Did you know that even a well-placed stop-loss can sometimes feel as unpredictable as a cat on a hot tin roof? In the world of trading, tight stop-loss placements can be a double-edged sword. This article dives deep into what a tight stop-loss is and why traders opt for them, while also unpacking the significant risks involved. From premature exits to increased trading costs, we’ll explore how market volatility and noise can affect your strategies. Additionally, we will discuss the psychological impacts, potential missed opportunities, and the relationship between position size and stop-loss risks. Finally, we’ll highlight better alternatives and strategies from DayTradingBusiness to help you navigate these challenges effectively.

What is a tight stop-loss in trading?

A tight stop-loss is set very close to the entry price, limiting potential loss on a trade. It aims to minimize risk but increases the chance of being stopped out by normal market fluctuations. This can lead to frequent small losses, even if the overall trade idea is correct.

Why do traders use tight stop-losses?

Traders use tight stop-losses to limit potential losses quickly when the market moves against them. However, tight stops increase the risk of getting stopped out by normal market fluctuations, leading to premature exits. This can cause traders to miss out on longer-term gains if the market quickly reverses in their favor. Additionally, tight stops may trigger false signals, resulting in frequent losses and higher transaction costs.

What are the main risks of tight stop-loss placement?

Tight stop-loss placement can lead to getting stopped out prematurely, causing missed potential gains. It increases the chance of false signals from market noise, triggering unnecessary exits. This can result in higher trading costs and reduced profit margins. It also forces traders to be more active, increasing stress and decision fatigue. In volatile markets, tight stops may be hit frequently, disrupting long-term strategies.

How can tight stop-losses cause premature exits?

Tight stop-losses can cause premature exits because small market fluctuations hit the stop quickly, closing trades before the position has room to breathe or move in favor. This increases the chance of getting stopped out on normal price noise, missing potential gains from larger market swings.

Does tight stop-loss increase the chance of stop-out?

Yes, tight stop-loss increases the chance of stop-out because small price movements can trigger the stop before the trade has room to breathe. It risks premature exit during normal market fluctuations, leading to missed gains or unnecessary losses.

Can tight stop-loss lead to higher trading costs?

Yes, tight stop-losses can lead to higher trading costs due to increased likelihood of being stopped out by normal market fluctuations, causing more frequent trades and potential slippage.

How does volatility affect tight stop-loss effectiveness?

Volatility can cause tight stop-losses to trigger prematurely, leading to frequent exits during normal price swings. When markets are volatile, small price movements can hit tight stops quickly, resulting in unnecessary losses. This makes tight stop-loss placement less effective, as it increases the risk of being stopped out before the trade has room to develop.

What is the impact of slippage on tight stop-loss orders?

Slippage can cause your tight stop-loss orders to trigger at worse prices than intended, increasing potential losses. When the market moves quickly, your stop might be executed far beyond your set level, reducing your control over risk. This makes tight stops less effective in volatile conditions, risking premature exits or larger-than-expected losses.

Are tight stop-losses suitable for all trading styles?

No, tight stop-losses aren’t suitable for all trading styles. They work well for quick, day-trading or scalping where rapid exits minimize losses. But for longer-term investing or swing trading, tight stops can trigger premature exits from market noise. They increase the risk of getting stopped out on normal price fluctuations, leading to missed gains. Choose stop-loss placement based on your trading timeframe, volatility, and risk tolerance.

How does market noise influence tight stop-loss triggers?

Market noise can trigger tight stop-losses unexpectedly, causing premature exits. Small price fluctuations from normal volatility hit the stop, leading to unnecessary losses. This increases the risk of getting stopped out during normal market jitters rather than true reversals. Tight stops in noisy markets often result in frequent whipsaws, reducing overall trading efficiency.

What are the psychological effects of tight stop-loss placement?

Tight stop-loss placement can increase anxiety and stress because small market moves trigger frequent exits, leading to emotional strain. It may cause traders to become overly cautious or hesitant, reducing their confidence and decision-making clarity. Frequent stop-outs can also lead to frustration, fear of missing out, and a tendency to overreact to short-term volatility. Over time, this emotional toll can impair judgment, cause burnout, and undermine consistent trading discipline.

Can tight stop-loss placement lead to missed opportunities?

Yes, tight stop-loss placement can lead to missed opportunities because the market may trigger the stop prematurely during normal fluctuations, causing you to exit trades before the move you anticipated unfolds.

Learn about Can stop-loss risk lead to missed opportunities?

How does position size relate to tight stop-loss risks?

Tight stop-loss placement reduces potential losses but increases the risk of being stopped out prematurely due to market noise. Smaller position sizes help manage this risk, preventing significant losses if the stop is hit unexpectedly. Conversely, larger positions with tight stops can lead to rapid, substantial losses if the stop triggers frequently.

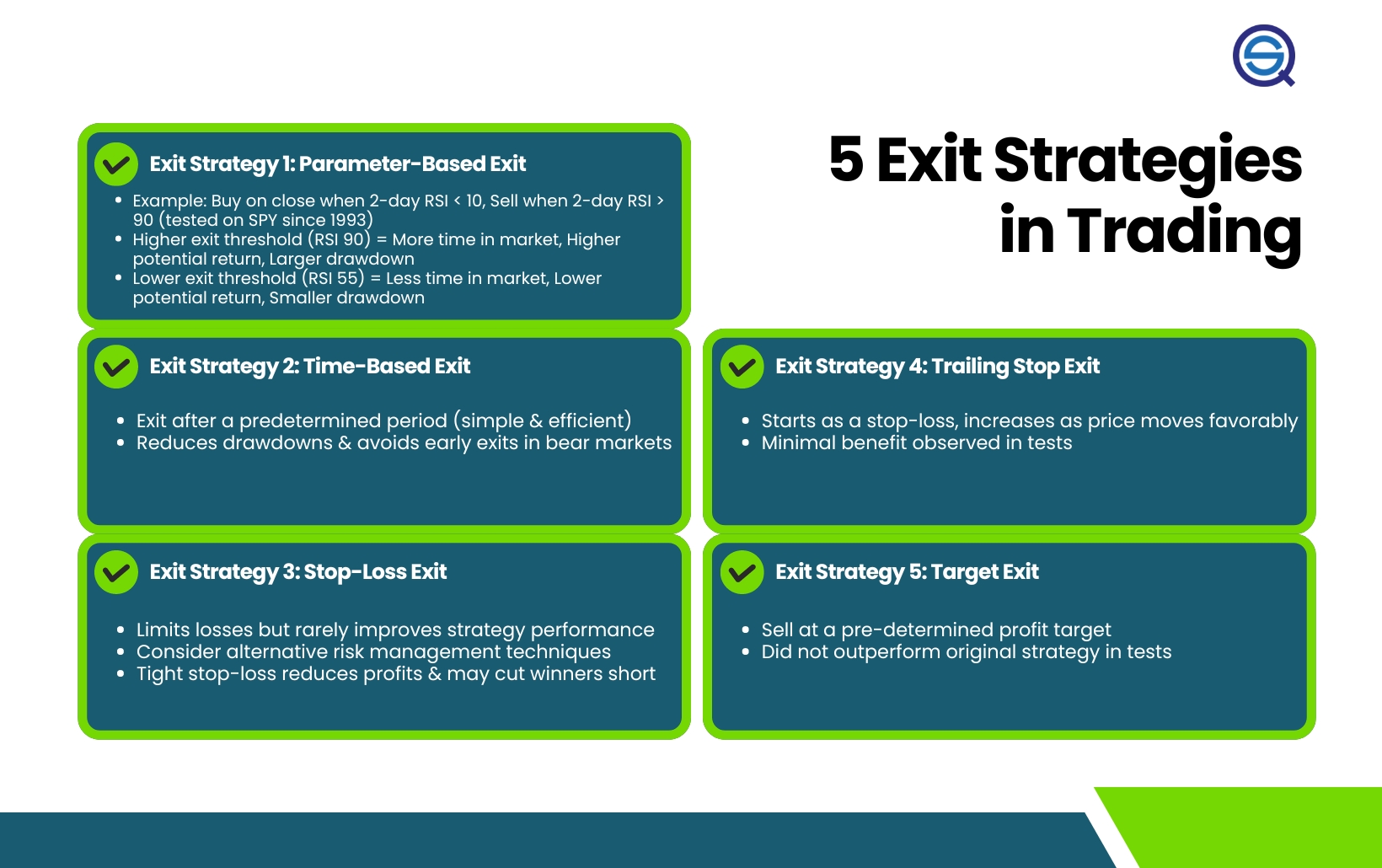

What are better alternatives to tight stop-losses?

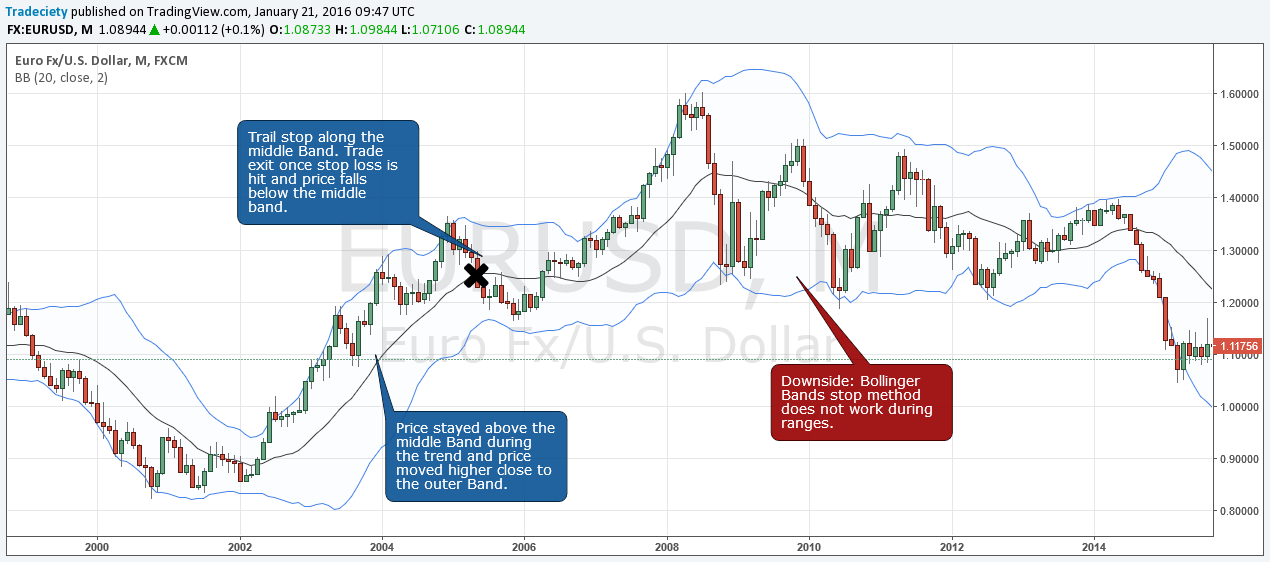

Better alternatives to tight stop-losses include using wider stops combined with position sizing, mental stops based on market structure, and employing trailing stops that adjust as the trade moves in your favor. These methods reduce the risk of being stopped out by normal market noise and allow the trade room to breathe. Instead of tight stops, consider placing stops at logical support or resistance levels, or using volatility-based stops that adapt to market conditions. This approach minimizes false exits and preserves your capital during normal fluctuations.

How can traders mitigate risks of tight stop-loss strategies?

Traders can mitigate risks of tight stop-loss strategies by adjusting stop levels based on market volatility, using wider stops during choppy periods, and combining stops with position sizing to prevent large losses. Incorporating technical analysis and setting stops outside key support or resistance levels also helps avoid premature exits. Regularly reviewing and adapting stop-loss points to changing market conditions reduces the chance of being stopped out unnecessarily.

What role does market trend analysis play in stop-loss placement?

Market trend analysis helps determine the optimal stop-loss level by identifying support and resistance points, minimizing the risk of being stopped out prematurely. It guides traders to set stop-losses outside key trend lines, reducing the chance of unnecessary losses in volatile conditions. Without trend analysis, tight stop-losses increase risk of false triggers, leading to small, frequent losses and missed long-term gains.

Conclusion about What are the risks of tight stop-loss placement?

In conclusion, while tight stop-loss placement can provide a sense of security and discipline in trading, it carries significant risks that can lead to premature exits, increased trading costs, and missed opportunities. Understanding the effects of market volatility, noise, and psychological factors is crucial for traders. Exploring alternatives and employing risk mitigation strategies can help enhance trading outcomes. For comprehensive insights into trading strategies, consider resources from DayTradingBusiness to navigate these complexities effectively.