Did you know that a well-placed stop-loss can be the difference between a profitable trade and a heart-wrenching loss? In the world of day trading, understanding stop-loss risk is crucial for maximizing profits while minimizing potential losses. This article dives deep into how stop-loss placement affects trading gains, the balance between risk and reward, and the psychological impact on traders. We’ll explore common mistakes made with stop-loss orders, the effects of market volatility, and the best strategies to manage stop-loss points effectively. Join us at DayTradingBusiness as we uncover the intricate relationship between stop-loss risk and trading success, ensuring you make informed decisions in your trading journey.

How does stop-loss risk limit potential profits in day trading?

Stop-loss risk caps potential profits because it forces you to exit trades at a predetermined loss point, preventing gains if the market moves favorably beyond that level. Setting a tight stop-loss limits upside profit potential, as you might close positions early and miss larger moves. While it protects against big losses, it also restricts how much you can earn from a winning trade.

What is the impact of stop-loss placement on overall trading gains?

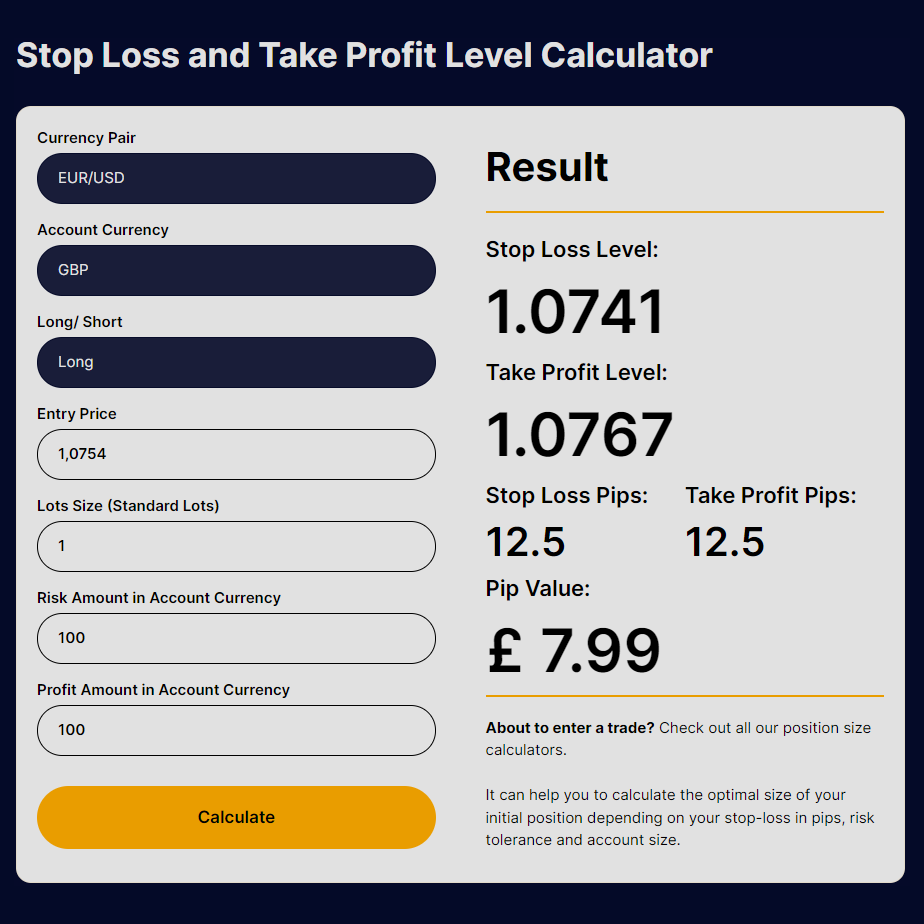

Proper stop-loss placement limits losses and protects gains, reducing the risk of big setbacks. Tight stops can lock in profits quickly but may cause premature exits, while wider stops give trades room to breathe but risk larger losses. Well-placed stop-losses help maintain consistent trading gains by managing downside risk effectively. Poor placement can lead to unnecessary losses or missed profit opportunities, hurting overall trading performance.

How can setting a stop-loss reduce day trading risks?

Setting a stop-loss limits potential losses on each trade, preventing small mistakes from spiraling into big ones. It automatically exits a trade if the market moves against you, protecting your capital. This control helps manage risk, so even if a trade goes poorly, your overall profit margin stays intact. Without a stop-loss, losses can wipe out gains quickly, increasing the risk of significant financial damage.

Does using a tight stop-loss increase the chance of getting stopped out?

Yes, using a tight stop-loss increases the chance of getting stopped out because small price movements can trigger the stop before the trade moves in your favor.

How does stop-loss size influence risk-reward ratio?

A tighter stop-loss reduces potential losses but also limits profit targets, lowering the risk-reward ratio. A wider stop-loss increases risk per trade but allows for larger gains, boosting the risk-reward ratio. Choosing stop-loss size directly impacts the balance between risk exposure and profit potential in day trading.

What are the common mistakes traders make with stop-loss orders?

Traders often set stop-loss orders too tight, getting stopped out by normal market fluctuations. They also place stops too far away, risking larger losses. Moving stops prematurely or adjusting them impulsively can lock in losses or miss opportunities. Ignoring volatility and not considering market context leads to poorly placed stops. These mistakes can cause unnecessary losses or limit profits, increasing risk and reducing overall day trading gains.

How does stop-loss risk affect trading psychology and decision-making?

Stop-loss risk can cause traders to second-guess their decisions, leading to hesitation or impulsive moves. It heightens emotional stress when trades hit the stop-loss, potentially causing panic or revenge trading. Fear of losses may make traders hesitant to enter good setups or cause them to exit trades prematurely. Conversely, the risk of stop-loss triggers can lead to overconfidence, making traders take larger, riskier positions. Overall, stop-loss risk influences trading psychology by increasing anxiety, reducing discipline, and impacting profit consistency.

Can a poorly placed stop-loss lead to significant losses?

Yes, a poorly placed stop-loss can cause significant losses by triggering prematurely or too late, letting losses escalate. If set too tight, it may exit trades that would have recovered; too loose, it fails to limit downside, risking bigger hits. Proper stop-loss placement is crucial to managing risk and protecting profits in day trading.

How do market volatility and stop-loss levels interact?

Market volatility influences stop-loss levels because higher volatility means prices fluctuate more, requiring wider stops to avoid being triggered prematurely. Tight stops in volatile markets can lead to frequent exits and losses, reducing profit potential. Conversely, setting stops too wide increases the risk of larger losses if the market moves against you. Properly managing stop-loss levels amid volatility balances protecting your capital and capturing gains, directly impacting day trading profits.

What are the best strategies for setting stop-loss points?

Set stop-loss points just below recent support levels or technical indicators like moving averages. Use a fixed percentage or dollar amount based on your risk tolerance, typically 1-2% of your account. Consider volatility—place stops outside typical price swings to avoid being stopped out prematurely. Adjust stops as the trade moves in your favor to lock in gains. Avoid setting stops too tight, which can trigger false exits, or too wide, risking bigger losses. Proper stop-loss placement minimizes risk and preserves profits, directly impacting your day trading profitability.

How does stop-loss risk vary across different trading styles?

Stop-loss risk in day trading can cause quick, unpredictable losses if set too tight, risking frequent stop-outs, or large, sudden losses if too loose. Scalpers use tight stop-losses to limit small losses but risk getting stopped out by market noise. Swing traders set wider stops, risking bigger losses but allowing for normal market fluctuations. Position traders often use even larger stops, exposing themselves to more significant drawdowns during volatile moves. Proper stop-loss placement directly impacts profit stability across trading styles, balancing risk and reward.

Learn about How automation can help control stop-loss risk in day trading

What role does stop-loss play in managing daily profit targets?

Stop-loss limits losses on a trade, helping you protect daily profit targets by preventing small setbacks from turning into big losses. It ensures you lock in gains when the market moves favorably and cut losses quickly when it reverses. Using a stop-loss keeps your daily profit goals achievable by controlling risk and maintaining consistent trading discipline.

How does stop-loss risk affect long-term trading profitability?

Stop-loss risk limits potential losses but can also cut into profits if triggered too early, especially in volatile markets. Overusing tight stop-losses may cause frequent small losses, eroding overall gains. Conversely, setting stops too wide exposes traders to larger drawdowns, risking significant capital. Properly managed stop-loss risk helps preserve capital and maintain consistent profitability over the long term, but poor placement or timing can hinder growth and lead to losses that outweigh gains.

Learn about How automation can help control stop-loss risk in day trading

Is it better to use fixed or trailing stop-losses for day trading?

Using a trailing stop-loss is generally better for day trading because it locks in profits as the trade moves in your favor. Fixed stop-losses can limit upside potential and may cause premature exits. Trailing stops adapt to market movements, reducing risk while allowing for gains.

How do different asset classes respond to stop-loss risk management?

Different asset classes react differently to stop-loss risk management. Stocks often hit stop-loss levels due to volatility, which can trigger frequent small losses but protect against large dips. Forex markets, with their high liquidity, usually allow tighter stop-loss placements, minimizing losses during rapid swings. Commodities can be more unpredictable; stops might be hit quickly during sudden price shocks, leading to increased slippage. Cryptocurrencies tend to be highly volatile, causing stops to trigger often, sometimes prematurely, impacting overall profit. In day trading, tight stop-losses limit downside risk but can also cut profits short if the market reverses quickly. Looser stops might capture bigger moves but expose traders to larger losses. Properly adjusting stop-loss levels based on asset class behavior balances risk and profit potential.

Learn about How to adapt stop-loss risk strategies to different markets

Conclusion about How does stop-loss risk affect day trading profits?

In conclusion, understanding stop-loss risk is crucial for maximizing day trading profits. Proper placement and strategy can significantly influence not only potential gains but also a trader's psychological resilience and decision-making processes. Avoiding common pitfalls while adjusting stop-loss strategies to align with market conditions and personal trading styles is essential for maintaining profitability. For more in-depth insights and guidance on managing stop-loss risk effectively, consider exploring the resources offered by DayTradingBusiness.

Learn about How automation can help control stop-loss risk in day trading

Sources:

- A Profitable Day Trading Strategy For The US Equity Market

- Can Day Trading Really Be Profitable?

- Are Professional Traders Too Slow to Realize Their Losses?

- When do stop-loss rules stop losses? - ScienceDirect

- Fear and Greed in Financial Markets: A Clinical Study of Day-Traders

- Dumb Alpha: Dr. Quantlove or: How I Learned to Stop Worrying and ...