Did you know that over 90% of day traders lose money, often due to emotional decision-making? In this article, we explore how automation can transform your trading strategy by effectively managing stop-loss risk. Discover how automated tools help streamline stop-loss orders, reduce emotional biases, and enhance accuracy through algorithmic trading. We’ll cover the benefits of automation, common pitfalls in manual settings, and how to adapt your strategies to volatile market conditions. Plus, learn the importance of backtesting and customizing your settings for different assets. By the end, you’ll have a clear understanding of how to integrate automation into your day trading plan with DayTradingBusiness.

How does automation help manage stop-loss risk in day trading?

Automation helps control stop-loss risk in day trading by instantly executing trades when prices hit predefined levels, preventing emotional delays. It ensures consistent adherence to risk management rules, avoiding impulsive decisions. Automated stop-loss orders respond faster than humans, minimizing potential losses during sudden market moves. This reduces the chance of holding onto losing trades too long and helps maintain disciplined trading strategies.

What are the main benefits of using automation for stop-loss orders?

Automation helps control stop-loss risk in day trading by executing orders instantly when targets are hit, preventing emotional delays. It ensures consistent adherence to your risk parameters, reducing the chance of costly manual errors. Automated stop-loss orders protect your capital during sudden market swings, locking in losses or gains without hesitation. Plus, automation allows for precise, pre-set exit points, freeing you from constant monitoring and helping maintain a disciplined trading strategy.

Can automated trading reduce emotional decision-making in stop-loss placement?

Yes, automated trading reduces emotional decision-making in stop-loss placement by executing predefined rules consistently, preventing impulsive moves driven by fear or greed. It ensures stop-loss levels are set based on strategy rather than emotion, leading to more disciplined risk management.

What types of automated tools are best for controlling stop-loss risk?

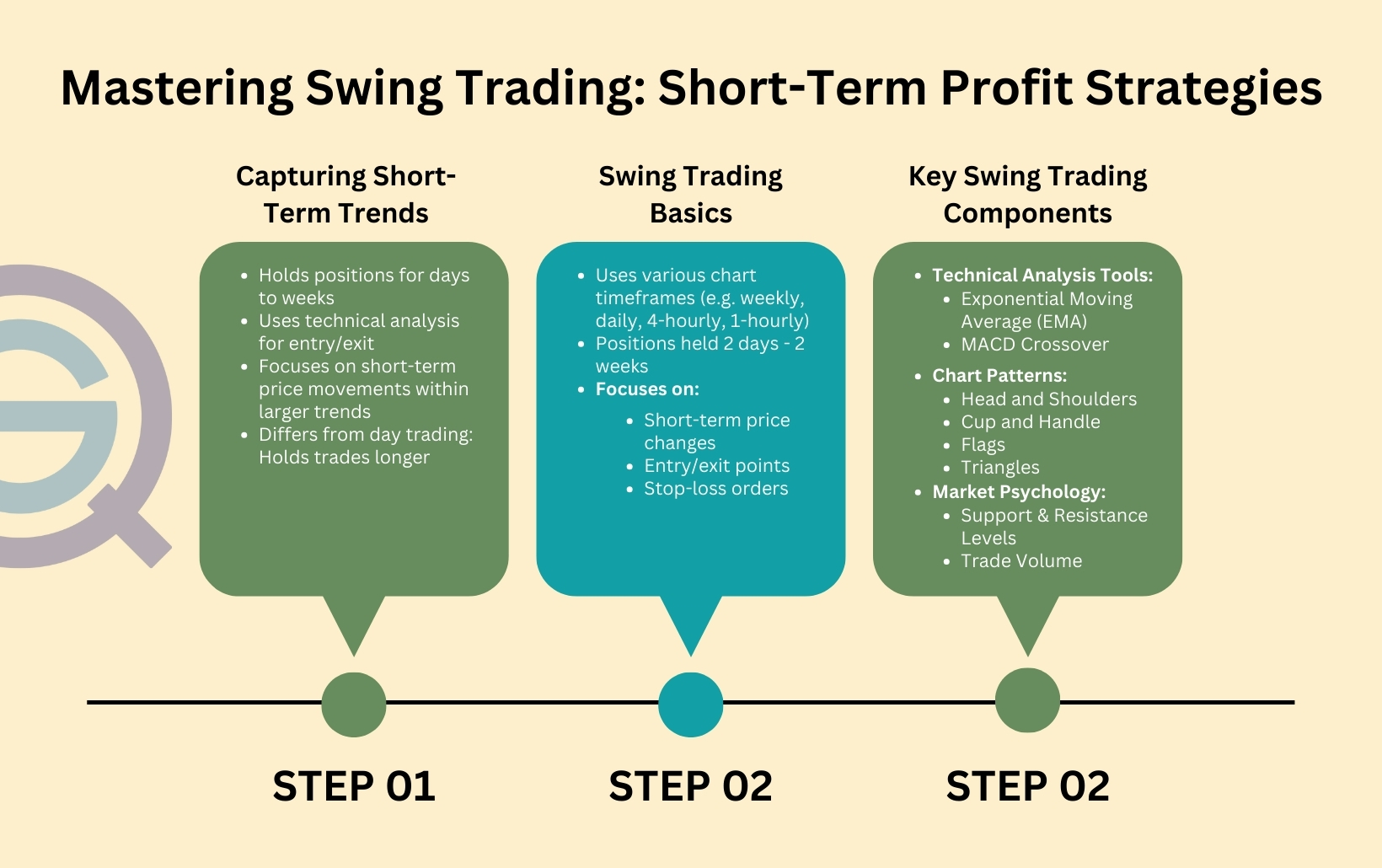

Automated trading platforms with algorithmic stop-loss orders are best for controlling risk. These tools automatically execute stop-loss levels based on predefined criteria, reducing emotional trading mistakes. Examples include trading bots, broker-integrated algorithms, and custom scripts in platforms like MetaTrader or TradingView. They help set precise, consistent stop-loss points and adjust them dynamically as the market moves.

How does algorithmic trading improve stop-loss accuracy?

Algorithmic trading improves stop-loss accuracy by automatically executing trades at precise price levels, eliminating emotional delays. It reacts instantly to market movements, ensuring stops are triggered exactly when targets are hit. This reduces slippage and avoids human hesitation, maintaining consistent risk control. Automation also allows for predefined risk parameters, so stop-loss orders are precise, timely, and less prone to manual errors.

What are common mistakes in manual stop-loss setting that automation can prevent?

Manual stop-loss setting often leads to inconsistent placements, emotional reactions, and delayed adjustments. Automation can prevent these by consistently applying predefined rules, reacting instantly to market changes, and removing emotional biases. It ensures stop-loss levels are based on data, not guesswork, reducing the risk of setting stops too tight or too loose. Automated systems also adapt quickly to volatility, preventing costly delays in exiting losing trades.

How can automation adapt stop-loss levels to changing market conditions?

Automation adjusts stop-loss levels by continuously monitoring market data and using algorithms to reset stops based on volatility, price swings, and trend changes. It dynamically moves stop-loss orders closer during sideways markets to lock in gains or trails behind rising prices to protect profits in trending markets. This ensures stop-loss levels stay aligned with current market conditions, reducing emotional decisions and minimizing risk.

What role does backtesting play in automating stop-loss strategies?

Backtesting shows how automated stop-loss strategies perform historically, helping traders refine rules to minimize losses. It identifies effective trigger points and risk levels, ensuring automation reacts quickly and accurately. By simulating past market conditions, backtesting builds confidence that automated stop-losses will protect capital in real-time trading.

How does automation help in minimizing losses during volatile markets?

Automation helps control stop-loss risk in day trading by executing trades instantly when prices hit predefined levels, preventing emotional delays. It ensures consistent adherence to stop-loss strategies, reducing the chance of holding losing positions too long. Automated systems can analyze real-time data and adjust stop-loss orders dynamically, minimizing potential losses during market volatility. This minimizes human error and reaction time, helping traders limit losses in unpredictable market swings.

What are the risks of relying solely on automation for stop-loss management?

Relying solely on automation for stop-loss management can cause missed signals during sudden market spikes, leading to larger-than-expected losses. It might execute stop-loss orders prematurely in volatile conditions, causing unnecessary exits. Automated systems lack judgment for context, missing nuances like news events or market sentiment. Technical glitches or connectivity issues can prevent timely order execution. Overdependence on automation can reduce trader oversight, decreasing ability to adapt to unpredictable market shifts.

How can traders customize automated stop-loss settings for different assets?

Traders can customize automated stop-loss settings for different assets by adjusting parameters like percentage loss, dollar amount, or technical indicators specific to each asset's volatility. Most trading platforms let you set unique stop-loss rules per asset, such as tighter stops for volatile stocks and wider stops for stable ones. Using conditional orders or scripting features (like alerts or automated scripts) allows tailored stop-loss triggers based on asset behavior. This way, you can optimize risk management for each asset, preventing premature exits or excessive losses.

What features should I look for in automated trading platforms for stop-loss control?

Look for platforms with real-time stop-loss adjustments, customizable trailing stops, and automatic order execution. Ensure they offer rapid order placement, reliable connectivity, and risk management tools like alerts and analytics. Features like backtesting, fast execution speed, and clear visualization of stop-loss levels also help control risk effectively.

Learn about Top Features to Look for in Day Trading Platforms

How does automation handle gap openings and fast price movements?

Automation detects gap openings and rapid price moves instantly through pre-set algorithms. It automatically adjusts or triggers stop-loss orders when sudden spikes or gaps occur, minimizing risk. Automated trading systems can respond faster than manual traders, closing positions before large losses happen during volatile moves.

Can automation improve the consistency of stop-loss execution?

Yes, automation improves stop-loss execution consistency by removing emotional errors and ensuring trades close at predefined levels, reducing slippage and missed exits.

What are the best practices for integrating automation into a day trading plan?

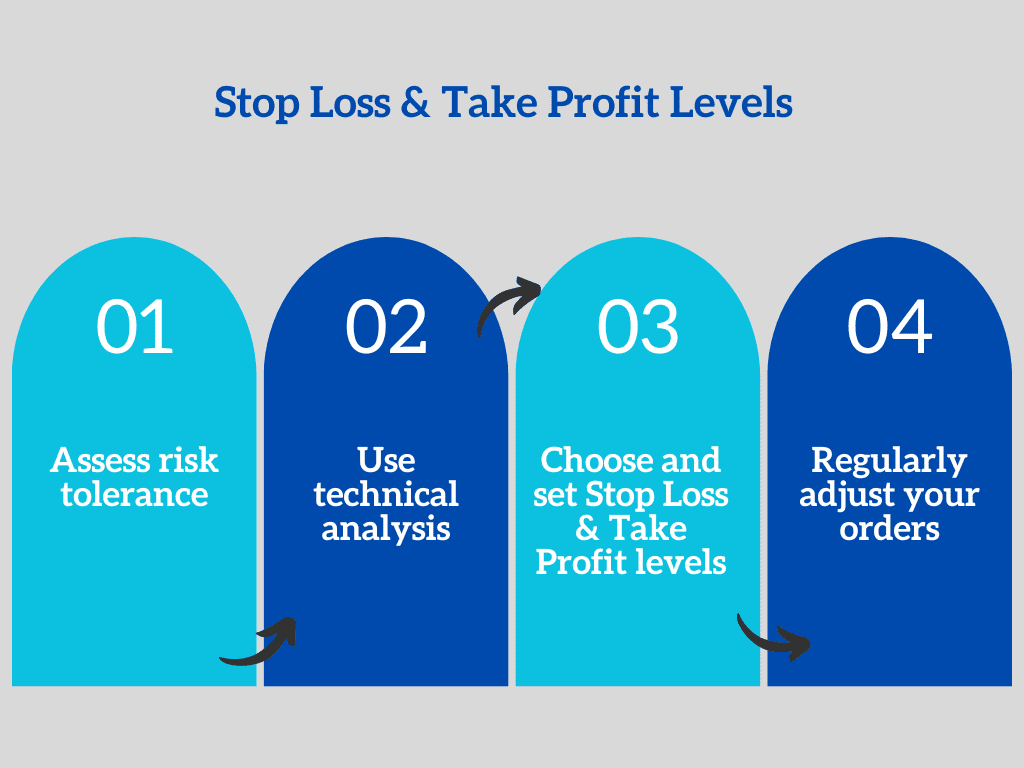

Use automated trading platforms to set predefined stop-loss orders before entering trades. Program your algorithms to exit positions automatically once a specific loss threshold is hit, preventing emotional decisions. Regularly backtest your automation strategies to ensure they respond correctly to market volatility. Keep your automation rules simple and clear to avoid unexpected behavior. Monitor your automated trades actively to adjust stop-loss settings as market conditions change. Incorporate trailing stop-loss orders to lock in profits while minimizing downside risk. Use automation to execute quick responses that human traders might miss during volatile swings.

Learn about What Are the Best Practices for Maintaining Day Trading Broker Compliance?

Conclusion about How automation can help control stop-loss risk in day trading

Incorporating automation into stop-loss management significantly enhances risk control in day trading. By utilizing automated tools, traders can improve accuracy, reduce emotional decision-making, and adapt to market changes seamlessly. However, it's essential to ensure that automated strategies are customized and regularly backtested to avoid common pitfalls and maximize effectiveness. Embracing these automated solutions can lead to more consistent and disciplined trading outcomes, ultimately driving success in your trading endeavors. For further insights and guidance on optimizing your trading strategies, DayTradingBusiness is here to assist.

Learn about How to avoid unnecessary stop-loss risk in day trading

Sources:

- Pro Trader RL: Reinforcement learning framework for generating ...

- Artificial intelligence for cybersecurity: Literature review and future ...

- Overview of Risk Management in Trading Activities Section 2000.1

- A profitable trading algorithm for cryptocurrencies using a Neural ...

- Trading and Capital-Markets Activities Manual | Federal Reserve ...