Did you know that in the world of trading, the right position size can make the difference between a fortune and a fiasco? In this article, we delve into position sizing strategies tailored to various market conditions, exploring how to effectively size your trades based on trends, volatility, and market dynamics. Learn what position sizing is, how it interacts with market conditions, and discover the best strategies for trending and volatile markets. We’ll also cover conservative methods, the impact of account size, and ways to adjust positions during sideways markets. Additionally, we’ll highlight common mistakes, differences between stocks and forex, and introduce tools that can automate your position sizing decisions. Join us at DayTradingBusiness to enhance your trading strategy and minimize risks effectively.

What is position sizing in trading?

Position sizing in trading is the process of determining how much money to invest in a single trade based on risk tolerance and account size. It controls potential losses and manages risk exposure. Proper position sizing adjusts trade size according to market volatility and your risk limits, helping protect your capital during different market conditions.

How do market conditions affect position sizing?

Market conditions determine how much you should risk per trade. In volatile markets, tighten your position size to avoid large losses. During stable or trending markets, you can size up your positions safely. Sudden market shifts or low liquidity call for smaller positions to manage risk. Overall, adapt your position sizing to match market volatility and trend strength to protect capital and optimize gains.

What is the best position sizing strategy for trending markets?

Use a volatility-based position sizing strategy, like the dollar volatility method. This means adjusting your position size based on market swings, risking a fixed percentage of your capital per trade. In trending markets, this helps you capture larger moves while managing risk, by scaling your position according to current market volatility.

How should I size positions in volatile markets?

In volatile markets, size your positions smaller to limit risk. Use tight stop-losses to protect against sudden swings. Consider reducing your position size by 50% or more compared to calmer markets. Focus on risk per trade, not total exposure, and adjust size based on your risk tolerance. Always prioritize capital preservation over chasing big gains in unpredictable conditions.

What are conservative position sizing methods?

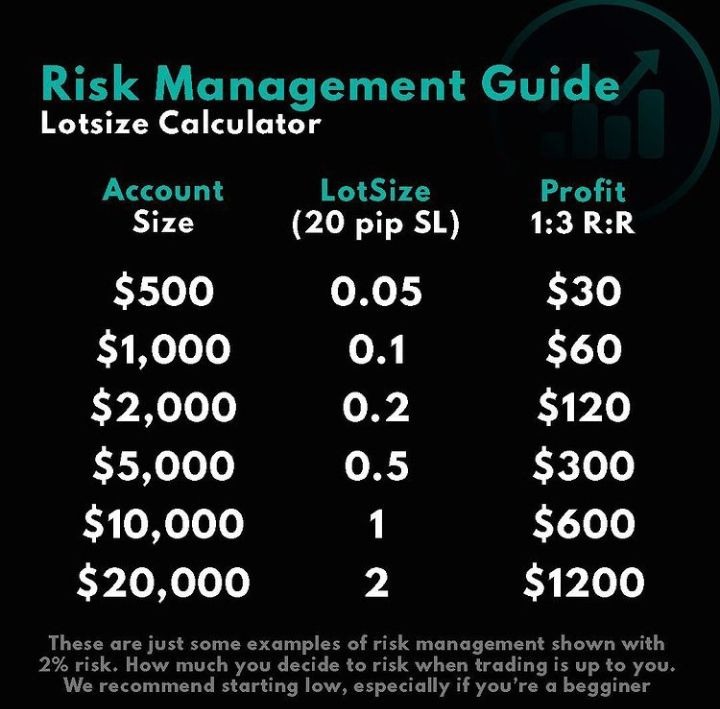

Conservative position sizing methods limit risk by reducing trade size relative to your account. Examples include using a fixed dollar amount per trade, a fixed percentage of your capital (like 1-2%), or the Kelly criterion with a cautious multiplier. These methods prioritize capital preservation, especially in volatile markets or uncertain conditions.

How can I determine the right position size for my risk level?

Calculate your risk per trade as a percentage of your total capital, then divide that amount by the stop-loss distance. For example, if you risk 1% of $10,000 and your stop-loss is $500, your position size is $10000 x 0.01 / $500 = 0.02 lots or units. Adjust your size based on market volatility and your risk appetite, ensuring it aligns with your overall risk management plan.

What role does account size play in position sizing?

Account size determines how much you can risk per trade, shaping your position size. Larger accounts allow bigger positions without risking too much of your capital, while smaller accounts require more conservative sizing. It helps manage risk exposure, ensuring you don’t overextend in volatile markets. Ultimately, your account size guides the balance between potential gains and risk management in position sizing strategies.

How do I adjust position sizes during sideways markets?

In sideways markets, reduce your position sizes to limit risk and avoid false breakouts. Focus on tighter stop-losses, and consider scaling in gradually as the trend shows signs of movement. Use smaller positions to stay flexible, and prioritize high-probability setups. Adjust position sizes based on volatility and your risk tolerance, ensuring you're not overexposed during choppy, non-trending periods.

What is fixed fractional position sizing?

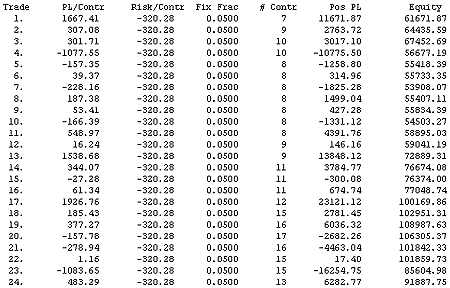

Fixed fractional position sizing is a strategy where you risk a set percentage of your trading capital on each trade, regardless of trade size. For example, risking 2% of your account on every trade keeps position sizes proportional to your account balance. It adjusts position size based on account growth or decline, helping manage risk consistently across different market conditions.

How does volatility-based sizing work?

Volatility-based sizing adjusts your position size based on market volatility. When volatility is high, it reduces your trade size to limit risk; when low, it allows larger positions. This method uses measures like the Average True Range (ATR) to determine how much the market typically moves. For example, if ATR indicates big swings, you trade smaller to avoid overexposure. Conversely, in calm markets, you can take bigger positions. It helps maintain consistent risk levels across varying market conditions.

What are the advantages of dynamic position sizing?

Dynamic position sizing adjusts your trade size based on market volatility and risk, helping maximize gains and minimize losses. It adapts to changing conditions, so you can increase positions in stable markets and reduce exposure during volatile swings. This flexibility improves risk management, keeps losses manageable, and optimizes capital use. By scaling positions dynamically, you maintain consistent risk levels, even as market conditions shift.

How can I use stop-loss levels to determine position size?

Set your stop-loss level based on your risk tolerance, such as 1-2% of your account. Divide your total risk amount by the distance between your entry price and stop-loss to find your position size. For example, if you're willing to risk $200 and the stop-loss is $10 away from entry, buy 20 units ($200 ÷ $10). Adjust this as market conditions change—tighten stops in volatile markets, loosen in calmer ones. This method ensures your position size aligns with your risk, protecting your capital across different market environments.

What are common mistakes in position sizing?

Common mistakes in position sizing include risking too much on a single trade, ignoring volatility, and not adjusting size for market conditions. Traders often use fixed sizes regardless of market volatility, leading to bigger losses during unpredictable swings. Underestimating the importance of stop-loss distances and overleveraging also cause significant errors. Failing to diversify position sizes based on account size or market environment limits risk management. Lastly, neglecting to review and adjust position sizes as market conditions change can amplify losses.

How do position sizing strategies differ for stocks vs. forex?

Position sizing for stocks typically involves risk percentage per trade, considering volatility and dollar amount. For forex, it often uses pip value and leverage, adjusting size based on currency pair volatility and account leverage. Stocks usually have fixed lot sizes or dollar amounts, while forex sizing depends on pip movement and leverage. Forex traders often use stop-loss pips to determine position size, whereas stock traders focus on dollar risk and company volatility. The key difference is that forex sizing emphasizes pip risk and leverage, while stock sizing centers on dollar risk and stock volatility.

What tools can help automate position sizing decisions?

Tools like TradingView’s position size calculator, MetaTrader’s expert advisors, and third-party apps like Edgewonk or MyFXBook can automate position sizing decisions. They factor in account size, risk percentage, stop-loss levels, and market volatility to recommend optimal trade sizes. Some brokers also offer built-in position sizing tools within their trading platforms.

Conclusion about Position Sizing Strategies for Different Market Conditions

Incorporating effective position sizing strategies is crucial for navigating various market conditions. Whether you’re trading in trending, volatile, or sideways markets, understanding how to adjust your position size based on risk and account size can significantly enhance your trading success. Utilizing methods such as fixed fractional sizing or volatility-based approaches, along with appropriate stop-loss levels, can further mitigate risk. To refine your position sizing techniques and stay informed about trading best practices, consider the insights and resources available through DayTradingBusiness.