Did you know that the average day trader spends about 50% of their time just trying to figure out what the market is doing? In the fast-paced world of day trading, honing advanced strategies is crucial for seasoned traders aiming to maximize profits. This article dives deep into the best advanced day trading strategies, emphasizing the importance of technical analysis and risk management. Learn how to identify high-probability trading setups and utilize key indicators for stock trading. We’ll explore market sentiment, trading volatile stocks, and the significance of a well-crafted trading plan. Discover advanced chart patterns, algorithmic trading benefits, and essential tools for success, while also addressing emotional management and common pitfalls. With insights from DayTradingBusiness, you’ll be better equipped to adapt your strategies in dynamic market conditions.

What Are the Best Advanced Day Trading Strategies for Experienced Traders?

1. Scalping: Focus on small price changes, executing multiple trades throughout the day to accumulate profits.

2. Momentum Trading: Identify stocks with strong trends and capitalize on their movement, entering early and exiting quickly as momentum shifts.

3. Swing Trading: Utilize technical analysis to identify short-term price patterns, holding positions for a few days to capture gains from swings.

4. Pair Trading: Trade correlated assets, buying one while shorting the other to hedge risk and exploit relative price movements.

5. News-Based Trading: React quickly to market-moving news, using economic reports or company announcements to inform your trades.

6. Algorithmic Trading: Develop automated strategies that use technical indicators and backtesting to identify optimal entry and exit points.

7. Volume Profile Analysis: Analyze trading volume at different price levels to pinpoint support and resistance areas, enhancing entry and exit strategies.

8. Risk Management Techniques: Implement stop-loss orders and position sizing to protect capital and maximize returns.

9. Market Sentiment Analysis: Monitor social media and news sentiment to gauge market psychology and anticipate price movements.

10. Technical Indicator Combination: Use a mix of indicators, like moving averages and RSI, to confirm trade signals and improve accuracy.

How Can I Use Technical Analysis for Day Trading Success?

To use technical analysis for day trading success, focus on these key strategies:

1. Chart Patterns: Identify patterns like triangles, flags, and head and shoulders to predict price movements.

2. Indicators: Use indicators such as moving averages, RSI, and MACD to gauge momentum and potential reversals.

3. Volume Analysis: Pay attention to trading volume to confirm trends. High volume often supports price movements.

4. Support and Resistance Levels: Mark these levels on your charts. They help set entry and exit points.

5. Time Frames: Analyze multiple time frames for a comprehensive view. Use shorter time frames for entry signals and longer for trend direction.

6. Risk Management: Set stop-loss orders based on your analysis to protect capital and manage risk effectively.

7. Backtesting: Test your strategies on historical data to refine your approach before applying it in real-time.

Implement these techniques to enhance your day trading outcomes.

What Role Does Risk Management Play in Advanced Day Trading?

Risk management is crucial in advanced day trading as it helps protect capital and minimize losses. It involves setting stop-loss orders, determining position sizes, and diversifying trades to mitigate exposure. Effective risk management allows traders to stay in the game longer, manage emotional responses, and make informed decisions. By assessing potential risks and rewards, traders can optimize their strategies and maintain consistent profitability.

How Do I Identify High-Probability Trading Setups?

To identify high-probability trading setups, focus on these key factors:

1. Technical Analysis: Use charts to spot patterns, trends, and support/resistance levels. Look for setups like breakouts or reversals at these critical points.

2. Volume Analysis: Confirm price movements with volume. High volume on breakouts suggests strength, while low volume can indicate weakness.

3. Risk-Reward Ratio: Aim for setups with at least a 2:1 reward-to-risk ratio. This increases potential profit while limiting losses.

4. Market News and Events: Stay updated on economic reports and news that can impact market conditions. These can create volatility and trading opportunities.

5. Time Frames: Analyze multiple time frames to validate setups. A strong signal on a higher time frame can enhance the reliability of your trade on a lower time frame.

6. Indicators: Utilize indicators like RSI, MACD, or moving averages to gauge momentum and overbought/oversold conditions.

By combining these elements, you can pinpoint high-probability trading setups that align with your strategy.

What Are the Key Indicators for Day Trading Stocks?

Key indicators for day trading stocks include:

1. Volume: High trading volume signals strong interest and potential price movement.

2. Price Action: Analyzing candlestick patterns helps identify trends and reversals.

3. Moving Averages: Use short-term moving averages (like the 5-day or 10-day) for quick trend identification.

4. Relative Strength Index (RSI): Measures momentum; values above 70 indicate overbought conditions, below 30 indicate oversold.

5. Bollinger Bands: Helps identify volatility and potential price breakouts when prices touch the bands.

6. Support and Resistance Levels: Identify price levels where stocks historically reverse direction.

These indicators will help you make informed, strategic decisions while day trading.

How Can I Use Market Sentiment in My Day Trading?

To use market sentiment in day trading, start by monitoring social media, news outlets, and financial forums to gauge trader emotions. Use sentiment indicators or tools like the Fear & Greed Index to quantify market mood. Look for discrepancies between sentiment and price action; for example, if sentiment is overly bullish but prices are dropping, consider shorting. Additionally, pay attention to volume spikes during sentiment shifts, as they can signal strong moves. Finally, incorporate sentiment analysis into your trading plan to align your strategies with prevailing market emotions.

What Strategies Work Best for Trading Volatile Stocks?

1. Technical Analysis: Use advanced chart patterns, moving averages, and indicators like RSI and MACD to identify entry and exit points.

2. Scalping: Focus on quick trades to capitalize on small price movements. Aim for tight spreads and fast execution.

3. News Trading: Monitor news releases and earnings reports. React quickly to volatility spikes caused by unexpected news.

4. Options Strategies: Employ strategies like straddles or strangles to profit from significant price movements in either direction.

5. Risk Management: Set strict stop-loss orders to protect against large losses. Use position sizing to manage overall risk.

6. Pre-market and After-hours Trading: Take advantage of price movements outside regular trading hours for increased volatility.

7. Trend Following: Identify and trade in the direction of the prevailing trend, using trailing stops to lock in profits as the trend moves.

8. Volume Analysis: Look for high trading volume to confirm price movements; avoid trades with low volume to reduce the risk of slippage.

9. Market Sentiment: Use sentiment indicators to gauge trader psychology and anticipate potential reversals in volatile stocks.

10. Diversification: Spread risk by trading multiple volatile stocks rather than concentrating on one.

How Do I Create a Winning Trading Plan?

To create a winning trading plan, start by defining your trading goals, including profit targets and risk tolerance. Next, choose specific trading strategies that align with your experience level, such as scalping or momentum trading. Incorporate technical analysis tools to identify entry and exit points, and set clear stop-loss and take-profit levels for each trade.

Regularly review and adjust your plan based on performance metrics and market conditions. Document your trades to analyze what works and what doesn’t. Lastly, maintain discipline and emotional control to stick to your plan, even in volatile markets.

What Are the Key Differences Between Day Trading Strategies for Beginners and Advanced Traders?

Advanced day trading strategies for experienced traders include using technical analysis, implementing options strategies, leveraging margin trading, employing algorithmic trading, and focusing on specific sectors or stocks for greater volatility.

Learn more about: Day Trading Strategies for Beginners

What Advanced Chart Patterns Should I Know for Day Trading?

For advanced day trading, focus on these chart patterns:

1. Head and Shoulders: Indicates trend reversal; look for a peak (head) between two smaller peaks (shoulders).

2. Inverse Head and Shoulders: Signals bullish reversal; the opposite of the standard head and shoulders.

3. Double Tops and Bottoms: A double top signals a bearish reversal, while a double bottom indicates a bullish reversal.

4. Triangles (Ascending, Descending, Symmetrical): These patterns reveal continuation trends; breakouts often follow.

5. Flags and Pennants: Short-term continuation patterns; they appear after a strong price movement and suggest a pause before the trend resumes.

6. Cup and Handle: A bullish continuation pattern that resembles a cup with a handle, indicating potential upward movement.

Master these patterns to enhance your day trading strategies effectively.

Learn about Chart Patterns Every Day Trader Should Know

How Can I Optimize My Trading Journal for Better Performance?

To optimize your trading journal for better performance, focus on these key aspects:

1. Detailed Entries: Record every trade with specifics—entry and exit points, position sizes, and your rationale.

2. Performance Metrics: Track win rates, average gains, and losses to identify patterns in your trading behavior.

3. Emotional Assessment: Note your emotional state during trades to understand how it impacts decisions.

4. Review Periodically: Regularly analyze your journal to pinpoint successful strategies and areas for improvement.

5. Set Goals: Define clear, measurable trading goals and monitor progress against them.

6. Adapt Strategies: Use insights from your journal to refine and adapt your trading strategies based on what works.

7. Visual Analysis: Incorporate charts or graphs for a visual representation of your performance over time.

Implementing these practices will enhance your trading discipline and ultimately improve your trading results.

Learn about How Do I Optimize My Day Trading Bot’s Performance?

What Are the Benefits of Using Algorithmic Trading in Day Trading?

Algorithmic trading in day trading offers several benefits. First, it enhances speed, executing trades in milliseconds, which is crucial in fast-moving markets. Second, it removes emotional decision-making, relying on data and predefined strategies, leading to more consistent results. Third, it allows for backtesting strategies against historical data, helping traders refine their approaches. Fourth, it can analyze vast amounts of market data quickly, identifying patterns or opportunities that might be missed manually. Lastly, it enables simultaneous monitoring of multiple markets and assets, increasing potential profit opportunities.

Learn about What Are the Benefits of Using a Prop Firm for Day Trading?

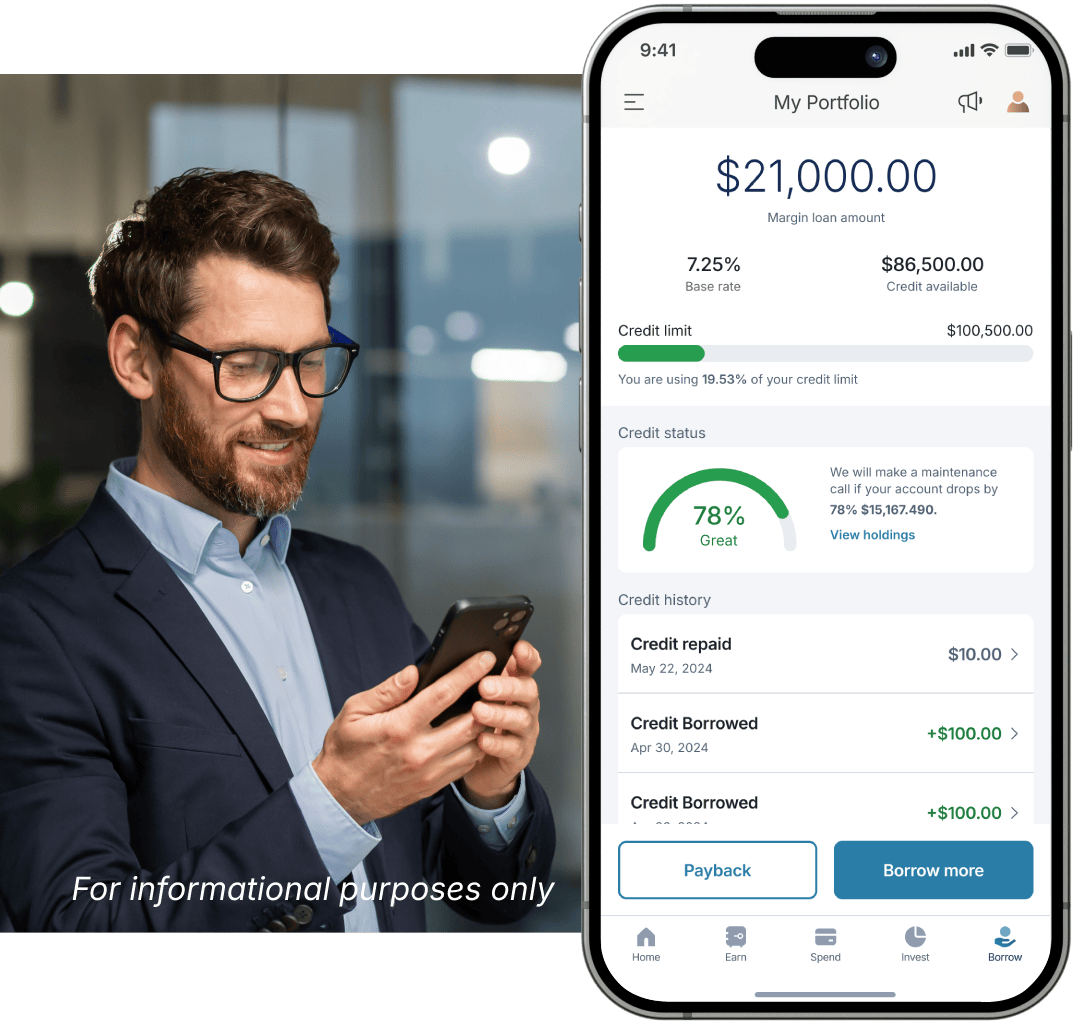

How Can I Leverage Leverage and Margin Effectively?

To leverage margin effectively in day trading, start by determining your risk tolerance. Use leverage to amplify potential gains, but don’t exceed 2:1 to manage risk. Focus on high-probability setups and use stop-loss orders to protect your capital. Monitor your positions closely, as high leverage can lead to rapid losses. Diversify trades to spread risk and avoid overconcentration in one asset. Regularly assess and adjust your strategy based on market conditions and personal performance.

Learn about How to Avoid Margin Calls and Leverage Risks

What Tools and Software Are Essential for Advanced Day Traders?

Essential tools and software for advanced day traders include:

1. Trading Platforms: Use robust platforms like Thinkorswim or MetaTrader for real-time data and advanced charting.

2. Stock Screeners: Tools like Finviz or Trade Ideas help identify trading opportunities based on specific criteria.

3. News Aggregators: Services like Benzinga Pro provide real-time news that can impact stock prices.

4. Technical Analysis Software: Programs like TradingView offer advanced charting capabilities and technical indicators.

5. Risk Management Tools: Software like Tradervue helps track performance and manage risk effectively.

6. Algorithmic Trading Tools: Using platforms like QuantConnect can help automate trading strategies.

7. Brokerage API Access: For custom solutions, APIs from brokers like Interactive Brokers allow direct access to trading functionalities.

These tools enhance decision-making, streamline trading processes, and improve overall strategy execution.

How Do I Manage Emotions While Day Trading?

To manage emotions while day trading, establish a clear trading plan with defined entry and exit points. Stick to your strategy, avoiding impulsive decisions driven by fear or greed. Use stop-loss orders to limit potential losses and maintain discipline. Practice mindfulness techniques, like deep breathing, to stay calm during trades. Keep a trading journal to reflect on your emotions and decisions, helping identify patterns. Lastly, set realistic goals to prevent frustration and burnout.

Learn about How Do Institutional Traders Manage Risk During Day Trading?

What Are Common Mistakes Experienced Traders Make?

Common mistakes experienced traders make include over-leveraging positions, ignoring risk management, letting emotions dictate trades, failing to adapt to market changes, and not keeping a trading journal. Many traders also underestimate the importance of staying informed about economic news and technical indicators, which can lead to poor decision-making. Additionally, some may chase losses instead of sticking to their strategies, resulting in further losses. Maintaining discipline and continuously refining strategies are crucial to avoid these pitfalls.

How Can I Adapt My Strategies to Changing Market Conditions?

To adapt your day trading strategies to changing market conditions, first, analyze current market trends and volatility. Use technical indicators like moving averages and the Relative Strength Index (RSI) to gauge momentum shifts. Adjust your risk management by tightening stop-loss orders in volatile markets and widening them during stable periods. Stay flexible with your entry and exit points based on real-time data.

Incorporate news and economic indicators into your strategy, as they can significantly impact price movements. Diversify your trades across different sectors to spread risk. Finally, continuously backtest your strategies against recent market data to ensure they remain effective.

Conclusion about Advanced Day Trading Strategies for Experienced Traders

In conclusion, mastering advanced day trading strategies requires a deep understanding of technical analysis, risk management, and market sentiment. By identifying high-probability setups and utilizing key indicators, traders can enhance their decision-making processes. It's essential to create a comprehensive trading plan, optimize performance through a well-maintained journal, and effectively leverage tools and software. Experienced traders must also adapt to market changes while managing emotions to avoid common pitfalls. For further insights and support in your trading journey, DayTradingBusiness offers invaluable resources tailored to elevate your trading success.

Learn about The Role of Insider Trading in Advanced Day Trading Strategies

Sources:

- "The Myth of Profitable Day Trading: What Separates the Winners ...

- Pro Trader RL: Reinforcement learning framework for generating ...

- Trading strategies and Financial Performances: A simulation approach

- Understanding and Testing Iceberg Algorithmic Trading Strategy

- The Impact of US-China Trade Tensions

- An agent-based model of intra-day financial markets dynamics ...