Did you know that the average person spends about 6 months of their life waiting for red lights to turn green? While patience is a virtue in many areas, in trading, the right position sizing is crucial for balancing profit potential and risk. In this article, we delve into the importance of position sizing, exploring how it directly impacts your profit potential and the role of risk management. You'll discover methods to determine the right position size, the influence of leverage, and how to navigate market volatility and asset types. Additionally, we’ll provide insights on avoiding overexposure, the risks of over-leveraging, and adapting your strategy under changing conditions. With tools and calculators at your disposal, you'll learn how to effectively manage your positions to enhance your trading success. Join us at DayTradingBusiness for a comprehensive guide to mastering position sizing!

How does position sizing affect profit potential?

Position sizing directly impacts profit potential by determining how much you risk per trade. Larger positions can amplify gains when the market moves in your favor, boosting profits. But they also increase risk, making losses bigger if the trade goes against you. Proper position sizing balances maximizing profit with managing risk, ensuring you don’t overexpose yourself while capturing gains. Small sizes limit profit but keep risk low; bigger sizes offer higher rewards but require careful risk control.

What is the role of risk management in position sizing?

Risk management guides how much to invest in each trade to limit potential losses. It determines position size based on your risk tolerance and account size, ensuring you don’t overexpose yourself. Proper position sizing balances profit potential with risk, helping you stay in the game after setbacks. It prevents large losses from small mistakes, allowing consistent growth while managing downside.

How can I determine the right position size for my trades?

Calculate how much you’re willing to lose per trade, usually 1-2% of your account. Divide that amount by the distance between your entry point and stop-loss to find your position size. For example, if your account is $10,000 and you risk $200 per trade, and your stop-loss is $2 away, you should trade 100 units ($200 ÷ $2). Adjust based on market volatility and your comfort level to balance profit potential and risk effectively.

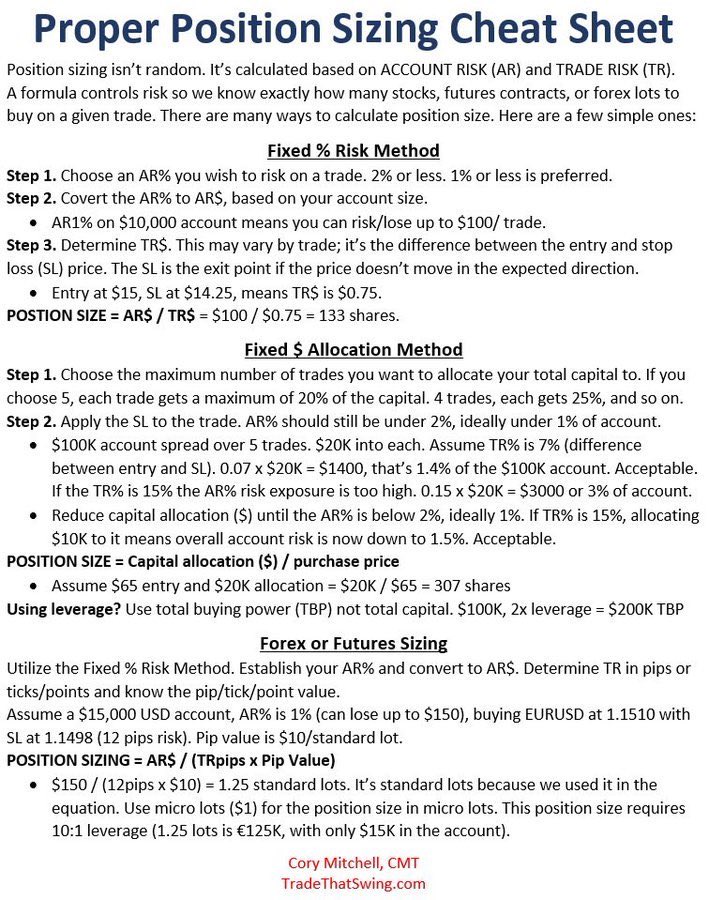

What are common methods to calculate position size?

Common methods to calculate position size include the fixed dollar amount method, where you risk a set dollar amount per trade; the percentage risk method, which involves risking a specific percentage of your trading capital; and the volatility-based method, adjusting size based on market volatility using tools like the Average True Range (ATR).

How does leverage influence position sizing decisions?

Leverage amplifies both gains and losses, so it forces traders to size positions carefully. Higher leverage means smaller positions can control more capital, increasing profit potential but also risk. When using leverage, traders often reduce position size to avoid excessive risk, balancing potential rewards against the possibility of larger losses. It makes precise position sizing crucial because a small market move can wipe out a leveraged position quickly.

How do I balance risk and reward when sizing my positions?

Determine your risk tolerance and set a maximum loss per trade, usually 1-2% of your account. Calculate the position size by dividing that risk amount by the distance between your entry point and stop-loss. Adjust your position size based on market volatility and asset behavior to avoid overexposure. Keep your risk consistent across trades to protect your capital and maximize long-term growth.

What is the impact of account size on position sizing?

Larger accounts allow for bigger position sizes without risking too much of the capital, reducing the chance of blow-up. Smaller accounts require careful, smaller positions to manage risk and avoid big losses. Account size influences how much of a trade you can take safely, balancing profit potential with risk management. Bigger accounts can absorb more volatility, while smaller accounts need tighter controls to protect capital.

How do market volatility and asset type affect position sizing?

Market volatility and asset type directly influence position size because high volatility or risky assets require smaller positions to manage risk. For volatile markets, limit exposure to prevent large swings from wiping out gains or causing big losses. Safer assets, like bonds, allow larger positions since their price movements are steadier. Conversely, volatile stocks or cryptocurrencies demand conservative sizing to avoid overexposure. Adjust position size based on the asset’s typical price swings and market conditions to balance profit potential with risk.

What tools or calculators can help with position sizing?

Tools like the Forex Position Size Calculator, Investopedia’s Risk Management Calculator, and MyFxBook’s Position Sizer help determine optimal trade sizes based on your risk tolerance and account size. These calculators consider stop-loss levels, risk percentage, and leverage to balance profit potential with risk. Some trading platforms, like MetaTrader, also include built-in position sizing tools.

How can I avoid overexposure with proper position sizing?

Set a fixed percentage of your trading capital for each trade, like 1-2%. Calculate position size based on that percentage and your stop-loss distance. This limits potential losses and prevents overexposure. Adjust size if market volatility changes. Never risk more than you're comfortable losing on a single trade.

What are the risks of over-leveraging in position sizing?

Over-leveraging in position sizing increases the risk of large losses, potentially wiping out your account quickly. It amplifies market volatility effects, making small swings more damaging. You might be forced to sell at a loss during downturns or margin calls, risking your capital. Over-leverage also reduces your ability to withstand unpredictable market moves, leading to emotional trading and poor decisions.

How does stop-loss placement relate to position size?

Stop-loss placement determines your risk per trade, which directly influences your position size. Placing a tight stop-loss limits potential losses, so you can buy a larger position without risking too much capital. Conversely, a wider stop-loss means smaller positions to keep risk manageable. Proper stop-loss placement ensures your position size aligns with your risk tolerance, balancing profit potential with acceptable loss.

How can I adapt position size during changing market conditions?

Adjust your position size based on market volatility and risk levels. During high volatility, reduce your size to limit exposure; in calm markets, increase it to capitalize on trends. Use dynamic risk management tools like ATR or volatility-adjusted calculations to set appropriate trade sizes. Always link position size to your total capital and risk tolerance, scaling down when signals weaken and scaling up when conditions favor higher returns.

Learn about How to Adjust Position Size During Volatile Markets

What is the difference between fixed and dynamic position sizing?

Fixed position sizing uses the same amount of capital for every trade, regardless of account size or market conditions. Dynamic position sizing adjusts the trade size based on factors like account balance, volatility, or risk percentage, helping you balance profit potential and risk more effectively.

How do psychological factors influence position sizing decisions?

Psychological factors like fear and greed heavily influence position sizing decisions. Fear of losing too much makes traders choose smaller sizes, limiting potential gains but protecting capital. Greed pushes traders to take larger positions, risking more for bigger profits. Overconfidence can lead to oversized trades, ignoring risk limits. Emotional reactions to market swings cause inconsistent sizing, increasing risk. These mental biases often override logical risk management, skewing the balance between profit potential and risk.

Conclusion about Balancing Profit Potential and Risk with Position Sizing

In summary, effective position sizing is crucial for optimizing profit potential while managing risk in trading. By understanding the impact of risk management, account size, and market conditions, traders can determine appropriate position sizes that align with their overall strategy. Utilizing tools and calculators can further enhance this process, allowing for a balance between risk and reward. Remember, DayTradingBusiness is here to provide you with the insights and support needed to refine your position sizing techniques for successful trading.