Did you know that even the best traders can sometimes feel like they're juggling flaming torches while riding a unicycle? In the world of trading, understanding the difference between hedging and stop-loss orders is crucial for managing risk effectively. This article delves into how hedging can protect your investments and the primary purpose of stop-loss orders. We’ll explore the mechanics of hedging strategies, the optimal times to use stop-loss orders, and the unique risks associated with each approach. Additionally, we’ll discuss how market volatility influences stop-loss effectiveness, the types of assets suitable for hedging, and the costs involved in implementing these strategies. Whether you're a seasoned trader or just starting, DayTradingBusiness is here to clarify these essential concepts and help you navigate the complexities of risk management in trading.

How does hedging protect my investments?

Hedging protects your investments by offsetting potential losses through strategies like options or futures, acting as insurance during market drops. Unlike stop-loss orders, which automatically sell when prices fall to a set point, hedging involves taking an opposite position beforehand to reduce risk across your portfolio. Hedging provides a proactive shield against downturns, while stop-loss orders are reactive, triggering sales to limit losses after a decline begins.

What is the main purpose of stop-loss orders?

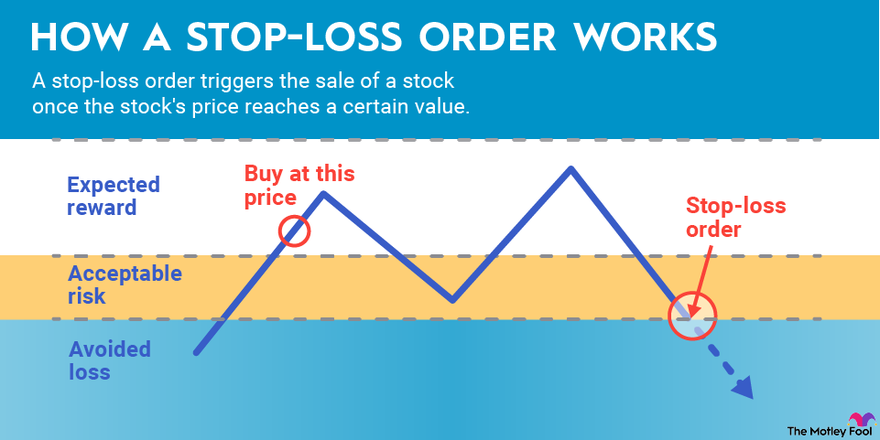

The main purpose of stop-loss orders is to limit potential losses by automatically selling a security once it reaches a specified price.

How do hedging strategies work in trading?

Hedging strategies in trading protect against potential losses by opening offsetting positions, like buying options or futures contracts to offset risk. Unlike stop-loss orders, which automatically sell a position at a set price to limit losses, hedging involves creating a separate trade that reduces overall risk without closing the original position. Hedging is proactive and ongoing, while stop-loss orders are reactive, triggered by price movement.

When should I use a stop-loss order?

Use a stop-loss order when you want to limit potential losses on a trade by automatically selling an asset if it drops to a certain price. Unlike hedging, which involves offsetting positions to reduce risk across different investments, a stop-loss is a direct, pre-set exit point for a single position. Use stop-loss orders to protect gains or prevent bigger losses on specific trades.

Can hedging limit losses without selling assets?

Yes, hedging can limit losses without selling assets by using derivative instruments like options or futures to offset potential declines. Unlike stop-loss orders, which automatically sell assets when they hit a set price, hedging involves creating a protective position that reduces risk while keeping the original asset. Hedging maintains exposure to potential gains but cushions against downside risk, whereas stop-loss orders trigger a sale to prevent further loss.

What are the risks of relying on stop-loss orders?

Relying on stop-loss orders risks sudden market gaps that skip the stop price, causing larger-than-expected losses. If the market moves quickly or gaps past the stop level, your order may not execute at your intended price. This can lead to unexpected losses, especially in volatile markets. Unlike hedging, which actively manages risk through offsetting positions, stop-loss orders only trigger a sale at a preset price, offering no protection if prices jump past that point.

How do hedging and stop-loss orders differ in execution?

Hedging involves opening a separate position to offset potential losses in your main trade, actively managing risk across different assets. Stop-loss orders automatically close a position when the price hits a set level to limit losses. Hedging requires strategic planning and multiple trades, while stop-loss orders are automatic triggers within a single trade.

Are hedging and stop-loss orders suitable for all investors?

No, hedging and stop-loss orders aren’t suitable for all investors. Hedging involves complex strategies to protect against market risks, often requiring advanced knowledge. Stop-loss orders automatically sell an asset at a set price to limit losses but can trigger false exits in volatile markets. Beginners might find stop-loss orders simple, but hedging strategies usually demand more experience and risk management skills. Investors should assess their risk tolerance and investment goals before using either.

What types of assets can be hedged effectively?

Assets like currencies, commodities, stocks, and bonds can be hedged effectively. Hedging uses financial instruments like options and futures to protect against price swings in these assets. Unlike stop-loss orders that trigger a sale at a specific price to limit losses, hedging aims to offset potential risks without necessarily selling the asset immediately.

How does market volatility affect stop-loss orders?

Market volatility can cause stop-loss orders to trigger prematurely or fail to trigger at the intended price, leading to unexpected exits or losses. When markets swing wildly, stops might get hit during brief dips or spikes, not reflecting the true trend. This makes managing risk tricky, as volatile moves can activate stops before the underlying asset's value stabilizes.

What are common hedging instruments used in trading?

Common hedging instruments in trading include options, futures, and forward contracts. Hedging involves using these instruments to offset potential losses in an existing position. Unlike stop-loss orders, which automatically sell an asset at a set price to limit losses, hedging creates a separate position to protect against adverse price movements without closing the original trade.

Can stop-loss orders prevent all losses?

No, stop-loss orders can't prevent all losses. They limit potential losses by triggering a sale at a set price, but market gaps, sudden moves, or slippage can cause losses beyond that level.

How do traders combine hedging with stop-loss orders?

Traders combine hedging with stop-loss orders by using a hedge to protect against large adverse moves while setting stop-loss orders to limit potential losses on individual positions. They open a counter-position (hedge) to offset risk, and place stop-loss orders on their main position to automatically exit if the market moves unfavorably beyond a set point. This way, hedging reduces overall exposure, and stop-loss orders control specific losses, providing layered risk management.

What are the costs associated with hedging strategies?

Hedging costs include premiums for options, spreads, transaction fees, and potential opportunity costs.

How do regulatory rules impact hedging and stop-loss orders?

Regulatory rules limit how much and how often traders can hedge or set stop-loss orders, aiming to prevent market manipulation. They require transparency and proper documentation, which can restrict aggressive hedging strategies or tight stop-loss placements. These rules ensure fair trading but can reduce flexibility and increase compliance costs for both hedging and stop-loss orders.

Conclusion about How does hedging differ from stop-loss orders?

In summary, hedging and stop-loss orders serve distinct purposes in risk management. While hedging aims to protect investments by offsetting potential losses through various instruments, stop-loss orders are designed to limit losses on specific trades by automatically selling assets at predetermined prices. Understanding these differences is crucial for traders seeking to navigate market volatility effectively. For those looking to enhance their trading strategies, DayTradingBusiness offers valuable insights and resources to optimize both hedging and stop-loss approaches.