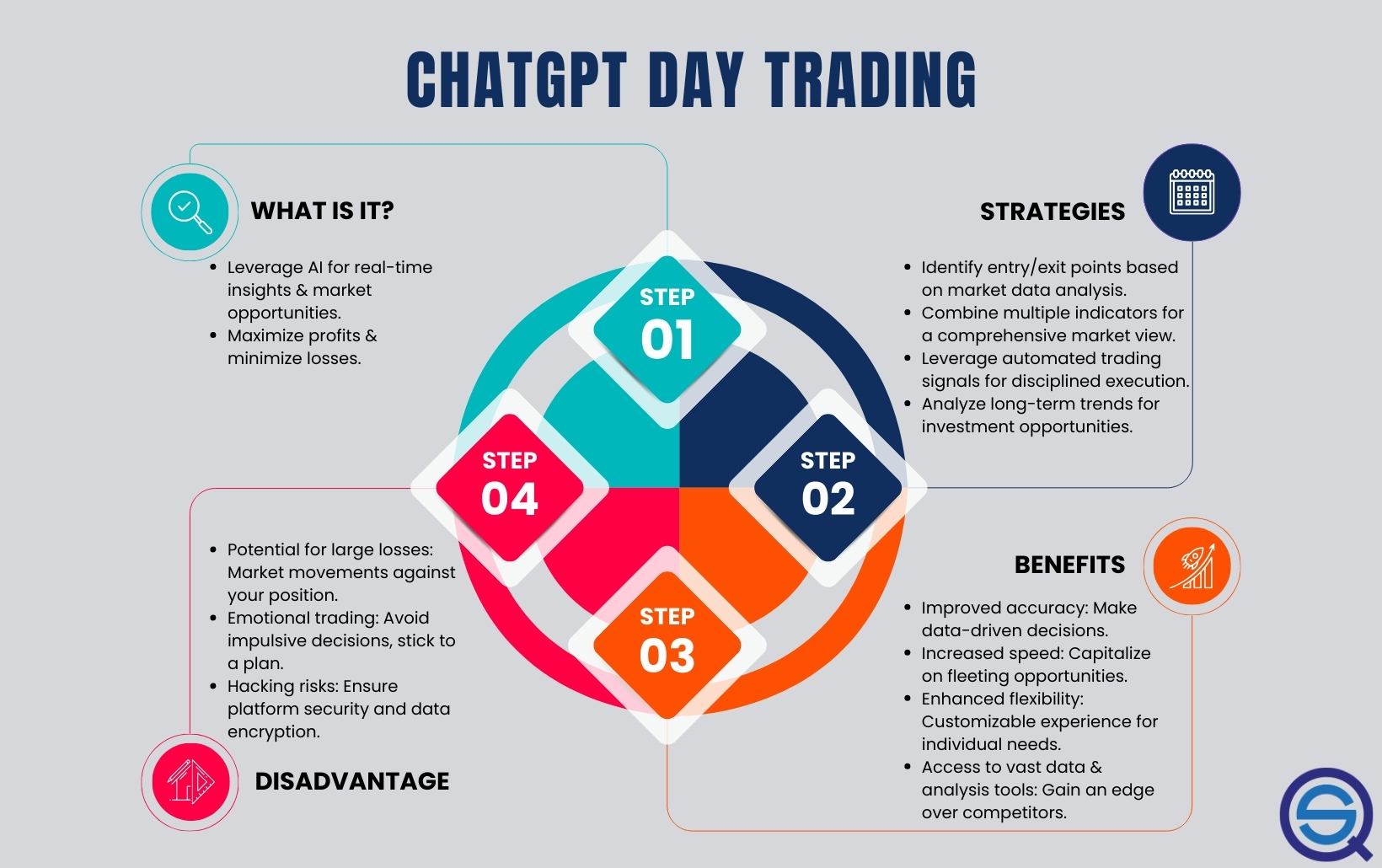

Did you know that the average human takes about 30 seconds to make a decision, while an algorithm can analyze thousands of data points in milliseconds? This speed is just one of the many advantages of using algorithms in day trading. In this article, we explore how algorithms enhance trading speed and efficiency, reduce emotional decision-making, and improve data analysis. We’ll also discuss the common types of algorithms, their role in risk management, and how they identify trading patterns. While there are potential drawbacks, the benefits, including adaptability to market changes and profitability, can be significant. Additionally, we’ll cover the impact of backtesting and the tools available for implementing these algorithms. Join us as we dive into the transformative power of algorithmic trading with insights from DayTradingBusiness!

What are the benefits of using algorithms in day trading?

Algorithms in day trading offer several benefits:

1. Speed: They execute trades within milliseconds, capitalizing on fleeting market opportunities.

2. Accuracy: Algorithms reduce human error, ensuring precise entry and exit points based on data-driven strategies.

3. Backtesting: Traders can test strategies against historical data to refine their approach and minimize risks.

4. Emotion Reduction: Algorithms remove psychological factors, leading to more disciplined trading decisions.

5. 24/7 Monitoring: They can analyze market conditions continuously, allowing for real-time adjustments without fatigue.

6. Scalability: Algorithms can manage multiple trades simultaneously, increasing potential profitability.

7. Data Analysis: They process vast amounts of market data quickly, identifying trends and patterns that may go unnoticed.

These advantages make algorithms valuable tools for maximizing efficiency and profitability in day trading.

How do algorithms improve trading speed and efficiency?

Algorithms improve trading speed and efficiency by executing orders in milliseconds, allowing traders to capitalize on market opportunities instantly. They analyze vast amounts of data quickly, identifying patterns and trends that human traders might miss. Algorithms can also automate repetitive tasks, reducing human error and emotional decision-making. By utilizing high-frequency trading strategies, they can place thousands of trades per second, optimizing entry and exit points. This leads to better pricing and lower transaction costs, enhancing overall trading performance.

Can algorithms help reduce emotional decision-making in trading?

Yes, algorithms can significantly reduce emotional decision-making in trading. They execute trades based on predetermined criteria, eliminating impulsive actions driven by fear or greed. By relying on data and statistical analysis, algorithms ensure consistency and discipline, leading to more rational trading outcomes. This helps traders stick to their strategies, avoid overtrading, and manage risk more effectively. Overall, using algorithms can enhance trading performance by minimizing the impact of emotions.

What types of algorithms are commonly used in day trading?

Commonly used algorithms in day trading include:

1. Trend Following Algorithms: Identify and capitalize on market trends.

2. Mean Reversion Algorithms: Bet on price corrections to average levels.

3. Arbitrage Algorithms: Exploit price differences across markets or instruments.

4. Market Making Algorithms: Provide liquidity and profit from bid-ask spreads.

5. Statistical Arbitrage Algorithms: Use statistical models to find pricing inefficiencies.

Each type offers advantages like speed, precision, and the ability to analyze vast data sets quickly, enhancing trading strategies and decision-making.

How do algorithms enhance data analysis in trading?

Algorithms enhance data analysis in trading by processing vast amounts of market data quickly and accurately. They identify patterns and trends that human traders might miss, enabling faster decision-making. Algorithms can execute trades at optimal prices, reducing slippage and improving profitability. They also manage risk by setting predefined stop-loss and take-profit levels, ensuring disciplined trading. Additionally, algorithms can backtest strategies against historical data, allowing traders to refine their approaches before risking real capital.

What role do algorithms play in risk management for day traders?

Algorithms in day trading help manage risk by automating decision-making, enabling quick response to market changes, and analyzing vast amounts of data for informed trading. They can set stop-loss and take-profit levels, minimizing potential losses and locking in profits. Algorithms also help diversify trades, spreading risk across different assets. Additionally, they reduce emotional trading, leading to more disciplined strategies. Overall, algorithms enhance efficiency, accuracy, and consistency in risk management for day traders.

How can algorithms assist in identifying trading patterns?

Algorithms can analyze vast amounts of market data quickly, identifying trading patterns that human traders might miss. They use historical data to recognize trends, detect anomalies, and execute trades based on predefined criteria. This automation enhances speed and precision, allowing traders to capitalize on opportunities in real time. Additionally, algorithms can adapt to changing market conditions, continually optimizing strategies for better performance. By minimizing emotional decision-making, they provide a systematic approach to day trading.

Are there any drawbacks to using algorithms in day trading?

Yes, there are drawbacks to using algorithms in day trading. They can lead to over-reliance on automated systems, causing traders to miss market nuances. Algorithms can also amplify losses during volatile conditions if not properly calibrated. Moreover, technical glitches or bugs can result in significant financial losses. Lastly, high-frequency trading algorithms can contribute to market instability and slippage issues, affecting trade execution.

How do algorithms adapt to changing market conditions?

Algorithms adapt to changing market conditions by employing real-time data analysis, adjusting trading strategies based on market volatility, trends, and patterns. They utilize machine learning to identify shifts and optimize decisions, ensuring quick responses to price movements. By backtesting against historical data, algorithms refine their methods, improving performance over time. This adaptability allows traders to capitalize on opportunities and minimize risks effectively.

What is the impact of backtesting algorithms in trading success?

Backtesting algorithms significantly enhance trading success by allowing traders to evaluate their strategies using historical data. This process identifies the effectiveness of the algorithm, fine-tunes parameters, and reduces the risk of losses. It provides insights into potential drawdowns and helps in understanding market behavior. Ultimately, backtesting enables traders to make informed decisions, increasing the likelihood of profitable trades in day trading.

How can algorithms help with trade execution?

Algorithms enhance trade execution by optimizing speed and precision, allowing traders to capitalize on market opportunities instantly. They analyze vast amounts of data, identify patterns, and execute trades based on predefined criteria, minimizing human error. This leads to better pricing, reduced slippage, and efficient order management. Additionally, algorithms can operate 24/7, ensuring trades are executed even outside regular hours, maximizing potential profits. Overall, using algorithms in day trading streamlines the process and improves decision-making.

What are the cost implications of using trading algorithms?

Using trading algorithms can lead to significant cost implications. They can lower transaction costs by executing trades faster and more efficiently, reducing slippage. However, there are initial costs for development and maintenance, including software and data fees. Additionally, high-frequency trading algorithms may incur higher costs due to increased market data consumption and potential exchange fees. Overall, while algorithms can minimize some costs, they may introduce new expenses that need careful management.

How do algorithms contribute to developing trading strategies?

Algorithms analyze vast amounts of market data quickly, identifying patterns and trends that human traders might miss. They execute trades at optimal times, minimizing costs and maximizing profits. By backtesting strategies against historical data, algorithms help refine approaches before live trading. Additionally, they can adapt to changing market conditions in real-time, allowing for more agile trading strategies. Overall, algorithms enhance precision, speed, and efficiency in day trading.

Can algorithms improve profitability in day trading?

Yes, algorithms can significantly improve profitability in day trading. They analyze vast amounts of data quickly, identify patterns, and execute trades at optimal times. This reduces emotional decision-making and increases trade precision. Algorithms can backtest strategies, optimizing them for better performance. They also enable high-frequency trading, capitalizing on small price movements. Overall, using algorithms enhances efficiency and can lead to higher returns in day trading.

What tools are available for implementing trading algorithms?

Popular tools for implementing trading algorithms include MetaTrader, TradingView, QuantConnect, and NinjaTrader. These platforms offer backtesting, charting, and real-time data features. Additionally, languages like Python and R are commonly used for algorithm development due to their extensive libraries and community support. Using these tools can enhance day trading by enabling automated strategies, reducing emotional bias, and improving execution speed.

How do algorithms handle high-frequency trading scenarios?

Algorithms handle high-frequency trading by executing trades based on complex mathematical models and real-time data analysis. They can process vast amounts of market data in milliseconds, allowing for rapid decision-making. This speed reduces latency, capitalizes on minute price fluctuations, and enables traders to exploit arbitrage opportunities effectively. Algorithms also minimize emotional decision-making and improve consistency in trading strategies, leading to better risk management and potentially higher returns.

Conclusion about Advantages of Using Algorithms in Day Trading

Incorporating algorithms into day trading offers numerous advantages, from enhanced speed and efficiency to improved risk management and emotional control. They facilitate advanced data analysis and pattern recognition, ultimately aiding in the development of robust trading strategies. While there are some drawbacks, the potential for increased profitability and effective trade execution makes algorithms a valuable tool for modern traders. For those looking to maximize their trading potential, leveraging insights from DayTradingBusiness can provide essential guidance in effectively utilizing these powerful tools.