Did you know that over 90% of traders fail, often due to psychological factors rather than market conditions? In the world of day trading, understanding the influence of psychology is crucial for managing risks and making sound decisions. This article delves into how emotions like fear, greed, and overconfidence can skew trading judgments and lead to impulsive choices. It also highlights the importance of discipline and emotional control in trading success, while addressing common psychological biases and their impact on performance. By recognizing and managing these psychological risks, traders can enhance their decision-making process and improve their overall outcomes. Join DayTradingBusiness as we explore the intricate relationship between psychology and day trading risk.

How Does Psychology Affect Day Trading Decisions?

Psychology influences day trading risk by shaping traders’ emotions like fear and greed, which can lead to impulsive decisions and overtrading. Fear of losing causes hesitation or premature exits, while greed drives risky bets. Overconfidence from recent wins can lead to larger, ill-considered trades, increasing risk. Emotional responses often override rational analysis, making traders chase losses or hold onto losing positions longer. Managing emotions and maintaining discipline are crucial to controlling trading risk influenced by psychology.

What Role Do Emotions Play in Day Trading Risks?

Emotions like fear and greed drive impulsive decisions, increasing day trading risks. Fear can cause premature exits, missing gains, while greed leads to overtrading or holding losing positions. Emotional reactions distort judgment, making traders ignore their strategies and risk management. Managing feelings is crucial to avoid reckless trades and keep a clear, disciplined mindset.

How Can Fear Impact Day Trading Performance?

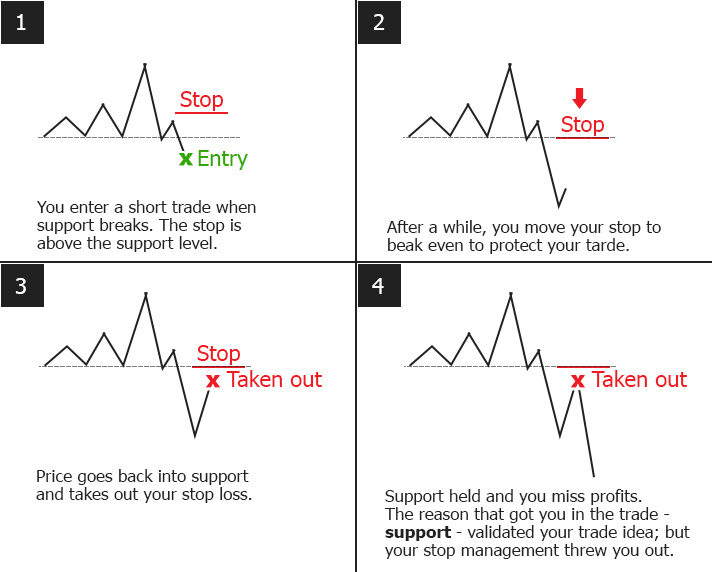

Fear can cause panic selling or hesitation, leading to missed opportunities or losses. It triggers emotional decisions instead of logical analysis, increasing the risk of impulsive trades. Fear also makes traders hesitant to take calculated risks, limiting profit potential. Overcoming fear improves discipline, helping traders stick to strategies and manage risk effectively.

How Does Overconfidence Increase Trading Risks?

Overconfidence makes traders underestimate risks, leading them to take bigger, riskier trades without proper analysis. It blinds traders to potential losses, causing them to ignore warning signs and overtrade. This false sense of skill pushes them into risky positions, increasing the chance of significant losses. Overconfidence also reduces caution, making traders less likely to set stop-losses or diversify, amplifying trading risks.

Why Is Discipline Important in Day Trading Psychology?

Discipline keeps traders focused and prevents impulsive decisions, reducing emotional mistakes that increase risk. It helps stick to trading plans, avoiding revenge trading or overtrading after losses. Strong discipline maintains consistency, which stabilizes emotional swings and preserves capital. Without discipline, fear and greed dominate, leading to poor risk management and bigger losses.

How Do Stress and Anxiety Influence Trading Outcomes?

Stress and anxiety impair decision-making, making traders more impulsive or hesitant. High stress levels cause emotional reactions that lead to poor risk management, like overtrading or holding onto losing positions. Anxiety fuels fear of missing out or panic selling, increasing losses. When traders are overwhelmed, they struggle to follow their strategies, raising the chance of costly mistakes. Managing stress and anxiety helps maintain focus, discipline, and rational choices, improving trading outcomes.

What Are Common Psychological Biases in Day Trading?

Common psychological biases in day trading include overconfidence, which makes traders take bigger risks; herd behavior, causing them to follow the crowd without analysis; loss aversion, leading to holding losing positions too long; and confirmation bias, where traders only see information that supports their views. Fear and greed also drive impulsive decisions, increasing risk. These biases distort judgment and can cause costly mistakes in day trading.

How Can Impulsivity Lead to Poor Trading Choices?

Impulsivity makes traders jump into trades without proper analysis, leading to rash decisions. It fuels emotional reactions like panic selling or overconfidence, ignoring market signals. Impulsive traders often chase quick gains, risking bigger losses. This behavior undermines discipline, causing inconsistent strategies. Ultimately, impulsivity clouds judgment, increasing the likelihood of costly mistakes in day trading.

How Does Loss Aversion Affect Trader Behavior?

Loss aversion makes traders fear losses more than they value gains, prompting them to hold onto losing positions too long or sell winners early. This bias leads to risk-averse decisions that can cause missed opportunities or larger losses. Traders may avoid taking needed risks, sticking to familiar trades to avoid regret. It pushes traders toward emotional reactions instead of rational analysis, increasing impulsive moves. Overall, loss aversion skews trading behavior, often undermining disciplined risk management.

What Is the Impact of Greed on Day Trading Risks?

Greed amplifies risk in day trading by pushing traders to chase bigger gains without proper analysis, leading to impulsive decisions and large losses. It blinds traders to warning signs, encouraging overleveraging and ignoring risk management. Greed can cause traders to hold onto losing positions longer, hoping for a turnaround, which increases financial risk. Overall, greed distorts judgment, making day trading riskier and more unpredictable.

Learn about How Do Fear and Greed Impact Day Trading Decisions?

How Can Mindset Improve Trading Success?

A strong, positive mindset helps traders stay calm and focused during volatile markets, reducing impulsive decisions. It builds resilience against losses, preventing emotional reactions from spiraling into bigger mistakes. Confidence rooted in a healthy mindset enables better risk management, like sticking to stop-losses and not overleveraging. When traders manage stress and maintain discipline, they avoid panic selling or greed-driven trades. Overall, mindset shapes reactions to market swings, directly influencing trading outcomes and long-term success.

How Do Cognitive Biases Skew Trading Judgments?

Cognitive biases distort trading judgments by clouding judgment and leading to poor decisions. For example, overconfidence makes traders underestimate risks, while herd mentality pushes them to follow the crowd without analysis. Confirmation bias causes traders to focus only on information that supports their existing positions, ignoring signs of risk. Loss aversion makes traders hold onto losing trades longer, hoping to recover losses, instead of cutting them early. These biases distort risk assessment, leading to impulsive trades, missed opportunities, and bigger losses in day trading.

Learn about How Do Cognitive Biases Affect Trading Risk Management?

How Important Is Emotional Control in Risk Management?

Emotional control is crucial in risk management because it prevents impulsive decisions that can lead to big losses. When traders stay calm, they stick to their strategies and avoid panic or greed that clouds judgment. Strong emotional control helps traders assess risks objectively, making smarter choices instead of reacting emotionally to market swings. Without it, fear and greed can cause reckless trades, increasing the chance of losing capital. In day trading, mastering emotions directly protects your risk management and improves long-term success.

How Does Psychological Fatigue Affect Trading Accuracy?

Psychological fatigue reduces focus and decision-making clarity, leading traders to make impulsive or sloppy trades. It impairs judgment, causing missed signals or overtrading, which increases risk. When mentally drained, traders are less able to stick to strategies, making emotional choices that hurt accuracy. Fatigue clouds perception, making it harder to assess market conditions accurately, often resulting in costly mistakes.

How Can Traders Manage Psychological Risks Effectively?

Traders manage psychological risks by staying disciplined, controlling emotions, and sticking to a solid trading plan. They avoid impulsive decisions by setting predefined stop-loss and take-profit levels. Regularly reviewing trades helps identify emotional patterns that lead to mistakes. Practicing mindfulness reduces stress and improves focus during volatile markets. Building confidence through education and experience prevents panic selling or overtrading. Avoiding revenge trading after losses keeps emotions in check. Overall, maintaining a balanced mindset and realistic expectations minimizes the negative impact of psychology on day trading risk.

Conclusion about How Does Psychology Influence Day Trading Risk?

Understanding the psychological factors that influence day trading is crucial for achieving success in the financial markets. Traders must recognize how emotions like fear and greed, cognitive biases, and stress can skew their judgment and decision-making processes. By cultivating discipline, emotional control, and a strong mindset, traders can mitigate risks and enhance their performance. DayTradingBusiness offers valuable insights to help you navigate these psychological challenges, empowering you to make informed trading choices and ultimately improve your trading outcomes.

Learn about How Liquidity and Depth Influence Day Trading Decisions