Did you know that even a goldfish has a better attention span than most day traders? In the fast-paced world of trading, determining the right trade size is crucial to your success. This article dives deep into effective strategies for calculating trade size, considering factors like account size, risk tolerance, and market volatility. We’ll explore common mistakes and the impact of leverage, as well as provide tools and best practices for scaling your trades. With insights from DayTradingBusiness, you'll learn how to manage trade size across different assets and prevent overtrading, ensuring a more strategic approach to your trading journey.

What is the best way to calculate trade size?

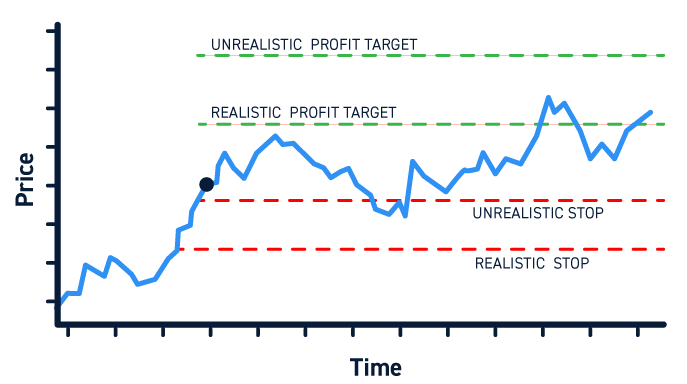

Calculate trade size by dividing your risk amount per trade by the stop-loss distance. For example, if you're willing to risk $200 and your stop-loss is $10 per share, buy 20 shares ($200 ÷ $10). Adjust for account size and risk tolerance to avoid overexposure. Use position sizing formulas or trading calculators for precision.

How do I choose the right position size for my trades?

Calculate your risk per trade, typically 1-2% of your account balance. Determine the distance between your entry point and stop-loss level. Divide your risk amount by that distance to find the position size. Adjust based on market volatility and your comfort level. Use position sizing calculators for accuracy.

What factors influence optimal trade size?

Account size, risk tolerance, and trading capital determine optimal trade size. Market volatility and asset liquidity also play roles. Additionally, your risk-reward ratio and stop-loss placement influence how much to trade. Proper position sizing balances potential gains against possible losses, ensuring sustainable trading.

How does account size affect trade sizing?

Larger accounts allow for bigger trades because of higher capital and risk capacity. Smaller accounts require more conservative trade sizing to manage risk and avoid significant losses. The account size influences position size, with bigger accounts taking larger trades, but always within risk limits. Proper trade sizing balances account size with risk tolerance, ensuring sustainability.

What role does risk tolerance play in trade size?

Risk tolerance directly influences trade size by setting how much capital you're willing to lose on a single trade. If you have a high risk tolerance, you might take larger positions, while a lower risk tolerance means smaller trades. It helps prevent emotional decision-making and overexposure, ensuring your trade size aligns with your comfort level and financial capacity.

How can I use stop-loss to determine trade amount?

Set your stop-loss at a level where you're willing to risk a specific dollar amount or percentage of your account. Divide that risk by the distance between your entry price and stop-loss level to find your maximum trade size. For example, if you risk $100 and your stop-loss is $2 away from entry, trade size = $100 / $2 = 50 shares. This ensures your trade amount aligns with your risk tolerance.

What are common mistakes in sizing trades?

Common mistakes in sizing trades include overestimating account size, risking too much on a single trade, ignoring stop-loss placement, and not adjusting position size for volatility. Traders often neglect to account for market conditions, leading to oversized positions that can wipe out accounts. They also fail to diversify risk or rely on fixed position sizes without considering trade-specific factors.

How does leverage impact trade size decisions?

Leverage allows traders to control larger positions with less capital, encouraging bigger trade sizes. It amplifies potential gains but also increases risk, making traders more willing to take larger positions. When leverage is high, traders might size trades aggressively, aiming for higher returns, but they must also brace for bigger losses. Conversely, lower leverage prompts more conservative trade sizing, focusing on risk management. Ultimately, leverage influences trade size decisions by making larger positions possible but also riskier.

What tools or calculators help determine trade size?

Tools like risk calculators, position size calculators, and trading journals help determine trade size. Many brokers offer built-in trade size tools. Online platforms such as Myfxbook, TradingView, and Investopedia have free calculators for risk per trade and lot sizes. These tools consider account balance, risk percentage, stop-loss distance, and pip value to set appropriate trade size.

How should I adjust trade size for volatile markets?

In volatile markets, reduce your trade size to manage risk. Use smaller positions to prevent large losses from sudden price swings. Focus on strict risk management rules, like risking only 1-2% of your capital per trade. Adjust your trade size based on the market’s volatility—if prices are jumping unpredictably, cut back. Consider using volatility indicators, like ATR, to guide your position size. The goal is to stay flexible and protect your capital during unpredictable swings.

Learn about How to Adjust Position Size During Volatile Markets

What is the relationship between trade size and risk reward?

Larger trade sizes increase potential profit but also raise risk exposure, making risk-reward ratios less favorable if not managed carefully. Smaller trades limit losses and protect capital, but may reduce profit opportunities. Finding the right trade size balances maximizing reward while keeping risk within acceptable limits, often guided by your risk tolerance and position sizing strategies.

How can I manage trade size across different assets?

Assess your risk tolerance and set a maximum percentage of your capital to risk per trade, typically 1-2%. Adjust trade size based on the volatility and liquidity of each asset—larger for stable assets, smaller for volatile ones. Use position sizing formulas that consider stop-loss levels and asset price to ensure consistent risk across assets. Keep trade size proportional to your account size, avoiding overexposure in any single asset. Regularly review and adjust trade sizes as your capital or risk appetite changes.

What are the benefits of proper trade sizing?

Proper trade sizing minimizes risk and protects your capital during market swings. It ensures you don’t overexpose yourself, reducing potential losses. Correct sizing helps maintain consistent performance and prevents emotional trading. It allows for better risk-reward ratios, making profitable trades more sustainable. Ultimately, proper trade sizing keeps your trading account healthier and boosts long-term profitability.

How do I prevent overtrading through size management?

To prevent overtrading, set a fixed percentage of your trading capital for each trade, like 1-2%. Use position sizing formulas to calculate exact trade sizes based on your risk tolerance and stop-loss levels. Stick to these limits strictly, regardless of market excitement. Avoid increasing trade size after wins or losses without reevaluating your risk plan. Regularly review your trading plan to ensure your trade sizes stay consistent with your overall risk management strategy.

What are best practices for scaling trade size?

Start with a small position to test your strategy and avoid big losses. Use a fixed percentage of your capital—typically 1-2%—to manage risk. Adjust trade size based on market volatility; larger trades when volatility is low, smaller when high. Always consider your stop-loss levels to prevent excessive drawdowns. Regularly review and refine your risk parameters as your account grows. Avoid over-leveraging, and ensure your trade size aligns with your overall risk tolerance.

Conclusion about How to Determine the Right Trade Size

In summary, determining the right trade size is crucial for effective risk management and overall trading success. Key factors include your account size, risk tolerance, and market volatility, all of which influence optimal position sizing. Utilizing tools and calculators can further refine your decisions, helping you to avoid common mistakes and prevent overtrading. By following best practices and adjusting your trade size appropriately, you can enhance your trading strategy. For more in-depth insights and guidance on trade sizing, consider exploring resources from DayTradingBusiness.

Sources:

- Measuring Liquidity in Financial Markets

- Imperialist appropriation in the world economy: Drain from the global ...

- Institutional trading, news, and accounting anomalies - ScienceDirect

- Informed options trading before FDA drug advisory meetings ...

- Who's Getting Globalized? The Size and Implications of Intra ...