Did you know that some traders believe their gut feelings are more reliable than charts? Spoiler alert: they’re often wrong! In the world of day trading, emotional trading can lead to significant risks and poor decision-making. This article delves into the nature of emotional trading, exploring how fear and greed skew judgment, and highlighting the common traps day traders fall into. We'll discuss the impact of stress, impulsive decisions, and the importance of a solid trading plan. By understanding emotional pitfalls and implementing strategies like mindfulness and journaling, traders can enhance their performance and safeguard their long-term profitability. Join us as we uncover the dangers of emotional trading and how DayTradingBusiness can help you navigate these challenges effectively.

What is emotional trading in day trading?

Emotional trading in day trading is making buy or sell decisions based on feelings like fear, greed, or frustration instead of analysis. It leads traders to act impulsively, chasing quick profits or panicking during losses. This behavior increases risks, causes poor timing, and can wipe out accounts faster than strategic trading.

Why does emotional trading increase risk?

Emotional trading increases risk because it leads to impulsive decisions, like holding onto losing positions or exiting winners too early. It clouds judgment, causing traders to ignore market signals and stick to biases. This unpredictability makes losses more likely and disrupts disciplined strategies. When emotions take over, risk management suffers, amplifying potential losses.

How can fear affect day trading decisions?

Fear can cause impulsive moves, leading traders to sell prematurely or avoid taking necessary risks. It clouds judgment, making it hard to stick to a plan, and can result in missed opportunities or panic exits. When traders panic, they might overreact to small losses, magnifying losses and damaging confidence. Fear also triggers hesitation, causing missed trades and forcing traders to abandon strategies just when they’re about to succeed.

What role does greed play in trading risks?

Greed fuels risky trades by pushing traders to chase bigger profits, often ignoring proper risk management. It blinds traders to potential losses, leading to impulsive decisions and overleveraging. Greed can make traders hold onto losing positions longer, hoping for a turnaround, increasing potential losses. In day trading, unchecked greed amplifies emotional trading risks, making disciplined strategies harder to stick to.

How does overtrading stem from emotional reactions?

Overtrading happens when traders let emotions like fear or greed drive excessive buying and selling. When markets move unpredictably, fear can push traders to enter or exit trades impulsively, trying to avoid losses. Greed can make traders chase big gains, leading them to trade more often than they should. These emotional reactions cloud judgment, causing them to ignore proper risk management and trade impulsively. As a result, emotional trading fuels overtrading, increasing the risk of significant losses.

What are common emotional traps for day traders?

Common emotional traps for day traders include impulsive decisions driven by fear or greed, overtrading to chase quick profits, panic selling during dips, and holding onto losing positions hoping they'll bounce back. These traps stem from emotional reactions rather than logic, leading to big losses.

How can stress impact trading performance?

Stress clouds judgment, leading to impulsive trades and poor decision-making. It narrows focus, causing traders to overlook signals or chase losses. High stress increases emotional reactions, making it hard to stick to strategies. Over time, stress can cause burnout and reduce overall trading discipline, risking bigger losses.

Why is impulsive trading risky?

Impulsive trading is risky because it’s driven by emotions rather than analysis, leading to poor decisions. It causes traders to chase losses or jump into trades without proper research, increasing the chance of big losses. Emotional reactions can make traders ignore risk management, magnifying losses during market swings. Quick, unplanned trades often lack strategy, making them more vulnerable to market volatility. Overall, impulsive trading erodes discipline and can wipe out profits fast.

How do patience and discipline reduce emotional risks?

Patience and discipline prevent impulsive trades, reducing emotional reactions like fear and greed that lead to risky decisions. They help traders stick to their strategies, avoiding panic-selling or overtrading during volatility. By maintaining calm and following a plan, traders avoid emotional biases that cloud judgment, lowering the chance of costly mistakes in emotional trading.

What signs indicate emotional trading is affecting you?

You find yourself making impulsive trades based on gut feelings rather than analysis. You feel anxious or stressed when trades go against you. You chase losses instead of sticking to your plan. Your judgment is clouded, and you prioritize emotion over logic. You get overly confident after winning or overly panicked after losing. These signs show emotional trading is impacting your decisions.

How can traders control their emotions during volatile markets?

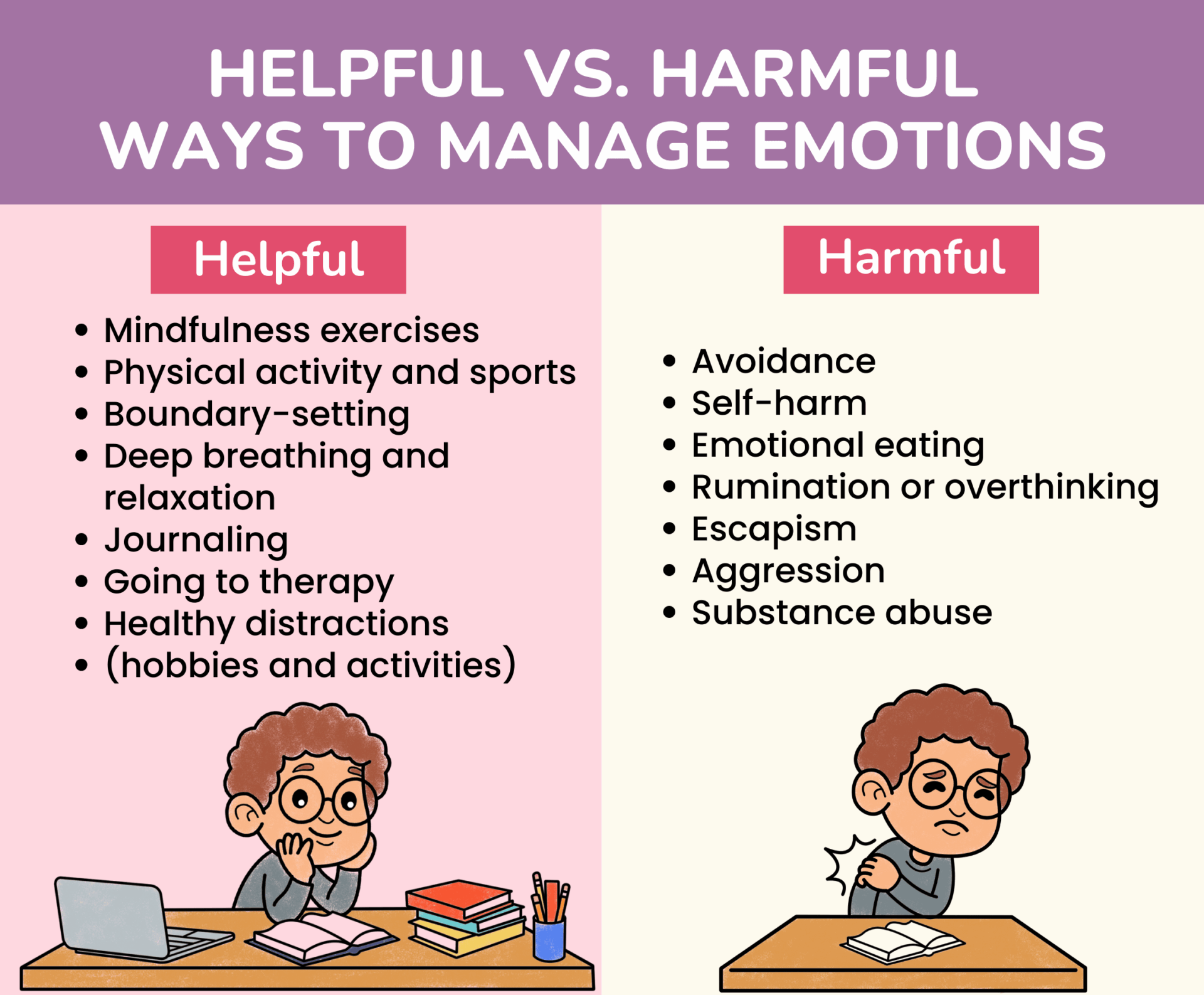

Traders control emotions during volatile markets by setting strict stop-loss and take-profit levels, sticking to a predetermined trading plan, avoiding impulsive decisions, practicing mindfulness or deep breathing to stay calm, and reviewing trades objectively to learn from mistakes instead of reacting emotionally.

What are the consequences of revenge trading?

Revenge trading leads to bigger losses, clouded judgment, and emotional decisions that ignore market analysis. It can cause a trader to chase losses, risking more money and increasing stress. Over time, it erodes trading discipline, making consistent profits impossible. It often results in severe financial setbacks and damages confidence, fueling a destructive cycle.

How does lack of preparation lead to emotional trading errors?

Lack of preparation causes traders to react impulsively instead of sticking to a plan, leading to emotional trading errors. When unprepared, traders feel anxious or panicked during market swings, making them more likely to chase losses or exit trades prematurely. This impulsiveness fuels fear and greed, overriding rational decision-making. Without proper research and strategy, traders become reactive rather than proactive, increasing the risk of costly mistakes driven by emotion.

What strategies can help manage trading anxiety?

Practice disciplined trading routines, set clear stop-loss and take-profit levels, and stick to your plan. Use meditation or deep breathing to stay calm during volatile moves. Limit screen time and avoid overtrading to reduce emotional triggers. Keep a trading journal to track feelings and decisions, identifying patterns that lead to anxiety. Focus on risk management—only trade with money you can afford to lose. Develop a routine that balances analysis with breaks to prevent emotional burnout.

How does emotional trading impact long-term profitability?

Emotional trading undermines long-term profitability by clouding judgment, leading to impulsive decisions and poor risk management. It causes traders to chase losses or hold onto losing positions, amplifying losses over time. Emotional reactions can prompt overtrading and neglect of strategic plans. This behavior erodes capital and hampers consistent gains, making sustained profitability nearly impossible.

Learn about How Do Prop Firms Impact Day Trading Profitability?

What tools or techniques can prevent emotional decision-making?

Use a trading plan with predefined rules, set strict stop-loss and take-profit levels, and stick to them. Keep a trading journal to analyze your emotional triggers. Practice mindfulness or meditation to stay calm. Automate trades with algorithms or alerts to reduce impulse decisions. Take regular breaks to clear your mind and avoid impulsivity. Avoid trading when emotionally upset or stressed.

How important is a trading plan to avoid emotional risks?

A trading plan is crucial because it sets clear rules and strategies, helping you stick to logical decisions instead of reacting emotionally. It prevents impulsive trades driven by fear or greed, reducing emotional risks. Without a plan, traders are more likely to panic sell or chase losses, increasing the chance of costly mistakes. A solid plan keeps emotions in check and promotes disciplined, consistent trading.

Learn about How does lack of a trading plan increase day trading risks?

Can mindfulness improve emotional control in trading?

Yes, mindfulness can improve emotional control in trading by helping you stay present, reduce impulsive decisions, and manage stress. It helps traders recognize emotional triggers before acting on them, preventing rash moves driven by fear or greed. Practicing mindfulness regularly can build resilience against emotional swings that often lead to risky trades and losses.

How does journaling help manage trading emotions?

Journaling helps manage trading emotions by making you see patterns in your reactions, reducing impulsive decisions. It forces you to reflect on your mindset during trades, highlighting emotional triggers like fear or greed. Tracking your trades and feelings improves self-awareness, helping you stay calm and stick to your plan. Writing down mistakes and wins builds discipline and prevents emotional bias from clouding judgment. Overall, journaling turns emotional chaos into clear insights, reducing risky, impulsive trading.

What are the psychological effects of repeated losses?

Repeated losses can cause emotional exhaustion, erode confidence, and boost anxiety. Traders may develop fear of future trades, leading to hesitation or impulsive decisions. Over time, this can cause depression, burnout, and a loss of motivation. The cycle of loss and regret often fuels negative self-talk, impairing judgment and increasing risky trading behaviors.

Conclusion about The Dangers of Emotional Trading Risks in Day Trading

Emotional trading poses significant risks that can undermine a trader's success. By recognizing the influence of fear and greed, and understanding how stress and impulsive decisions lead to detrimental choices, traders can better navigate the challenges of the market. Implementing a solid trading plan, practicing mindfulness, and utilizing journaling techniques can enhance emotional control, ultimately improving long-term profitability. DayTradingBusiness is here to support traders in mastering their emotions and developing strategies to mitigate these risks effectively.