Did you know that overconfidence can be as dangerous in trading as a cat chasing a laser pointer? It’s amusing until you realize the potential for chaos. In this article, we explore how overconfidence can drastically impact day trading behaviors, leading to risky decisions and detrimental outcomes. We'll delve into how it affects trading discipline, risk management, and the tendency to ignore critical market signals. You'll learn why confident traders often chase losses, underestimate potential pitfalls, and overtrade, ultimately exposing themselves to greater market volatility. By understanding the psychological factors behind overconfidence, traders can better recognize its signs and take control to improve their long-term performance. Join DayTradingBusiness as we unpack the complex relationship between confidence and risk in day trading.

How does overconfidence affect day trading decisions?

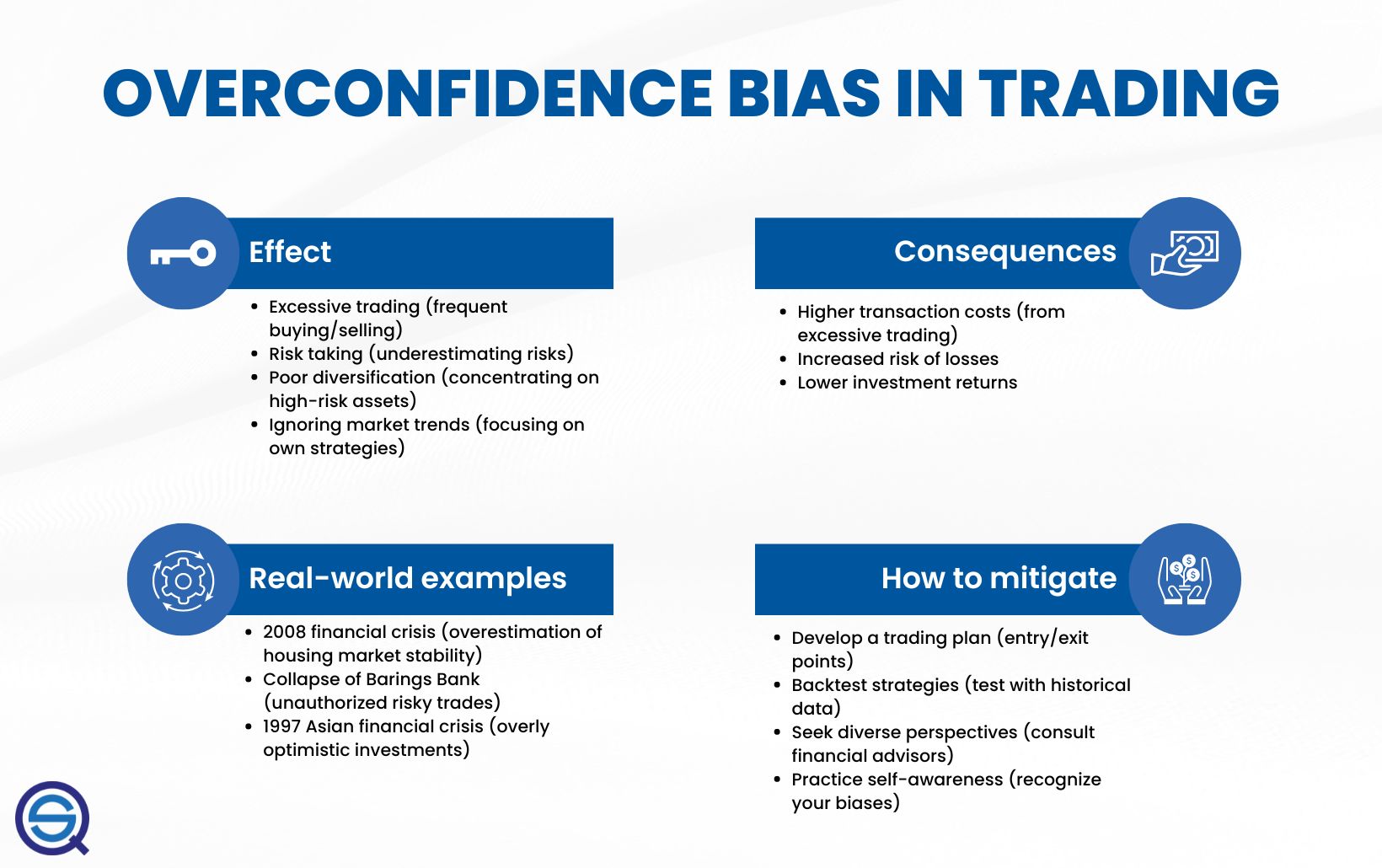

Overconfidence makes day traders underestimate risks, leading them to take larger positions and ignore warning signs. It causes them to believe they’re more skilled than they are, increasing impulsive trades and reducing caution. This mindset often results in chasing losses or holding onto losing trades, amplifying potential losses. Overconfidence blinds traders to market volatility, making risky decisions more likely and decreasing overall trading discipline.

Why do confident traders take more risks?

Confident traders take more risks because they overestimate their abilities, believing they can predict market moves accurately. Overconfidence tricks them into thinking small mistakes won’t hurt, encouraging bigger trades and higher leverage. They often ignore warning signs or past losses, thinking luck is on their side. This mindset pushes them into risky day trading behaviors, like holding onto losing positions too long or chasing quick gains without proper analysis.

Can overconfidence cause traders to ignore market signals?

Yes, overconfidence can make traders ignore market signals, leading them to underestimate risks. They may believe they have superior knowledge, causing them to dismiss warning signs and take unnecessary risks. This overconfidence often results in impulsive trades, ignoring technical or fundamental cues that suggest caution.

How does overconfidence lead to overtrading?

Overconfidence makes traders believe they have superior knowledge, prompting them to take bigger, more frequent trades. This false sense of certainty leads to ignoring risks and market signs, increasing impulsive decisions. As a result, overconfidence fuels overtrading, exposing traders to unnecessary losses and volatility.

What are the signs of overconfidence in day trading?

Signs of overconfidence in day trading include taking larger positions than justified, ignoring risk management, believing you can't lose, and doubling down after losses. Overconfidence makes traders underestimate risks, leading them to chase quick gains, avoid stop-losses, and ignore market signals. It often results in impulsive trades, overtrading, and ignoring signs of market fatigue or volatility.

How does overconfidence impact risk management?

Overconfidence makes day traders underestimate risks, leading to larger, impulsive trades. They believe their predictions are more accurate than they are, ignoring warning signs. This often results in excessive trading, ignoring stop-loss strategies, and taking on unnecessary risks. Overconfident traders may also ignore market signals, thinking they can outsmart the market, which increases chances of significant losses.

Why do overconfident traders underestimate potential losses?

Overconfident traders underestimate potential losses because they overestimate their skill and knowledge, believing they're less likely to make mistakes. They assume their predictions are correct and ignore market risks, which makes them ignore stop-losses or risk management strategies. This false sense of certainty pushes them into risky trades, thinking losses are unlikely or manageable, leading to bigger, unchecked risks.

How does overconfidence influence trading discipline?

Overconfidence makes traders believe they know more than they do, leading them to take bigger risks and ignore warning signs. It causes them to overestimate their accuracy, hold onto losing trades too long, and chase quick profits instead of sticking to a solid plan. This mindset reduces discipline, making impulsive decisions that can quickly wipe out gains.

Can overconfidence cause traders to ignore stop-loss levels?

Yes, overconfidence can make traders ignore stop-loss levels, believing they can predict market moves better than the risk controls. They may think their analysis is infallible, leading them to hold onto losing positions or avoid setting stop-loss orders altogether. This overconfidence boosts risky day trading behaviors, increasing the chance of significant losses when the market moves against them.

Why do confident traders often chase losses?

Confident traders chase losses because they believe their skills will turn things around quickly. Overconfidence makes them underestimate risks, so they take bigger trades to recover losses faster. They trust their intuition too much, thinking they’re due for a win, which leads to impulsive, risky moves. This behavior fuels a cycle of chasing losses, risking even more capital.

How does overconfidence increase exposure to market volatility?

Overconfidence makes traders underestimate risks, leading them to take bigger, more aggressive trades. This amplifies exposure to market volatility because they ignore warning signs and hold onto losing positions longer. As a result, they’re more likely to panic or overtrade during sharp market swings, increasing potential losses.

What psychological factors drive overconfidence in trading?

Overconfidence in trading stems from cognitive biases like the illusion of control, where traders believe they can predict market movements accurately. Confirmation bias reinforces this by focusing only on information that supports their beliefs. Past successes boost self-esteem, making traders underestimate risks and overestimate their skills. This leads to excessive risk-taking, impatience, and ignoring warning signs, all fueling risky day trading behaviors.

How can overconfidence lead to larger-than-expected losses?

Overconfidence in day trading makes traders underestimate risks, leading them to take bigger positions or ignore warning signs. They believe they have superior skill or information, causing impulsive trades without proper analysis. This often results in larger-than-expected losses when the market moves against their overestimated confidence.

What role does past success play in overconfidence?

Past success boosts overconfidence by creating a false sense of skill, making traders underestimate risks. When they see quick wins, they believe they can repeat them, ignoring market volatility. This overconfidence pushes traders to take bigger, riskier positions without proper analysis. It blinds them to potential losses, leading to reckless day trading decisions.

How can traders recognize and control overconfidence?

Traders recognize overconfidence by noticing excessive optimism, ignoring risks, and taking bigger trades without proper analysis. To control it, they set strict stop-losses, stick to predetermined plans, and review past trades honestly. Keeping a trading journal helps identify overconfidence patterns and maintain discipline, preventing risky decisions driven by arrogance.

Does overconfidence lead to more impulsive trades?

Yes, overconfidence makes traders underestimate risks, leading to more impulsive trades. They believe they have better insights, ignore warning signs, and chase quick gains without proper analysis. This overestimation of skill fuels risky, emotionally driven decisions in day trading.

How can overconfidence impact long-term trading performance?

Overconfidence in day trading causes traders to underestimate risks, trade larger positions, and ignore signals indicating potential losses. This mindset leads to impulsive decisions, overtrading, and ignoring stop-losses, increasing the chance of significant losses. Overconfidence can also make traders ignore their trading plans, believing they’re immune to mistakes, which worsens long-term performance.

Conclusion about How can overconfidence lead to risky day trading behaviors?

Overconfidence can significantly disrupt day trading strategies, leading to risky behaviors and detrimental financial outcomes. It causes traders to overlook critical market signals, ignore risk management practices, and underestimate potential losses. Recognizing and controlling overconfidence is essential for maintaining discipline and ensuring long-term trading success. By fostering a balanced perspective, traders can mitigate impulsive decisions and enhance their overall performance in the dynamic trading landscape. For further insights and support in navigating these challenges, consider the resources available from DayTradingBusiness.