Did you know that the average person makes about 35,000 decisions each day? When it comes to day trading, one of the most critical choices you’ll face is position sizing. This article dives into the essentials of position sizing in day trading, explaining its significance and how it impacts your overall trading strategy. We’ll explore how to determine the right position size based on factors like account size, risk management, and volatility. Additionally, we’ll discuss common mistakes traders make, the role of stop-loss placements, and how leveraging can alter your approach. By understanding these elements, you can enhance your trading consistency and make informed decisions. With insights from DayTradingBusiness, you'll be well-equipped to navigate the complexities of position sizing.

What is position sizing in day trading?

Position sizing in day trading is how much money you allocate to each trade. It determines your risk level per trade based on your account size and stop-loss distance. Proper sizing helps manage risk, prevent big losses, and maximize potential gains. For example, risking 1% of your account on each trade keeps losses limited if the market moves against you.

Why is position sizing important in day trading?

Position sizing in day trading controls risk, ensuring no single trade can wipe out your account. It helps manage volatility and prevents overexposure to unpredictable market moves. Proper sizing keeps your trades consistent, so you can stay in the game longer and avoid catastrophic losses. It also aligns with your risk tolerance, allowing you to trade confidently without risking too much on one move.

How do traders determine the right position size?

Traders determine the right position size by assessing their risk tolerance, account size, and the amount they’re willing to lose per trade. They usually set a maximum percentage of their account (like 1-2%) to risk on each trade. Then, they calculate position size based on the stop-loss distance, ensuring the potential loss doesn’t exceed that limit. For example, if risking 1% of a $10,000 account and the stop-loss is $1 away, they buy 100 shares. This method balances potential gains with manageable risk.

What factors influence position sizing decisions?

Risk tolerance, account size, trade setup quality, stop-loss distance, market volatility, and overall trading strategy influence position sizing decisions in day trading.

How does risk management relate to position sizing?

Risk management directly influences position sizing by determining how much capital to allocate to each trade based on acceptable risk levels. Proper position sizing ensures you don’t risk too much of your account on a single trade, aligning with your overall risk management strategy. It helps control potential losses, keeping them within your predefined risk limits.

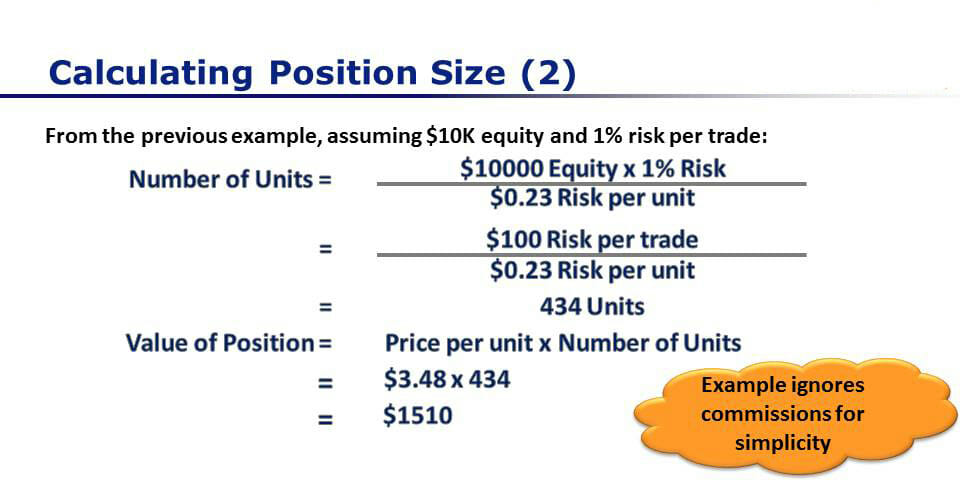

What is the formula for calculating position size?

Position size in day trading is calculated by dividing your risk per trade by the stop-loss amount. The formula is:

Position Size = (Account Equity × Risk Percentage) / Stop-Loss in Dollars

For example, if you have a $10,000 account, risk 1% ($100) per trade, and your stop-loss is $2 away, then:

Position Size = $100 / $2 = 50 shares.

How does account size affect position sizing?

Larger accounts can take bigger positions because they have more capital, reducing the risk of ruin. Smaller accounts need to limit position size to avoid over-leverage and excessive risk. Account size determines the percentage of capital you risk per trade—larger accounts can diversify better, while smaller accounts must be more conservative. Ultimately, bigger accounts allow for more flexible, higher position sizing without jeopardizing overall capital.

What role does stop-loss placement play in position sizing?

Stop-loss placement determines how much you risk on a trade, directly influencing your position size. Setting a tight stop-loss limits your potential loss per trade, allowing you to take a larger position without risking too much capital. Conversely, a wider stop-loss reduces your position size to stay within your risk tolerance. Proper placement ensures your position size aligns with your risk management rules, preventing big losses from unexpected market moves.

How can leverage impact position sizing strategies?

Leverage enhances position sizing by allowing you to control larger trades with less capital, amplifying potential gains. Use leverage carefully to avoid overexposure, as it also increases risk. Adjust your position size based on your account size and risk tolerance, ensuring leverage boosts your trading efficiency without exposing you to outsized losses. Proper leverage application means smaller, more strategic trades that maximize your capital’s potential in day trading.

What are common mistakes in setting position sizes?

Common mistakes in setting position sizes include risking too much capital per trade, ignoring account size, and not adjusting for volatility. Traders often use fixed dollar amounts without considering market conditions, leading to oversized positions. Overestimating the size they can handle can cause big losses. Ignoring stop-loss levels when sizing positions increases risk. Not diversifying or spreading risk across multiple trades also leads to poor position sizing.

How does volatility influence position sizing?

Volatility determines position size by affecting risk levels; higher volatility means larger price swings, so traders reduce position size to limit potential losses. Conversely, lower volatility allows for bigger positions since price movements are more stable. This balance helps traders manage risk and avoid overexposure during unpredictable market swings.

What is the risk/reward ratio in position sizing?

The risk/reward ratio in position sizing determines how much you're willing to risk for a potential reward on each trade. It helps you decide how big your position should be to maximize gains while limiting losses. A favorable ratio, like 1:3, means risking $1 to make $3, guiding how much capital to allocate per trade based on your risk tolerance. Proper position sizing ensures you don’t overexpose yourself and maintains steady growth in day trading.

How do different trading styles affect position sizing?

Different trading styles impact position sizing because each style involves varying risk levels and trade frequencies. Day traders often use smaller positions to manage quick, frequent trades and limit losses. Swing traders might take larger positions since they hold over days or weeks, risking more per trade. Scalpers prefer tiny positions to capitalize on small price moves without exposing too much capital. Position size adjusts based on the trader’s risk tolerance, trade duration, and market volatility, ensuring each trade aligns with their overall risk management strategy.

Can position sizing improve trading consistency?

Yes, proper position sizing in day trading helps control risk, prevents large losses, and maintains consistency. It ensures you trade the right amount based on your account size and risk tolerance, leading to more stable results over time.

What tools or software can help with position sizing?

Tools like MetaTrader, TradingView, and ThinkorSwim offer position sizing calculators. Online calculators such as Myfxbook Position Size Calculator or Forex Position Size Calculator help determine trade size based on risk percentage and stop-loss. Some broker platforms have built-in position sizing tools. Excel spreadsheets can also be customized for precise position sizing calculations.

Conclusion about What Is Position Sizing in Day Trading?

In summary, position sizing is a critical component of successful day trading, influencing risk management and overall trading performance. By understanding the factors that affect position size, such as account size, volatility, and stop-loss placement, traders can make informed decisions that enhance their strategies. Utilizing effective tools and maintaining awareness of common mistakes can further improve trading consistency. For comprehensive insights and tailored guidance on position sizing and other trading topics, refer to DayTradingBusiness.

Learn about What are the dangers of improper position sizing in day trading?