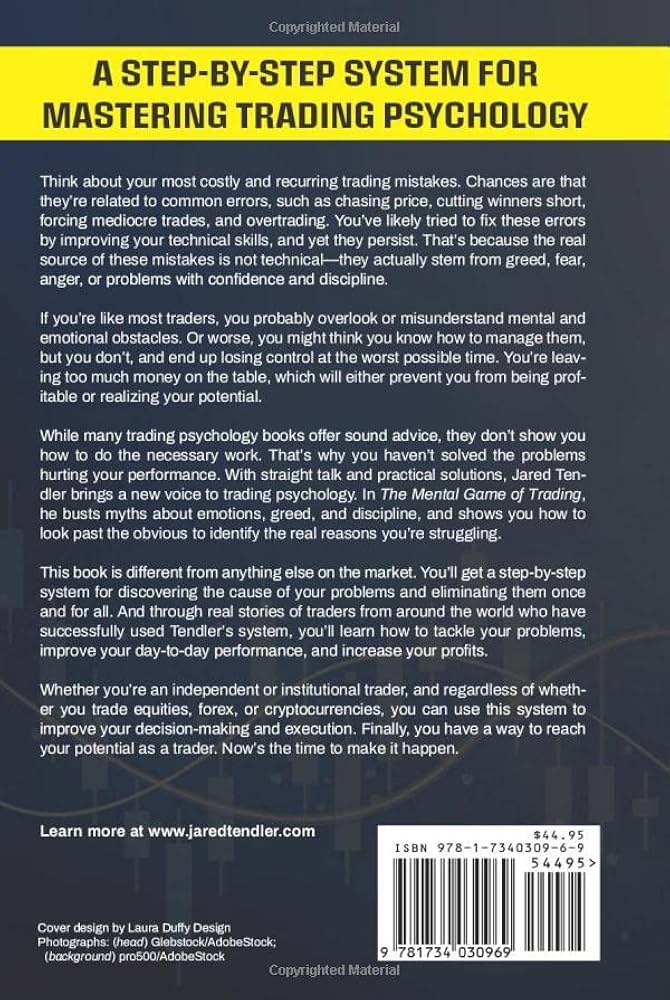

Did you know that even the most seasoned traders can feel like they're riding a rollercoaster of emotions? Confidence plays a crucial role in managing trading risks, influencing decision-making and performance. This article delves into how confidence impacts trading risk management, from its importance in decision-making to the dangers of overconfidence. We explore the signs of overconfidence, strategies to build confidence, and how it can enhance risk assessment and adherence to trading plans. Discover how emotions interact with confidence and learn to balance it with caution to maintain discipline and improve your trading outcomes. With insights from DayTradingBusiness, you'll be equipped to navigate the psychological aspects of trading like a pro.

How Does Confidence Affect Trading Risk Management?

Confidence helps traders stick to their risk management plans and avoid impulsive decisions. When confident, traders can set appropriate stop-losses and position sizes without second-guessing. Too much confidence can lead to overtrading and ignoring risk limits, while too little causes hesitation and missed opportunities. Balancing confidence ensures decisive actions aligned with risk tolerance, reducing emotional reactions that jeopardize trades.

Why Is Confidence Important for Making Trading Decisions?

Confidence helps traders make quick, decisive moves, reducing hesitation that can lead to missed opportunities or second-guessing. It enables better risk management by trusting your analysis and sticking to your trading plan, which prevents impulsive or emotional decisions. When confident, traders can handle market volatility without panic, maintaining discipline and avoiding unnecessary losses.

Can Too Much Confidence Increase Trading Risks?

Yes, too much confidence can increase trading risks by leading to overtrading, ignoring signs of market change, and taking reckless positions. Overconfidence makes traders underestimate potential losses and overestimate their skills, which can cause poor decision-making. Balancing confidence with caution and realistic risk assessments is crucial to managing trading risks effectively.

How Does Lack of Confidence Impact Trading Performance?

Lack of confidence causes hesitation, leading to missed trading opportunities and poor decision-making. It makes traders risk-averse, causing them to exit trades too early or avoid taking necessary risks. This uncertainty increases emotional reactions like fear and doubt, which impair judgment and lead to inconsistent strategies. Without confidence, traders struggle to stick to their risk management plans, increasing exposure to losses. Overall, low confidence undermines discipline, increases stress, and hampers effective risk management in trading.

What Are Signs of Overconfidence in Trading?

Signs of overconfidence in trading include taking larger positions than justified, ignoring risk management, believing you're invincible after wins, and dismissing market signals. Overconfidence leads traders to underestimate risks, skip stop-losses, and chase losses, risking significant losses. It clouds judgment, causing traders to ignore warnings and overestimate their skill in managing trading risks.

How Can Confidence Improve Risk Assessment in Trading?

Confidence helps traders make clearer, decisive choices, reducing hesitation that can lead to missed opportunities or mistakes. When traders trust their analysis, they stick to their risk management plans instead of second-guessing, which minimizes impulsive decisions. Confidence also enables better evaluation of market signals, allowing for more accurate risk-reward assessments. Ultimately, it sharpens judgment, helping traders avoid overreacting to short-term fluctuations and stick to their long-term risk strategies.

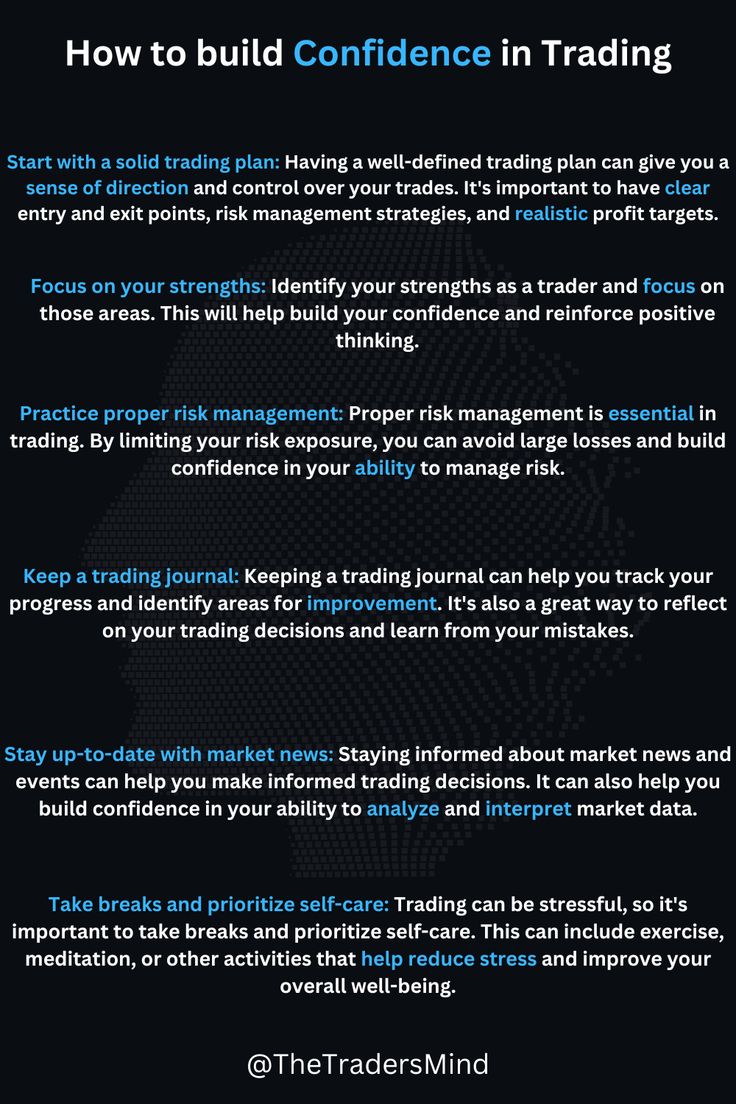

What Are Strategies to Build Confidence in Trading?

Building confidence in trading involves practicing consistently to understand market patterns, starting with small positions to reduce fear, and studying successful traders’ strategies. Keeping a trading journal helps identify strengths and mistakes, boosting self-assurance. Staying disciplined with a solid plan and managing risk carefully prevents emotional decisions that shake confidence. Trust your analysis, avoid overtrading, and learn from losses without losing focus. Confidence grows when you see your strategies work over time, making you more resilient in managing trading risks.

How Does Confidence Influence Stop-Loss and Take-Profit Decisions?

Confidence shapes how traders set stop-loss and take-profit levels. High confidence makes them comfortable placing wider stops and aiming for bigger gains, trusting their analysis. Low confidence leads to tighter stops to limit risk and conservative profit targets. Overconfidence can cause traders to take bigger risks, risking larger losses. Proper confidence helps balance risk management, ensuring decisions are neither reckless nor overly cautious. It directly affects the willingness to stick to planned exit points amid market fluctuations.

Can Confidence Help Traders Stick to Their Trading Plans?

Yes, confidence helps traders stick to their trading plans by reducing impulsive decisions and emotional reactions. When traders believe in their strategy, they’re less likely to deviate or panic during volatility. Confidence fosters discipline, enabling consistent risk management and adherence to predefined entry and exit points. It also boosts resilience, helping traders recover from losses without abandoning their plan.

How Do Emotions Interact with Confidence in Trading?

Confidence helps traders trust their analysis and stick to their strategies, reducing impulsive decisions during volatile markets. When traders feel assured, they’re less likely to panic sell or chase losses, which manages risk effectively. However, overconfidence can lead to underestimating risks, increasing potential losses. Balancing confidence with emotional awareness ensures traders stay disciplined and make rational choices, ultimately controlling trading risks better.

What Role Does Confidence Play in Managing Trading Anxiety?

Confidence helps traders stay calm and make rational decisions during market fluctuations. It reduces fear and impulsive actions, allowing better risk management. When confident, traders trust their analysis, avoid panic selling, and stick to their strategies. This mental resilience minimizes emotional reactions that can lead to costly mistakes, ultimately balancing trading risks effectively.

How Can Overconfidence Lead to Poor Risk Management?

Overconfidence makes traders underestimate risks, leading them to take bigger bets or ignore warning signs. When confidence overshadows caution, they overlook potential losses and fail to set proper stop-losses. This false sense of security can cause reckless decisions, increasing the chance of significant financial setbacks. Confidence should support careful risk assessment, not replace it. Overconfidence distorts judgment, making traders ignore risk management strategies that protect their capital.

Learn about How can poor risk management lead to losses in day trading?

How Do Successful Traders Develop Confidence?

Successful traders build confidence through consistent practice, analyzing their wins and losses, and refining their strategies. They start small, gain experience, and learn to trust their analysis over emotions. Confidence grows when traders stick to disciplined risk management and see steady results, helping them make calmer, more informed decisions.

What Are Common Confidence-Related Trading Mistakes?

Common confidence-related trading mistakes include overestimating your ability, taking excessive risks based on unwarranted optimism, ignoring risk management rules, doubling down after losses, and neglecting to set stop-loss orders. Overconfidence can lead to impulsive decisions, risking bigger losses. Underestimating risks due to misplaced confidence makes traders vulnerable to significant setbacks. Balancing confidence with discipline is crucial to manage trading risks effectively.

How Can Traders Balance Confidence and Caution?

Traders balance confidence and caution by trusting their analysis without overestimating their ability. They stick to their trading plan, set strict stop-losses, and avoid emotional decisions. Confidence fuels decisive moves, but caution keeps risk in check through disciplined risk management. Regularly reviewing trades and learning from mistakes prevents overconfidence from taking over.

How Does Confidence Affect Trading Discipline?

Confidence helps traders stick to their risk management plans and avoid impulsive decisions. When confident, traders trust their strategies and resist panic selling or overtrading. Too much confidence can lead to reckless risk-taking, while too little causes hesitation and missed opportunities. Balanced confidence ensures traders manage risks effectively, stay disciplined, and stick to their trading plans under pressure.

Learn about How Does Confidence Fluctuate and Affect Trading Outcomes?

Conclusion about What Is the Role of Confidence in Managing Trading Risks?

In summary, confidence plays a pivotal role in managing trading risks and making informed decisions. It can enhance risk assessment, influence crucial actions like stop-loss and take-profit strategies, and help traders adhere to their plans. However, overconfidence can lead to detrimental outcomes, including poor risk management and emotional instability. To cultivate a balanced approach, traders should focus on building confidence through education, experience, and mindfulness. For those looking to deepen their understanding of trading psychology and risk management, DayTradingBusiness offers valuable resources to support your journey.