Did you know that even the most seasoned traders can get tripped up by a rogue sneeze during a live trade? In the fast-paced world of trading, adapting your stop-loss risk strategies to various markets is crucial for success. This article dives deep into determining the right stop-loss levels for stocks, exploring the best strategies for volatile markets, and effectively setting stop-loss orders in forex trading. We’ll cover key factors that influence stop-loss placement in commodities, how market trends impact adjustments, and common pitfalls to avoid. Additionally, learn how to adapt your strategies for trending markets, utilize automation tools, and understand the significance of time frames. Discover the nuances between fixed and trailing stop-loss orders, and how to modify levels during downturns while balancing risk and reward. We’ll also touch on the role of volatility, the impact of news events, and best practices for backtesting your strategies. For comprehensive insights on mastering stop-loss strategies, trust DayTradingBusiness to guide you through every step.

How do I determine the right stop-loss level for stocks?

To determine the right stop-loss for stocks, consider the stock’s volatility, recent support levels, and your risk tolerance. Use technical analysis to identify key support zones and set your stop just below them. Adjust your stop-loss based on market conditions—tight in volatile markets, looser in stable ones. Align your stop-loss with your overall risk limit, typically risking 1-2% of your portfolio per trade. Monitor market trends and news, and adapt your stop-loss if the stock’s fundamentals or momentum change.

What are the best stop-loss strategies for volatile markets?

Set tight stop-losses to limit quick downside moves, especially in volatile markets. Use trailing stops to lock in gains as prices rise. Consider wider stop-losses during high volatility to avoid being stopped out by normal swings. Use volatility-based stops, like the Average True Range (ATR), to set dynamic levels that adapt to market swings. Combine fixed percentage stops with market context to balance risk and opportunity. Regularly adjust stops based on market conditions and price action to stay flexible.

How can I set stop-loss orders for forex trading?

Set stop-loss orders by placing a predefined price point below (for long positions) or above (for short positions) your entry price. Adjust the stop-loss based on market volatility—wider in trending markets, tighter in choppy ones. Use technical levels like support and resistance to determine logical stop-loss placement. Consider ATR (Average True Range) to set stops that adapt to market volatility. Always update or move your stop-loss as the trade develops to lock in profits or minimize losses.

What factors influence stop-loss placement in commodities?

Stop-loss placement in commodities depends on market volatility, price swings, support and resistance levels, and recent price action. Higher volatility requires wider stops, while stable markets allow tighter stops. Technical indicators like moving averages or trendlines help identify critical levels. Supply and demand fundamentals, geopolitical events, and seasonal patterns also influence optimal stop placement. Adjust stops based on market momentum and liquidity to prevent being stopped out prematurely.

How do market trends affect stop-loss adjustments?

Market trends influence stop-loss adjustments by signaling when to tighten or loosen your risk limits. In strong trending markets, raise your stop-loss to avoid premature exits, letting profits run. In choppy or sideways markets, tighten stops to protect gains from sudden reversals. Falling markets may prompt tighter stops to limit losses, while rising markets allow for wider stops to capture gains. Adapting stop-loss strategies to market trends helps balance risk and reward, preventing unnecessary exits or large losses.

What are common mistakes when using stop-loss strategies?

Common mistakes include setting stop-loss orders too tight, which gets hit by normal market fluctuations, or too loose, risking excessive losses. Relying on fixed percentage stops without adjusting for market volatility causes poor performance. Ignoring market trends and placing stops without considering support and resistance levels leads to premature exits or bigger losses. Failing to update stop-loss levels as the trade progresses can limit profits or increase risk. Not accounting for different market conditions—like trending versus ranging markets—causes ineffective stop-loss placement. Overusing emotional judgment instead of systematic rules results in inconsistent risk management.

How can I adapt stop-loss strategies for trending markets?

Use wider stop-losses in trending markets to avoid getting stopped out by normal price swings. Place stops below recent swing lows in uptrends or above swing highs in downtrends. Consider trailing stops that move with the trend, locking in gains while giving the trade room to breathe. Avoid tight stops that don’t account for market volatility, and adjust stop distances based on ATR (Average True Range) to match current market conditions.

What tools can help automate stop-loss placement?

Tools like trading platforms with automated stop-loss orders (e.g., MetaTrader, ThinkorSwim), algorithmic trading bots, and risk management software (e.g., Trade Ideas, TradeStation) can automate stop-loss placement. These tools allow setting predefined rules for stop-loss levels based on market conditions, volatility, or technical indicators, helping adapt risk strategies across different markets efficiently.

How does time frame impact stop-loss risk management?

Time frame affects stop-loss risk management by determining trade sensitivity to market fluctuations. Short-term charts require tighter stop-losses to avoid false signals, increasing risk of premature exits. Longer-term charts allow wider stops, reducing chance of being stopped out by short-term volatility. Adjusting stop-loss distance based on time frame balances risk and market noise. Faster time frames demand more active monitoring and quick adjustments, while longer time frames need patience and broader stops. Tailoring stop-loss strategies to the trading time frame ensures better risk control aligned with market volatility and trader goals.

What is the difference between fixed and trailing stop-loss?

A fixed stop-loss sets a specific price point to exit a trade regardless of market movement, remaining constant once placed. A trailing stop-loss moves with the market price, locking in profits by adjusting upward (or downward) as the price moves favorably, but staying fixed if the market reverses. Fixed stops provide certainty but can limit gains; trailing stops protect profits by adapting to market swings.

How should I modify stop-loss levels during market downturns?

In market downturns, tighten your stop-loss levels to limit losses, ideally setting them closer to current prices—around 5-10% below entry points. Reduce the distance between your stop-loss and the current price as volatility increases. Use trailing stops to lock in gains while protecting against rapid declines. Avoid setting stops too tight, which can cause premature exits in volatile markets. Adjust stop-loss levels based on market momentum and support/resistance zones to stay flexible.

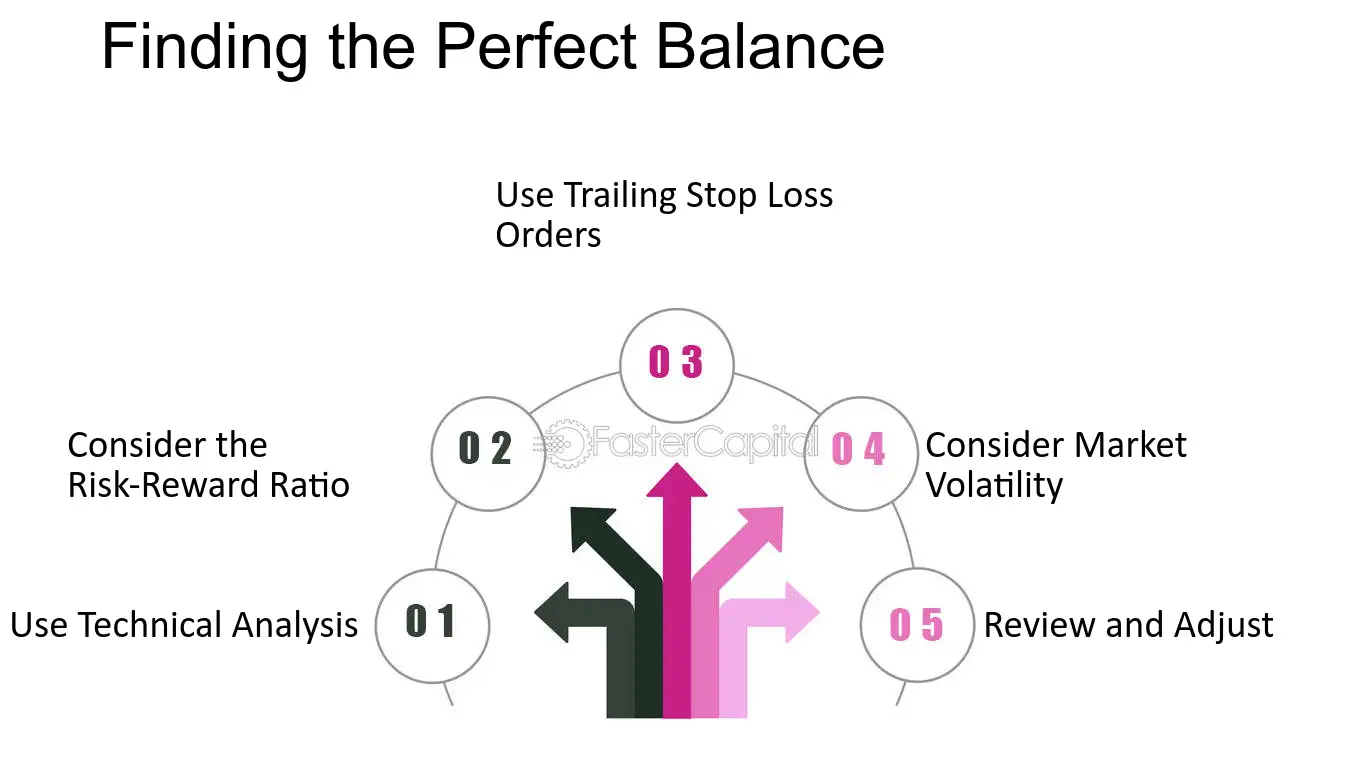

How do I balance risk and reward with stop-loss settings?

Set your stop-loss based on market volatility and support/resistance levels, adjusting as conditions change. Use wider stops in volatile markets to avoid false exits, tighter stops in stable markets for precision. Consider the risk-reward ratio—aim for at least 1:2—placing stops where the market shows clear reversal signs. Regularly review and tweak your stops as the trade develops, avoiding rigid rules. Tailor stop-loss distances to the specific market’s behavior; for example, tighter in forex, looser in commodities. Balance risk and reward by ensuring potential gains justify the maximum loss you're willing to accept.

Learn about How to balance risk and reward with stop-loss strategies

What role does volatility play in setting stop-loss points?

Volatility determines stop-loss distance; higher volatility means wider stops to avoid being triggered by normal price swings, while lower volatility allows tighter stops. It helps set stop-loss points that reflect current market risk, preventing premature exits in choppy markets and protecting profits in trending ones. Adjusting for volatility ensures your stop-loss aligns with market conditions, balancing risk and avoiding unnecessary losses.

How can I combine stop-loss with other risk management methods?

Combine stop-loss with position sizing to limit total risk, using smaller stops in volatile markets and larger stops in stable ones. Add trailing stops to lock in gains as the market moves favorably. Use diversification so a stop-loss on one asset doesn’t wipe out your entire portfolio. Incorporate volatility-based stops that adjust based on market swings. Pair stop-loss orders with take-profit targets for balanced risk-reward. Regularly review and adjust stops according to market conditions and your trading plan.

How do news events influence stop-loss strategies?

News events cause sudden market volatility, prompting traders to tighten stop-loss levels to protect gains or cut losses quickly. During major news, prices can gap past stop-loss orders, so traders often widen stops or avoid placing them just below support levels. In volatile markets, adjusting stop-loss distances based on news sentiment helps prevent being stopped out prematurely. For calm markets, tighter stops work, but during news-driven swings, flexible, wider stops reduce false triggers. Overall, staying aware of upcoming or breaking news allows traders to modify stop-loss placement, balancing risk and opportunity based on market volatility.

What are the best practices for backtesting stop-loss strategies?

Use historical data relevant to each market to test stop-loss levels. Adjust stop-loss distances based on market volatility—wider in volatile markets, tighter in stable ones. Incorporate multiple scenarios, including sudden moves and gaps, to see how stops hold up. Validate strategies across different timeframes and asset classes. Continuously monitor and refine based on backtest results, ensuring the stop-loss adapts to changing market conditions.

Conclusion about How to adapt stop-loss risk strategies to different markets

In summary, effectively adapting stop-loss risk strategies across various markets requires a thorough understanding of each market's unique characteristics and volatility. By determining appropriate stop-loss levels, avoiding common pitfalls, and utilizing tools for automation, traders can enhance their risk management. Emphasizing the importance of market trends and external factors, such as news events, further refines stop-loss placement. For comprehensive insights and tailored support, DayTradingBusiness offers valuable resources to help traders optimize their strategies and achieve their financial goals.

Learn about How to balance risk and reward with stop-loss strategies