Did you know that the average person spends about 6 months of their life waiting in line? In trading, however, patience can mean the difference between profit and loss. This article dives into the pivotal role patience plays in managing trading risks, emphasizing its importance in preventing impulsive decisions and reducing losses. You'll learn how waiting for the right setups can enhance your risk-reward ratio while improving your entry and exit points. We’ll explore how patience helps manage emotional stress, avoid overtrading, and support long-term profitability. With insights on why traders should wait for confirmation and how impatience can lead to risky trades, this guide from DayTradingBusiness will equip you with the tools to cultivate patience for consistent trading success.

Why is patience crucial in trading risk management?

Patience in trading risk management prevents impulsive decisions that can lead to losses. It allows traders to wait for the right setups, reducing exposure to unnecessary risk. Staying patient helps stick to predefined risk levels and avoid emotional trades. It also enables traders to monitor market conditions carefully, avoiding hasty exits or entries. Ultimately, patience safeguards capital by encouraging disciplined, well-timed moves instead of reckless ones.

How does patience help prevent impulsive trading decisions?

Patience helps prevent impulsive trading by giving you time to analyze market signals, avoid rushing into bad trades, and stick to your strategy. It reduces emotional reactions, like panic or greed, that lead to hasty decisions. Waiting for clear setups ensures better risk management and minimizes losses. It keeps you disciplined, so you trade based on logic rather than impulse.

What role does patience play in reducing trading losses?

Patience helps traders wait for high-probability setups and avoid impulsive decisions, reducing the chance of unnecessary losses. It prevents rushing into trades based on emotion or fear, allowing for better risk management. By practicing patience, traders can stick to their strategies and avoid premature exits or entries that often lead to losses. Ultimately, patience keeps emotions in check, promotes disciplined trading, and improves decision quality, lowering overall trading risks.

Why is waiting for the right setup important in trading?

Waiting for the right setup is crucial because it minimizes trading risks. Entering trades prematurely often leads to losses if market conditions aren’t ideal. Patience ensures you only trade when technical signals or market trends align, reducing exposure to unpredictable moves. It helps avoid impulsive decisions that can wipe out gains and keeps your risk management on track. Ultimately, waiting for the right setup boosts your chances of success and preserves your trading capital.

How does patience improve a trader’s risk-reward ratio?

Patience helps traders wait for high-probability setups, reducing impulsive trades that often lead to losses. By avoiding premature entries, traders can target better entry points, increasing potential reward relative to risk. It also prevents overtrading, which can weaken risk management and skew the risk-reward ratio. Ultimately, patience ensures disciplined decision-making, leading to more favorable risk-reward outcomes over time.

In what ways does patience help manage emotional stress during trading?

Patience helps manage emotional stress during trading by preventing impulsive decisions that often lead to losses. It allows traders to wait for optimal setups instead of rushing, reducing anxiety. Staying patient keeps emotions in check, avoiding panic selling or overtrading. It promotes discipline, helping traders stick to their risk management plans. Over time, patience builds confidence and resilience, making setbacks easier to handle without emotional upheaval.

Why is patience key to avoiding overtrading?

Patience prevents impulsive trades driven by emotion, reducing overtrading. It allows traders to wait for high-probability setups, minimizing unnecessary risks. Being patient helps avoid chasing losses or making hasty decisions that can amplify losses. It encourages disciplined trading, leading to better risk management and more consistent results.

How can patience lead to better entry and exit points?

Patience allows traders to wait for optimal entry and exit points, avoiding premature moves that increase risk. It helps them observe market trends and confirm signals, reducing impulsive decisions. By waiting for clear setups, traders can enter trades with better risk-reward ratios and exit before reversals. Patience prevents chasing the market, minimizing losses and maximizing gains.

What is the connection between patience and consistent trading success?

Patience helps traders avoid impulsive decisions, reducing unnecessary risks. It allows waiting for optimal setups, increasing the chance of profitable trades. Consistent patience prevents chasing losses or overtrading, which can wipe out gains. Over time, patient traders stick to their strategy, managing risks better and building sustainable success.

How does impatience increase the likelihood of risky trades?

Impatience leads traders to rush into risky trades without proper analysis, hoping for quick gains. It clouds judgment, making them ignore warning signs or set tight stop-losses. Rushed decisions often ignore market signals, increasing chances of costly mistakes. When traders seek immediate results, they overlook risk management strategies, amplifying potential losses. Patience allows for better timing and disciplined trading, reducing impulsive, high-risk moves.

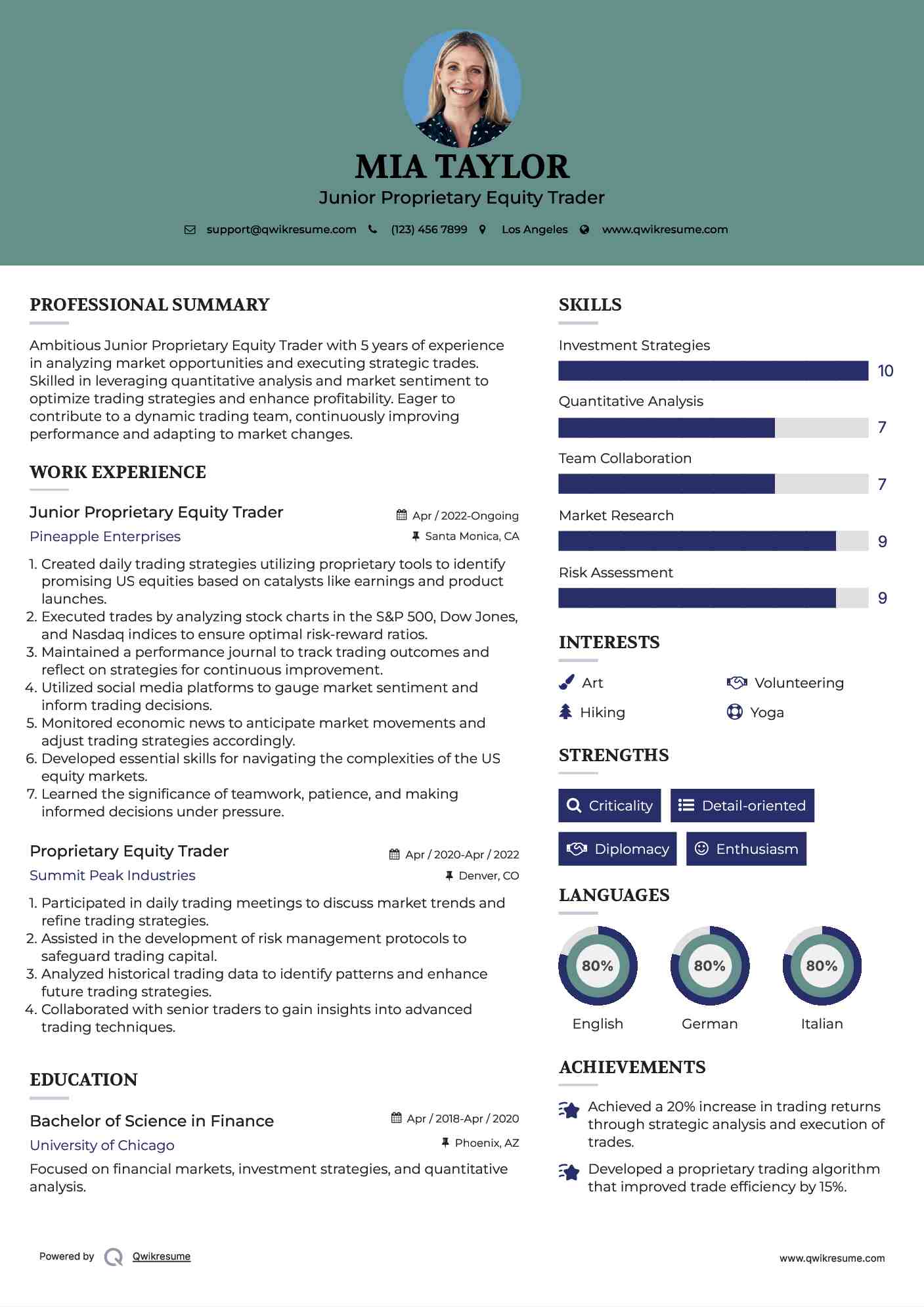

Why should traders wait for confirmation before executing trades?

Traders wait for confirmation to avoid false signals and reduce risk. Jumping in without confirmation can lead to losses from quick reversals. Patience ensures trades align with the trend and market momentum, increasing success chances. It helps prevent impulsive decisions and protects capital during volatile moves. Waiting for confirmation filters out noise, making trades more reliable and less risky.

How does patience support long-term trading profitability?

Patience helps traders wait for optimal entry and exit points, reducing impulsive decisions that increase risk. It allows for better analysis of market trends, avoiding premature trades that can lead to losses. By staying patient, traders can ride out volatility and avoid panic selling, which preserves capital. Over time, patience fosters disciplined trading, leading to consistent profits and lower risk exposure.

In what ways does patience help in managing market volatility?

Patience helps traders avoid impulsive decisions during market swings, preventing losses from emotional reactions. It allows for waiting for clearer signals or better entry points, reducing exposure to unpredictable volatility. By staying calm and disciplined, traders can avoid panic selling or overtrading, which often worsens risk. Patience also enables longer-term perspective, helping traders ride out short-term fluctuations and capitalize on bigger trends. Ultimately, it preserves capital and fosters more thoughtful, strategic trading amid market ups and downs.

Why is patience essential for following a trading plan?

Patience is crucial for managing trading risks because it prevents impulsive decisions, allowing traders to wait for optimal setups and avoid unnecessary losses. It helps stick to the plan, reducing emotional reactions to market fluctuations. By practicing patience, traders can better manage volatility and avoid rushing into trades that don’t meet their criteria. It ensures they only enter trades with favorable risk-reward ratios, ultimately protecting their capital and improving long-term success.

How can practicing patience reduce trading anxiety?

Practicing patience helps traders avoid impulsive decisions, reducing stress from rash moves. It allows for better analysis of market trends, preventing overtrading and emotional reactions. When traders wait for clear setups, they feel more in control, easing anxiety. Patience fosters discipline, making risk management more consistent and less panic-driven. Ultimately, it creates a calmer mindset, helping traders handle market fluctuations without panic.

Conclusion about Why Is Patience Important for Managing Trading Risks?

In trading, patience is a fundamental virtue that significantly enhances risk management and decision-making. By waiting for the optimal setups and confirmations, traders can avoid impulsive moves that lead to losses. This quality not only improves the risk-reward ratio but also helps manage emotional stress and market volatility. Ultimately, cultivating patience fosters adherence to a trading plan, reduces anxiety, and paves the way for long-term profitability. For those seeking to refine their trading strategies, embracing patience is vital for achieving consistent success in the dynamic world of trading. Trust in the insights provided by DayTradingBusiness to bolster your trading journey.

Learn about Why Is Discipline Key to Managing Trading Psychology Risks?

Sources:

- Patience, persistence and pre-signals: Policy dynamics of planned ...

- Patient capital outperformance: The investment skill of high active ...

- A field study of donor behaviour in the Iranian kidney market ...

- Doctor–patient differences in risk and time preferences: A field ...

- Speech, Greenspan -- Financial derivatives -- March 19, 1999 - FRB

- Strategies enhancing the patient experience in mammography: A ...