Did you know that some day traders hedge their positions just like a squirrel stashes nuts for winter? In the unpredictable world of day trading, hedging can be a vital strategy to mitigate risks associated with market swings. This article delves into the intricacies of hedging, exploring its effectiveness in reducing risks, how it works, and the various strategies available for day traders. We’ll also examine the costs, potential limitations, and the role of leverage in hedging. Additionally, we’ll guide you on implementing hedging in your trading plan and highlight common pitfalls to avoid. Whether you’re a novice or an experienced trader, understanding hedging can significantly enhance your risk management approach. Let DayTradingBusiness help you navigate these strategies for a more resilient trading experience.

Can hedging reduce risks during day trading?

Yes, hedging can reduce risks during day trading by offsetting potential losses from market swings. It allows traders to protect positions if the market moves against them, minimizing downside while still participating in potential gains. However, it doesn’t eliminate risk entirely and can add complexity and costs to trading strategies.

How does hedging work in day trading?

Hedging in day trading involves opening a position opposite your main trade to offset potential losses from market swings. For example, if you buy a stock expecting it to rise, you might short another related asset to protect against a sudden downturn. It acts as insurance—if the market moves against you, gains from the hedge can reduce overall losses. However, it’s not foolproof; costs and timing matter. Properly executed, hedging can shield your account from sharp, unpredictable market swings during a trading session.

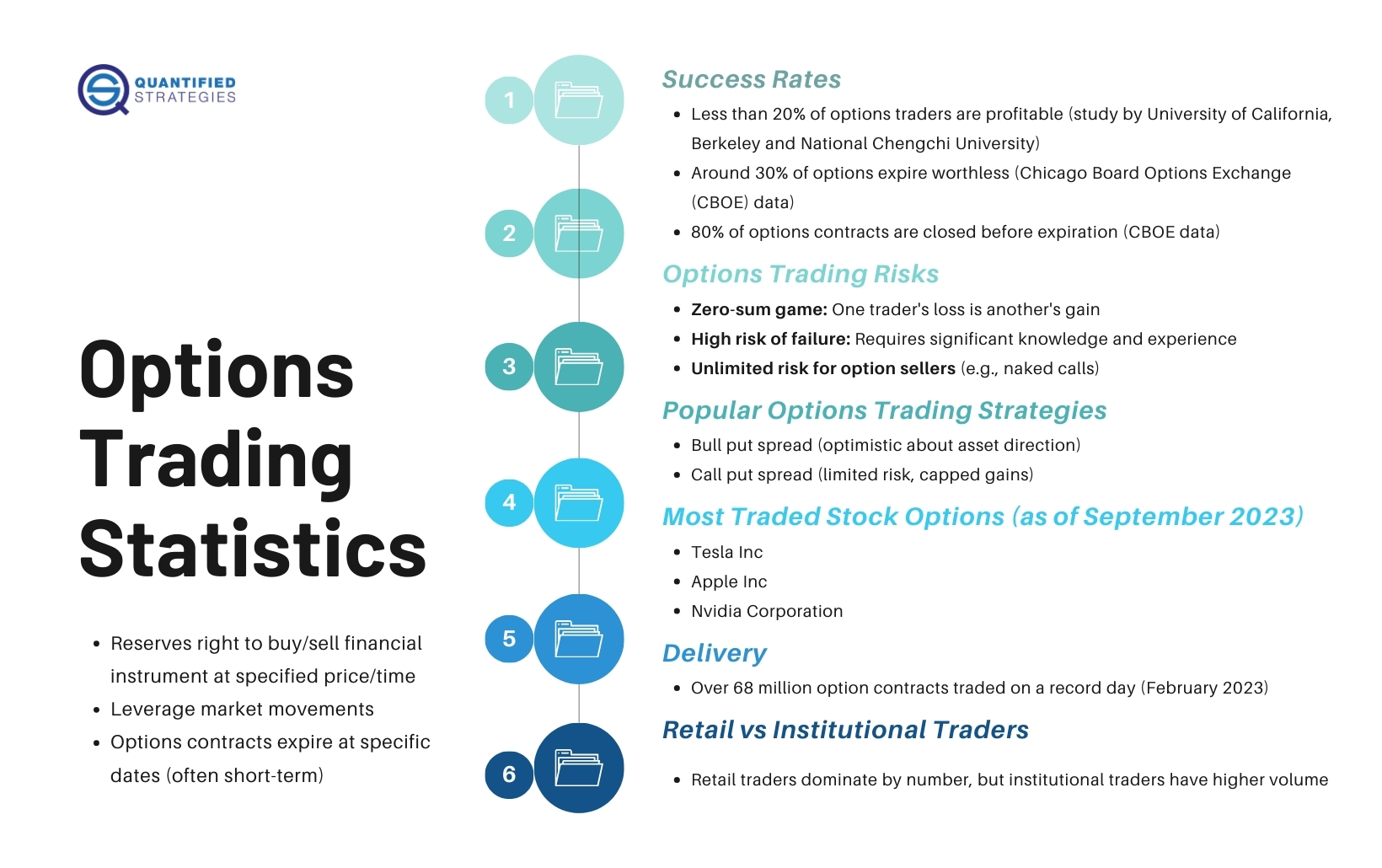

What are the main types of hedging strategies for day traders?

Hedging strategies for day traders include using options like puts and calls to offset potential losses, employing inverse ETFs to profit from market declines, and executing short sales to protect against drops. Some also use stop-loss orders to limit downside risk quickly. These methods aim to minimize losses during sudden market swings.

Is hedging effective against sudden market swings?

Yes, hedging can protect against sudden market swings in day trading by offsetting potential losses with positions that move in the opposite direction. It acts as a risk management tool, helping to limit volatility. However, it doesn't eliminate all risk and can reduce profits if the market moves favorably. Properly executed, hedging provides a safety net during unpredictable price movements.

Can hedging guarantee profit in volatile markets?

No, hedging can't guarantee profit in volatile markets. It reduces risk but doesn't eliminate losses or ensure gains during market swings. In day trading, hedging can protect against sudden drops, but unpredictable moves can still cause losses.

How do I implement hedging in my day trading plan?

To implement hedging in your day trading plan, open opposite positions in correlated assets or use options like puts to offset potential losses. For example, if you're long a tech stock, buy a put option to protect against a sudden drop. Use stop-loss orders strategically to limit downside, and monitor market volatility closely. Hedging can protect against market swings by balancing your trades, but it requires quick execution and active management.

What are the costs associated with hedging in day trading?

Hedging in day trading costs include bid-ask spreads, commissions, and sometimes overnight or margin interest. You might pay higher transaction fees due to extra trades. Additionally, if the hedge isn’t perfectly aligned, you could face losses or reduced gains. Sometimes, holding positions overnight to hedge can incur interest charges. Overall, these costs can eat into potential profits and should be weighed against protection benefits.

Does hedging limit potential losses or also cap gains?

Hedging limits potential losses but also caps gains. It reduces risk by offsetting losses if the market moves against you, but it also restricts how much you can profit if the market moves in your favor.

When should a day trader consider using hedging?

A day trader should consider hedging when expecting a sudden market swing that could cause significant losses on open positions. Use hedging if you want to limit risk during volatile periods or upcoming news events. It’s especially useful if you hold large positions or face unpredictable price gaps. Hedge when you need to protect gains, reduce exposure, or manage short-term market uncertainty.

Are there specific financial instruments used for hedging in day trading?

Yes, traders use options, futures, and inverse ETFs to hedge against market swings in day trading. Options can lock in prices or protect against losses; futures allow quick offsetting of positions; inverse ETFs move opposite to the market, providing a hedge.

Learn about Are there risks to hedging in day trading?

How does leverage impact hedging strategies?

Leverage amplifies both gains and losses in hedging strategies. Using leverage can make hedges more effective by increasing position size, but it also heightens risk if market swings move against your hedge. In day trading, leverage can quickly erode capital if market volatility causes unexpected moves, making hedging more critical but riskier. Properly managed, leverage can enhance the protective role of hedges during market swings, but overleveraging can undermine the safety net.

Can hedging protect against market crashes in day trading?

Hedging can reduce losses from sudden market swings in day trading, but it can't fully prevent crashes. It acts as insurance, offsetting potential big declines, but may limit gains too. Quick market moves can outpace hedging strategies, so it offers some protection but not complete safety during crashes.

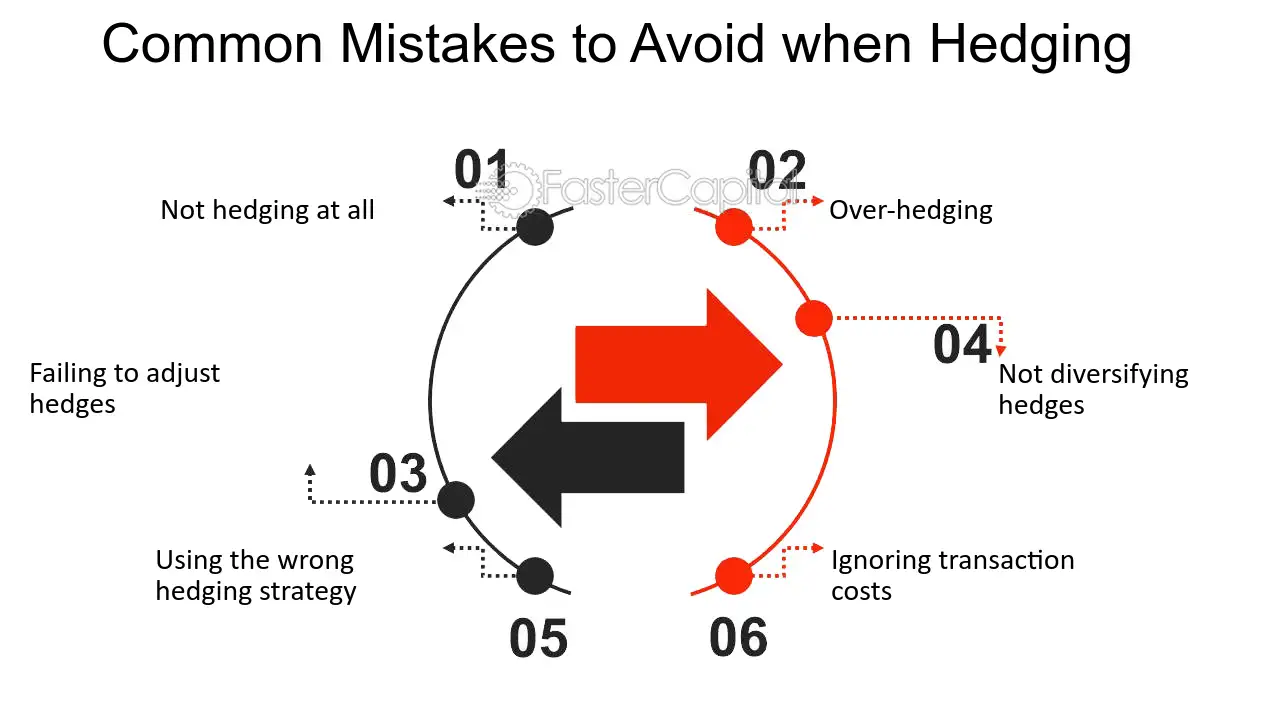

What are common mistakes to avoid when hedging?

Common mistakes to avoid when hedging in day trading include over-hedging, which limits profit potential, and under-hedging, leaving you vulnerable to losses. Ignoring transaction costs can eat into gains. Relying solely on one hedging strategy instead of combining methods reduces effectiveness. Not adjusting hedges as market conditions change risks misalignment. Using excessive leverage amplifies losses if the hedge fails. Failing to monitor the hedge continuously can cause mismatches and unexpected exposure.

How do market conditions influence hedging effectiveness?

Market conditions affect hedging effectiveness by changing volatility and liquidity, which can make hedges more or less reliable during swings. In highly volatile markets, hedges may struggle to keep pace with rapid price moves, reducing their protective value. Conversely, stable market conditions allow hedges to perform more predictably, shielding traders from sudden swings. Liquidity impacts the ability to enter or exit hedge positions without slippage, influencing overall effectiveness. Ultimately, unpredictable or extreme market swings can diminish a hedge’s ability to fully protect against losses in day trading.

Is hedging suitable for beginner day traders?

Hedging can protect against market swings in day trading, but it's complex and risky for beginners. It requires understanding options, futures, or other derivatives, which might be overwhelming for someone new. Most beginner traders should focus on mastering basic strategies before trying hedging. Without experience, hedging can lead to bigger losses instead of protection.

Learn about Is hedging suitable for beginner day traders?

How do I evaluate if hedging is right for my trading style?

Assess if hedging fits your trading style by analyzing your risk tolerance and trading frequency. If you’re quick to react to market swings and want to limit losses without closing positions, hedging can help. Consider your experience with complex strategies and whether you can manage the additional trades effectively. Test it with small positions first to see if it aligns with your day trading goals.

What tools and platforms support hedging strategies?

Tools and platforms for hedging in day trading include options trading platforms like Thinkorswim, Interactive Brokers, and TD Ameritrade, which allow buying puts or calls to offset risks. Futures trading platforms, such as CME Group or NinjaTrader, enable locking in prices to hedge against market swings. Some brokers also offer inverse ETFs and spread betting options for quick hedging. Automated trading systems and risk management software like MetaTrader and TradeStation help execute hedging strategies efficiently.

Can hedging replace traditional risk management methods?

Hedging can protect against market swings in day trading but doesn't replace traditional risk management. It reduces potential losses during volatile moves but isn't foolproof. Combining hedging with stop-loss orders and position sizing offers stronger protection. Hedging manages specific risks, while traditional methods control overall exposure.

Conclusion about Can hedging protect against market swings in day trading?

In conclusion, hedging can be an effective strategy for day traders looking to mitigate risks associated with market volatility. While it does not guarantee profits, it provides a way to limit potential losses during sudden market swings. By understanding various hedging techniques and the associated costs, traders can incorporate these strategies into their trading plans thoughtfully. As always, evaluating personal trading styles and market conditions is essential when deciding on the use of hedging. For more in-depth insights and guidance, DayTradingBusiness is here to help you navigate the complexities of day trading and risk management.

Sources:

- Bitcoin market reactions to large price swings of international stock ...

- Delta-hedging demand and intraday momentum: Evidence from China

- Stock Index Futures: Is There Life After Death for the Securities ...

- Artificial Intelligence Can Make Markets More Efficient—and More ...

- Beat the Market An Effective Intraday Momentum Strategy for ...

- Estimation of value at risk for copper - ScienceDirect