Did you know that even the most seasoned traders can feel as jittery as a cat in a room full of rocking chairs? Confidence plays a pivotal role in trading success, influencing decision-making and risk tolerance. In this article, we delve into how confidence can fluctuate, why it matters, and the impact it has on your trading outcomes. Explore the connection between emotional confidence and market conditions, the dangers of overconfidence, and the importance of self-assessment. Learn how to build consistent trading confidence and manage the psychological aspects that can lead to missed opportunities or emotional trading. Join DayTradingBusiness as we uncover the nuances of confidence in the trading world.

How Does Confidence Influence Trading Success?

Confidence boosts decision-making, helping traders stick to their strategies and avoid hesitation. When confidence is high, traders are more likely to act decisively, seize opportunities, and follow their plan. However, overconfidence can lead to risky trades and ignoring warning signs. Fluctuating confidence causes emotional swings—fear can make traders exit too early, while overconfidence might push them into reckless moves. Steady, realistic confidence helps maintain discipline and improves overall trading outcomes.

Why Does Trading Confidence Fluctuate Over Time?

Trading confidence fluctuates due to emotional reactions to wins or losses, market volatility, and personal experiences. When trades go well, confidence rises, encouraging risk-taking; losses shake it, leading to hesitation or overconfidence. Market unpredictability amplifies these swings, as traders react emotionally instead of logically. This constant ebb and flow of confidence impacts decision-making, sometimes causing impulsive trades or missed opportunities. Confidence changes are natural, but they directly influence trading outcomes by shaping risk appetite and discipline.

How Can Overconfidence Harm My Trading Results?

Overconfidence can cause you to take bigger risks, ignore warning signs, and overtrade. It leads to overestimating your abilities, making impulsive decisions that increase losses. When you’re too confident, you may dismiss market signals, hold onto losing trades, or ignore proper risk management. This often results in larger drawdowns and reduced overall profitability.

What Causes Confidence to Drop in Trading?

Confidence drops in trading due to losing streaks, unexpected market moves, and emotional stress. When trades go against expectations, traders doubt their skills and decisions. Fear of further losses can lead to hesitation or impulsive moves, worsening outcomes. Overtrading or taking unnecessary risks also erodes confidence. Negative feedback loops—losing trades, self-criticism—damage belief in abilities. Market volatility and uncertainty shake trust in predictions, causing confidence to fluctuate.

How Does Emotional Confidence Impact Decision Making?

Emotional confidence boosts clarity and reduces hesitation in trading, leading to more decisive actions. When confident, traders stick to their strategies, avoid impulsive moves, and handle losses better. Conversely, low confidence causes doubt, overtrading, and panic selling, which damage outcomes. Fluctuating confidence makes traders unpredictable, increasing risk of mistakes and missed opportunities. Stable emotional confidence helps maintain discipline and improves overall trading results.

Can Lack of Confidence Lead to Missed Opportunities?

Yes, lack of confidence can cause traders to hesitate or second-guess decisions, leading to missed opportunities in the market. When confidence drops, traders may avoid entering trades or exit too early, missing potential gains. Fluctuating confidence impacts risk-taking and decision-making, directly affecting trading outcomes.

How Do Market Conditions Affect Trading Confidence?

Market conditions directly impact trading confidence; strong, stable markets boost trust in decisions, while volatile or declining markets cause doubt. When markets are predictable and trending, traders feel more secure, leading to larger, more decisive moves. Conversely, sudden swings or economic uncertainty erode confidence, making traders hesitant or overly cautious. This fluctuation influences trading outcomes—confidence encourages risk-taking and can improve profits, but overconfidence during volatile times increases the chance of losses. Unstable conditions often lead to emotional trading, risking poor decisions and inconsistent results.

What Role Does Self-Assessment Play in Confidence Levels?

Self-assessment helps traders recognize their strengths and weaknesses, boosting confidence when skills improve and highlighting areas needing growth. Accurate self-evaluation reduces emotional trading and impulsive decisions, leading to more consistent outcomes. When traders honestly assess their performance, they build trust in their abilities, which stabilizes confidence and improves risk management. Conversely, poor self-assessment can cause overconfidence or doubt, destabilizing trading results.

How Does Risk Tolerance Change with Confidence?

As confidence rises, traders often take bigger risks, believing they can handle potential losses. When confidence dips, they tend to play it safe, reducing risk exposure. Fluctuating confidence leads to inconsistent risk tolerance, causing traders to overreach during overconfidence and be cautious when unsure. This imbalance can impact trading outcomes, increasing losses when overconfident and missed opportunities when too cautious. Confidence directly influences how much risk a trader is willing to accept at any given moment.

Why Do Traders Experience Confidence Swings During Losses?

Traders experience confidence swings during losses because setbacks challenge their beliefs, causing doubt. When trades go wrong, fear and frustration seep in, shaking their self-trust. This dip in confidence can lead to hesitation or impulsive decisions, worsening losses. Conversely, some traders might become overconfident after small wins, risking bigger mistakes. These emotional shifts stem from the psychological rollercoaster of trading, directly impacting decision-making and overall results.

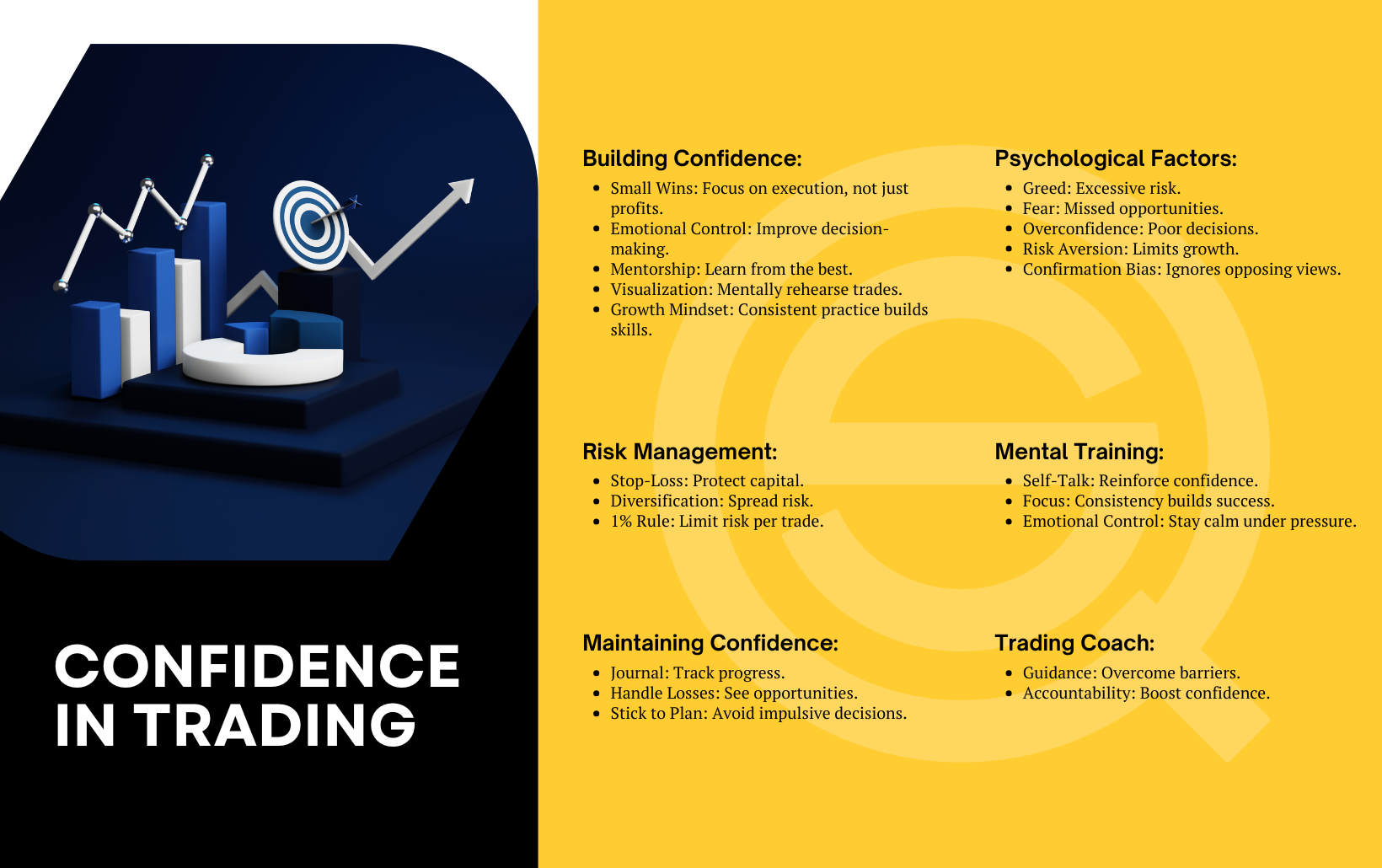

How Can I Build Consistent Trading Confidence?

Build consistent trading confidence by sticking to a proven plan, managing risk carefully, and learning from each trade. Confidence fluctuates with wins and losses, making you overtrust or hesitant. Recognize these swings, stay disciplined, and focus on process over results to keep confidence steady and improve trading outcomes.

What Is the Link Between Confidence and Trading Discipline?

Confidence in trading boosts decision-making and risk-taking, but too much can lead to overconfidence and reckless trades. When confidence wanes, traders may hesitate, second-guess, or exit positions prematurely, causing missed opportunities or losses. Fluctuating confidence affects discipline: high confidence can make traders stick to their strategy, while low confidence may lead to impulsive or abandoned plans. Maintaining a realistic level of confidence helps sustain disciplined trading, reducing emotional reactions and promoting consistent, strategic decisions.

How Does Confidence Affect Use of Trading Strategies?

Confidence influences how boldly traders follow their strategies. High confidence can lead to sticking with proven plans, but it might cause overtrading or ignoring risks. Low confidence makes traders second-guess decisions, causing hesitation or missed opportunities. Fluctuating confidence can lead to inconsistent application of strategies, increasing volatility in trading outcomes. Proper confidence helps balance risk-taking and discipline, improving overall success.

Learn about How Do Prop Firms Affect Day Trading Strategies?

Can Confidence Fluctuations Lead to Emotional Trading?

Yes, confidence fluctuations can lead to emotional trading. When traders feel overly confident, they might take bigger risks, ignoring signs of danger. Conversely, when confidence dips, they may second-guess themselves, hesitate, or exit trades prematurely. These emotional swings cause impulsive decisions, increasing the chance of losses. Fluctuating confidence fuels impulsive actions driven by fear or greed, directly impacting trading outcomes.

How Do Successful Traders Manage Confidence?

Successful traders manage confidence by staying disciplined and sticking to their trading plan, regardless of emotional swings. They recognize confidence can fluctuate based on wins or losses and avoid overtrading or reckless decisions when feeling overly confident. They analyze their mistakes objectively to rebuild trust in their strategy. Maintaining a balanced mindset helps prevent overconfidence from clouding judgment and ensures they stay focused on consistent, data-driven decisions.

What Is the Impact of Confidence on Trading Psychology?

Confidence in trading boosts decision-making and risk-taking, often leading to better outcomes when justified. When confidence is high but unwarranted, traders may take reckless risks, increasing losses. Fluctuating confidence causes emotional swings—overconfidence can lead to impulsive trades, while doubt causes hesitation and missed opportunities. Consistent confidence grounded in analysis helps maintain discipline and improves long-term results. Conversely, wavering confidence erodes focus, raises stress, and hampers rational judgment, negatively impacting trading outcomes.

Conclusion about How Does Confidence Fluctuate and Affect Trading Outcomes?

In conclusion, confidence plays a crucial role in trading outcomes, influencing decision-making, risk tolerance, and overall success. Understanding the factors that cause fluctuations in confidence can empower traders to manage their emotions and avoid pitfalls like overconfidence and missed opportunities. By building consistent trading confidence and maintaining discipline, traders can navigate market conditions more effectively. For further insights and strategies to enhance your trading journey, explore the resources available at DayTradingBusiness.