Did you know that trading with high leverage can sometimes feel like riding a roller coaster blindfolded—exciting but potentially disastrous? In this article, we delve into the complexities of leverage risk across various markets. We'll explore how leverage impacts risk differently in stock versus forex markets, commodities trading, and even cryptocurrencies. Discover whether emerging markets carry higher leverage risks and how regulatory differences play a role. We'll also discuss the effects of market volatility, trading duration, and margin requirements on leverage risk. Additionally, learn how investor experience and market conditions can amplify or mitigate these risks. Join us at DayTradingBusiness to navigate these crucial insights for smarter trading decisions.

Does leverage risk differ between stock and forex markets?

Yes, leverage risk is higher in forex markets because leverage ratios are often much larger—sometimes 50:1 or 100:1—compared to stocks, where leverage is usually lower. This means small price moves can cause bigger losses or gains in forex. Stock markets generally have lower leverage limits, reducing the risk of rapid, large losses.

How does leverage impact risk in commodities trading?

Leverage amplifies both gains and losses in commodities trading. Higher leverage means small price moves can wipe out your capital quickly, increasing risk. Risk varies across markets: some, like energy, are more volatile, so leverage there can lead to bigger swings. In less volatile markets, leverage still raises risk but less dramatically. Overall, leverage magnifies risk proportionally to market volatility.

Is leverage risk higher in emerging markets than in developed markets?

Yes, leverage risk is higher in emerging markets due to greater economic volatility, less stable financial systems, and higher borrowing costs.

Do regulatory differences affect leverage risk across markets?

Yes, regulatory differences significantly impact leverage risk across markets. Stricter regulations limit leverage, reducing risk, while lenient rules allow higher leverage, increasing risk exposure.

How does market volatility influence leverage risk?

Market volatility amplifies leverage risk by increasing the chance of rapid price swings that can wipe out leveraged positions quickly. In volatile markets, small moves can trigger margin calls or forced liquidations, making leverage risk higher. Different markets, like stocks, forex, or commodities, show varying volatility levels, so leverage risk is more pronounced in highly volatile markets. When volatility spikes, the safety margin for leveraged trades shrinks, raising the chance of substantial losses.

Does leverage risk vary in cryptocurrency markets?

Yes, leverage risk varies in cryptocurrency markets because of higher volatility and less regulation, making leveraged positions riskier compared to traditional markets.

Are certain assets more sensitive to leverage risk?

Yes, some assets like cryptocurrencies, small-cap stocks, and high-yield bonds are more sensitive to leverage risk due to their volatility and liquidity issues. These markets amplify leverage's impact, increasing potential losses quickly. Conversely, assets like government bonds or large-cap stocks tend to be less sensitive because of their stability.

How does leverage risk change during market downturns?

Leverage risk increases during market downturns as borrowed funds amplify losses, making positions more vulnerable to margin calls and forced liquidations. When markets fall, the value of leveraged assets drops faster, escalating the chance of significant financial damage. Different markets can see varying leverage risks; highly leveraged sectors like real estate or crypto experience sharper shocks in downturns than more conservative markets.

Can leverage risk lead to faster losses in volatile markets?

Yes, leverage risk can lead to faster losses in volatile markets because high leverage amplifies both gains and losses, making rapid declines more likely when market swings are sharp.

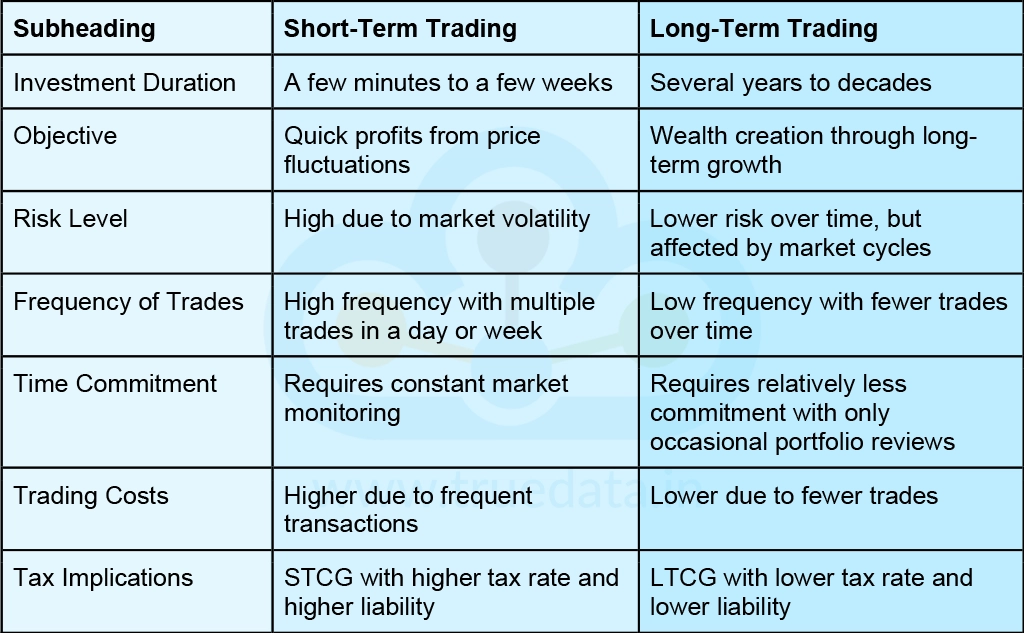

How does leverage risk vary in short-term vs. long-term trading?

Leverage risk is higher in short-term trading because quick price swings can wipe out your position rapidly with high leverage. Long-term trading typically involves lower leverage or more stable positions, reducing the immediate risk of large losses. In volatile markets, short-term traders face more frequent margin calls, while long-term traders can ride out fluctuations but still face risks if leverage is too high. Overall, leverage amplifies risk more in short-term trades due to rapid market moves.

Learn about How to minimize leverage risk in day trading?

Are there market conditions that amplify leverage risk?

Yes, markets with high volatility, low liquidity, or unpredictable price swings amplify leverage risk. When asset prices fluctuate wildly or trading volume drops, leveraged positions can quickly wipe out capital. Emerging markets or thinly traded assets often have higher leverage risk due to these conditions.

How do margin requirements affect leverage risk?

Margin requirements directly limit leverage; lower margins increase leverage risk, while higher margins reduce it. When margin requirements are tight, traders can control larger positions with less capital, raising the potential for bigger losses. Conversely, higher margin demands restrict leverage, making markets less risky for traders. Different markets set varying margin standards, so leverage risk varies—futures markets often require higher margins than forex, influencing how much traders can amplify their gains or losses.

Does leverage risk differ in different trading hours?

Yes, leverage risk varies with trading hours. During volatile periods like market openings or major news releases, the risk increases because leverage amplifies price swings. In quieter hours, lower volatility means less risk even with high leverage. Different markets also have different leverage limits and liquidity, affecting how leverage risk changes throughout the day.

Learn about How does leverage risk differ from other trading risks?

How does leverage risk vary across different investment instruments?

Leverage risk varies widely across markets. In forex trading, high leverage can amplify gains but also losses, making it very risky. Stock markets typically have lower leverage limits, so risk is less extreme but still significant. Futures and commodities often allow substantial leverage, increasing potential for rapid losses. Real estate generally involves lower leverage but can still be risky if borrowed heavily. Overall, markets with higher leverage options pose greater risk of outsized losses relative to invested capital.

Can high leverage cause market crashes?

Yes, high leverage can cause market crashes by amplifying small shocks into large sell-offs. When traders use excessive leverage, a minor dip can wipe out positions quickly, triggering panic selling and cascading declines across markets. The risk from leverage varies; some markets, like forex or derivatives, allow higher leverage, increasing crash potential. Others, like equities in well-regulated environments, limit leverage to reduce systemic risk. Overall, increased leverage raises the chance of rapid, severe crashes during turmoil.

How do investor experience levels influence leverage risk?

Investor experience levels influence leverage risk because seasoned investors typically use leverage more strategically, understanding its risks, while less experienced investors may over-leverage, increasing their vulnerability to market swings. In markets with high leverage, inexperienced investors often take bigger risks, amplifying potential losses. Conversely, experienced investors tend to manage leverage cautiously, reducing overall leverage risk in volatile markets.

Conclusion about Does leverage risk vary across different markets?

In conclusion, leverage risk indeed varies significantly across different markets, influenced by factors such as market type, volatility, regulatory frameworks, and asset sensitivity. Understanding these dynamics is crucial for traders to mitigate potential losses. For more in-depth insights and guidance on managing leverage risk effectively, consider exploring resources from DayTradingBusiness.

Sources:

- Revisiting Risk-Weighted Assets “Why Do RWAs Differ Across ...

- Portfolio rebalancing in general equilibrium - ScienceDirect

- Global Financial Stability Report, April 2024, Chapter 2: “The Rise ...

- October 2015 GFSR Chapter 3: Corporate Leverage in Emerging ...

- The bank capital-competition-risk nexus – A global perspective ...