Did you know that the average person spends about two years of their life waiting at red lights? While waiting might not be your favorite activity, smart traders know that being patient with position sizing can save you from disastrous losses. In this article, we’ll explore the essentials of position sizing in trading, including its definition, how it helps limit losses, and the best methods for calculating your position size. We'll also cover crucial aspects like determining your risk per trade, the importance of stop-loss orders, and how account size and market volatility affect your strategies. Plus, you'll learn to avoid common mistakes and discover tools that can enhance your trading consistency. Join us at DayTradingBusiness to master position sizing and protect your investments effectively!

What is position sizing in trading?

Position sizing in trading is deciding how much money to invest in a single trade. It determines the number of units or contracts based on your account size and risk tolerance. Proper position sizing helps limit losses by controlling how much you risk on each trade relative to your total capital. For example, risking 1% of your account on a trade means your position size adjusts to ensure you don't lose more than that if the market moves against you.

How does position sizing help limit losses?

Position sizing controls the amount of capital risked per trade, so smaller positions reduce potential losses. By setting a fixed percentage of your trading capital, you prevent one trade from depleting your account. It ensures losses stay within your risk tolerance, making it easier to recover from setbacks. Proper position sizing acts as a safeguard, keeping losses manageable even during volatile markets.

What are the best methods for calculating position size?

The best methods for calculating position size include the fixed fractional method, where you risk a set percentage of your trading capital per trade, and the Kelly criterion, which adjusts size based on win probability and payout. Use stop-loss levels to determine how much you’re willing to lose on a trade, then divide that by the distance to your entry point. This gives you the number of units or contracts to trade, ensuring losses stay within your risk tolerance. Always align position size with your account size and risk appetite to limit losses effectively.

How do I determine my risk per trade?

Calculate your risk per trade by deciding how much money you're willing to lose on a single trade, usually 1-2% of your trading capital. Identify your stop-loss level for the trade, then subtract it from your entry price to find the dollar amount you're risking per share or contract. Divide your total risk dollar amount by that per-share risk to determine your position size. For example, if you're willing to risk $200 and your stop-loss is $2 away from your entry, trade 100 shares ($200 / $2). This keeps losses controlled and aligns your trade size with your risk tolerance.

What is the role of stop-loss in position sizing?

Stop-loss in position sizing limits potential losses by automatically closing a trade when the price moves against you beyond a set point. It helps manage risk, ensuring you don’t lose more than your predefined amount on a single trade. Incorporating stop-loss into position sizing keeps your overall risk consistent and protects your capital from large, unexpected downturns.

How can I use position sizing to manage my trading risk?

Use position sizing by calculating the dollar amount you're willing to risk per trade, typically 1-2% of your trading capital. Determine your stop-loss level to know how much the trade could lose if it hits your limit. Adjust your position size so that the potential loss matches your risk percentage, ensuring no single trade can wipe out your account. For example, if your account is $10,000 and you risk 1%, that's $100 per trade; if your stop-loss is $1 per share, buy only 100 shares. This keeps risk controlled and helps prevent large losses from volatile swings.

What are common mistakes in position sizing?

Common mistakes in position sizing include risking too much on a single trade, ignoring account size, not adjusting size for volatility, and neglecting stop-loss levels. Traders often over-leverage, underestimate market moves, or fail to diversify, leading to unnecessary large losses. They also forget to recalibrate position sizes as account balance changes or ignore the importance of aligning size with their risk tolerance.

How does account size influence position sizing?

Larger accounts allow for bigger position sizes, reducing the impact of small losses relative to total capital. Smaller accounts require smaller positions to avoid risking too much on a single trade. Account size determines the percentage of capital you risk per trade, shaping your position size to control potential losses. Bigger accounts can absorb larger trades without risking significant capital, while smaller accounts need precise sizing to prevent rapid drawdowns.

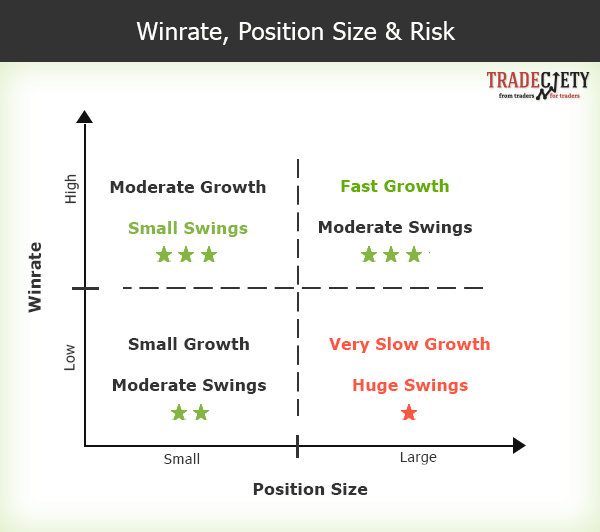

How can position sizing improve my trading consistency?

Using position sizing limits your losses by controlling how much you risk on each trade. It prevents large losses from single bad trades, helping you stay in the game longer. Proper position sizing keeps your risk consistent, so your trading doesn't spiral out of control after a few mistakes. It makes your results more predictable and easier to manage, boosting overall trading discipline.

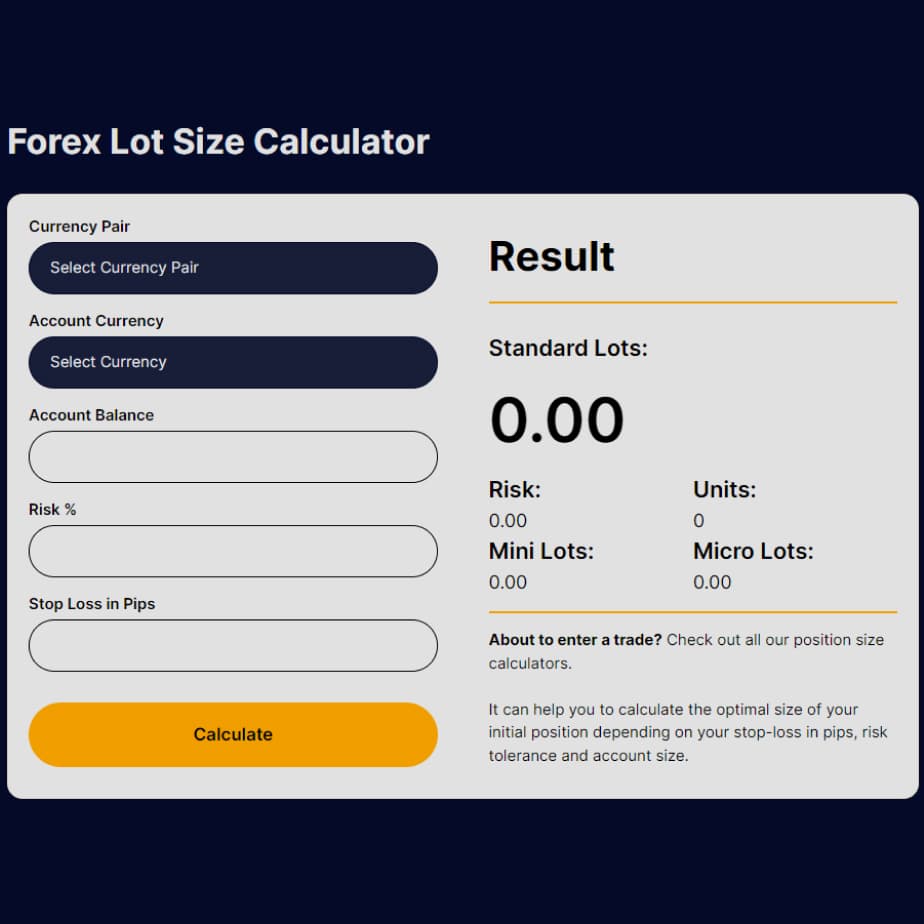

What tools or calculators can assist with position sizing?

Tools like the Trader’s Position Size Calculator, Myfxbook’s Position Size Calculator, and Investopedia’s Forex Position Size Calculator help determine the right trade size based on risk percentage and account balance. Many brokerage platforms also offer built-in position sizing tools. These calculators factor in stop-loss levels and risk tolerance to prevent overexposure.

How do market volatility and position size relate?

Market volatility affects how much prices fluctuate, so larger position sizes in volatile markets increase risk of bigger losses. To limit losses, traders reduce position size when volatility is high, ensuring they don’t expose themselves to outsized risk during wild swings. Conversely, in calm markets, they can increase position size safely. Proper position sizing adjusts for volatility, keeping potential losses within acceptable limits.

Can position sizing prevent large losses during volatile markets?

Yes, proper position sizing can prevent large losses during volatile markets by limiting exposure and controlling risk on each trade.

How should I adjust position size for different asset classes?

Adjust position size based on each asset class’s volatility and risk profile. For volatile assets like stocks, reduce size; for stable assets like bonds, increase it. Use a fixed percentage of your trading capital—typically 1-2%—and scale down for riskier assets. Consider the asset’s historical swings and liquidity when sizing. This helps limit losses across different asset classes.

Learn about How to Adjust Position Size During Volatile Markets

What is the impact of leverage on position sizing?

Leverage increases the size of your position relative to your account, amplifying both potential gains and losses. Using high leverage means smaller moves can wipe out your capital quickly, so it requires smaller position sizes to control risk. Proper position sizing with leverage helps limit losses by keeping your exposure aligned with your account size, preventing overleveraging that could lead to large, uncontrollable losses.

How do I balance potential profits and losses with position sizing?

Determine your risk per trade, usually 1-2% of your total capital. Calculate position size by dividing that risk amount by the distance between your entry point and stop-loss. Adjust size so a small move hits your stop-loss without risking too much. This way, potential profits scale with your target gains, while losses stay within your risk limit. For example, if you risk $100 per trade and your stop-loss is $10 away, buy 10 units. This keeps losses manageable and profits proportional.

Conclusion about Using Position Sizing to Limit Losses

Incorporating effective position sizing strategies is crucial for any trader aiming to limit losses and enhance overall performance. By understanding your risk per trade, utilizing stop-loss orders, and adapting to market conditions, you can significantly improve your trading consistency and decision-making. Remember, common mistakes can derail your progress, so leverage tools and calculators to assist in your position sizing approach. Ultimately, mastering position sizing not only protects your capital but also positions you for long-term success in the trading landscape—key insights that DayTradingBusiness is here to provide.