Did you know that hedging is like wearing a raincoat while carrying an umbrella—you might not need both, but it’s better to be prepared! This article dives into the essential aspects of hedging, detailing how it helps balance risk and reward in trading. We’ll define hedging and explore its role in identifying and mitigating investment risks. Common strategies and their impact on potential returns will be examined, alongside when and how to effectively implement hedging. Understand the costs involved, the use of options and futures, and the importance of diversification. We’ll also cover measuring effectiveness, the implications of market volatility, and tips for currency hedging. Finally, learn about the tools available for managing these strategies and avoid common pitfalls. Join us at DayTradingBusiness as we simplify the complexities of hedging for your trading success.

What is hedging and how does it help balance risk and reward?

Hedging is using financial strategies or instruments like options, futures, or swaps to reduce potential losses from market moves. It helps balance risk and reward by protecting against adverse price swings, so you can pursue higher returns without exposing yourself to unlimited downside. For example, an investor holding stocks might buy put options to limit losses if prices fall, maintaining a better risk-reward ratio.

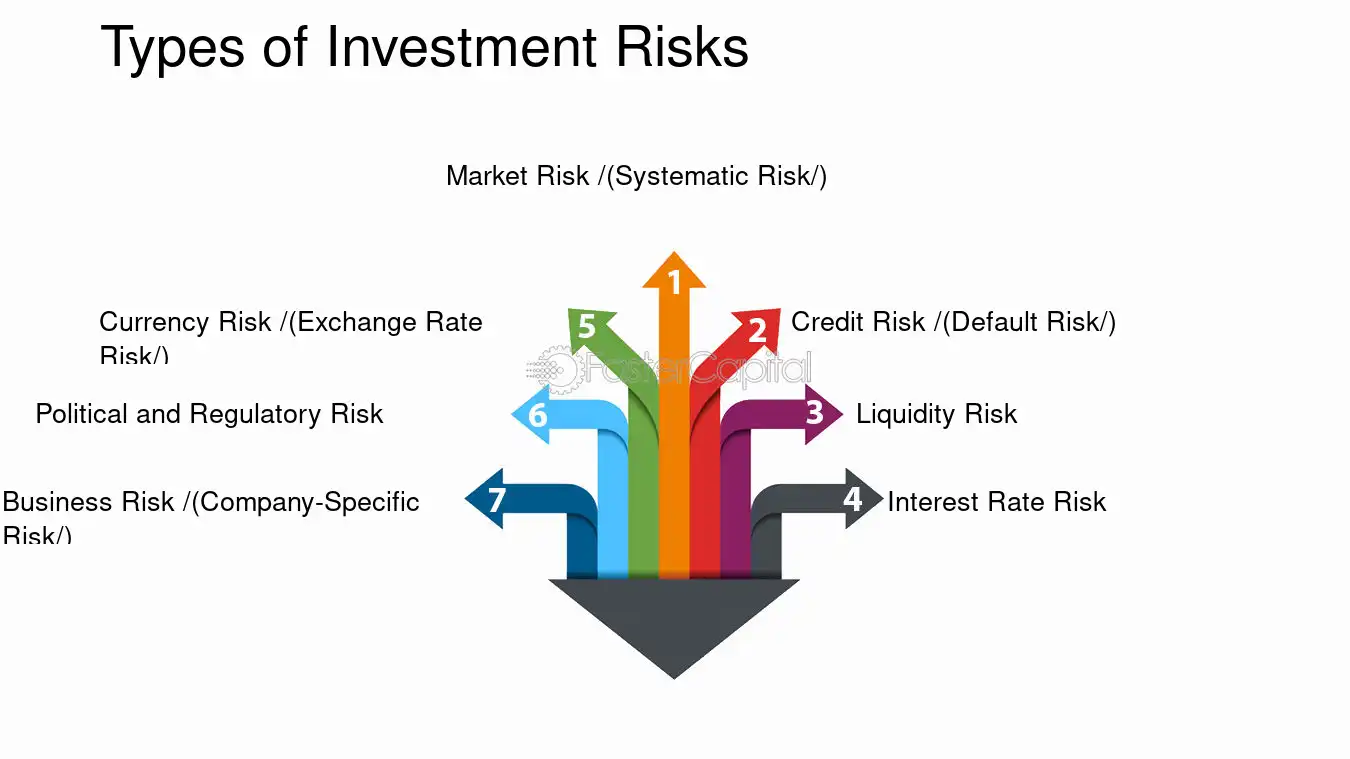

How do I identify risks that need hedging?

Identify risks that impact your financial stability or goals, such as currency fluctuations, interest rate changes, or commodity price swings. Look for exposures where losses could outweigh gains and where market movements are unpredictable. Use risk assessments, sensitivity analyses, and scenario planning to spot vulnerabilities. Prioritize risks with high potential impact and clear correlation to market variables. If your exposure can cause significant losses or disrupt your strategy, it likely needs hedging.

What are the most common hedging strategies used by investors?

The most common hedging strategies include options (puts and calls), futures contracts, and inverse ETFs. Investors also use stop-loss orders and diversification across asset classes. These strategies protect against downside risk while allowing for potential upside, helping balance risk and reward effectively.

How does hedging impact potential returns?

Hedging reduces potential returns by offsetting gains with protective positions, limiting upside. It safeguards against losses, but often caps profit potential. For example, using options to hedge a stock means smaller gains if the stock rises sharply. Balancing risk and reward with hedging involves accepting lower returns to prevent significant losses, ensuring more predictable outcomes.

When should I consider hedging my investments?

Consider hedging when your investments face significant market volatility or potential downturns. Use hedging strategies like options or futures to protect gains or limit losses during uncertain times. If your portfolio has high exposure to risky assets or upcoming events that could cause sharp declines, it's time to hedge. Don't wait until losses mount; proactive hedging helps maintain balance between risk and reward.

What are the costs associated with hedging?

Hedging costs include premiums for options, transaction fees, bid-ask spreads, and potential opportunity costs if the hedge limits gains. These expenses reduce overall profits and can impact the risk-reward balance.

How do options work in hedging risk?

Options let you lock in prices or protect against losses. Buying a put option on a stock you own limits downside risk if the price drops. Selling a call option generates income but caps upside potential, balancing risk and reward. Using options strategically helps you hedge against market swings while still aiming for gains.

Can futures contracts be used for effective hedging?

Yes, futures contracts are effective tools for hedging risk. They lock in prices or costs, protecting against adverse market movements. For example, a farmer can sell futures to secure a selling price, reducing the risk of falling prices. Similarly, an airline might buy futures to lock in fuel costs, avoiding price spikes. Properly used, futures balance risk and reward by providing predictability and minimizing potential losses.

What are the risks of over-hedging?

Over-hedging reduces potential gains if market moves favor the original position, leading to opportunity costs. It can also increase transaction costs and complexity, making managing the hedge harder. Excessive hedging may cause liquidity issues or limit flexibility, trapping you in unfavorable positions if market conditions shift unexpectedly.

How does diversification complement hedging strategies?

Diversification spreads risk across different assets, reducing reliance on a single hedge. It complements hedging by minimizing overall portfolio volatility, so if one hedge underperforms, others can offset the loss. Together, they create a more balanced approach to managing risk and maximizing rewards. For example, combining currency hedges with stocks and bonds helps protect against various market shocks, ensuring smoother returns.

How do I measure the effectiveness of my hedging?

To measure hedging effectiveness, compare the actual hedge performance against the expected risk reduction or cost. Use metrics like hedge ratio accuracy, basis risk (difference between hedge instrument and underlying), and the hedge effectiveness ratio (percentage of variance in the underlying explained by the hedge). Regularly analyze the correlation between the hedge and the underlying asset, and assess whether the hedge reduces volatility or potential losses as intended.

What role does market volatility play in hedging decisions?

Market volatility influences hedging decisions by increasing uncertainty, prompting traders to tighten or adjust their hedges to protect against sudden price swings. When volatility spikes, the cost of hedging rises, making it more expensive but also more essential to limit potential losses. Conversely, low volatility might lead to lighter hedges, as risks appear smaller. Traders monitor volatility indexes like VIX to time their hedging, balancing the cost of protection against potential adverse moves. Ultimately, high volatility encourages more aggressive hedging to safeguard gains, while stable markets allow for more relaxed risk management.

How can I balance risk and reward in currency hedging?

To balance risk and reward in currency hedging, analyze your exposure and set a hedging ratio that aligns with your risk appetite. Use instruments like forward contracts or options to protect against adverse currency movements while allowing some upside. Avoid over-hedging, which caps potential gains, or under-hedging, which exposes you to excessive risk. Regularly review market trends and adjust your hedge ratio accordingly. Focus on clear goals—protecting profits or minimizing losses—and choose strategies that match your financial situation and risk tolerance.

Learn about How to balance risk and reward with stop-loss strategies

What are the best tools for managing hedging strategies?

The best tools for managing hedging strategies include options and futures contracts, swaps, and forward contracts. Use trading platforms like Bloomberg Terminal or Thomson Reuters Eikon for real-time risk management. Risk management software such as Palisade’s @RISK or SAS Risk Management helps analyze and optimize hedge effectiveness. Additionally, spreadsheet tools like Excel with advanced modeling can track hedge performance and adjust positions dynamically.

How do hedging strategies differ across asset classes?

Hedging strategies vary by asset class because each has different risk profiles and market behaviors. In equities, options and short positions protect against downturns; in commodities, futures hedge price swings; in currencies, forward contracts lock in exchange rates; and in fixed income, interest rate swaps manage rate fluctuations. The key difference is the instrument used and the timing, tailored to how each asset responds to market changes.

What are common mistakes to avoid when hedging?

Avoid over-hedging, which limits potential gains and reduces profit. Don’t ignore transaction costs, as they can eat into your hedge’s effectiveness. Relying solely on historical data without considering current market conditions leads to poor hedge decisions. Failing to update or adjust your hedge as market conditions change increases risk exposure. Using inappropriate hedge instruments for your specific risk profile weakens protection. Ignoring correlation risks between your hedge and underlying asset can cause ineffective coverage. Lastly, neglecting to evaluate liquidity risks may leave you unable to execute or unwind positions when needed.

Conclusion about How to balance risk and reward with hedging?

In summary, effective hedging is crucial for balancing risk and reward in trading. By understanding various hedging strategies, identifying risks, and utilizing tools like options and futures contracts, you can safeguard your investments against market volatility. However, it's vital to avoid over-hedging and to measure the effectiveness of your strategies regularly. For more in-depth insights and guidance on refining your hedging approach, explore the resources available at DayTradingBusiness.

Learn about How to balance risk and reward with stop-loss strategies