Did you know that some traders believe stop-loss hunts are as common as coffee breaks on Wall Street? In this article, we delve into the intricacies of stop-loss hunts—what they are, how they operate, and the tactics behind them. You’ll learn to identify signs of potential stop-loss hunting and the influence of market manipulation and liquidity. We also discuss effective strategies for setting your stop-loss orders, adjusting your trading approach, and utilizing technical indicators to mitigate risks. Additionally, we'll explore the impact of slippage, the benefits of wider stop-losses, and how trailing stops can provide added protection. Lastly, discover how to navigate high-volatility periods and the role of news events in stop-loss activity. Equip yourself with the knowledge from DayTradingBusiness to stay ahead of the game and enhance your trading strategy.

What is a stop-loss hunt and how does it work?

A stop-loss hunt happens when large traders or market makers push prices to trigger stop-loss orders, causing rapid price drops. They do this by intentionally hitting levels where many traders have set their stops, then profiting as the market moves downward. To prevent this from increasing your risk, avoid placing stops at obvious levels like round numbers or recent lows. Use wider, less predictable stop-loss levels or mental stops. Consider trailing stops to reduce exposure once your trade moves in your favor. Keep an eye on market depth and avoid clustering stops around common levels. Diversify your stop placements and avoid making them too tight or predictable.

How can I identify signs of a stop-loss hunt?

Look for sudden, sharp price spikes just below key support levels, especially when volume increases. Watch for quick, coordinated dips that trigger multiple stop-losses, causing the price to move sharply. Notice if the market repeatedly pushes down to certain levels where many traders have placed stops. Pay attention to unusual price activity or increased volatility around support zones. If the price quickly reverses after hitting a stop-loss level, it’s a sign of a potential stop-loss hunt.

What are the main tactics used in stop-loss hunting?

Stop-loss hunters use tactics like baiting with fake setups, triggering wide swings to hit stop-loss orders, and exploiting low liquidity to push prices past stops. They often target key support or resistance levels, create sudden spikes or dips, and use high-volume trades to trigger stop-loss clusters. To prevent this, set tight, logical stop-loss levels, avoid placing stops near obvious support/resistance, and use wider stops in volatile markets. Keep an eye on liquidity and avoid predictable patterns that hunters can exploit.

How does market manipulation influence stop-loss hunts?

Market manipulation triggers stop-loss hunts by intentionally pushing prices to trigger these orders, causing rapid dips that liquidate traders' positions. To prevent this risk, set wider stop-loss levels, avoid placing stops just below obvious support, and use mental stops or trail your stops to stay flexible. Staying alert to unusual price moves and trading in less liquid times can also reduce exposure to manipulation tactics.

What role does liquidity play in stop-loss hunts?

Liquidity attracts stop-loss hunts because large traders or algorithms target areas with thin liquidity to trigger stops easily. Low liquidity makes it easier for big players to move the price quickly, hitting stop-loss orders and causing sharp price drops. To prevent increased risk, avoid placing stops just below obvious support levels in low-liquidity zones, and use wider stops or mental stops in volatile markets. Monitoring liquidity levels helps identify safe zones for placing stops, reducing the chance of being caught in a hunt.

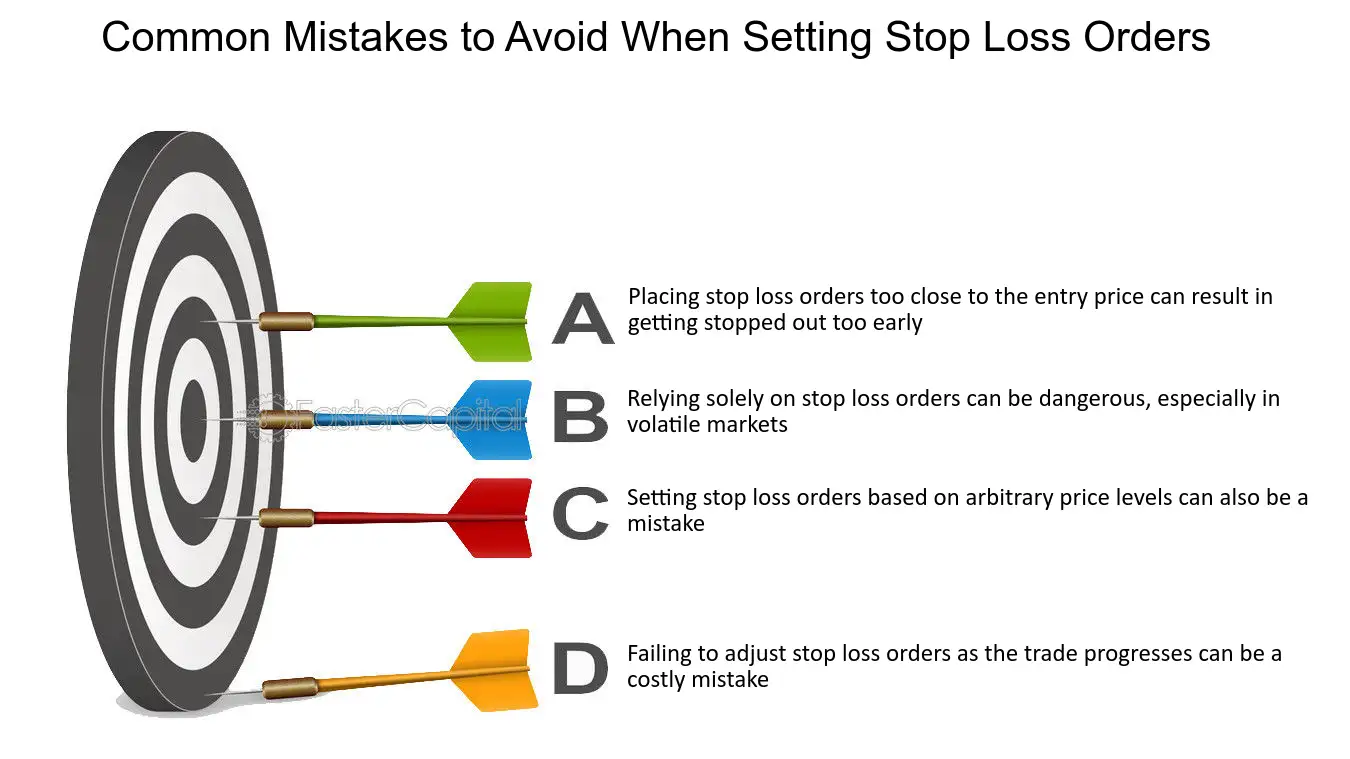

How can I set stop-loss orders to avoid being targeted?

Place wider stop-losses beyond typical market noise to avoid triggering false hunts. Use mental or manual stops instead of automated ones when possible. Set stops based on technical support levels, not just a fixed percentage. Consider using mental stops and exit manually during volatile conditions. Avoid placing stops just below major support levels or recent lows that traders often target. Spread out stop-loss levels across different trades to reduce risk concentration. Keep an eye on market news and avoid placing tight stops during high-impact events.

Are there specific trading hours more vulnerable to stop-loss hunts?

Yes, during low liquidity hours like late Friday or early Monday mornings, stop-loss hunts are more common because fewer traders are active, making it easier for large players to trigger stops and manipulate prices.

How can I adjust my trading strategy to reduce stop-loss risk?

Use wider stop-loss levels based on volatility, avoid placing stops at obvious levels like round numbers or recent lows, and diversify your trades to prevent a single stop from triggering multiple losses. Consider using mental stops instead of fixed levels, monitor market news to avoid sudden moves, and implement trailing stops to lock in gains without exposing yourself to stop-loss hunts.

What technical indicators help detect potential stop-loss hunts?

Indicators like the Average True Range (ATR) show volatility spikes that often precede stop-loss hunts. Watch for sudden volume surges and abnormal price gaps, which suggest liquidity grabs. The Relative Strength Index (RSI) can hint at overextended moves vulnerable to manipulation. Moving averages and support/resistance levels help identify critical zones where stop-loss hunts are likely. Price patterns like false breakouts or quick reversals also signal potential traps. Combining these indicators improves detection of potential stop-loss hunts.

How does slippage impact stop-loss orders during hunts?

Slippage causes stop-loss orders to execute at worse prices than intended during hunts, increasing losses. When traders try to limit risk with a stop-loss, market manipulation can push prices past these points, triggering orders prematurely. This accelerates losses and can force traders out of positions at unfavorable prices. To prevent this, use wider stop-loss levels, avoid tight stops during volatile periods, and monitor for signs of manipulation.

Can using wider stop-losses prevent being caught in hunts?

Yes, using wider stop-losses can reduce the risk of being caught in stop-loss hunts by giving your trade more room to breathe and avoiding triggering false breakouts.

What are the risks of setting stop-losses too close to current price?

Setting stop-losses too close to the current price increases the risk of being triggered by normal market fluctuations or temporary swings, leading to premature exits. This can cause you to lose money on trades that would have been profitable if given more room. It also makes your position vulnerable to stop-loss hunts, where traders or algorithms intentionally push prices to hit these tight stops, triggering a cascade of forced selling.

How can I use trailing stops to protect against hunts?

Use trailing stops to lock in profits and limit losses as the price moves in your favor. Set the trailing stop at a percentage or dollar amount below the current price, adjusting as the asset rises. This prevents the stop-loss from being triggered by normal volatility, reducing the chance of being hunted. Avoid placing stops just below obvious support levels or recent lows where whales might push the price to trigger stops. Regularly monitor and tighten your trailing stop if the market becomes more volatile. Combining trailing stops with other risk management tools helps protect against stop-loss hunts and minimizes your exposure.

Are there any tools or platforms that help avoid stop-loss hunts?

Yes, platforms like TradingView and MetaTrader offer tools to set precise stop-loss orders, reducing the risk of stop-loss hunts. Some brokers provide guaranteed stop-loss orders (GSLOs) that protect your position even during volatile swings. Using order types like mental stops or avoiding placing stops just below obvious support levels also helps prevent being targeted in stop-loss hunts. Additionally, algorithms and trading bots can help set dynamic stop-losses that adapt to market volatility, minimizing the chance of hunts.

What are best practices for managing risk during high-volatility periods?

Use wider stop-losses during high-volatility to avoid triggering stop-loss hunts. Avoid placing stops at obvious levels like recent lows or round numbers that hunters target. Incorporate mental stops or use volatility-based stops like ATR to set more flexible levels. Monitor market news and avoid trading during major events that can trigger unpredictable moves. Use multiple timeframes to confirm entries and exits, reducing reliance on a single stop level. Consider partial position exits to lock in gains and reduce overall risk. Stay disciplined and avoid chasing after false breakouts that can lead to stop-loss hunts.

How does news or economic data releases influence stop-loss hunting activity?

News or economic data releases can trigger stop-loss hunting by causing sudden market moves, pushing prices to levels where many traders have set stop-loss orders. When big players see these clusters of stops, they might push prices to trigger them, then reverse, profiting from the triggered stops. To prevent increased risk from stop-loss hunts, avoid placing stops near obvious support or resistance levels before major data releases, and wait for market volatility to settle. Use wider stops or mental stops instead of tight ones around key news events, and monitor news calendars to anticipate potential market swings.

Can algorithmic trading mitigate stop-loss hunt risks?

Algorithmic trading can help reduce stop-loss hunt risks by detecting market manipulation patterns and executing trades faster than humans. It can set smarter, dynamic stop-loss levels that adjust to market conditions, making it harder for predators to trigger stops intentionally. Algorithms also analyze order book data and price movements to avoid common trap setups. However, it doesn’t eliminate the risk entirely; traders still need to combine algorithms with sound risk management strategies.

Conclusion about How to prevent stop-loss hunts from increasing risk

In summary, understanding stop-loss hunts is crucial for effective risk management in trading. By identifying signs of manipulation, adjusting your stop-loss strategies, and utilizing the right tools and indicators, you can significantly reduce your exposure to these risks. Incorporating these practices into your trading routine will not only enhance your decision-making but also help you navigate the complexities of the market. For more in-depth insights and guidance on trading strategies, DayTradingBusiness is here to support your journey.

Sources:

- Games as experiments to understand why wildlife devaluation may ...

- Averting wildlife-borne infectious disease epidemics requires a ...

- An immediate way to lower pandemic risk: (not) seizing the low ...

- The management of perioperative bleeding - ScienceDirect

- Inherited antithrombin deficiency in pregnancy - ScienceDirect

- Hunting of Wildlife in Tropical Forests