Did you know that if you make too many trades in a day, you could be labeled a "Pattern Day Trader," which sounds way cooler than it actually is? In this article, we break down the Pattern Day Trader (PDT) rule, exploring its definition, how to determine if you fall under it, and the primary requirements that come with it. We’ll discuss how the rule limits trading activity, the minimum account balance needed to avoid restrictions, and the implications for margin trading. Additionally, we’ll highlight ways to legally navigate around the PDT rule, the risks of violating it, and strategies to ensure compliance. Finally, we’ll consider the impact of the PDT rule on beginner traders and overall day trading profitability. Join us at DayTradingBusiness for a comprehensive look at how this regulation can affect your trading journey.

What is the Pattern Day Trader (PDT) rule?

The Pattern Day Trader (PDT) rule restricts traders from executing four or more day trades within five business days in a margin account unless they maintain at least $25,000 in equity. It targets active traders who frequently buy and sell the same security on the same day. If you fall below the $25,000 minimum, your account gets flagged as a PDT, limiting you to only three day trades every five days unless you deposit more funds. This rule aims to prevent excessive trading risks and protects brokers from potential losses.

How do I know if I’m classified as a pattern day trader?

You’re a pattern day trader if you execute four or more day trades within five business days in a margin account, and those trades make up more than 6% of your total trading activity during that period. The PDT rule requires maintaining at least $25,000 in your account to day trade freely. If you fall below this amount, you’re restricted from day trading until you restore the minimum balance.

What are the main requirements of the PDT rule?

The PDT rule requires traders with less than $25,000 in their account to limit their day trades to three within five business days. If they make four or more day trades in that period, they face a 90-day trading restriction. This rule applies to margin accounts trading stocks or options and aims to prevent excessive day trading without sufficient capital.

How does the PDT rule limit trading activity?

The PDT rule limits traders to three day trades within five business days unless they maintain at least $25,000 in their account. If they hit the limit, they can't make additional day trades until the account balance rises above $25,000. This restricts active traders from executing frequent trades without meeting minimum equity requirements.

What is the minimum account balance needed to avoid PDT restrictions?

You need at least $25,000 in your account to avoid Pattern Day Trader (PDT) restrictions.

How does the PDT rule impact margin trading?

The PDT rule limits traders to three day trades within five business days unless they maintain a minimum $25,000 account balance. In margin trading, this means if you hit three day trades without that balance, you can’t make additional day trades until your account is funded above $25,000. It forces traders to choose between maintaining higher capital or avoiding frequent day trades, impacting strategy and flexibility in margin trading.

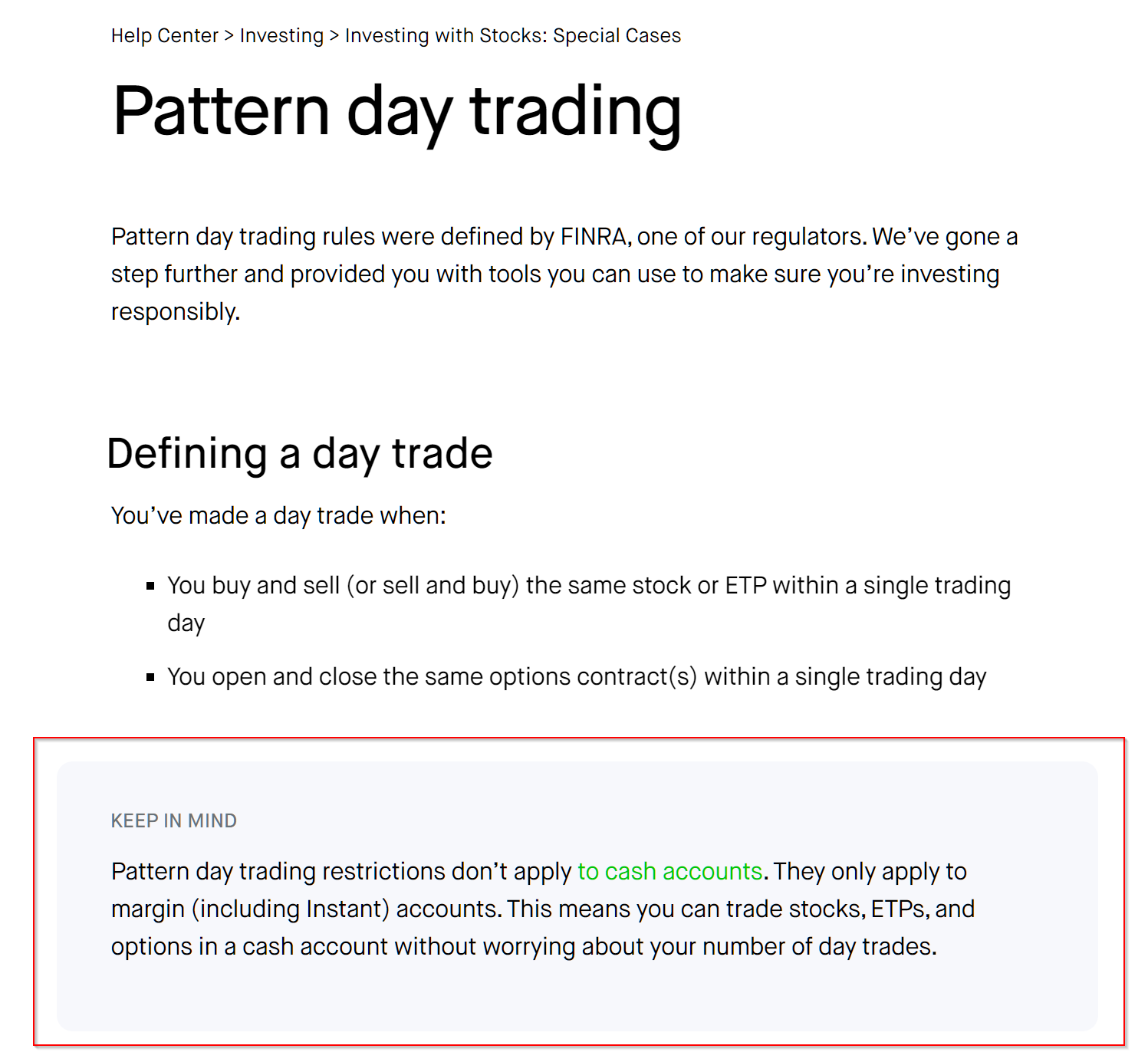

Can I avoid the PDT rule by using cash accounts?

Yes, using cash accounts instead of margin accounts allows you to avoid the PDT rule. The PDT rule applies only to margin accounts with less than $25,000 in equity, restricting day trading to four trades in five days. With a cash account, you can execute as many day trades as you want since it doesn't have the same regulatory limits.

What are the risks of violating the PDT rule?

Violating the PDT rule risks account restrictions, like a 90-day trading ban, and limits your ability to day trade with less than $25,000 in your account. It can lead to forced closures of open positions, financial penalties, and damage your trading record. Repeated violations may result in account suspension or even permanent restrictions from day trading activities.

How can traders work around the PDT rule legally?

Traders can work around the PDT rule legally by maintaining a minimum account balance of $25,000, which exempts them from the pattern day trader restrictions. They can also open multiple accounts at different brokerages to spread trades across accounts, avoiding the 4-day trading limit in a single account. Alternatively, trading with cash accounts instead of margin accounts bypasses the PDT rule because it only applies to margin accounts. Lastly, trading less than four day trades within five business days keeps them under the PDT radar.

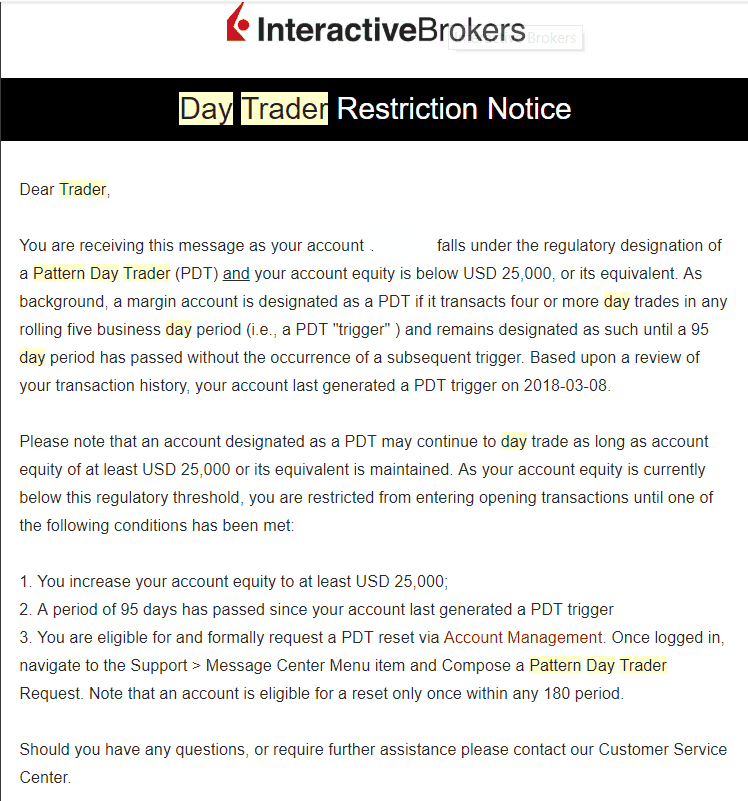

What happens if I am labeled a pattern day trader?

If you're labeled a pattern day trader, you must maintain a minimum of $25,000 in your trading account daily. If your account falls below that, you'll be restricted from executing new day trades for 90 days or until you meet the minimum equity. This rule applies to accounts used for buying and selling the same security within five business days. It limits frequent traders but allows casual trading without the same restrictions.

How long does the PDT restriction last after violation?

The PDT restriction lasts 90 days after your first violation if you have less than $25,000 in your trading account.

Are there any exemptions or special cases under the PDT rule?

Yes, there are exemptions. The PDT rule doesn't apply if you maintain a margin account with at least $25,000 in equity or if you're trading with a cash account. Also, traders in futures or options on futures are exempt. Some brokerages offer limited exceptions for certain accounts or trading strategies, but generally, if you execute four or more day trades within five business days and have less than $25,000, the PDT rule applies.

Learn about Are There Any Loopholes in the PDT Rule?

How does the PDT rule affect beginner traders?

The PDT rule limits beginner traders by restricting them to three day trades within five business days unless they maintain a minimum $25,000 account balance. It forces new traders to either wait to build their account or trade less frequently, which can slow down their learning curve. Without the $25,000 minimum, beginners often face restrictions that make active trading challenging, pushing them toward longer-term strategies.

Learn about How Does the PDT Rule Affect Trading Frequency?

What strategies can traders use to stay compliant with PDT?

Traders can avoid PDT restrictions by maintaining a minimum of $25,000 in their trading account, using cash accounts instead of margin, or trading options that don't count toward the pattern day trader rule. They can also limit day trades to fewer than four in five business days or open accounts at brokerages that don’t enforce PDT rules. Keeping detailed records and staying informed about regulatory changes helps ensure ongoing compliance.

How does the PDT rule influence day trading profitability?

The PDT rule limits traders to three day trades within five business days unless they maintain a minimum $25,000 account balance. It forces many traders to pause or reduce frequent trading, making quick profits harder. Traders must either wait five days after hitting the limit or increase their account size to avoid restrictions. This rule can restrict profit opportunities, especially for active day traders relying on rapid trades.

Learn about How Do Prop Firms Impact Day Trading Profitability?

Conclusion about What is the Pattern Day Trader (PDT) rule and how does it affect traders?

In summary, the Pattern Day Trader (PDT) rule plays a significant role in shaping trading strategies and account management for day traders. Understanding its requirements and limitations is crucial to navigate the market effectively. By adhering to the PDT regulations, traders can avoid penalties and maintain their trading activities. For those looking to deepen their knowledge and find ways to work within or around these restrictions, resources from DayTradingBusiness can provide valuable insights and strategies to enhance trading success.

Learn about What Is the Pattern Day Trader (PDT) Rule and Its Tax Impact?

Sources:

- Day Traders, Noise, and Cost of Immediacy | NBER

- Does proprietary day trading provide liquidity at a cost to investors ...

- A Theory of the Interday Variations in Volume, Variance, and ...

- FRB: Appendix B: Models to Project Net Income and Stressed ...

- The Impact of Trading Commission Incentives on Analysts' Stock ...

- Five Facts about Beliefs and Portfolios