Did you know that trading without proper analysis is like a chef throwing ingredients into a pot without a recipe? You might end up with a surprising dish, but it’s more likely to be a disaster! In this article, we delve into the critical risks of trading without thorough analysis, highlighting how it can lead to financial losses, missed opportunities, and emotional decision-making. We'll explore common mistakes traders make, the dangers of relying on speculation, and how neglecting both technical and fundamental analysis can derail your trading discipline. Additionally, we'll discuss the implications for risk management and long-term profitability. Arm yourself with insights from DayTradingBusiness to navigate the trading landscape more effectively!

What are the main risks of trading without proper analysis?

Trading without proper analysis can lead to significant losses, unpredictable market moves, and poor decision-making. You might buy high and sell low because you miss critical signals. It increases exposure to volatility and sudden price swings. Without analysis, you overlook key trends, technical indicators, or fundamental data that inform smart trades. This can cause emotional trading, overconfidence, or panic selling. Overall, it dramatically raises the chance of losing your investment quickly and consistently.

How does lack of analysis increase the chance of financial loss?

Trading without proper analysis increases the risk of financial loss because it leads to poor decision-making based on guesswork instead of data. Without analyzing market trends, technical indicators, or economic factors, traders miss signals that could prevent losses. This ignorance makes them vulnerable to sudden price swings, false breakouts, or misjudged entries and exits. Essentially, skipping analysis reduces their ability to manage risk and increases the likelihood of costly mistakes.

Can trading without analysis lead to missed opportunities?

Yes, trading without proper analysis can cause missed opportunities because you won’t identify the best entry or exit points, leading to less profitable trades or missed gains. Without analysis, you rely on luck rather than data, increasing the chance of entering trades at poor prices or holding onto losing positions longer. It also makes you vulnerable to unpredictable market moves, reducing your chances of capitalizing on favorable trends.

What are the common mistakes traders make without proper analysis?

Trading without proper analysis leads to poor decision-making, increasing the risk of significant losses. Traders often rely on gut feelings or rumors instead of data, causing impulsive moves. Ignoring market trends and technical signals can result in missed opportunities or entering bad trades. Overestimating chances of success without evaluating risk-reward ratios heightens exposure. Lack of analysis also means failing to set stop-losses, risking larger losses. Overall, it’s like flying blind—more likely to crash financially.

How does ignoring analysis affect trading discipline?

Ignoring analysis leads to impulsive trades, increasing the risk of significant losses. Without proper analysis, traders miss key market signals, making their decisions random rather than strategic. This erodes discipline, as trades become unpredictable and emotionally driven instead of based on data. Over time, it fosters bad habits like chasing losses or skipping risk management. Ultimately, neglecting analysis weakens trading discipline, making consistent profitability nearly impossible.

What is the impact of trading blindly on emotional decision-making?

Trading blindly leads to impulsive decisions driven by emotions, causing significant financial losses. Without proper analysis, traders miss critical market signals, increasing the chance of bad trades. Emotional trading can cause panic selling or overconfidence buying, eroding capital quickly. Relying on feelings instead of data often results in inconsistent results and long-term setbacks.

How does insufficient analysis increase exposure to market volatility?

Insufficient analysis leads traders to make decisions based on guesswork rather than data, increasing vulnerability to sudden market swings. Without proper analysis, traders miss warning signs of volatility, making them prone to rapid losses when the market shifts unexpectedly. This lack of understanding causes delayed reactions, amplifying exposure to unpredictable price fluctuations. Ultimately, trading without thorough analysis heightens the risk of significant financial setbacks during volatile market conditions.

What risks arise from relying on speculation instead of analysis?

Relying on speculation instead of analysis can lead to unpredictable losses, as decisions are based on guesses rather than data. It increases the chance of missing key market signals, causing impulsive trades and heightened volatility exposure. Without solid analysis, traders might overlook risks, leading to significant financial setbacks. Speculation often results in emotional trading, reducing discipline and increasing the likelihood of poor timing. Overall, it risks substantial capital loss and long-term instability in trading results.

How can trading without analysis cause significant account drawdowns?

Trading without analysis can lead to massive account drawdowns because you miss critical market signals, cause impulsive decisions, and enter trades based on emotions or guesswork. Without analysis, you can't identify trends, support and resistance levels, or potential reversals, increasing the chance of holding losing positions. This reckless approach often results in overtrading, poor risk management, and reacting to short-term volatility, all of which drain your account quickly.

What are the dangers of trading based on rumors or tips?

Trading based on rumors or tips can lead to significant financial losses because these cues lack solid analysis and can be false or misleading. You risk making impulsive decisions driven by unreliable information, which can cause sudden market swings against you. Without proper analysis, you overlook key fundamentals and technical signals, increasing the chance of entering bad trades. This approach also exposes you to manipulation and hype, making your investments unpredictable and risky.

How does poor analysis contribute to inconsistent trading results?

Poor analysis leads to inconsistent trading results by causing misjudged entry and exit points, increasing losses and missed opportunities. Without thorough analysis, traders rely on guesswork or incomplete data, making their strategies unpredictable. This lack of insight results in emotional decisions, overtrading, and failure to adapt to market changes. Over time, these mistakes erode capital and create erratic, unreliable performance.

Can trading without analysis lead to overtrading?

Yes, trading without analysis often leads to overtrading, as traders make impulsive decisions without understanding market trends or risks, increasing the chance of losses.

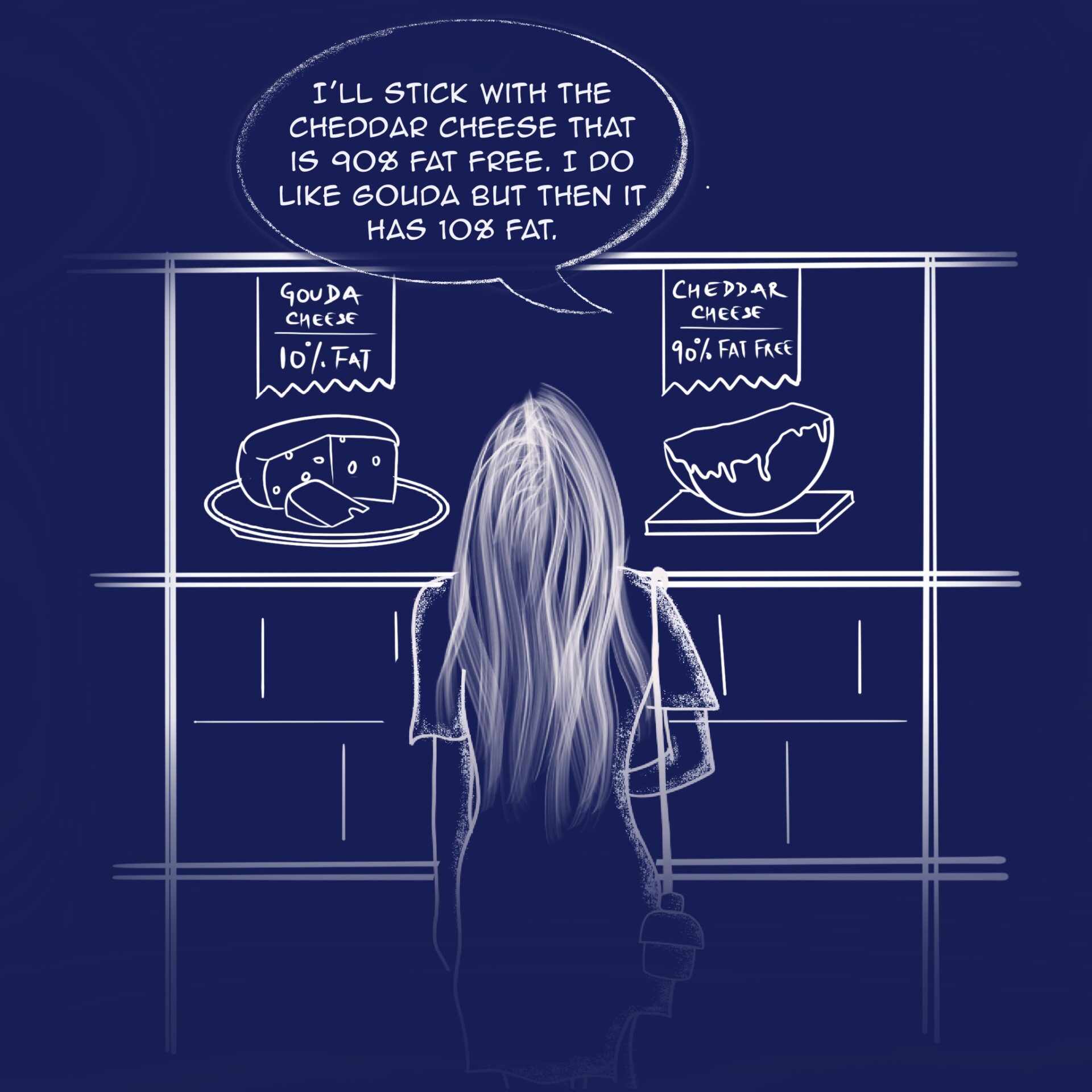

How does neglecting technical and fundamental analysis harm trading strategies?

Ignoring technical and fundamental analysis leads to uninformed trades, increasing the risk of costly mistakes. Without analyzing price patterns or market fundamentals, you miss key signals indicating entry or exit points. This lack of insight causes poor timing, higher losses, and missed opportunities. Trading without proper analysis makes strategies unreliable and unpredictable, risking your capital.

Learn about How to Combine Fundamental and Technical Analysis in Day Trading

What role does proper analysis play in risk management?

Trading without proper analysis increases the risk of significant financial loss, poor decision-making, and missed opportunities. It leaves traders vulnerable to market volatility, false signals, and unexpected events. Without thorough analysis, traders can't accurately assess potential risks or set effective stop-loss levels, leading to impulsive or uninformed trades. This can result in higher exposure to losses and reduced chances for consistent profits. Proper analysis helps identify trends, evaluate market conditions, and make strategic choices, reducing unnecessary risk.

How does trading without analysis impact long-term profitability?

Trading without analysis increases the risk of making impulsive, poorly informed decisions, leading to unpredictable losses. It undermines the ability to identify market trends, entry and exit points, and potential reversals. Over time, this approach erodes capital, making sustained profitability unlikely. Without proper analysis, traders miss opportunities and expose themselves to unnecessary volatility and risk.

Learn about How Do Prop Firms Impact Day Trading Profitability?

Conclusion about What are the risks of trading without proper analysis?

In summary, trading without proper analysis significantly heightens the risks of financial loss, emotional decision-making, and missed opportunities. It can lead to common mistakes, overtrading, and increased exposure to market volatility, ultimately jeopardizing long-term profitability. To navigate these challenges successfully, incorporating thorough technical and fundamental analysis is essential. By prioritizing analytical methods, traders can enhance their risk management strategies and improve overall trading discipline. For comprehensive guidance on effective trading practices, explore the resources available through DayTradingBusiness.

Sources:

- 23B. The Risks of Financial Derivatives in: Current Legal Issues ...

- Strengths and Weaknesses in Securities Market Regulation: A ...

- Interagency Supervisory Guidance on Counterparty Credit Risk ...

- An introduction to illegal wildlife trade and its effects on biodiversity ...

- Blind to carbon risk? An analysis of stock market reaction to the ...