Did you know that most traders would rather wrestle a bear than face the consequences of poor position sizing? It's no joke—getting this crucial aspect right can make or break your trading success. In this article, we delve into the significant impact of position sizing on trading risk, exploring how it affects risk management and profitability. We’ll discuss the importance of proper position sizes in minimizing losses and the perils of over-leveraging. Additionally, we’ll cover practical methods to determine optimal position sizes, the influence of market volatility, and the vital connections between position size and stop-loss placement. With insights tailored for both beginners and seasoned traders, this guide from DayTradingBusiness will equip you with the knowledge to balance position size with risk-reward ratios effectively, ensuring you maintain emotional control while trading.

How does position sizing affect trading risk?

Position sizing directly determines how much money you risk on each trade. Smaller positions limit potential losses, reducing overall risk, while larger positions can amplify gains but also increase the chance of significant losses. Proper position sizing helps manage volatility and protect your capital during unfavorable market moves. It’s the key to controlling trading risk and maintaining consistent performance.

What is the role of position size in risk management?

Position size controls how much capital you risk on each trade, directly affecting your potential losses. Proper sizing ensures you don’t lose more than your risk tolerance, protecting your account from big swings. It balances the tradeoff between maximizing gains and limiting losses, helping maintain consistent, manageable risk levels.

Why is proper position sizing important for traders?

Proper position sizing controls risk exposure, preventing large losses that can wipe out your account. It helps traders stay consistent, manage volatility, and avoid over-leveraging. Correct sizing aligns with your risk tolerance, making losses manageable and preserving capital for future trades.

How can small position sizes reduce trading losses?

Small position sizes limit the amount of money at risk per trade, reducing the potential for large losses. They allow you to absorb market swings without wiping out your account. By trading smaller, you can better control risk and avoid emotional decision-making during volatility. This approach helps preserve capital, giving you more opportunities to learn and refine your strategy. For example, risking 1% per trade with small positions means a 10% loss is manageable, unlike risking 10% on a larger position.

What are the risks of over-leveraging with large positions?

Over-leveraging with large positions increases the risk of significant losses if the market moves against you. It can wipe out your capital quickly due to amplified margin requirements and margin calls. High leverage reduces your buffer against market volatility, making your account vulnerable to rapid drawdowns. It also heightens emotional stress, leading to poor decision-making and potential overtrading. In extreme cases, over-leveraging can result in account liquidation, risking your entire investment.

How does position sizing influence trading profitability?

Position sizing controls how much you risk per trade, directly affecting potential profit and loss. Proper sizing helps manage risk, prevent big losses, and maximize gains during winning trades. Overestimating size increases exposure, risking your account, while underestimating limits growth. Adjusting position size based on account size and market conditions keeps your trading profitable and sustainable.

What methods can traders use to determine optimal position size?

Traders use methods like fixed fractional, Kelly Criterion, and volatility-based sizing to determine optimal position size. Fixed fractional involves risking a set percentage of capital per trade. Kelly recommends sizing based on expected value and probability of success. Volatility-based sizing adjusts position size according to market volatility, often using ATR (Average True Range). These methods help balance risk and maximize growth while avoiding overexposure.

How does market volatility impact position sizing strategies?

Market volatility forces traders to adjust position sizes to manage risk. High volatility means larger price swings, prompting smaller positions to prevent big losses. Low volatility allows for bigger positions since price moves are steadier. Proper position sizing during volatile periods helps preserve capital and reduces the chance of rapid account drawdowns. Ignoring volatility can lead to overexposure and increased risk of ruin.

Can wrong position sizing lead to account blowouts?

Yes, wrong position sizing can cause account blowouts by exposing your account to excessive risk, leading to large losses that wipe out your balance.

How does position size relate to stop-loss placement?

Position size determines how much capital you risk per trade, which directly influences your stop-loss placement. A larger position size requires a tighter stop-loss to keep risk levels manageable, while a smaller size allows for a wider stop-loss. Proper alignment ensures your total risk stays within your acceptable limit, balancing potential reward and loss.

What is the relationship between position size and drawdown risk?

Larger position sizes increase drawdown risk because they amplify potential losses during adverse moves. Smaller positions limit exposure, reducing the chance of significant drawdowns. Proper position sizing balances profit potential with risk control, preventing large account declines.

How do traders balance position size and risk-reward ratios?

Traders balance position size and risk-reward ratios by calculating their maximum acceptable loss per trade and adjusting their position size accordingly. They use tools like the 1-2% rule, risking only a small percentage of their capital per trade, and ensure the potential reward justifies the risk—aiming for at least a 2:1 reward-to-risk ratio. They analyze market volatility, set stop-loss orders, and scale their trades to maintain consistent risk levels across different setups, avoiding overexposure and preserving capital for future opportunities.

Why should beginner traders focus on proper position sizing?

Beginner traders should focus on proper position sizing to control risk and avoid large losses that can wipe out their account. Correct sizing helps them manage emotional reactions, stay disciplined, and learn without risking too much on any single trade. It ensures they can withstand market volatility and build confidence over time.

How does position sizing differ across various trading styles?

Position sizing varies with trading styles: day traders often use small positions to limit quick losses, swing traders take moderate sizes to balance risk and reward, while long-term investors might hold larger positions based on fundamental analysis. Day traders prioritize tight stops and small sizes to manage rapid market moves, whereas position size for swing and position traders depends on volatility and risk tolerance. Long-term investors can afford larger positions because they typically endure bigger market swings, focusing on overall growth.

Learn about How to Incorporate Position Sizing into Your Trading Plan

What tools or calculators help with position sizing?

Tools like the Forex Position Size Calculator, risk management calculators, and trading journal apps help determine optimal position sizes. They consider account size, risk percentage, stop-loss distance, and leverage to calculate trade size. Platforms like MetaTrader, TradingView, and specialized risk calculators from brokers also offer built-in tools for precise position sizing.

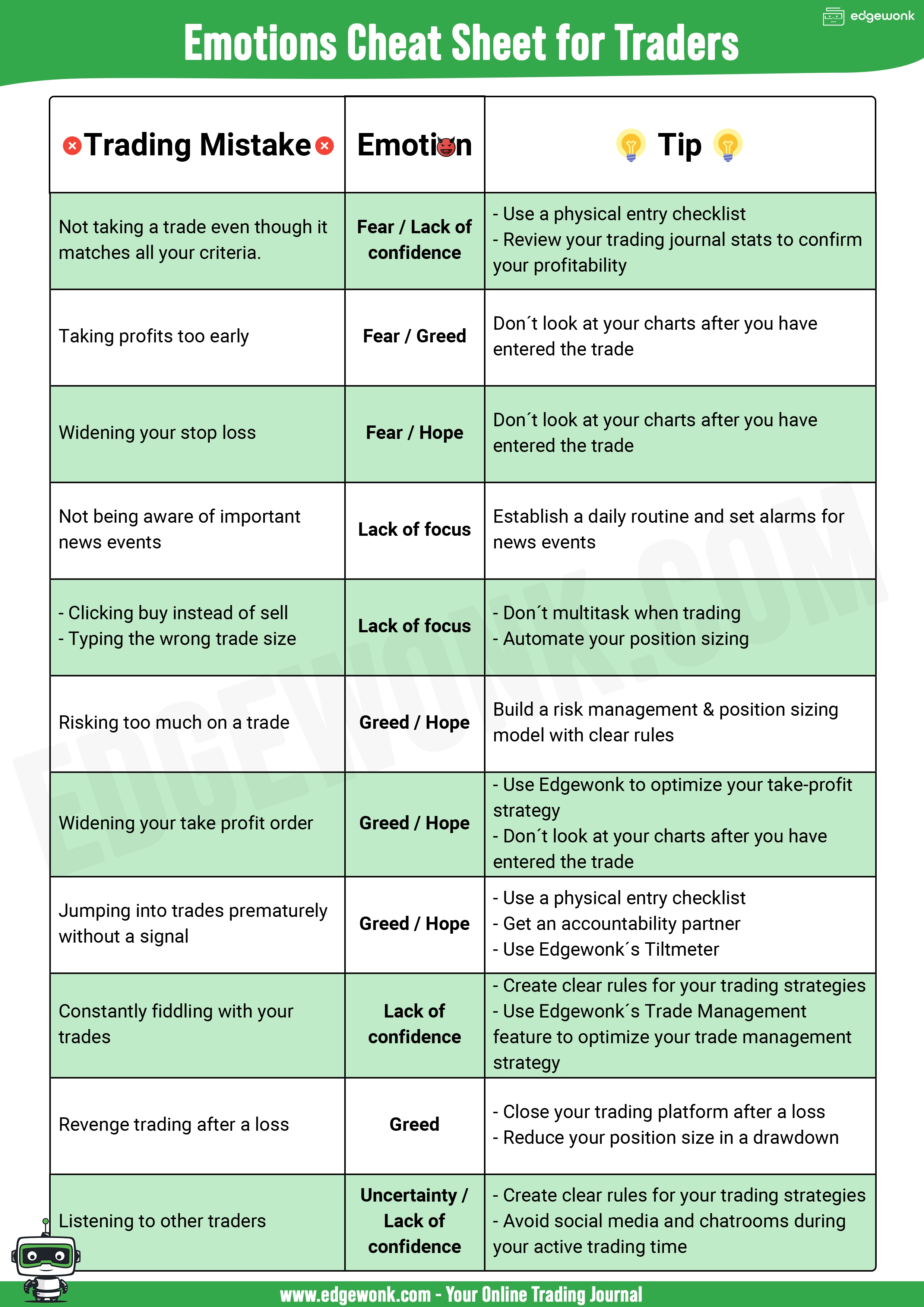

How does position sizing affect emotional trading control?

Position sizing directly influences emotional trading control by limiting potential losses, reducing fear and greed. When traders size positions appropriately, they feel more confident and less anxious about market swings. Small, well-managed positions prevent emotional overreactions during volatility, helping traders stick to their plans. Overly large positions can trigger panic or greed, leading to impulsive decisions. Proper position sizing keeps emotions in check, promoting disciplined, consistent trading behavior.

Learn about How to Incorporate Position Sizing into Your Trading Plan

Conclusion about The Impact of Position Sizing on Trading Risk

In summary, mastering position sizing is crucial for mitigating trading risk and enhancing profitability. Properly managing position size allows traders to navigate market volatility effectively while minimizing potential losses. By avoiding over-leveraging and aligning position sizes with risk-reward ratios, traders can maintain better emotional control and reduce the likelihood of account blowouts. For those seeking to improve their trading strategies, leveraging resources from DayTradingBusiness can provide valuable insights into effective position sizing techniques.