Did you know that even the most seasoned traders sometimes set stop-loss orders tighter than their favorite pair of jeans after the holidays? In the fast-paced world of day trading, managing stop-loss risk is crucial for protecting your capital. This article dives into the essentials of stop-loss risk, exploring effective methods to set stop-loss levels, the different types of stop-loss orders, and the significance of trailing stops. We’ll also cover position sizing, determining the right stop-loss distance, and strategies for adjusting your stops. Additionally, you'll learn how volatility, market momentum, and news events can affect your stop-loss placement, as well as the pros and cons of mental versus automatic stops. Finally, we’ll highlight common mistakes to avoid and tools that can enhance your stop-loss management. With insights from DayTradingBusiness, you'll be well-equipped to navigate these challenges and optimize your trading strategies.

What is stop-loss risk in day trading?

Stop-loss risk in day trading is the chance that your stop-loss order gets triggered during a sudden market spike or gap, causing you to sell at a less favorable price than intended.

How do I set effective stop-loss levels?

Set effective stop-loss levels by placing them based on technical support or resistance levels, like below recent swing lows for long trades or above swing highs for shorts. Use a fixed percentage or dollar amount you're comfortable risking per trade, typically 1-2%. Consider the asset's volatility—wider stops for volatile stocks, tighter for stable ones. Avoid setting stops too tight, which can trigger unnecessary exits, or too loose, risking bigger losses. Use chart patterns and ATR (Average True Range) to determine realistic stop points that give the trade room to breathe. Always stick to your stop-loss plan without emotional interference.

What are the common types of stop-loss orders?

The common types of stop-loss orders are fixed stop-loss, trailing stop-loss, and mental stop-loss. Fixed stop-loss sets a specific price to exit a trade. Trailing stop-loss moves with the price, locking in gains while limiting losses. Mental stop-loss is an informal decision to exit when a certain loss threshold is hit, but it’s not placed as an actual order.

How can I use trailing stops to manage risk?

Set a trailing stop at a percentage or dollar amount below your entry price. As the price rises, the trailing stop moves up automatically, locking in gains and limiting losses if the price reverses. Adjust the trailing stop based on volatility—wider in choppy markets, tighter in trending ones. Use it to let winners run while protecting your downside. For example, if you buy a stock at $50 and set a 5% trailing stop, the stop initially stays at $47.50; if the stock climbs to $55, the stop moves up to $52.25. If the price drops back, you sell at the trailing stop, capping your loss and securing profits.

What role does position sizing play in stop-loss management?

Position sizing determines how much you trade relative to your account, directly affecting your stop-loss risk. Proper sizing ensures that a single loss won’t wipe out your capital, keeping risk within acceptable limits. It helps control potential losses by matching position size to your stop-loss distance and risk tolerance. Smaller positions reduce the impact of a stop-loss hit, while larger ones can amplify losses if not managed carefully. Overall, it’s a key tool to manage risk effectively and preserve capital during volatile day trading.

How do I determine the right stop-loss distance?

Calculate average volatility and set your stop-loss 1-2 times that range to avoid getting stopped out by normal price swings. Use ATR (Average True Range) to gauge daily price movement; place your stop-loss accordingly, typically 1.5 to 2 times ATR. Adjust based on your risk tolerance—smaller for tight risk, larger for more room to breathe. Consider support and resistance levels to set stops just beyond key points, so you avoid premature exits. Always align your stop-loss with your overall risk management plan, limiting loss to a small percentage of your trading capital.

What are the best strategies for adjusting stop-losses?

Set stop-losses based on technical support or resistance levels to avoid premature exits. Use a fixed percentage or dollar amount that aligns with your risk tolerance, typically 1-2% of your trading capital. Trail your stop-loss as the trade moves in your favor, locking in gains while giving the trade room to breathe. Avoid placing stops too close, which can trigger by normal volatility, or too far, risking bigger losses. Adjust stop-losses dynamically during high-volatility periods to protect against sudden swings. Regularly review and refine your stop-loss placement based on market conditions and your trading performance.

How can volatility influence my stop-loss placement?

Volatility can widen or tighten your stop-loss placement. During high volatility, set wider stops to avoid being stopped out by normal price swings. In low volatility, tighten stops to protect gains and reduce risk. Understanding recent price swings helps you place stops that match current market conditions, avoiding false triggers. Adjust your stop-loss based on volatility to balance risk and avoid premature exits.

What are the risks of setting too tight stop-losses?

Setting too tight stop-losses can cause frequent exits from trades due to normal market fluctuations, leading to unnecessary losses and missed gains. It might trigger stop-outs during normal volatility, reducing overall profitability. Tight stops can also cause emotional stress and overtrading, as you get stopped out often and try to re-enter. This approach increases transaction costs and can disrupt your trading plan, making it harder to ride out small market swings for bigger moves.

How do I avoid false breakouts triggering my stop-loss?

To avoid false breakouts triggering your stop-loss, set wider or mental stop-loss levels based on true support and resistance, not just quick price spikes. Use confirmed breakout signals, like volume surges or retests, before acting. Avoid placing stops too tight around false breakout zones; give the trade room to breathe. Incorporate trailing stops to lock in profits without getting stopped out prematurely. Also, wait for multiple confirmations, such as price retests or pattern validation, before entering. This reduces the chance of false breakouts hitting your stop-loss.

What tools or indicators help in setting stop-losses?

Tools like ATR (Average True Range) help set stop-losses based on market volatility, providing a dynamic buffer. Moving averages, such as the 20- or 50-day MA, act as support or resistance levels to place stops just beyond them. Chart patterns and support/resistance zones guide where to place stops to avoid false breakouts. Trading platforms often have automated stop-loss orders and alerts, making risk management precise. Additionally, trailing stops adjust as the trade moves favorably, locking in gains while limiting risk.

How does market momentum affect stop-loss effectiveness?

Market momentum can cause stop-loss orders to trigger prematurely during rapid price swings, making them less effective. When momentum is strong, prices can gap past stop levels, leading to larger-than-expected losses. Conversely, in choppy or sideways markets, momentum fades, increasing the risk of false stops. To manage this, traders often use wider stops in high-momentum conditions or combine stop-loss orders with other tools like volatility-based stops.

What are the pros and cons of mental vs. automatic stop-losses?

Mental stop-losses let you decide when to exit based on your judgment, offering flexibility but risking emotional mistakes. Automatic stop-losses execute trades instantly at set levels, reducing emotional bias and ensuring discipline, but they can trigger prematurely in volatile markets. Mental stops require constant attention and discipline; automatic stops provide peace of mind but may result in unwanted exits during quick price swings. Use mental stops for more control; automatic stops for consistency and emotional safety.

How can I backtest my stop-loss strategies?

Use historical data to simulate trades with your stop-loss rules, testing how they perform across different market conditions. Implement paper trading to practice your stop-loss strategy live without risking real money. Use backtesting software like TradingView or MetaTrader to automate testing of various stop-loss setups, analyzing metrics like drawdown and win rate. Review past trades and adjust your stop-loss levels based on performance insights. Combine backtesting with forward testing on a demo account to ensure your stop-loss management works in real-time markets.

What are common mistakes to avoid when managing stop-loss risk?

Avoid setting stop-losses too tight, which can trigger premature exits on normal volatility. Don't rely solely on fixed percentages; adjust stops based on market conditions and support/resistance levels. Ignoring market trends or news can cause stops to be hit unexpectedly. Overusing emotional judgment instead of sticking to a plan leads to inconsistent results. Failing to trail stops as the trade moves in your favor limits profit potential. Placing stops too far away risks larger losses, while too tight stops increase the chance of being stopped out prematurely. Avoid neglecting to review and adapt your stop-loss strategy regularly based on market behavior.

How do news events impact stop-loss management?

News events can cause sudden market volatility, making stop-loss orders hit unexpectedly. During major news releases, prices can gap past stop levels, increasing loss risk. To manage this, avoid placing tight stops before big events and consider wider stops or temporary exits. Stay alert to economic calendars and news updates to adjust stop-loss levels proactively. Using mental stops or alerts rather than strict orders can also help avoid being triggered by false moves during news spikes.

Learn about How News Events Impact Day Trading Decisions

Conclusion about Best ways to manage stop-loss risk in day trading

Effectively managing stop-loss risk is crucial for successful day trading. By understanding stop-loss orders, utilizing trailing stops, and applying proper position sizing, traders can protect their capital while maximizing potential gains. It's essential to consider factors such as market volatility and momentum to refine stop-loss strategies and avoid common pitfalls. For comprehensive insights and expert guidance on stop-loss management and other trading strategies, DayTradingBusiness is here to support your trading journey.

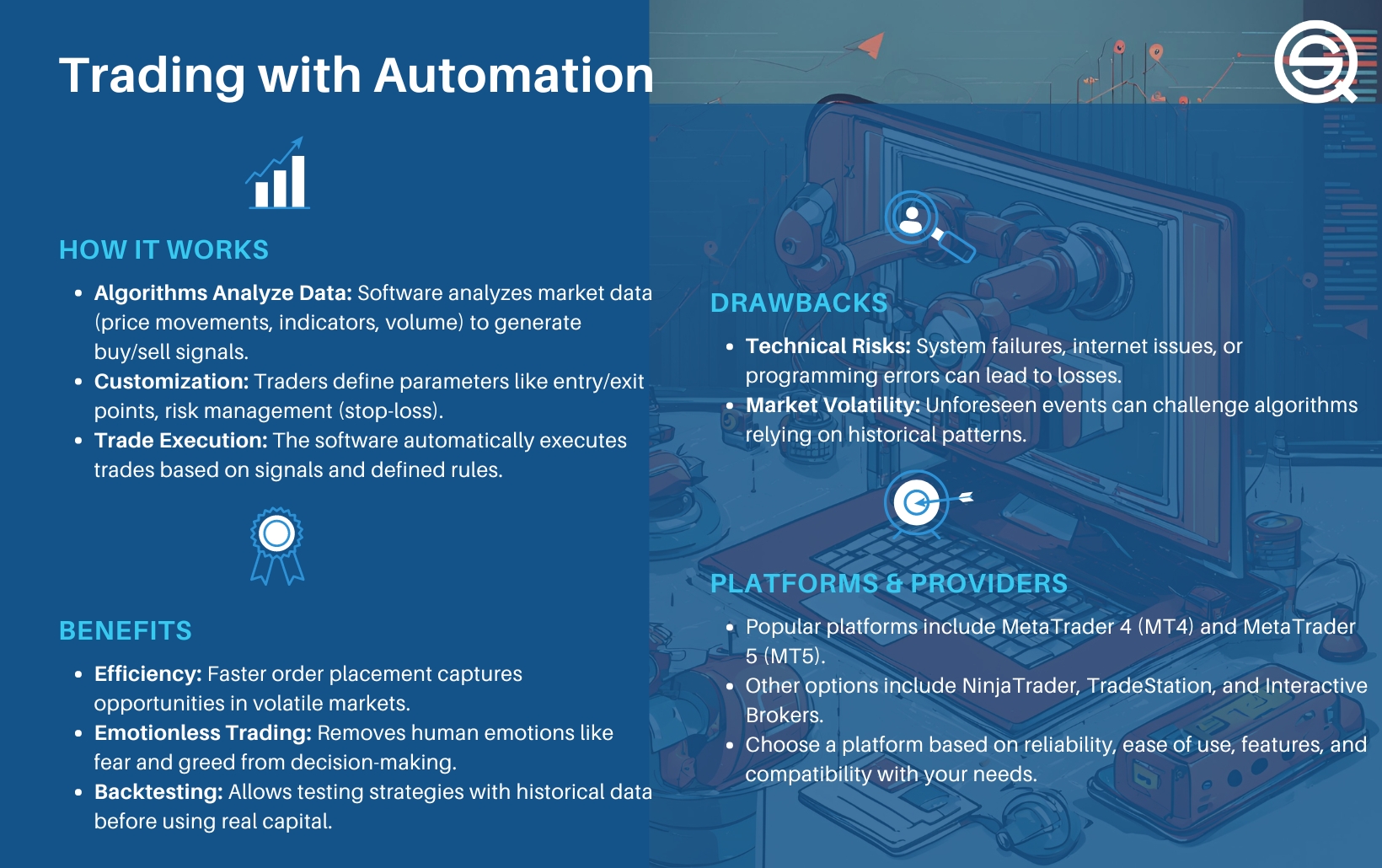

Learn about How automation can help control stop-loss risk in day trading