Did you know that hedging without derivatives is like trying to catch a fish with your bare hands—risky and likely futile? In this article, we dive into how derivatives play a crucial role in managing financial risk. We explore their various types, including futures, options, and swaps, and how each can minimize price volatility and protect against losses. You’ll learn how derivatives assist in currency and commodity hedging, reduce interest rate risk, and improve overall financial stability for businesses. Additionally, we’ll discuss the advantages and risks associated with derivatives-based hedging strategies. Discover how DayTradingBusiness can guide you through these complex concepts to enhance your trading success.

How do derivatives help manage financial risk?

Derivatives help manage financial risk by allowing you to lock in prices or rates, reducing exposure to market fluctuations. For example, a company can use futures contracts to hedge against rising commodity costs. Options give the right to buy or sell assets at a set price, protecting against unfavorable price swings. Swaps let parties exchange cash flows to hedge interest rate or currency risks. Overall, derivatives act as insurance, enabling businesses to stabilize revenues and costs despite market volatility.

What are the main types of derivatives used for hedging?

The main types of derivatives used for hedging are futures, options, and swaps. Futures lock in prices for commodities or assets, reducing exposure to market swings. Options give the right, but not the obligation, to buy or sell at set prices, protecting against adverse moves while allowing upside. Swaps exchange cash flows, like interest rate or currency swaps, to manage specific financial risks.

How does a futures contract reduce price volatility?

Futures contracts reduce price volatility by locking in prices, allowing traders and producers to hedge against unpredictable market swings. When you enter a futures contract, you agree on a fixed price for a commodity or asset, which minimizes the impact of sudden price changes. This predictability stabilizes cash flows and reduces uncertainty, making markets less volatile overall. Essentially, futures act as insurance against price swings, smoothing out fluctuations for both buyers and sellers.

How can options be used to protect against losses?

Options protect against losses by giving the holder the right to buy or sell an asset at a set price, limiting downside risk while allowing upside potential. They act as insurance—if the market moves against you, you can exercise the option to minimize losses; if it moves favorably, you benefit from the price increase. For example, buying a put option on a stock shields you from a steep decline, capping your maximum loss to the premium paid. This makes options a flexible tool for hedging risk in derivatives trading.

What is the role of swaps in risk management?

Swaps help manage risk by allowing parties to exchange cash flows or financial obligations, reducing exposure to interest rate, currency, or commodity price fluctuations. They lock in predictable payments, smoothing out potential losses from market volatility. For example, a company can swap variable interest payments for fixed ones, stabilizing borrowing costs. Swaps act as customized tools that hedge against specific risks, making financial planning more reliable.

How do derivatives help in currency risk hedging?

Derivatives like currency futures, options, and swaps lock in exchange rates or provide protection against currency fluctuations. They allow businesses to set a fixed rate for future transactions, reducing uncertainty. If the currency moves unfavorably, the derivative offsets the loss, stabilizing profits. For example, a company expecting to pay a foreign supplier in six months can buy a currency forward to lock in the current rate, avoiding adverse shifts. This way, derivatives act as insurance, minimizing the impact of currency volatility on financial outcomes.

Can derivatives minimize commodity price fluctuations?

Yes, derivatives like futures and options help lock in prices or set limits, reducing exposure to commodity price swings. They allow producers and consumers to hedge against sudden fluctuations, stabilizing costs and revenues.

How does hedging with derivatives work in stock markets?

Hedging with derivatives in stock markets involves using options or futures to offset potential losses. For example, buying put options on a stock you own protects against a price drop. Futures contracts can lock in prices, shielding you from market swings. These tools act like insurance—limiting downside risk while allowing potential gains. Essentially, derivatives help investors manage volatility and protect their portfolios from unpredictable market moves.

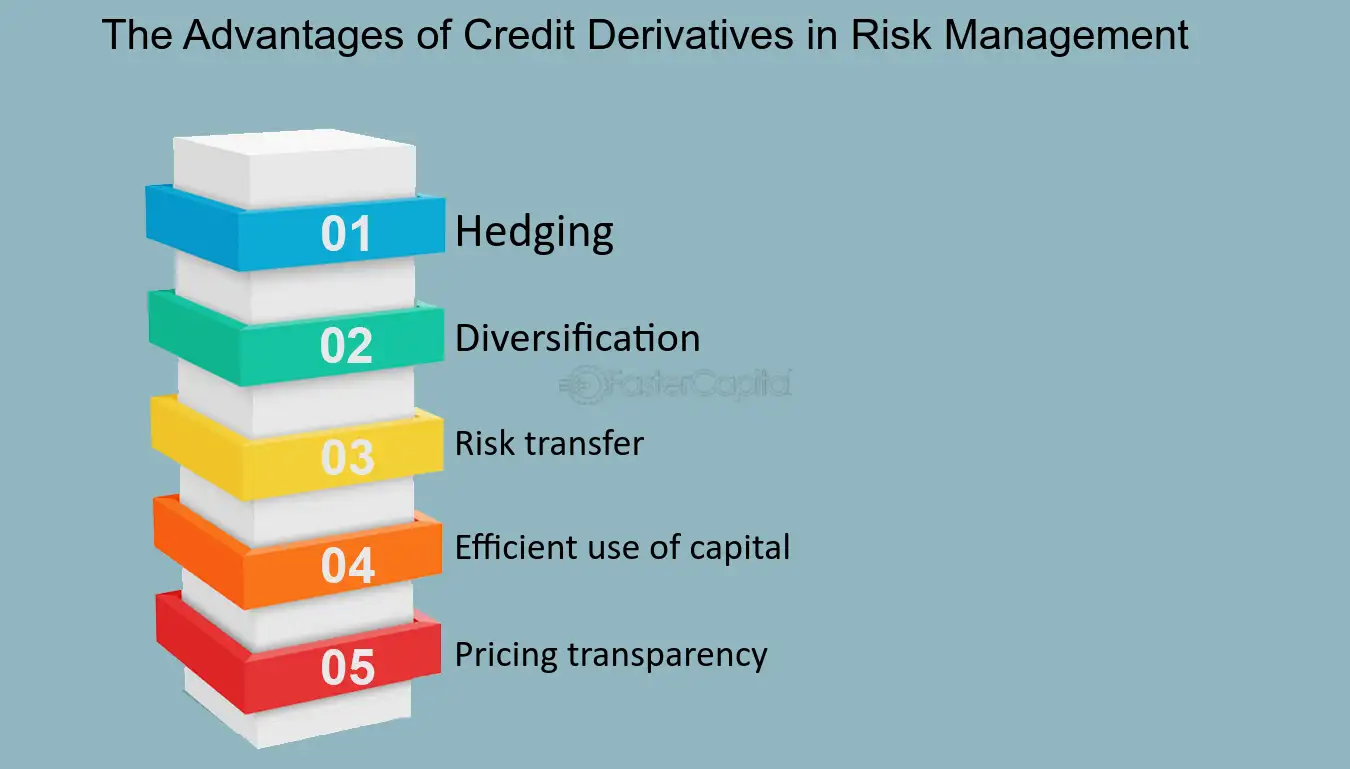

What are the advantages of using derivatives for risk mitigation?

Derivatives help hedge risk by allowing businesses to lock in prices or rates, reducing exposure to market fluctuations. They provide a way to transfer risk to a counterparty, minimizing potential losses. Using options, futures, or swaps stabilizes cash flows and protects profit margins during volatile market conditions. They also enable precise risk management tailored to specific exposures, improving financial predictability. Overall, derivatives act as insurance policies, giving companies peace of mind against unpredictable price swings.

What are the risks associated with derivatives-based hedging?

Derivatives-based hedging risks include potential losses if market movements don’t align with expectations, counterparty default risk, and liquidity issues that can make unwinding positions difficult. They can also introduce complexity, leading to mispricing or over-hedging. Additionally, leverage in derivatives can amplify losses beyond initial investments.

How do companies use derivatives to hedge interest rate risk?

Companies use interest rate swaps, options, and futures to lock in borrowing costs or future cash flows, minimizing exposure to rate fluctuations. They might enter into an interest rate swap to pay fixed and receive floating, stabilizing payments if rates rise. Options give them the right to lock in rates or protect against rate increases without obligation. Futures contracts allow companies to hedge against short-term interest rate swings by locking in future borrowing or investment costs. These derivatives help manage uncertainty and reduce financial risk from changing interest rates.

What is the difference between hedging and speculation with derivatives?

Hedging with derivatives involves using contracts like futures or options to protect against price swings, minimizing potential losses. Speculation with derivatives means taking on risk to profit from expected price movements, aiming for high returns. Hedging reduces risk exposure, while speculation increases it for potential gains.

How do derivatives improve financial stability for businesses?

Derivatives help businesses hedge risk by locking in prices or rates, reducing exposure to market fluctuations. For example, a company can use futures to stabilize costs or revenues, avoiding unpredictable swings. This stability allows better planning and prevents sudden financial shocks, supporting overall financial health.

What are common strategies for derivatives-based risk hedging?

Common strategies for derivatives-based risk hedging include using futures contracts to lock in prices, options to protect against price swings while allowing upside potential, and swaps to manage interest rate or currency risks. Traders also use forward contracts for customizing hedges over specific periods. These derivatives help stabilize cash flows, reduce exposure to market volatility, and protect against adverse price movements.

How do derivatives influence overall portfolio risk?

Derivatives help hedge risk by acting as insurance against price swings, reducing overall portfolio volatility. They allow investors to offset potential losses in their assets, stabilizing returns. For example, using options or futures to lock in prices can protect against market downturns. This risk mitigation makes the portfolio's performance more predictable and less exposed to unpredictable market moves.

Conclusion about How do derivatives assist in hedging risk?

In summary, derivatives play a crucial role in hedging risk by providing tools to manage financial uncertainties across various markets. They offer companies and investors the ability to mitigate price volatility, protect against losses, and enhance overall financial stability. By understanding the different types of derivatives—such as futures, options, and swaps—traders can effectively implement strategies that align with their risk management goals. For those seeking to deepen their knowledge and improve their trading strategies, DayTradingBusiness offers valuable insights and resources to navigate the complexities of derivatives and enhance risk mitigation efforts.