Did you know that the stock market has been known to react faster than a cat can knock a glass off a table? Understanding systemic risks in day trading is crucial for navigating this fast-paced environment. In this article, we explore the nature of systemic risks, how market-wide events and economic indicators can signal potential threats, and the role of geopolitical and regulatory changes. We’ll also examine common indicators of systemic risks, tools for real-time detection, and strategies for effective risk management. Finally, learn how portfolio diversification, stress testing, and recognizing asset correlations can increase your resilience against sudden shocks. With insights from DayTradingBusiness, you'll be equipped to mitigate risks and enhance your trading strategies.

What are systemic risks in day trading?

Systemic risks in day trading are potential widespread market disruptions that can cause significant losses across many traders, such as market crashes, liquidity shortages, or abrupt regulatory changes. They stem from factors like economic downturns, major geopolitical events, or technological failures in trading platforms. To identify them, watch for signs like high market volatility, systemic news, or sudden liquidity drops. Mitigate these risks by diversifying your trades, setting strict stop-loss orders, and staying informed about broader market conditions.

How do market-wide events affect day trading risks?

Market-wide events increase day trading risks by causing sudden, unpredictable price swings across multiple assets. They can trigger rapid liquidity drops, widen spreads, and lead to high volatility, making trades more unpredictable. These events, like economic crises or geopolitical tensions, affect the entire market, amplifying potential losses. To mitigate this risk, monitor news and economic indicators closely, set tight stop-loss orders, and avoid overleveraging during uncertain times.

What are common indicators of systemic risks?

Common indicators of systemic risks in day trading include market-wide volatility spikes, sudden liquidity shortages, widespread price swings across multiple assets, and declines in major indices. Watch for economic shocks, geopolitical events, or regulatory changes that ripple through the entire financial system. Elevated correlation among different assets also signals increased systemic risk. Sudden drops in market confidence or liquidity crunches can be early warning signs.

How can economic indicators signal potential systemic threats?

Economic indicators reveal systemic threats when they show widespread issues like rising unemployment, declining GDP, or soaring debt levels, hinting at financial instability. Sudden shifts in indicators such as bond yields or credit spreads can signal looming market stress. For day traders, these signals warn of potential market crashes or liquidity crunches, prompting caution. Tracking macroeconomic data helps spot vulnerabilities that could trigger a ripple effect across markets, indicating systemic risks.

What role do geopolitical events play in systemic risks?

Geopolitical events can trigger widespread market instability, amplifying systemic risks in day trading. They can cause sudden price swings, liquidity shortages, and volatility spikes across multiple assets. These events threaten the stability of financial systems, making it harder to predict market behavior and increasing the chance of large-scale losses. Recognizing geopolitical risks helps traders adjust positions quickly and avoid exposure to unpredictable shocks.

How do regulatory changes impact systemic risk in day trading?

Regulatory changes can increase systemic risk in day trading by causing sudden market disruptions, limiting liquidity, or altering trading behaviors. When rules tighten or shift unexpectedly, traders may react impulsively, amplifying market volatility. Conversely, relaxed regulations can encourage risky trading practices, raising the chance of widespread failures. Monitoring regulatory updates helps traders anticipate shifts that could trigger broader market instability.

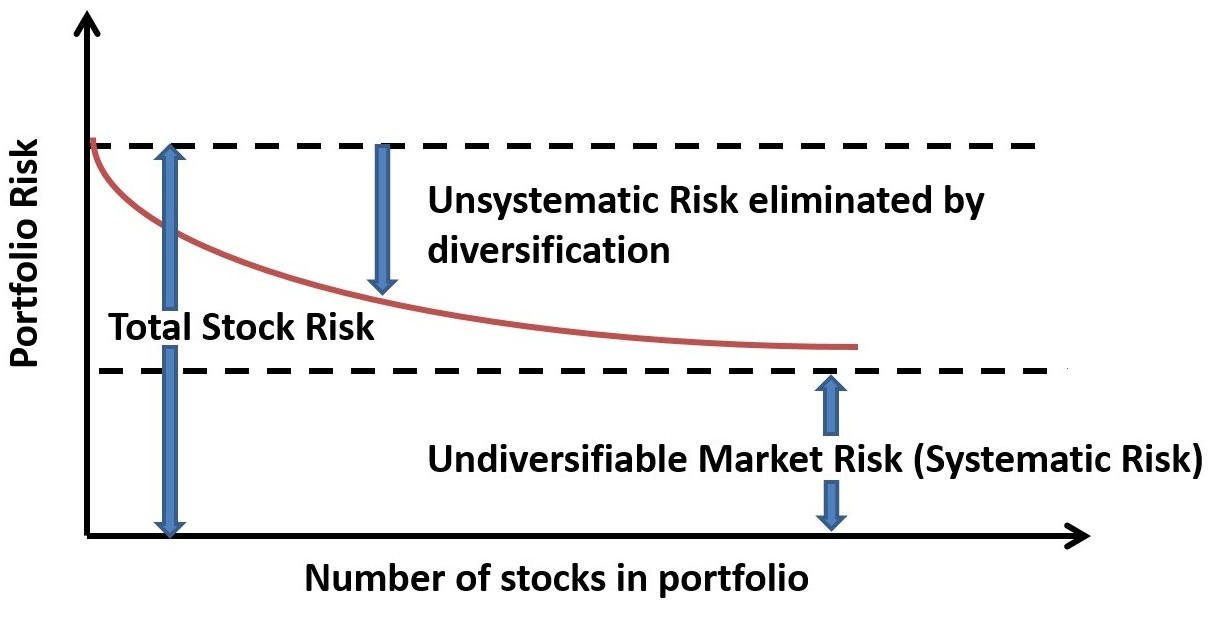

How can portfolio diversification reduce systemic risk?

Portfolio diversification spreads investments across different assets, sectors, and geographic regions, reducing exposure to any single market's downturn. This minimizes the impact of systemic risk, which affects the entire financial system, by preventing heavy losses if one sector or asset class crashes. For example, holding stocks, bonds, and commodities ensures that a collapse in the stock market doesn't wipe out your entire portfolio. Diversification doesn't eliminate systemic risk entirely but cushions your portfolio against widespread market failures.

What tools help detect systemic risks in real-time?

Tools like Bloomberg Terminal, Reuters Eikon, and S&P Capital IQ provide real-time data and analytics to detect systemic risks. Financial network analysis platforms such as Palantir and Dataminr monitor interconnected market exposures instantly. Additionally, risk dashboards with live stress testing, market sentiment analysis tools like RavenPack, and algorithms tracking liquidity and volatility help identify emerging systemic threats during trading hours.

How can leverage increase exposure to systemic risks?

Leverage amplifies exposure to systemic risks by magnifying losses during market downturns, causing small dips to escalate into major financial hits. High leverage makes traders vulnerable to sudden market shocks, which can trigger cascading failures across the financial system. Using excessive leverage can lead to margin calls or forced liquidations, spreading instability through interconnected markets.

What are the best risk management strategies for systemic threats?

Diversify your portfolio to spread exposure, set strict stop-loss orders to limit losses, and monitor market indicators for early warning signs. Use stress testing and scenario analysis to understand potential systemic impacts. Maintain liquidity to withstand market shocks and avoid over-leverage. Stay informed on macroeconomic trends and regulatory changes that could trigger broader disruptions. These strategies help you detect and reduce systemic risks in day trading.

How does liquidity risk relate to systemic market risks?

Liquidity risk can amplify systemic market risks by causing sudden asset sell-offs, freezing markets, and triggering cascading failures among financial institutions. When liquidity dries up, even solid assets become hard to sell, spreading fear and instability across the entire market. In day trading, recognizing signs of liquidity risk—like widening bid-ask spreads or declining trading volumes—helps prevent getting caught in a market meltdown. Managing liquidity—by avoiding thinly traded assets and maintaining cash reserves—reduces exposure to systemic shocks.

How can stress testing improve risk mitigation?

Stress testing reveals how your trading system reacts under extreme market conditions, helping you spot vulnerabilities. It shows potential losses during crashes or high-volatility periods, enabling better risk management. By simulating worst-case scenarios, you can adjust strategies, set appropriate stop-losses, and diversify to prevent catastrophic failures. Regular stress testing keeps your risk mitigation plan proactive, not reactive, ensuring you’re prepared for systemic risks in day trading.

What are the signs of an impending market collapse?

Signs of an impending market collapse include a sharp decline in stock indices, widespread panic selling, soaring volatility, and dropping liquidity. Watch for overleveraged traders and margin calls, extreme valuations detached from fundamentals, and deteriorating economic indicators. Sudden drops in bond prices or credit spreads also hint at systemic risk. When multiple sectors show weakness simultaneously and negative news triggers outsized reactions, a market downturn may be near.

How do correlations between assets influence systemic risk?

Correlations between assets increase systemic risk by causing losses to spread quickly during market downturns. When assets move together strongly, a shock to one can trigger widespread declines, amplifying financial instability. Recognizing rising correlations helps traders anticipate how risks can cascade across markets, enabling better hedging and diversification strategies to mitigate systemic threats.

How can traders prepare for sudden systemic shocks?

Traders can prepare for sudden systemic shocks by diversifying their portfolio, setting strict stop-loss orders, and maintaining high liquidity. Stay informed about macroeconomic indicators and financial news to spot early warning signs. Use risk management tools like hedging with options or futures. Keep a cash reserve to avoid forced liquidation during market turmoil. Regularly review and adjust trading strategies to adapt quickly to changing conditions.

Conclusion about How to Identify and Mitigate Systemic Risks in Day Trading

In conclusion, understanding and mitigating systemic risks is essential for successful day trading. By recognizing how market-wide events, economic indicators, and geopolitical factors influence risk, traders can better prepare for potential threats. Utilizing tools for real-time detection, practicing effective risk management strategies, and diversifying portfolios are crucial steps. Stay informed and proactive, and consider the insights from DayTradingBusiness to enhance your trading approach and navigate systemic challenges effectively.

Learn about How to Mitigate Risks When Day Trading ETFs