Did you know that the average person spends about 6 months of their life waiting for a red light to turn green? In the world of day trading, however, waiting can mean the difference between profit and loss. This article dives deep into strategies for reducing stop-loss risk, covering effective stop-loss levels, risk management techniques, and the benefits of position sizing. We’ll discuss how technical indicators can guide safer placements, the protective power of volatility-based stops, and the importance of market trend analysis. Learn about trailing stops, the impact of news and economic data, and the advantages of mental versus automatic stop-loss orders. We’ll also explore time-based exits, diversification, and best practices for adjusting stop-loss levels. Finally, discover tools and platforms that can help you manage stop-loss risk more effectively. With insights from DayTradingBusiness, you’ll be better equipped to navigate the complexities of day trading and protect your investments.

How can I set effective stop-loss levels in day trading?

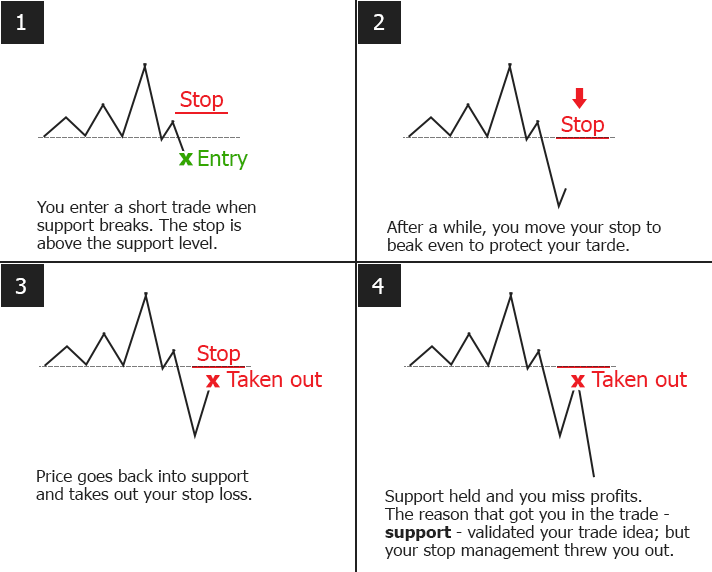

Set tight stop-loss levels based on the stock’s recent volatility, like using the Average True Range (ATR). Place stops just beyond key support or resistance levels to avoid premature exits. Use trailing stops to lock in profits as the trade moves in your favor. Avoid setting stops too close, which can trigger false exits from market noise. Adjust stop-loss levels as the trade develops, based on new price action. Always stick to your plan and avoid emotional decisions.

What are the best risk management strategies for day traders?

Use tight, well-placed stop-loss orders to limit losses quickly. Set stop-loss levels based on technical support or volatility rather than arbitrary percentages. Avoid moving stop-losses further away once the trade is in profit to lock in gains. Trade only high-probability setups with clear entry and exit signals. Manage position sizes to prevent large losses from any single trade. Use trailing stops to maximize gains while protecting downside. Keep emotions in check to prevent impulsive decisions that increase stop-loss risk. Regularly review and adjust your risk parameters based on market conditions.

How does position sizing help reduce stop-loss risk?

Position sizing limits potential losses by controlling how much capital is at risk per trade. When the trade moves against you, a smaller position means the stop-loss triggers with less money lost. It prevents a single bad move from wiping out your account, making your overall risk more manageable. Proper position sizing ensures you don’t overexpose yourself, reducing the chance of large, damaging stop-loss hits.

Which technical indicators can signal safer stop-loss placements?

Moving averages, especially the 20- or 50-period, help identify trend support levels for safer stop-loss placement. The Average True Range (ATR) indicates market volatility; placing stops beyond the ATR helps avoid premature exits. Fibonacci retracement levels can mark key support zones, guiding where to set stops. Support and resistance levels serve as natural stop-loss points. Price action patterns like double bottoms or trendline bounces also signal safer stop placements. Combining these indicators reduces the risk of stop-loss hits during normal market fluctuations.

How can volatility-based stops protect my trades?

Volatility-based stops protect your trades by adjusting stop-loss levels according to market fluctuations, preventing premature exits during normal price swings. When volatility rises, they widen stops to avoid getting stopped out by normal noise; when volatility drops, they tighten stops to lock in gains and reduce risk. This approach helps you stay in trades during healthy market moves and exit quickly when volatility spikes, reducing the chance of large losses.

What role does market trend analysis play in minimizing stop-loss risk?

Market trend analysis helps identify when an asset is likely to reverse or continue, allowing traders to set stop-loss orders more effectively. By understanding trend strength and direction, traders can place stops at logical levels, reducing the chance of being stopped out by normal fluctuations. It also helps in avoiding false signals, preventing premature exits that can lead to losses. Overall, trend analysis guides better risk management, keeping stop-loss levels aligned with actual market movements.

How can I use trailing stops to limit losses?

Set a trailing stop at a specific percentage or dollar amount below the current price. As the price moves in your favor, the trailing stop moves up accordingly, locking in gains and limiting losses if the price reverses. For example, if you buy a stock at $50 and set a 5% trailing stop, the stop stays at $47.50 initially. If the stock rises to $55, the stop moves up to $52.25. If the price drops from its peak, the trailing stop triggers a sell, capping your loss. Adjust the trailing stop based on volatility and your risk tolerance to effectively reduce stop-loss risk in day trading.

What are common mistakes that increase stop-loss risk?

Setting stop-loss orders too tight causes premature exits from trades.

Using emotional or impulsive decisions instead of planned levels increases risk.

Ignoring market volatility leads to stops being triggered by normal price swings.

Not adjusting stops as the trade develops leaves positions vulnerable.

Relying solely on static stop-loss levels without considering trend changes heightens risk.

Overleveraging amplifies small market moves, making stop-loss hits more frequent.

Failing to analyze support and resistance levels results in poorly placed stops.

How can news and economic data impact stop-loss strategies?

News and economic data can cause sudden market swings, triggering stop-loss orders unexpectedly. If an economic report releases unexpectedly strong or weak data, prices can gap past your stop-loss level, leading to larger losses. Incorporating news alerts and economic calendars helps you avoid placing stops before major releases. Using wider stop-losses around scheduled data releases or adjusting position sizes reduces risk from sudden volatility. Staying aware of upcoming news events allows you to time entries and exits better, minimizing the chance of stop-loss hits during unpredictable market moves.

What are the advantages of using mental stop-loss versus automatic orders?

Mental stop-loss lets you stay flexible and avoid getting triggered by temporary market noise, reducing premature exits. It allows emotional control, so you don't panic sell during volatility. Automatic orders ensure precise, disciplined exits, preventing emotional mistakes but risk getting hit by whipsaws or market spikes. Mental stops can adapt to changing conditions, while automatic orders stick to predefined levels. Using mental stop-loss helps maintain psychological resilience, but automatic orders provide consistency and discipline.

How do time-based exits help control stop-loss risk?

Time-based exits limit losses by closing trades after a set period, preventing prolonged exposure to adverse moves. They avoid holding onto losing positions in hope of a reversal, reducing emotional decision-making. This strategy ensures you cut losses quickly if your trade isn’t moving in your favor within a specific timeframe. It helps control risk by enforcing discipline and preventing small losses from turning into bigger ones.

Learn about How automation can help control stop-loss risk in day trading

How can diversification reduce overall stop-loss exposure?

Diversification spreads your trades across multiple assets, so a loss in one doesn’t wipe out your entire capital. By avoiding concentration in a single stock or sector, you lower the chance of a major hit that triggers your stop-loss. This balance helps manage risk, making it less likely that market swings will push your portfolio into significant losses.

What are the best practices for adjusting stop-loss levels during a trade?

Set tight stops based on recent support or resistance levels, not arbitrary percentages. Use technical indicators like ATR to determine volatility-adjusted stop-loss levels. Avoid moving stop-losses impulsively; adjust only after confirmed price actions, like breakouts or pullbacks. Trail stops gradually to lock in profits as the trade moves in your favor. Never widen stops without solid technical reasons—stay disciplined to prevent larger losses. Regularly review and adapt stop-loss levels to changing market conditions.

How does understanding support and resistance improve stop-loss placement?

Understanding support and resistance helps you place stop-losses just beyond key levels, reducing the chance of being stopped out by normal price fluctuations. It allows you to set stops that protect your capital while giving trades room to breathe, avoiding premature exits. Recognizing these levels also helps you avoid placing stops too tight or too loose, balancing risk and potential for profit.

What tools and platforms assist in managing stop-loss risk effectively?

Tools like trading platforms with automatic stop-loss orders, such as Thinkorswim, MetaTrader, and Interactive Brokers, help manage stop-loss risk. Charting software like TradingView provides real-time alerts for price movements, enabling quick adjustments. Risk management tools like trailing stops and alerts improve control. Additionally, trading journals and analytics platforms, such as Edgewonk or TraderSync, help refine stop-loss strategies based on past performance. Combining these tools with disciplined trading plans reduces stop-loss risks effectively.

Conclusion about Strategies to reduce stop-loss risk in day trading

In day trading, effectively managing stop-loss risk is essential for long-term success. By setting appropriate stop-loss levels, employing sound risk management strategies, and utilizing technical indicators, traders can better protect their capital. Understanding market trends, using trailing stops, and avoiding common mistakes further enhance risk control. Incorporating these strategies along with tools and platforms can significantly reduce stop-loss exposure. For tailored advice and in-depth insights into optimizing your trading approach, consider leveraging the expertise offered by DayTradingBusiness.

Learn about How automation can help control stop-loss risk in day trading