Did you know that even the most seasoned traders can sometimes mistake a winning streak for a personal talent? This article from DayTradingBusiness delves into the phenomenon of overconfidence in trading, exploring its definition and how it distorts decision-making. We'll examine the risks it introduces, the psychological biases at play, and the signs that indicate a trader may be too confident. Discover why overconfidence can lead to larger losses, impact risk management, and how it affects traders differently based on their experience. Finally, we provide effective strategies to help traders recognize and mitigate overconfidence, ensuring more informed decision-making and a healthier trading approach.

What is overconfidence in trading?

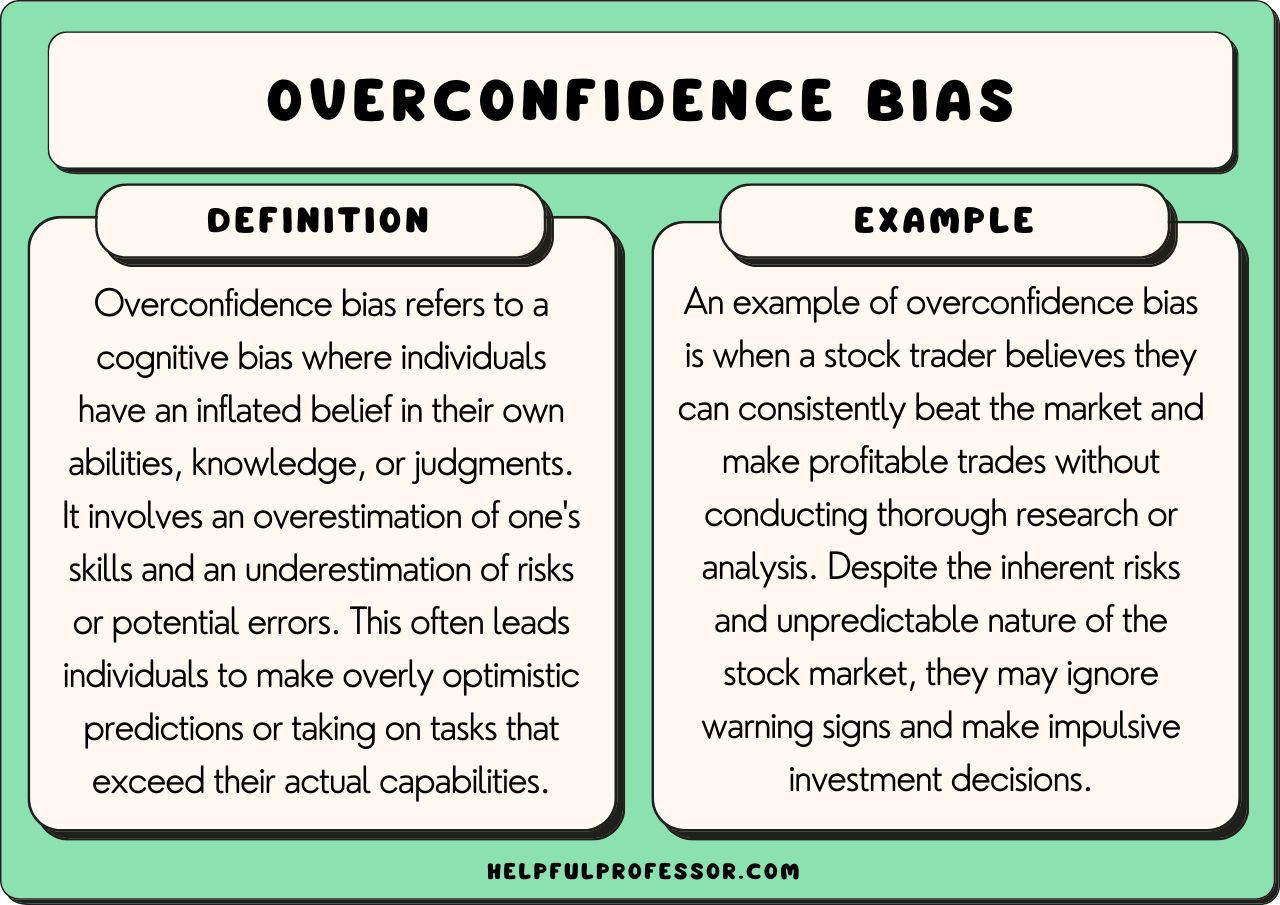

Overconfidence in trading is when traders overestimate their knowledge, skills, or ability to predict market movements. It leads to taking bigger risks, trading more frequently, and ignoring potential losses. This mindset can cause poor decision-making, increased exposure to market volatility, and bigger financial losses. Overconfidence makes traders dismiss warning signs and underestimate risks, amplifying trading dangers.

How does overconfidence affect trading decisions?

Overconfidence leads traders to underestimate risks, take larger positions, and ignore warning signs. It causes them to overestimate their knowledge and predictability, increasing the likelihood of holding losing trades longer. This mindset often results in impulsive decisions, reducing diversification and amplifying potential losses. Ultimately, overconfidence raises trading risks by encouraging reckless behavior and ignoring market uncertainties.

Can overconfidence increase trading risks?

Yes, overconfidence can increase trading risks by leading traders to take larger positions, underestimate market volatility, and ignore warning signs, which often results in bigger losses. Overconfident traders may ignore diversification and risk management strategies, believing they know better, exposing themselves to higher potential for significant financial setbacks.

Why do traders become overconfident?

Traders become overconfident because they experience early successes, which boost their belief in their skills. They overestimate their knowledge and underestimate risks, thinking they can beat the market. This inflated confidence leads them to take bigger, riskier trades without proper analysis. Overconfidence makes traders ignore warning signs and cling to losing positions, increasing their chances of significant losses.

What are the common signs of overconfidence in trading?

Common signs of overconfidence in trading include taking larger or more frequent trades without proper analysis, ignoring risk management, believing you’re always right, and underestimating market risks. Traders may also dismiss losing streaks as luck or short-term anomalies, feeling invincible after wins. This mindset leads to excessive risk-taking, poor decision-making, and increased chances of significant losses.

How does overconfidence lead to larger losses?

Overconfidence makes traders overestimate their abilities, leading them to take bigger risks without proper analysis. This often results in ignoring warning signs or sticking with losing trades longer than they should. As a result, overconfident traders tend to make larger, impulsive bets that amplify losses when the market moves against them.

Does overconfidence cause traders to take more risks?

Yes, overconfidence makes traders underestimate risks and take bigger, riskier positions. They believe they have superior knowledge or skills, leading to impulsive decisions. This mindset often results in excessive trading, larger losses, and increased exposure to market volatility.

How can overconfidence impact trading performance?

Overconfidence leads traders to underestimate risks, take larger positions, and ignore warning signs, increasing the chance of bigger losses. It causes them to believe they know more than they do, resulting in impulsive decisions and poor risk management. This mindset can lead to frequent overtrading and ignoring market signals, ultimately undermining trading performance and profitability.

What psychological biases are linked to overconfidence?

Overconfidence in trading often stems from biases like overestimation bias, where traders believe they're better than they are, and the illusion of control, making them think they can predict market movements accurately. Confirmation bias also plays a role, causing traders to focus only on information that supports their optimistic view. These biases lead traders to underestimate risks, take larger positions, and ignore warning signs, increasing the chance of significant losses.

How can traders recognize overconfidence?

Traders recognize overconfidence when they take excessive risks, trade too frequently, or ignore market signals. They often believe they have superior knowledge, leading to larger positions and reluctance to cut losses. Signs include overestimating their accuracy, dismissing warning signs, and feeling invincible after wins. Overconfidence shows in inconsistent decision-making and ignoring proper risk management.

What strategies help reduce overconfidence in trading?

To reduce overconfidence in trading, set strict risk management rules, stick to a predefined trading plan, analyze past mistakes honestly, and avoid impulsive trades driven by emotions. Use stop-loss orders to limit losses and review your trades regularly to identify overestimations. Keep learning and stay cautious about your success stories, acknowledging that markets are unpredictable.

Does overconfidence affect different types of traders equally?

No, overconfidence impacts different types of traders unevenly. Experienced traders might underestimate risks, but novice traders often overestimate their skills, making overconfidence more risky for them. Day traders might take bigger, impulsive bets, while long-term investors may ignore warning signs due to overconfidence. The effect varies with trading style, experience, and risk tolerance.

Can overconfidence lead to poor risk management?

Yes, overconfidence can lead to poor risk management by causing traders to underestimate potential losses and take on larger, riskier positions without proper analysis. It often results in ignoring warning signs and overestimating their ability to predict market moves, increasing the chance of significant losses.

What role does experience play in overconfidence?

Experience can reduce overconfidence in trading by providing better market insights and realistic risk assessment. Traders with more experience tend to recognize their limits and avoid overestimating their abilities. However, inexperienced traders often overestimate their knowledge, leading to higher overconfidence and increased trading risks. Overconfidence from lack of experience can cause reckless decisions, while seasoned traders tend to be more cautious, balancing confidence with awareness of uncertainties.

How can traders improve decision-making despite overconfidence?

Traders can improve decision-making despite overconfidence by sticking to a disciplined trading plan, using stop-loss orders, and regularly reviewing past trades to identify biases. Keeping a trading journal helps recognize overconfidence patterns, while seeking diverse opinions prevents overestimating personal judgment. Practicing humility and sticking to data rather than gut feelings also reduces risky overconfidence.

Conclusion about What Is the Impact of Overconfidence on Trading Risks?

In summary, overconfidence can significantly skew trading decisions and heighten risks, often leading to detrimental outcomes. It manifests in various forms, from underestimating market volatility to overtrading. Traders must recognize the signs of overconfidence and implement strategies like thorough analysis and disciplined risk management to mitigate its effects. By fostering a more balanced perspective, traders can improve their decision-making and enhance overall performance. For more in-depth insights and support, DayTradingBusiness is here to help you navigate the complexities of trading.