Did you know that the average trader's brain can sometimes make decisions faster than a speeding bullet—yet just as often, it leads them straight to losses? In the world of trading, mental habits play a crucial role in shaping outcomes. This article delves into the key psychological pitfalls that can lead to trading losses, such as emotional decision-making, overconfidence, and fear. It highlights the dangers of impatience, neglecting a trading plan, and the perils of revenge trading. Furthermore, we explore how negative self-talk, greed, and stress can cloud judgment, while poor discipline and inconsistency can derail even the most promising strategies. With insights from DayTradingBusiness, you'll learn to identify and overcome these mental traps to enhance your trading success.

What mental habits cause traders to lose money?

Fear and greed drive impulsive decisions, causing traders to panic sell or overtrade. Overconfidence leads to risky trades without proper analysis. Revenge trading after losses blinds judgment, making traders chase losses instead of sticking to their plan. Lack of discipline results in ignoring stop-losses and deviating from strategies. Emotional reactions like frustration or excitement override rational thinking. Confirmation bias makes traders see only what supports their bets, ignoring warning signs. Habitual overtrading and chasing the market blur risk management. These mental habits erode discipline and increase the chance of losing money.

How does emotional decision-making affect trading outcomes?

Emotional decision-making causes traders to act impulsively, chase losses, or hold onto losing positions, increasing the risk of significant losses. It clouds judgment, leading to poor timing and overtrading. Relying on emotions rather than analysis makes traders vulnerable to panic and greed, which derail consistent, disciplined trading strategies.

Why is overconfidence risky in trading?

Overconfidence makes traders underestimate risks, ignore market signals, and take bigger positions without proper analysis. It leads to impulsive decisions, overestimating skill, and ignoring potential losses. This mental habit blinds traders to warning signs, increasing chances of significant losses.

How does fear impact trading decisions?

Fear causes traders to hesitate or exit trades prematurely, often locking in losses or missing gains. It leads to impulsive decisions, like selling during dips or avoiding risky setups, which hampers growth. Fear also fuels panic selling in volatile moments, amplifying losses. Over time, it erodes confidence and promotes revenge trading, making losses worse. Ultimately, fear clouds judgment, making traders reactive instead of strategic.

Can impatience lead to trading losses?

Yes, impatience can lead to trading losses. When traders rush into trades without proper analysis or hold onto losing positions hoping for quick gains, they often make poor decisions. Impatience causes premature exits or overtrading, increasing risk and reducing chances of profitable outcomes. It clouds judgment, leading to emotional reactions rather than disciplined strategy, which results in financial losses.

Why is ignoring a trading plan dangerous?

Ignoring a trading plan is dangerous because it leads to impulsive decisions, emotional trading, and inconsistent strategies. Without sticking to your plan, you risk overtrading, mismanaging risk, and losing discipline, all of which increase the chance of significant losses. It undermines your ability to stay focused and patient, making you vulnerable to market volatility and psychological setbacks.

How does revenge trading harm your profits?

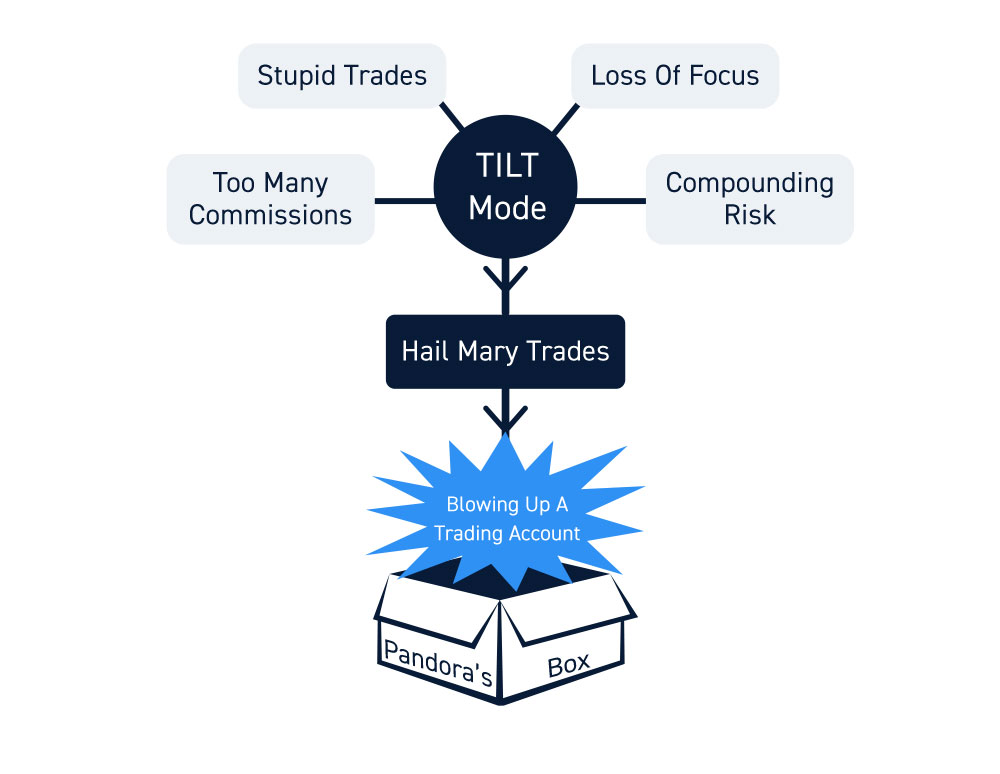

Revenge trading damages profits by forcing impulsive decisions after losses, leading to chasing the market instead of sticking to a plan. It skews risk assessment, often making you take bigger, unnecessary risks to recover losses quickly. This emotional reaction clouds judgment, causing poor entries and exits, which erodes your capital over time. Instead of learning from mistakes, revenge trading fuels a cycle of further losses and frustration, undermining long-term profitability.

What role does hesitation play in trading mistakes?

Hesitation in trading often causes missed opportunities or impulsive decisions, leading to losses. It stems from fear or doubt, making traders second-guess their strategies. This mental habit prevents timely execution and can trap traders in indecision, increasing the chance of losing trades. Overcoming hesitation helps traders act confidently and stick to their plan, reducing costly mistakes.

How does overtrading increase the risk of losses?

Overtrading increases the risk of losses by causing traders to make impulsive decisions driven by emotions like greed or fear. It leads to excessive trades, often without proper analysis, increasing exposure to market swings. This behavior erodes capital quickly because each unnecessary trade adds to the potential for error. Overtrading also reduces focus and discipline, making it harder to stick to a solid strategy, which amplifies chances of big losses.

Why is poor discipline a common cause of trading failure?

Poor discipline causes trading failure because it leads to impulsive decisions, ignoring stop-loss rules, and overtrading. Without discipline, traders chase losses, deviate from strategies, and let emotions drive actions. This chaos increases risk, causes inconsistent results, and erodes capital over time.

How do negative self-talk and mindset affect trading success?

Negative self-talk and mindset undermine trading success by fostering doubt, impulsivity, and fear. They cause traders to second-guess decisions, hesitate, or overreact to losses. Constant negativity erodes confidence, leading to poor risk management and emotional trading. A toxic mindset makes it harder to stick to strategies, increasing the likelihood of costly mistakes. Positive mental habits, in contrast, promote discipline, clarity, and resilience, essential for consistent trading performance.

What is the impact of greed on trading decisions?

Greed drives traders to take bigger, riskier bets, often ignoring their original plans. It clouds judgment, making them chase quick profits instead of steady growth. This impulsiveness leads to overtrading, ignoring stop-losses, and holding onto losing positions too long. Ultimately, greed causes emotional decision-making, increasing the chance of significant trading losses.

Learn about How Do Fear and Greed Impact Day Trading Decisions?

How does a lack of patience lead to poor trades?

Lack of patience causes traders to rush entries and exits, leading to impulsive decisions. They ignore proper setups and risk management, increasing losses. Patience helps wait for high-probability trades; without it, emotions take over, and mistakes happen. Rushing trades often results in poor timing and unnecessary risk, damaging long-term profitability.

Why is inconsistency in trading habits harmful?

Inconsistency in trading habits causes emotional swings, leading to impulsive decisions and poor risk management. It erodes discipline, making it hard to stick to strategies during volatile moments. This unpredictability increases mistakes, like overtrading or ignoring stop-losses, raising the chance of losses. Consistent habits build mental resilience, helping traders stay calm and focused, reducing the likelihood of costly errors.

How do stress and anxiety influence trading performance?

Stress and anxiety impair decision-making, making traders impulsive and prone to errors. They cause emotional reactions instead of logical analysis, leading to poor risk management. High stress can cloud judgment, causing traders to hold losing positions or panic-sell. Anxiety increases fear of missing out, pushing traders into risky trades. Over time, these mental habits erode discipline and confidence, increasing the likelihood of trading losses.

Learn about How Does Stress Affect Day Trading Performance?

What mental traps should traders avoid to prevent losses?

Traders should avoid overconfidence, which makes them ignore risks; revenge trading, trying to recover losses impulsively; chasing the market, entering trades out of FOMO; and confirmation bias, only seeing info that supports their bias. Emotional decision-making, like panic selling or greed-driven entries, also leads to losses. Stick to your plan, stay disciplined, and don’t let emotions drive trades.

Conclusion about What Mental Habits Lead to Trading Losses?

In summary, cultivating the right mental habits is crucial for successful trading. Emotional decision-making, overconfidence, fear, impatience, and a lack of discipline can significantly impair trading performance and lead to losses. By recognizing and addressing these pitfalls—such as revenge trading and negative self-talk—traders can enhance their decision-making processes. To achieve long-term success, it is essential to remain disciplined and adhere to a well-structured trading plan. For more insights on overcoming these mental barriers, consider exploring resources from DayTradingBusiness.

Sources:

- Loss aversion, habit formation and the term structures of equity and ...

- Dynamics of social influence on consumption choices: A social ...

- The Role of Behavioural Finance in Retail Investment Decisions: A ...

- An overview of effects of COVID-19 on mobility and lifestyle: 18 ...

- Mental Accounting, Loss Aversion, and Individual Stock Returns