Did you know that using too much leverage in day trading can feel like trying to balance on a unicycle while juggling flaming torches? It's a risky endeavor that can lead to serious financial burns. In this article, we’ll explore essential strategies to minimize leverage risk in day trading, including how to identify high-risk scenarios and the best practices for reducing exposure. You'll learn about the impact of leverage on trading losses, safe limits, and the critical role of stop-loss orders and position sizing. We’ll also discuss the importance of monitoring your leverage levels, signs of excessive use, and how economic events can influence your risk. Finally, we’ll highlight regulatory rules and common mistakes to avoid, ensuring you can navigate the wild world of leverage responsibly. With insights from DayTradingBusiness, you’ll be better equipped to make informed trading decisions.

How can I identify high leverage risks in day trading?

To identify high leverage risks in day trading, look for positions where the leverage ratio is significantly amplified, such as trading with 10:1 or higher. Watch for margin requirements that, if hit, could force a margin call or liquidation. Pay attention to volatile markets and low-liquidity assets, which can cause rapid losses when leverage is involved. Use risk management tools like stop-loss orders to limit potential downside. Regularly review your leverage levels and avoid overexposing your capital on highly leveraged trades.

What are the best strategies to reduce leverage exposure?

To minimize leverage risk in day trading, use lower margin levels, set strict stop-loss orders, and avoid overtrading. Regularly monitor your position sizes and limit the amount of borrowed funds you use. Diversify trades to prevent heavy losses on a single position. Keep a cash reserve to cushion against volatility. Stay disciplined with your trading plan and avoid emotional decisions. Use leverage cautiously, only risking what you can afford to lose.

How does leverage amplify trading losses?

Leverage amplifies trading losses by borrowing money to increase position size, so a small unfavorable price move can wipe out your capital quickly. When the market moves against your leveraged position, losses grow faster than with just your own funds. High leverage means even minor dips can trigger significant losses, risking your entire account. To minimize leverage risk in day trading, use lower leverage ratios, set strict stop-losses, and avoid overexposing your capital on risky trades.

What are safe leverage limits for day traders?

Safe leverage limits for day traders typically stay below 10:1, with many experts recommending no more than 2:1 or 3:1. Using high leverage increases margin calls and loss potential, so keeping leverage low helps manage risk. For most retail traders, sticking to 2:1 or 3:1 minimizes the chance of significant losses while allowing for reasonable position sizing. Always adjust leverage based on your experience, risk tolerance, and the specific market you're trading.

How can I set stop-loss orders to manage leverage risk?

Set stop-loss orders just below your entry point for long positions or above for short positions. Use a fixed percentage or dollar amount to limit losses, like 2% of your account balance. Adjust stop-loss levels based on market volatility, such as placing them outside recent price swings. Use trailing stops to lock in profits while protecting against sudden reversals. Always set your stop-loss before entering a trade and stick to it strictly.

What role does position sizing play in minimizing leverage risk?

Position sizing controls how much capital you risk per trade, preventing overexposure. Smaller positions reduce the impact of a losing trade, lowering leverage risk. Proper sizing ensures no single trade can wipe out your account, helping you manage risk effectively. It’s a key tool to keep leverage from amplifying losses beyond your comfort zone.

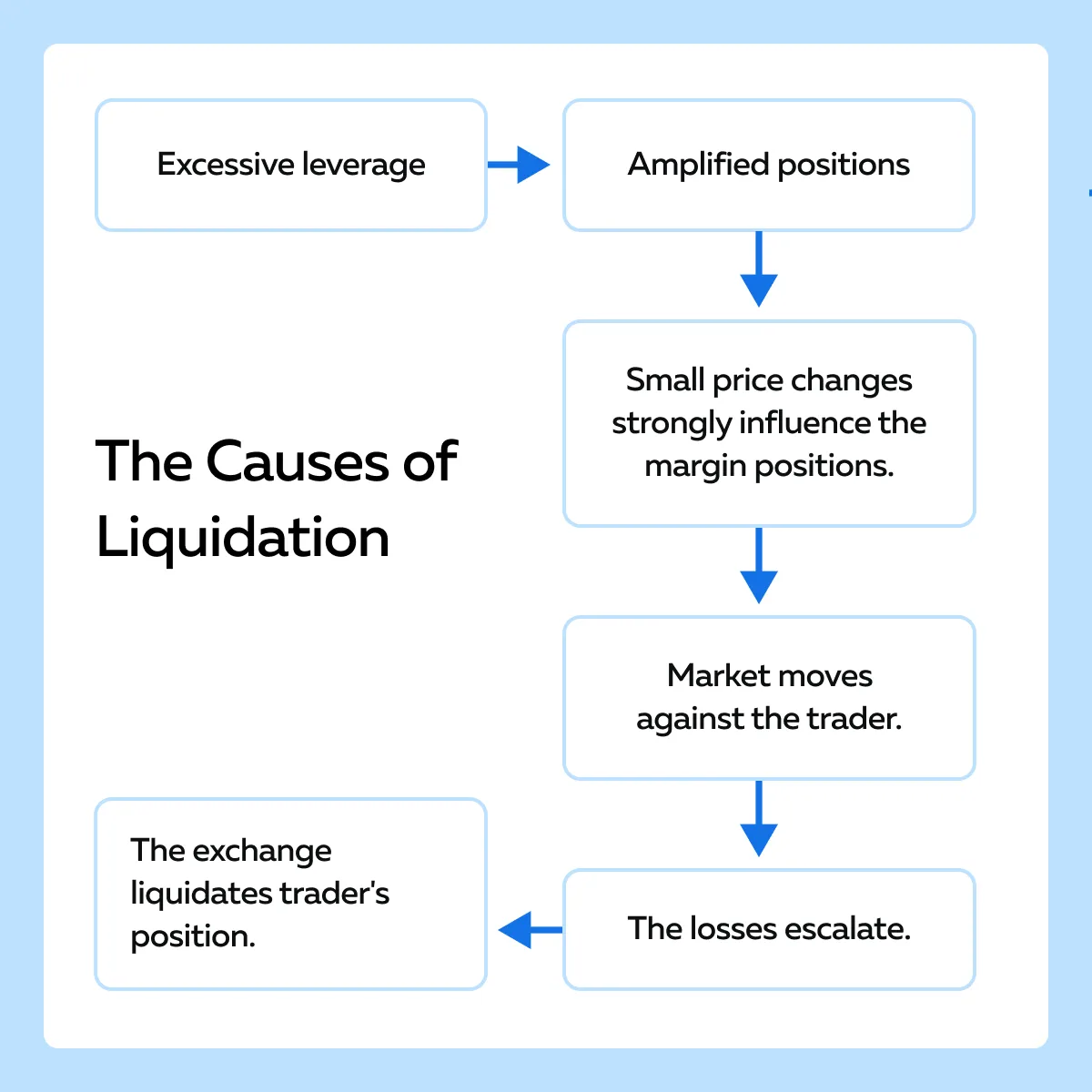

How do margin calls increase leverage danger?

Margin calls force traders to add more funds or sell positions quickly, increasing leverage danger. When prices move against a trade, margin calls can trigger forced liquidation, amplifying losses. Higher leverage means smaller price swings lead to larger percentage losses, making margin calls more frequent and risky. To minimize leverage risk, keep leverage low, use stop-loss orders, and avoid overextending your positions.

What are the signs of excessive leverage use?

Signs of excessive leverage use include rapid account drawdowns, frequent margin calls, and large position sizes relative to account balance. You might notice increased volatility in your trading results and difficulty maintaining consistent gains. If your margin requirements are constantly strained or you’re forced to close positions unexpectedly, that’s a clear warning. Overleveraging often leads to emotional trading, panic selling, or holding onto losing trades longer than wise.

How can I diversify to lower leverage risk?

To lower leverage risk in day trading, diversify your trades across different asset classes like stocks, forex, and commodities. Avoid putting all your capital into a single position; spread it out to reduce exposure. Use smaller position sizes relative to your account balance, so no single trade can cause major losses. Incorporate uncorrelated assets to prevent cascading losses if one market moves against you. Regularly review your portfolio and adjust positions to maintain balanced risk. Consider using stop-loss orders to limit potential downside and avoid over-leveraging on any single trade.

What trading tools help monitor leverage levels?

Trading platforms with real-time margin and leverage dashboards help monitor leverage levels. Some tools include margin calculators, risk management software, and broker-provided leverage alerts. These tools notify you when leverage approaches risky thresholds, allowing quick adjustments. Using platform alerts and integrated risk management features ensures you stay within safe leverage limits during day trading.

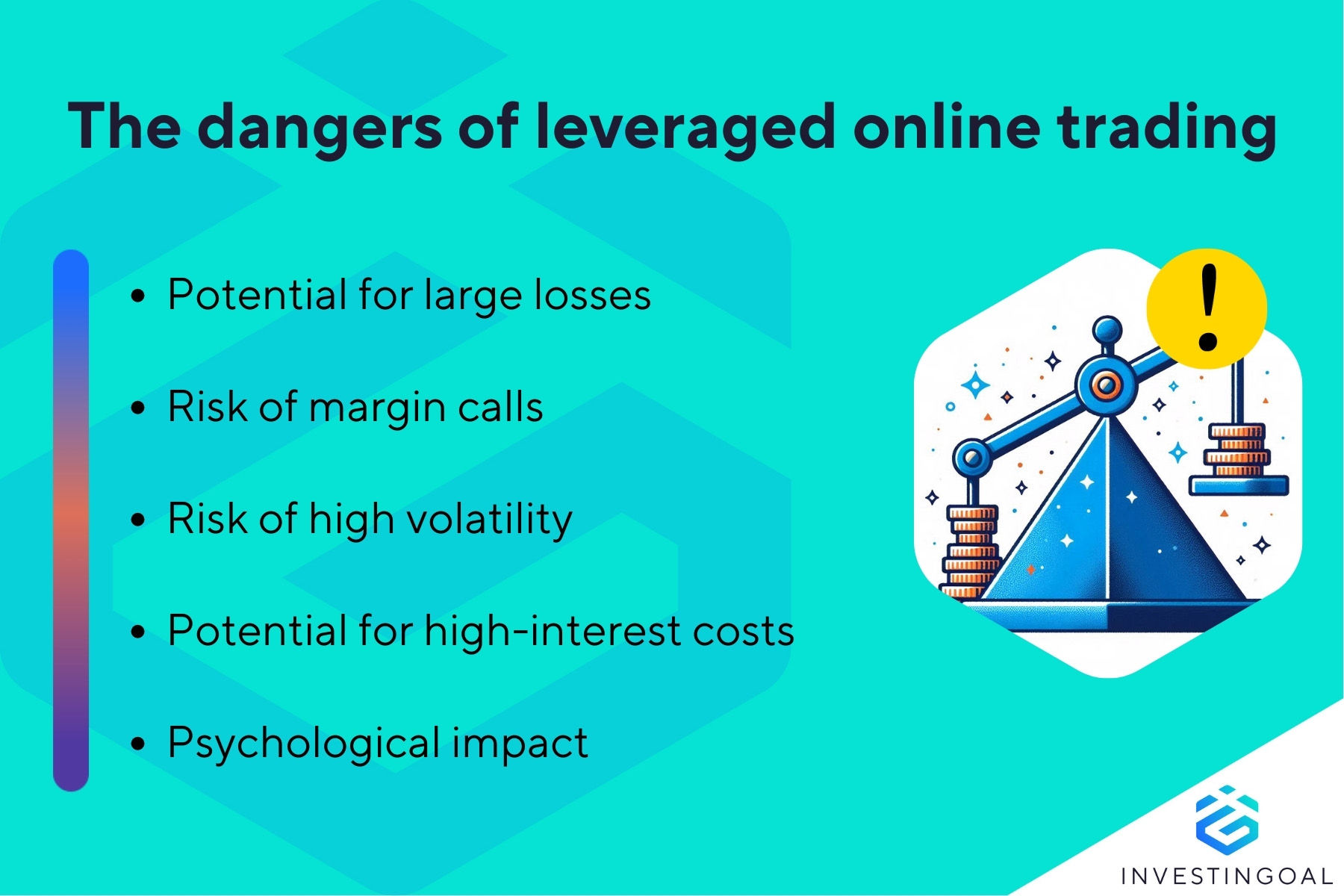

How does leverage impact my trading psychology?

High leverage amplifies both gains and losses, increasing emotional stress during trading. It makes setbacks feel more severe, triggering fear, panic, or overconfidence. Using excessive leverage can lead to impulsive decisions and chasing losses. To minimize leverage risk, stick to lower leverage ratios, set strict stop-losses, and maintain discipline. Managing leverage helps keep your emotions in check and preserves your mental clarity during volatile markets.

Learn about How does leverage affect day trading psychology?

What are the regulatory rules on leverage in day trading?

Regulatory rules on leverage in day trading vary by country. In the U.S., FINRA limits day trading leverage to 4:1 for margin accounts, meaning you can borrow up to four times your account equity. The SEC also imposes rules to prevent excessive leverage, requiring pattern day traders to maintain a minimum of $25,000 in their account. In Europe, regulations like ESMA restrict leverage to 2:1 for retail traders on major forex pairs. Always check your local financial authority’s rules, as they set maximum leverage limits to protect traders from excessive risk.

How can I use leverage responsibly as a beginner?

Start small, using minimal leverage to limit potential losses. Set strict stop-loss orders to exit trades if the market moves against you. Focus on a few assets you understand well, avoiding overtrading. Always have a clear trading plan and stick to it, avoiding emotional decisions. Regularly review your trades to learn and adjust your risk management. Use demo accounts to practice leverage without real money. Never risk more than you can afford to lose.

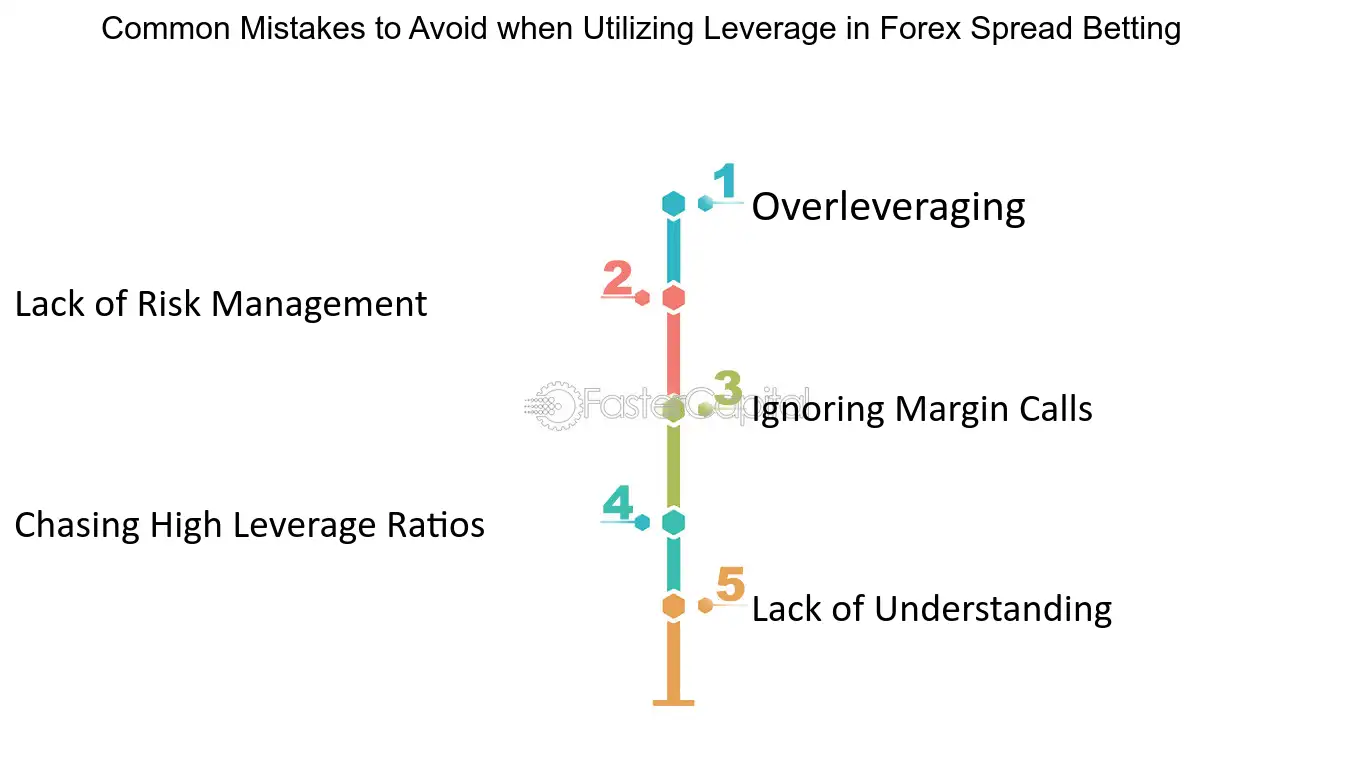

What are common mistakes leading to high leverage risk?

Using excessive leverage beyond your trading experience, overleveraging on volatile assets, ignoring stop-loss orders, and failing to diversify trades increase leverage risk. Not understanding margin requirements or market conditions also heightens the danger. Relying on high leverage without proper risk management or emotional discipline leads to bigger losses.

How do economic events affect leverage risk?

Economic events can cause sudden market swings, increasing leverage risk by amplifying losses. When news like interest rate changes or economic reports hit, prices can gap or move unpredictably, making leveraged positions riskier. To minimize leverage risk in day trading, avoid overleveraging during major economic releases, use stop-loss orders, and stay aware of economic calendars to prepare for volatile periods. Keep position sizes small relative to your account to limit exposure during unpredictable market moves.

How can backtesting improve leverage management?

Backtesting helps identify optimal leverage levels by simulating past trades, showing how different leverage ratios impact risk and profitability. It reveals how high leverage can amplify losses during volatile markets, guiding traders to set safer leverage limits. By analyzing historical data, traders can develop strategies that avoid over-leverage, reducing the chance of margin calls. Essentially, backtesting provides a clear picture of how leverage affects performance, enabling more informed, cautious risk management in day trading.

Conclusion about How to minimize leverage risk in day trading?

In summary, minimizing leverage risk in day trading requires a proactive approach that includes identifying high-risk scenarios, employing effective strategies, and maintaining safe leverage limits. Utilizing stop-loss orders, proper position sizing, and diversification can further mitigate potential losses. By understanding the psychological impacts of leverage and adhering to regulatory guidelines, traders can navigate the complexities of the market more effectively. For deeper insights and tailored guidance on managing leverage risk, DayTradingBusiness is here to support your trading journey.

Learn about How does leverage impact stop-loss risk in day trading?