Did you know that trading with leverage can make your gains feel like a rollercoaster ride—exciting, but with the potential for a steep drop? Understanding leverage risk is crucial for day traders, as it can significantly amplify both potential gains and losses. This article delves into why managing leverage is essential, explores the common risks associated with high leverage, and discusses how leverage can exacerbate market volatility. We’ll also cover the relationship between leverage and margin calls, the dangers of over-leveraging, and the impact on a trader's capital. Additionally, we’ll highlight the differences in leverage risks faced by beginners versus professionals and present strategies to mitigate these risks. For any day trader looking to navigate the markets safely, grasping the nuances of leverage is vital, and DayTradingBusiness is here to guide you through it.

Why is leverage risk important for day traders?

Leverage risk is crucial for day traders because it amplifies both potential gains and losses. High leverage can wipe out your account quickly if trades move against you. Managing leverage risk helps prevent catastrophic losses and keeps trading sustainable. It forces traders to set strict stop-losses and avoid overexposing themselves. Without controlling leverage risk, even small market swings can lead to significant financial damage.

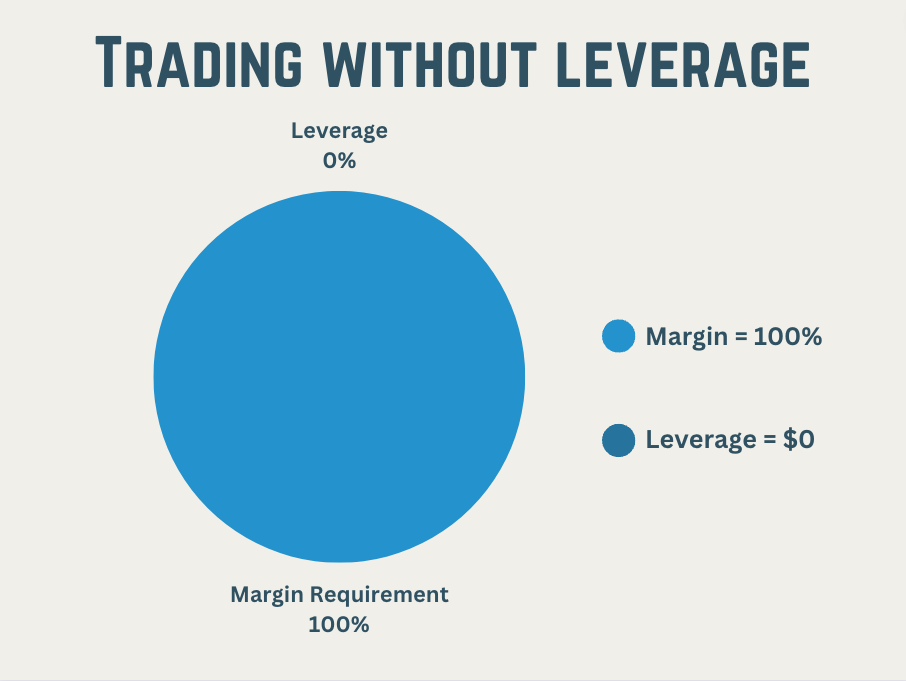

How does leverage increase potential losses for day traders?

Leverage amplifies both gains and losses. For day traders, using leverage means small price moves can wipe out their entire capital quickly. If the market moves against their position, losses grow faster than with unleveraged trading, increasing the risk of significant financial damage.

What are the common risks associated with high leverage?

High leverage amplifies both gains and losses, making day trading riskier. It can wipe out your account quickly if the market moves against you. Sudden price swings, gaps, and volatile moves become even more damaging with high leverage. Overleveraging can lead to margin calls, forcing you to close positions at a loss or add more funds. The key risk is losing more than your initial investment, which can happen in a matter of moments.

Why should day traders carefully manage leverage levels?

Day traders must carefully manage leverage levels because high leverage amplifies both gains and losses. Excessive leverage can wipe out their capital quickly during volatile market swings. Proper management reduces the risk of margin calls and forced liquidations. It helps maintain control over trading risks and keeps losses within manageable limits. Without careful leverage control, a small market move can turn into a catastrophic loss.

How can leverage amplify market volatility impact?

Leverage amplifies market volatility by increasing both potential profits and losses. For day traders, high leverage means small price movements can lead to significant financial swings, raising the risk of rapid account depletion. During volatile market swings, leverage magnifies the impact of sudden price shifts, making losses grow quickly. This heightened risk can wipe out trading accounts if not managed carefully.

What is the relationship between leverage and margin calls?

Leverage amplifies both gains and losses for day traders. When a trade moves against them, high leverage can quickly wipe out their margin, triggering a margin call. This forces traders to deposit more funds or close positions at a loss. The higher the leverage, the more likely a small adverse price move leads to a margin call, increasing risk significantly.

Why is leverage risk higher in volatile markets?

Leverage risk is higher in volatile markets because sharp price swings can quickly wipe out your margin, amplifying losses. When markets fluctuate unpredictably, borrowed funds magnify both gains and losses, making it easier to lose more than your initial investment. For day traders, this means small miscalculations or sudden shifts can lead to rapid, substantial losses, increasing the overall risk of leverage.

How does leverage affect a day trader’s capital?

Leverage amplifies a day trader’s potential gains but also increases the risk of significant losses, sometimes exceeding their initial capital. It allows traders to control larger positions with less money, but if the market moves against them, losses can quickly wipe out their account. High leverage makes it easier to lose capital fast, turning small price swings into major financial setbacks.

What are the dangers of over-leveraging in day trading?

Over-leveraging in day trading amplifies losses quickly, risking margin calls and account liquidation. It can lead to wiping out your capital in volatile markets. High leverage makes small price swings devastating, increasing emotional stress and reckless decisions. It also reduces your ability to withstand sudden market moves, risking significant financial ruin.

How can leverage risk lead to rapid account depletion?

Leverage risk causes rapid account depletion because it amplifies both gains and losses. When day traders use high leverage, small market moves can wipe out their entire account quickly if trades go against them. This magnified exposure means a single bad trade can exceed the initial investment, leaving traders with significant losses or margin calls. Overleveraging makes it harder to recover from setbacks, increasing the chances of rapid account depletion.

Learn about Can leverage risk lead to account liquidation?

Why is understanding leverage crucial for risk management?

Understanding leverage is crucial for risk management because it amplifies both gains and losses. For day traders, high leverage means small market moves can wipe out accounts quickly. Managing leverage helps prevent overexposure and controls potential losses, keeping trading sustainable. Without it, traders risk catastrophic financial damage from volatile market swings.

How do leverage risks differ between professional and beginner traders?

Leverage risk hits beginner traders harder because they often underestimate market swings and overuse leverage. Professionals manage leverage with experience, reducing the chance of large losses, while beginners can quickly wipe out their capital. High leverage amplifies small errors into major setbacks, making it a critical risk factor for day traders regardless of skill level.

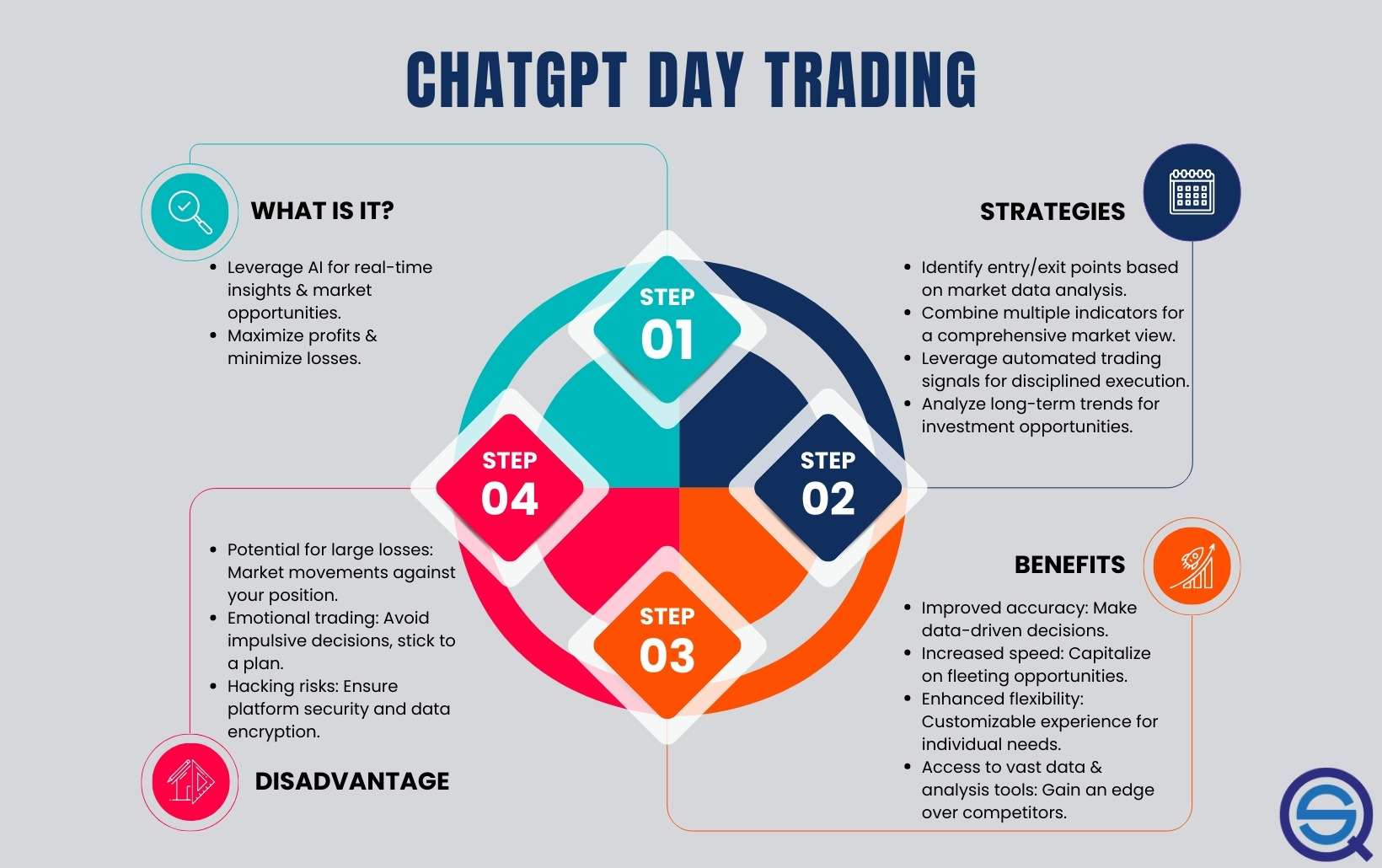

What strategies can mitigate leverage risk for day traders?

Leverage risk is significant for day traders because it amplifies both gains and losses, risking substantial capital with small market moves. To mitigate this, day traders should limit leverage levels, set strict stop-loss orders, and avoid overtrading. Using proper position sizing and maintaining a solid risk-reward ratio also helps control potential losses. Regularly monitoring trades and sticking to a disciplined trading plan prevent emotional decisions that compound leverage risk.

Why should day traders avoid excessive leverage?

Day traders should avoid excessive leverage because it amplifies losses quickly, risking their entire capital in a single bad move. High leverage can turn small market swings into huge financial setbacks, making trading riskier and more unpredictable. It increases the chance of margin calls and forced liquidations, wiping out accounts faster. Using too much leverage also clouds judgment, leading to reckless decisions under pressure. Keeping leverage moderate helps manage risk and preserve capital during volatile market swings.

How does leverage influence trading psychology?

Leverage amplifies both gains and losses, increasing emotional stress for day traders. It can lead to impulsive decisions driven by fear or greed, as traders chase quick profits or panic sell. High leverage makes setbacks feel more threatening, causing anxiety and reducing discipline. This heightened risk exposure can cause traders to overtrade or abandon strategies, undermining mental clarity. In short, leverage magnifies risk, fueling psychological pressure that impacts decision-making.

Learn about How does leverage affect day trading psychology?

What regulatory measures exist to control leverage risks?

Regulatory measures to control leverage risks include setting maximum leverage limits, requiring margin maintenance levels, and enforcing strict disclosure rules. Financial authorities like the SEC, FCA, and ASIC impose these rules to prevent excessive borrowing. They also mandate risk warnings and impose restrictions on high-leverage products to protect traders from catastrophic losses.

Conclusion about Why is leverage risk significant for day traders?

In conclusion, understanding leverage risk is crucial for day traders, as it significantly impacts potential losses and overall trading performance. By carefully managing leverage levels and being aware of the associated risks, traders can safeguard their capital and minimize the danger of rapid account depletion. DayTradingBusiness emphasizes the importance of risk management strategies to navigate the complexities of leverage, especially in volatile markets. Ultimately, informed trading decisions can lead to more sustainable success in the fast-paced world of day trading.

Learn about What should I know about leverage risk before day trading?

Sources:

- Can Day Trading Really Be Profitable?

- Global Financial Stability Report

- The Fed - Quantifying Treasury Cash-Futures Basis Trades

- Does trade friction exacerbate stock price crash risk? Evidence from ...

- Heterogeneous Traders, the Leverage Effect and Volatility of the ...

- Leveraged carry trade portfolios - ScienceDirect