Did you know that hedging is like putting on a raincoat before stepping outside, even if the sun is shining? In day trading, it’s essential to protect your investments against unexpected market shifts. This article delves into common hedging techniques that can safeguard your trades, including popular methods like short selling and options. We’ll explore how stop-loss orders, inverse ETFs, and futures contracts play crucial roles in hedging strategies. Additionally, we’ll discuss the importance of diversification, the risks of leverage, and how correlated assets can be utilized effectively. Timing, technical analysis, and market volatility also significantly influence hedging success. Finally, remember that combining multiple hedging methods could enhance your strategy. For more in-depth insights and guidance, DayTradingBusiness is here to help you navigate these complexities.

What are the most popular hedging techniques in day trading?

The most popular hedging techniques in day trading include using options like puts and calls to protect positions, executing opposite trades to offset risk, and employing stop-loss orders to limit potential losses. Traders also hedge with futures contracts or inverse ETFs to counteract market moves. These methods help manage volatility and reduce exposure during rapid price swings.

How does short selling serve as a hedging method?

Short selling helps day traders hedge by offsetting potential losses in long positions. If a trader owns stocks and expects a short-term decline, selling short reduces exposure, balancing gains and losses. It acts as insurance—if the market drops, profits from short sales can compensate for losses elsewhere. This technique minimizes overall risk during volatile trading days.

Can options be used effectively for hedging in day trading?

Yes, options can be effective for hedging in day trading. Traders often buy put options to protect against downside risk or sell call options to generate income and hedge long positions. Using spreads like vertical or iron condors also helps limit losses while maintaining upside potential. Proper timing and quick execution are essential because day trading requires precise, short-term hedging.

What is the role of stop-loss orders in hedging strategies?

Stop-loss orders limit potential losses by automatically selling a position if the price drops to a certain level, helping day traders hedge against sudden adverse price movements. They protect gains and manage risk in volatile markets, acting as a safeguard during rapid price swings. Using stop-loss orders as part of a hedging strategy ensures that losses are contained without constant monitoring.

How do inverse ETFs help in hedging day trades?

Inverse ETFs help day traders hedge by providing a quick way to profit from market declines. If a trader expects a short-term drop, they can buy inverse ETFs to offset potential losses in long positions. This reduces risk without closing their main trades. Inverse ETFs act as a hedge by moving inversely to the market or specific sectors, allowing traders to protect gains or limit downside during volatile days.

When should a trader use futures contracts for hedging?

A trader should use futures contracts for hedging when they want to protect against short-term price swings in the underlying asset, especially if they hold or plan to buy/sell that asset soon. Use futures for hedging when expecting price volatility that could impact your position, like upcoming earnings reports or geopolitical events. It’s ideal for quick, targeted risk mitigation rather than long-term strategies.

How does diversification act as a hedging tool for day traders?

Diversification spreads a day trader's risk across different assets, reducing the impact of a single loss. By holding a mix of stocks, options, or other instruments, traders can offset downturns in one position with gains in another. This acts as a hedge, protecting the overall portfolio from sudden market swings. It helps smooth out volatility and limits big losses during unpredictable trading days.

What are the risks of using leverage as a hedging technique?

Using leverage as a hedging technique amplifies potential losses if the market moves against your position. It can cause rapid margin calls and wipe out your capital quickly. Leverage increases risk exposure, making your hedge more fragile during volatile swings. If your hedge fails, losses on leveraged positions can far exceed initial investments.

How can correlated assets be used to hedge trades?

Correlated assets can be used to hedge trades by taking opposite positions in assets that historically move together. For example, if you’re long a stock, you might short a highly correlated ETF or sector index to offset potential losses. When the primary asset declines, the correlated asset’s movement can offset your risk, reducing overall exposure. This technique helps stabilize returns during market swings by balancing gains and losses across related assets.

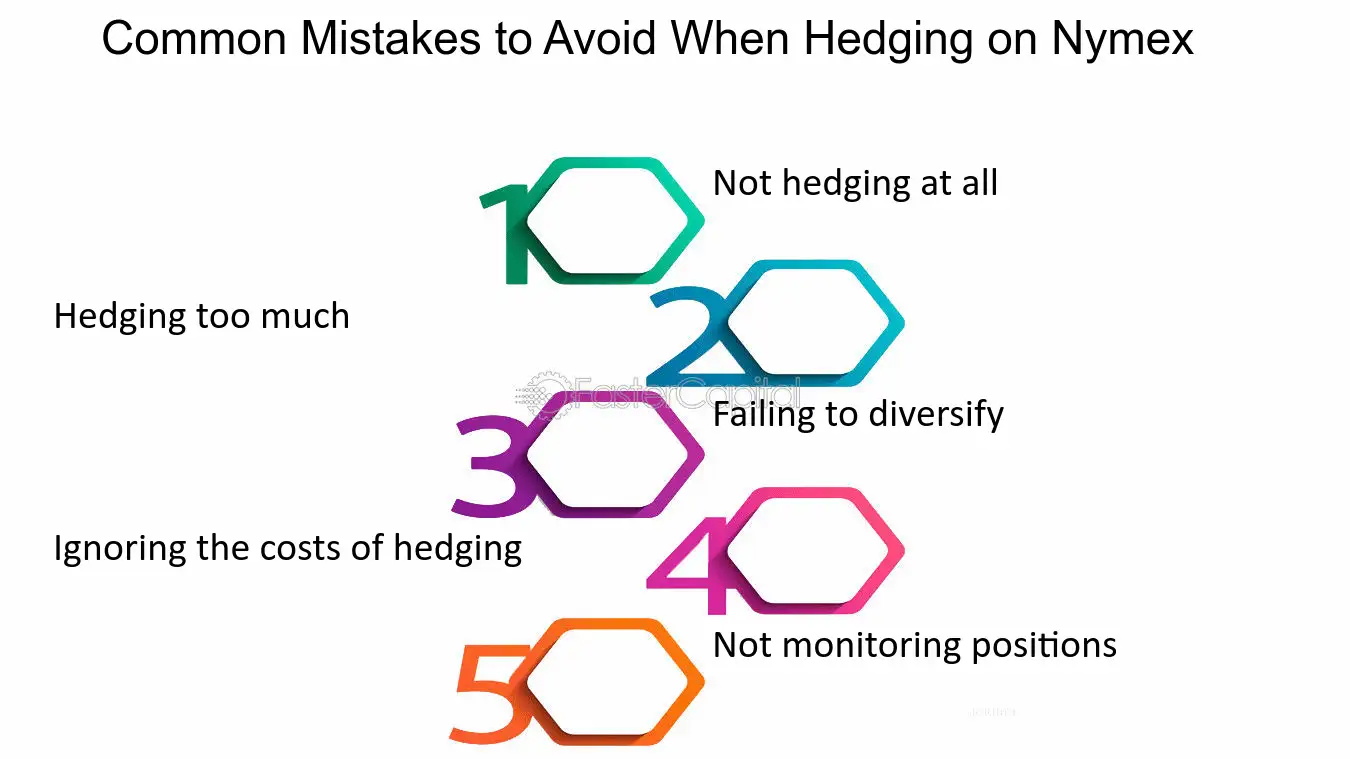

What are common mistakes to avoid in hedging?

Common mistakes in hedging include over-hedging, which limits profit potential, and under-hedging, leaving exposure too risky. Ignoring transaction costs can wipe out gains. Relying on ineffective or poorly timed hedge ratios reduces effectiveness. Using static hedges instead of adjusting as markets move leads to gaps. Failing to understand the underlying asset or market conditions causes poor hedge performance. Overlooking liquidity issues can prevent timely adjustments. Not setting clear exit points risks losses if the hedge doesn’t perform as expected.

How does timing influence the effectiveness of hedging?

Timing is crucial for hedging because it determines when you can offset potential losses. The right moment to hedge—like during volatile market swings—maximizes protection. If you hedge too early, market moves might make the hedge unnecessary; too late, you face losses before the hedge kicks in. Effective timing ensures your hedge reduces risk without sacrificing too much profit.

Can technical analysis improve hedging decisions?

Yes, technical analysis can improve hedging decisions by identifying entry and exit points, trend reversals, and volatility patterns. It helps day traders time their hedges more precisely, reducing risk exposure during market swings. Using charts, moving averages, and momentum indicators, traders can determine when to implement or adjust hedges for maximum effectiveness.

How do market volatility and news impact hedging strategies?

Market volatility and news can cause sudden price swings, making hedging strategies essential for day traders. They often use options like puts and calls to protect against sharp moves, or set tight stop-loss orders to limit losses during volatile swings. News events can trigger unpredictable price gaps, so traders might hedge with inverse ETFs or diversify positions to reduce risk. Rapid market changes demand flexible, quick-acting hedges to prevent large losses.

What are the costs associated with hedging techniques?

Costs of hedging techniques for day traders include option premiums, spreads, transaction fees, and potential opportunity costs if the hedge limits gains. These expenses can add up quickly, reducing overall profit margins.

How can traders combine multiple hedging methods?

Traders combine options, futures, and stop-loss orders to hedge positions. For example, they might buy puts to protect against downside while using futures to lock in prices. Using multiple methods creates layered protection, reducing risk from different angles. Adjust the size and timing of each hedge based on market conditions. This mix balances cost and coverage, making it more resilient to sudden moves.

Conclusion about What are common hedging techniques for day traders?

Incorporating effective hedging techniques is crucial for day traders aiming to mitigate risks and protect profits. Methods such as short selling, options, stop-loss orders, and the use of inverse ETFs can enhance a trader's strategy. Understanding the role of futures contracts, diversification, and correlated assets further refines these approaches. However, traders must remain vigilant about the risks associated with leverage and timing, as well as the potential costs of these strategies. By leveraging these insights, traders can make informed decisions and optimize their hedging techniques. For comprehensive support and guidance on implementing these strategies, DayTradingBusiness is here to assist you.