Did you know that using high leverage in day trading can feel like riding a roller coaster with no safety harness? In this article, we delve into the perils of high leverage—what it is, how it amplifies risks, and the potential for significant financial losses. We’ll explore the psychological impacts on traders, the regulatory landscape, and the dangers of over-leveraging in volatile markets. Additionally, we provide essential strategies to mitigate these risks and discuss whether high leverage is appropriate for beginners. Join us at DayTradingBusiness as we navigate these critical insights to help you trade wisely.

What is high leverage in day trading?

High leverage in day trading means borrowing a large amount of money to control bigger positions with a small initial investment. The danger is that it amplifies both gains and losses, so a small market move can wipe out your account quickly. It increases risk of margin calls, forced liquidations, and significant financial losses if the trade moves against you.

How does high leverage increase trading risks?

High leverage amplifies both gains and losses, making your trades riskier. If the market moves against you, small price swings can wipe out your entire account quickly. It’s easy to overtrade or take bigger positions than you can afford, increasing the chance of margin calls or forced liquidation. Essentially, high leverage magnifies risks, turning minor market fluctuations into major financial hits.

Can high leverage lead to significant financial losses?

Yes, high leverage can lead to significant financial losses because it magnifies both gains and losses. If the market moves against your position, leverage causes losses to escalate quickly, potentially exceeding your initial investment. This increases the risk of margin calls and losing more money than you invested in the trade.

What are the common dangers of using high leverage?

High leverage amplifies both gains and losses, increasing the risk of significant financial loss. It can lead to margin calls if trades move against you, forcing quick liquidation of positions. In day trading, high leverage makes volatile markets more unpredictable, risking account blowouts. It can cause emotional trading decisions, leading to reckless moves. Overall, high leverage heightens the chance of losing more than your initial investment.

How does leverage amplify market volatility?

High leverage magnifies both gains and losses in day trading, causing market moves to look more dramatic. When traders use large leverage, small price swings can wipe out their accounts quickly. This increased sensitivity to price fluctuations fuels sharper market swings, making volatility more intense. Essentially, leverage acts like a multiplier, turning minor market shifts into major price swings that can destabilize trading positions.

What is the impact of high leverage on trading psychology?

High leverage amplifies both gains and losses, increasing stress and emotional swings in day trading. It can lead to impulsive decisions, fear of losing, and overconfidence when trades go well. The pressure to recover losses quickly may cause traders to take bigger risks, worsening psychological strain. Ultimately, high leverage can cause anxiety, burnout, and poor judgment, making emotional control harder.

Are there regulatory limits on leverage in day trading?

Yes, regulatory limits on leverage exist in day trading. For example, U.S. regulators like FINRA and the SEC impose maximum leverage ratios—typically 2:1 or 4:1—for retail traders on certain securities. These limits aim to reduce the risks of excessive leverage, which can amplify losses and lead to margin calls.

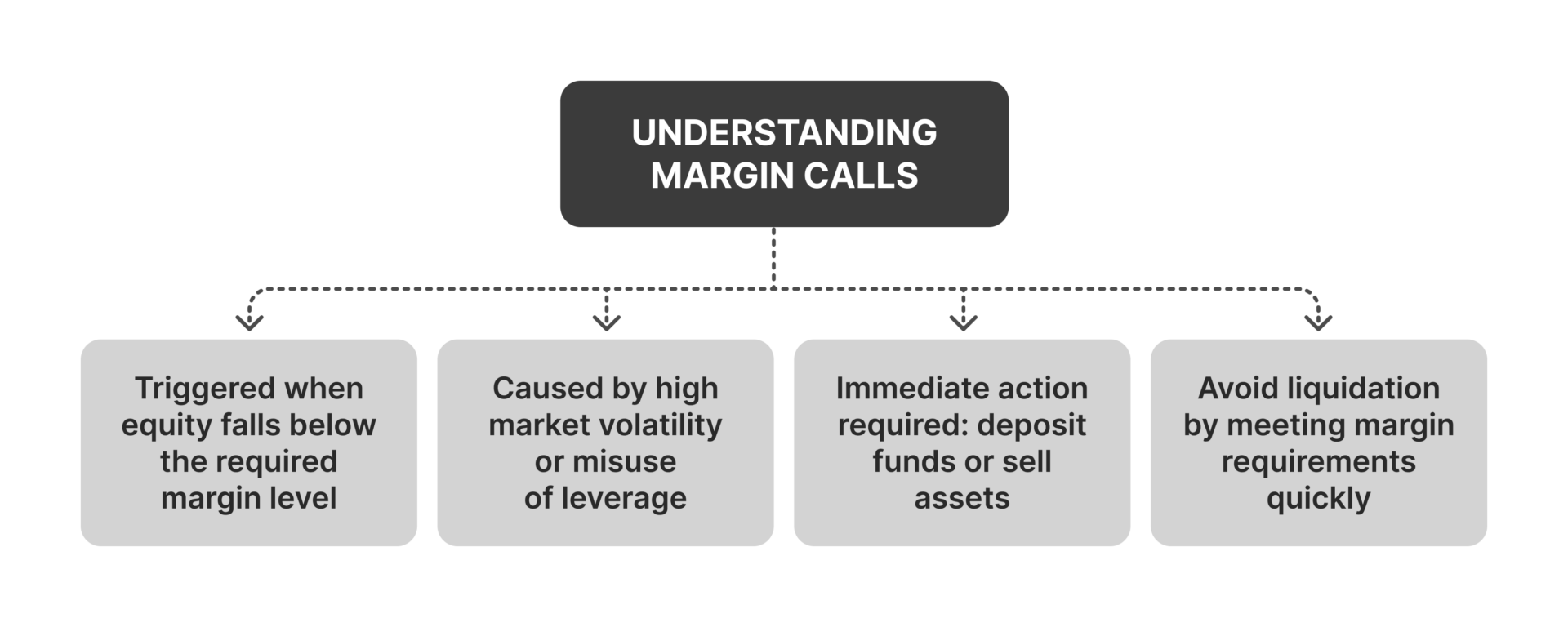

How does high leverage affect margin calls?

High leverage increases the risk of margin calls because even small market moves can wipe out your account balance. When your position loses value, the broker demands more funds to cover the reduced margin, leading to a margin call. If you can't meet it, your positions get liquidated quickly, amplifying losses. Essentially, high leverage makes margin calls more frequent and severe, risking rapid account depletion.

What are the risks of over-leveraging in volatile markets?

Over-leveraging in volatile markets can wipe out your capital quickly, as small price swings amplify losses. It increases the risk of margin calls, forcing you to liquidate positions at a loss. High leverage can lead to emotional trading decisions, causing you to hold onto losing trades longer. Sudden market swings can trigger rapid margin requirements, leaving you exposed to rapid capital depletion. Overall, it magnifies risk, making trading more unpredictable and financially dangerous.

How can high leverage lead to margin calls or account liquidation?

High leverage magnifies both gains and losses, so a small adverse move can wipe out your account. If your trades go against you, your margin drops below required levels, triggering a margin call. If you don’t add funds quickly, the broker will liquidate your positions to cover the losses, risking complete account loss.

Learn about How to Avoid Margin Calls and Leverage Risks

What strategies can mitigate the risks of high leverage?

To mitigate high leverage risks, use smaller position sizes, set strict stop-loss orders, diversify trades, avoid emotional trading, and limit leverage ratios. Always have a clear risk management plan and only trade with money you can afford to lose.

Is high leverage suitable for beginner traders?

No, high leverage is not suitable for beginner traders. It amplifies small mistakes into big losses, making trading riskier and harder to manage for newcomers. Beginners lack the experience to handle sudden market swings caused by leverage, increasing the chance of losing their entire capital quickly.

How does high leverage influence trading discipline?

High leverage magnifies gains but also amplifies losses, making it harder to stick to disciplined trading. When traders use excessive leverage, they risk overtrading, chasing losses, and abandoning their risk management plans. It can lead to impulsive decisions, rapid account depletion, and emotional trading that breaks discipline. High leverage pressures traders to take bigger risks, often causing them to deviate from their predefined strategies.

What are the long-term consequences of high leverage use?

High leverage in day trading can lead to significant long-term financial losses, increased risk of margin calls, and potential debt accumulation. It amplifies small market moves into large losses, making sustained profitability difficult. Over time, traders may experience emotional stress, decreased confidence, and a tendency to take reckless risks to recover losses. Persistent high leverage can wipe out trading accounts quickly, undermining long-term trading success.

How can traders manage the risks associated with high leverage?

Traders manage risks from high leverage by setting strict stop-loss orders, limiting position sizes, and avoiding over-leveraging their accounts. Using risk-reward ratios helps ensure potential gains outweigh losses. Diversifying trades and maintaining a solid trading plan also reduce exposure. Regularly monitoring the market and not overtrading prevent emotional decisions that amplify risk.

Conclusion about What are the dangers of high leverage in day trading?

In summary, while high leverage can amplify potential profits in day trading, it also significantly increases the risk of substantial financial losses. Traders must be aware of the dangers, including heightened market volatility, psychological impacts, and regulatory implications. Effective risk management strategies are essential to navigate these challenges. For those seeking guidance on managing leverage responsibly, DayTradingBusiness offers valuable insights to help traders make informed decisions and enhance their trading discipline.

Learn about What should I know about leverage risk before day trading?

Sources:

- Are Concerns About Leveraged ETFs Overblown?

- The price discovery role of day traders in futures market: Evidence ...

- Should retail investors' leverage be limited? - ScienceDirect

- Can Day Trading Really Be Profitable?

- Market Liquidity after the Financial Crisis

- Stochastic leverage effect in high-frequency data: a Fourier based ...