Did you know that some traders jump into the market without a plan, just like a cat chasing a laser pointer—exciting but often pointless? In the world of day trading, the absence of a well-defined trading plan can significantly increase risks and lead to emotional decision-making. This article explores how lacking a trading strategy affects success, increases exposure to market volatility, and leads to costly mistakes. It highlights the importance of setting realistic profit and loss targets, maintaining discipline, and managing risks effectively. For traders, especially novices, understanding the pitfalls of trading without a plan is crucial. At DayTradingBusiness, we emphasize that a solid trading plan is your roadmap to consistent results and profitability.

How does not having a trading plan affect day trading success?

Not having a trading plan increases day trading risks by leading to impulsive decisions, poor risk management, and inconsistent strategies. Without a plan, traders often chase losses, overtrade, or hold onto bad positions, amplifying potential losses. It also prevents setting clear entry and exit points, making it harder to stick to disciplined trading. Overall, lack of a plan makes it easier to deviate from sound trading practices, increasing the chance of significant financial loss.

Why is a trading plan essential for managing risks in day trading?

Without a trading plan, you make impulsive decisions, risking bigger losses. It leaves you vulnerable to emotional trading, like chasing losses or overtrading. A plan sets clear entry and exit points, helping you stick to your strategy instead of reacting to market swings. Without it, you lack discipline, increasing the chance of costly mistakes. Overall, no plan means higher exposure to unpredictable market moves and bigger financial risks.

How does the absence of a trading plan lead to emotional trading?

Without a trading plan, traders rely on gut feelings instead of strategy, making them more emotional. When trades don’t go as expected, they panic or chase losses, driven by fear or greed. This impulsive behavior increases mistakes, losses, and overall risk in day trading.

What risks increase when traders skip planning their trades?

Skipping a trading plan heightens risks like impulsive decisions, emotional trading, and inconsistent strategies. It leads to poor risk management, bigger losses, and missed opportunities for profit. Without a plan, traders are more vulnerable to market volatility and can quickly deviate from their goals, increasing the chance of significant financial loss.

How can lack of a trading plan cause bigger losses?

Without a trading plan, you lack clear entry and exit strategies, making impulsive decisions that can lead to bigger losses. It leaves you vulnerable to emotional trading, such as panic selling or overtrading, which amplifies risk. Without predefined risk management rules, you might hold onto losing trades too long or overexpose your capital, increasing potential losses. A missing plan also means you can’t evaluate your performance or learn from mistakes, setting the stage for recurring costly errors.

Why do inexperienced traders suffer more without a trading plan?

Inexperienced traders suffer more without a trading plan because they lack clear entry, exit, and risk management strategies. Without a plan, they make impulsive decisions based on emotions, increasing chances of losses. It leaves them vulnerable to overtrading and poor risk control, which can wipe out their account quickly. A trading plan provides structure, helping traders stay disciplined and avoid costly mistakes during volatile moments.

How does a trading plan help in setting realistic profit and loss targets?

A trading plan clarifies your profit and loss targets by setting specific, achievable goals based on your strategy and risk tolerance. Without it, you risk chasing unrealistic profits or holding onto losing trades too long, increasing emotional decision-making. It helps you stay disciplined, avoid impulsive moves, and manage risks effectively, reducing overall day trading dangers.

What are the common mistakes made without a trading plan?

Without a trading plan, traders often chase quick gains, leading to impulsive decisions. They risk larger losses because they lack predefined entry and exit points. Overtrading becomes common, exposing them to unnecessary market fluctuations. Without risk management rules, they may hold onto losing trades longer, magnifying losses. Emotional reactions take over, causing inconsistent strategies. Overall, not having a plan increases the chance of significant, avoidable losses and makes day trading much riskier.

How does poor planning impact day trading discipline?

Poor planning makes day trading riskier by leading to impulsive decisions, chasing losses, and overtrading. Without a clear trading plan, traders lack entry and exit strategies, causing emotional reactions instead of disciplined actions. This increases exposure to unpredictable market swings and amplifies losses. A solid plan helps maintain focus, manage risk, and avoid panic-based trades. Without it, discipline collapses, making losses more likely.

Why is a trading plan important for risk management in day trading?

Without a trading plan, you’re likely to make impulsive decisions, leading to bigger losses. It leaves you unprepared for market swings, increasing emotional trading and poor risk control. Without clear entry, exit, and stop-loss rules, you can chase losses or hold onto losing trades longer than wise. A plan keeps your trading disciplined, reducing the chance of costly mistakes and helping manage risk effectively.

Learn about How to Develop a Risk Management Plan for Day Trading

How does not planning trades increase exposure to market volatility?

Not planning trades leaves you vulnerable to sudden market swings because you don’t have clear entry, exit, or risk management strategies. Without a trading plan, you react emotionally to volatility, often holding losing positions or chasing quick gains. This impulsiveness amplifies exposure to unpredictable price swings, increasing the chances of large losses during volatile market moves. Lack of planning also prevents disciplined adjustments to changing conditions, making you more susceptible to sharp, unexpected market volatility.

What role does a trading plan play in avoiding impulsive decisions?

A trading plan provides clear rules and strategies, helping traders stick to logical decisions instead of reacting impulsively. Without it, emotions like fear or greed take over, leading to reckless trades. A plan keeps focus on predefined entry, exit, and risk management, reducing the chance of impulsive mistakes and enhancing consistency.

How can a lack of planning lead to inconsistent trading results?

A lack of a trading plan makes it easy to panic or make impulsive decisions, leading to inconsistent results. Without predefined entry and exit rules, traders react emotionally, risking bigger losses. It also increases the chance of overtrading and ignoring risk management, causing unpredictable outcomes. Without a clear strategy, traders can chase losses or hold onto bad trades longer, amplifying volatility and inconsistency in their results.

Why do traders with no plan struggle to stick to strategies?

Without a trading plan, traders lack clear entry and exit rules, making impulsive decisions. This increases emotional trading, leading to overtrading and bigger losses. Without predefined risk management, they can’t limit losses or protect gains. The absence of a plan creates confusion, causing inconsistent strategies and higher day trading risks.

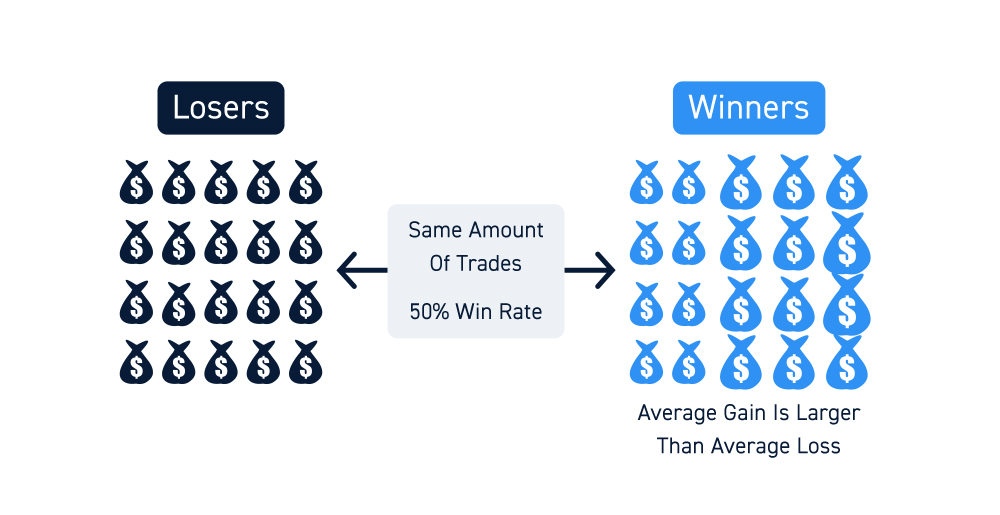

How does the absence of a trading plan affect overall profitability?

Without a trading plan, day traders make impulsive decisions, leading to inconsistent results and higher losses. It causes poor risk management, making them vulnerable to big swings and emotional trading. This lack of structure often results in overtrading and missed exits, reducing overall profitability. In short, no plan equals more unpredictable trades and increased risk of significant financial setbacks.

Conclusion about How does lack of a trading plan increase day trading risks?

In summary, a well-defined trading plan is critical for mitigating risks in day trading. Without it, traders face heightened emotional responses, increased exposure to market volatility, and potential for significant losses. Inexperienced traders, in particular, may struggle to achieve consistent results and profitability due to the absence of clear strategies and targets. To ensure success and maintain discipline in the fast-paced trading environment, embracing a structured trading plan is essential. For more insights and guidance on creating effective trading strategies, rely on DayTradingBusiness.

Learn about How to Plan Your Day Trading Strategy Around the PDT Rule?

Sources:

- The impact and profitability of day trading following the relaxation of ...

- Are cryptos different? Evidence from retail trading - ScienceDirect

- The joint impact of the European Union emissions trading system on ...

- Does price efficiency increase with trading volume? Evidence of ...

- Information and optimal trading strategies with dark pools ...

- Excessive trading, a gambling disorder in its own right? A case study ...