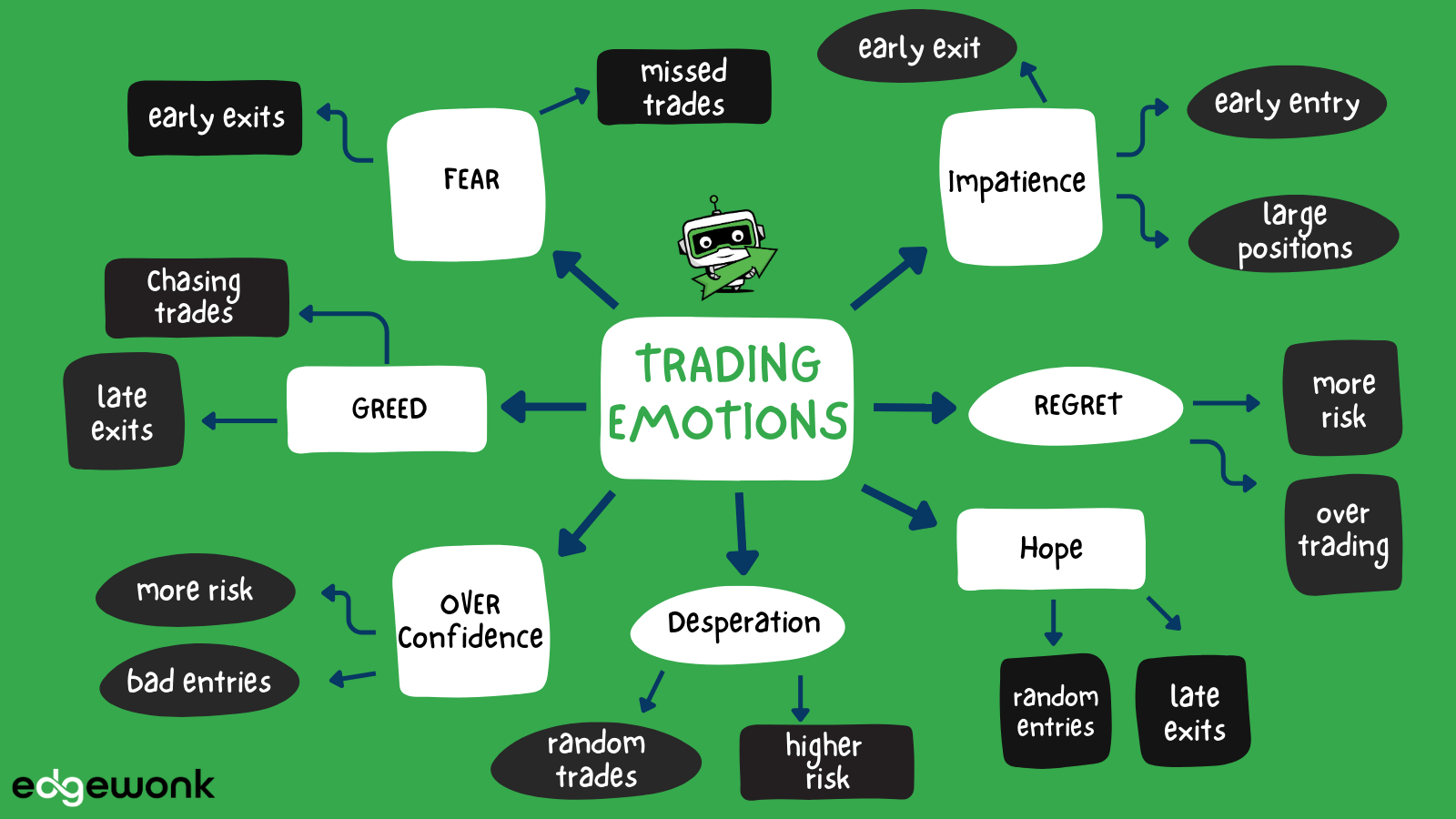

Did you know that some traders experience adrenaline spikes similar to skydivers before making big trading decisions? In the high-stakes world of day trading, emotions like fear and greed play pivotal roles in shaping traders' decisions. This article dives into how fear influences choices, prompting sudden sell-offs, while greed can lead to overtrading and holding onto losing positions. We’ll explore emotional triggers, risk management strategies, and the psychological effects of these powerful feelings. Discover how traders can maintain discipline and balance between fear and greed for more effective trading with insights from DayTradingBusiness.

How Does Fear Influence Day Trading Choices?

Fear makes day traders hesitate or exit trades too early, often locking in losses or missing gains. It triggers panic selling during market dips, amplifying losses. Fear also causes traders to avoid risk, leading to missed opportunities. Instead of sticking to their strategy, they might panic and make impulsive decisions. Overall, fear reduces confidence, increases stress, and skews judgment, making day trading riskier.

What Role Does Greed Play in Day Trading?

Greed drives traders to chase bigger gains, often leading to impulsive decisions and risking too much. It can cause them to hold onto winning positions too long or enter risky trades hoping for quick profits. Greed pushes traders to ignore warnings and overlook risk management, increasing chances of significant losses. It creates a cycle where the desire for bigger wins clouds judgment and leads to emotional trading.

Can Fear Cause Traders to Make Sudden Sell-offs?

Yes, fear can trigger traders to sell suddenly, especially during market dips or unexpected volatility. When traders panic, they often prioritize quick exit to avoid losses, causing rapid sell-offs. Fear amplifies negative sentiment, leading to impulsive decisions rather than strategic moves.

How Does Greed Lead to Overtrading?

Greed pushes traders to chase bigger gains, making them trade more frequently and hold positions longer than they should. This overconfidence fuels impulsive decisions, ignoring risk management. As greed grows, traders ignore signs to exit, leading to excessive trades and potential losses. It clouds judgment, making them prioritize quick wins over strategic planning.

What Are Common Emotional Triggers for Day Traders?

Common emotional triggers for day traders include fear of losing money and greed for quick profits. Fear causes hesitation, leading to missed opportunities or premature exits. Greed pushes traders to hold onto positions too long, risking bigger losses. Both emotions can cloud judgment, causing impulsive trades and poor risk management. Fear often triggers panic selling, while greed drives overtrading and chasing high-risk setups. Recognizing these triggers helps traders stick to their strategies.

How Do Fear and Greed Affect Risk Management?

Fear makes traders exit positions too early or avoid risks, leading to missed opportunities. Greed pushes traders to hold on too long or take excessive risks, risking bigger losses. Both emotions can cause irrational decisions, disrupting disciplined risk management. Fear can trigger panic selling during dips, while greed may encourage overleveraging during rallies. Managing these emotions is crucial for consistent day trading risk control.

Why Do Traders Often Panic During Market Drops?

Traders panic during market drops because fear triggers a fight-or-flight response, making them want to sell quickly to avoid further losses. Greed also plays a role, as traders may hold on hoping for a rebound, but when fear dominates, they sell impulsively. This emotional reaction clouds judgment, leading to hasty decisions and increased market volatility. Fear and greed amplify each other, causing traders to react emotionally rather than strategically during downturns.

How Does Greed Lead to Holding Losing Positions?

Greed pushes traders to hold onto losing positions hoping they’ll rebound, even when evidence suggests otherwise. It fuels the desire for bigger gains, making traders ignore stop-loss signals and cling to hope. This emotional grip prevents quick exits, turning small losses into bigger ones. Instead of cutting losses early, greed tricks traders into riding the wave, risking more capital and increasing the chance of substantial losses.

What Strategies Help Control Fear in Day Trading?

Breathing exercises and staying disciplined help control fear in day trading. Setting strict stop-loss orders and sticking to a plan reduces emotional reactions. Limiting trades to well-researched setups prevents impulsive decisions driven by fear. Practicing mindfulness keeps emotions in check during volatile moments. Accepting losses as part of trading reduces panic, and maintaining a balanced mindset prevents greed from fueling risky moves.

How Can Traders Manage Greed During Bull Runs?

Traders manage greed during bull runs by setting strict profit targets and stop-loss points, sticking to pre-planned exit strategies, and avoiding the temptation to chase every high. They stay disciplined, maintain emotional control, and focus on consistent gains instead of impulsive moves. Using risk management tools like position sizing helps prevent overexposure. Regularly reviewing their trading plan keeps greed in check and encourages rational decision-making amid market euphoria.

Learn about How Do Institutional Traders Manage Risk During Day Trading?

What Are the Psychological Effects of Fear and Greed?

Fear and greed heavily influence day trading decisions. Fear causes traders to panic sell, locking in losses and missing potential rebounds. Greed pushes traders to hold onto winning positions too long, risking larger losses. These emotions lead to impulsive moves, reducing rational analysis. Fear can lead to hesitation, causing missed opportunities, while greed fuels risky trades for quick profits. Both emotions cloud judgment, increasing trading volatility and mistakes.

How Do Emotions Impact Trading Discipline?

Fear and greed directly influence day trading discipline by causing impulsive decisions. Fear prompts traders to exit trades prematurely or avoid taking risks, leading to missed opportunities. Greed pushes traders to hold onto positions too long or chase after quick profits, risking larger losses. Both emotions can override logical analysis, causing inconsistency and poor judgment. Staying disciplined requires recognizing these feelings and sticking to a well-defined trading plan.

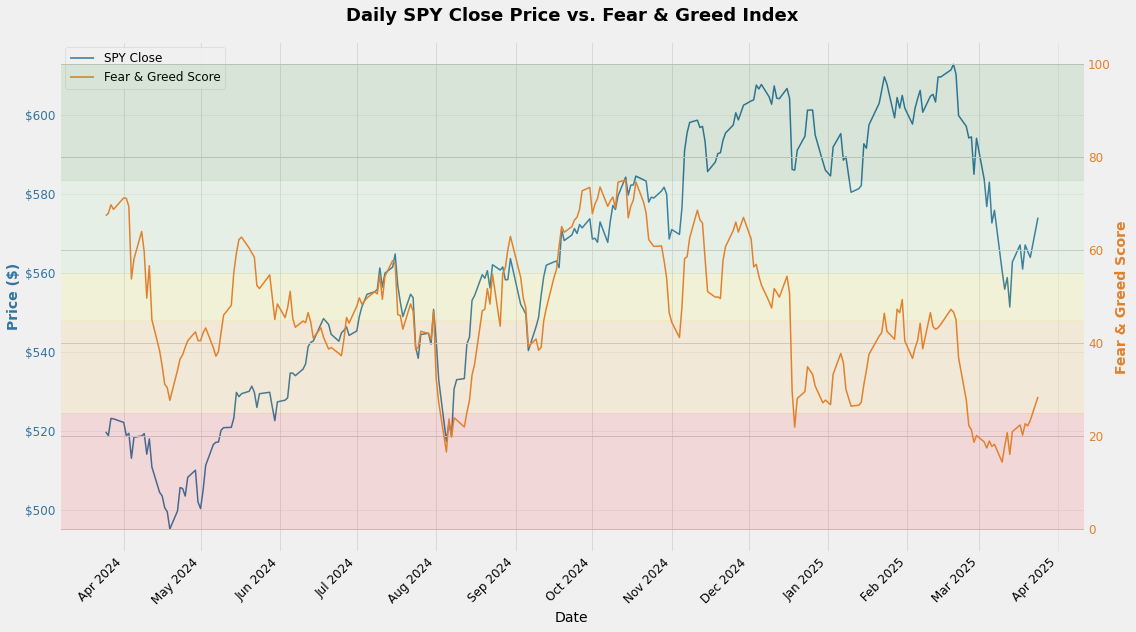

Can Fear and Greed Cause Market Fluctuations?

Yes, fear and greed drive emotional reactions that cause market fluctuations. When traders panic and sell in fear, prices drop quickly. Conversely, greed pushes traders to buy aggressively, inflating bubbles. These emotional swings lead to rapid, unpredictable price movements in day trading.

How Do Emotional Biases Affect Trading Decisions?

Fear causes traders to panic sell, locking in losses and missing gains. Greed pushes traders to chase quick profits, risking bigger losses and overtrading. Both biases cloud judgment, leading to impulsive moves instead of strategic decisions. Fear often makes traders exit too early, while greed makes them hold on too long. These emotional biases distort risk assessment and undermine disciplined trading.

Learn about How Do Cognitive Biases Affect Trading Risk Management?

What Tips Help Maintain Balance Between Fear and Greed?

Set strict trading rules and stick to them to avoid impulsive moves driven by fear or greed. Use stop-loss orders to limit losses and take profits at predefined levels to prevent greed from eroding gains. Practice disciplined risk management, risking only a small percentage of your capital per trade. Keep emotions in check by reviewing your trading plan regularly, and avoid chasing after big wins or panicking during losses. Stay focused on the long-term strategy instead of short-term market swings.

Conclusion about How Do Fear and Greed Impact Day Trading Decisions?

In conclusion, understanding the impact of fear and greed on day trading decisions is crucial for success. These emotions can lead to impulsive actions, such as sudden sell-offs and overtrading, ultimately jeopardizing a trader's strategy and risk management. By recognizing common emotional triggers and implementing effective strategies to control these feelings, traders can enhance their discipline and decision-making. For further insights and support in navigating these psychological challenges, DayTradingBusiness offers valuable resources to help traders maintain a balanced approach.

Learn about How Do Prop Firms Impact Day Trading Profitability?